Tax System In Malaysia

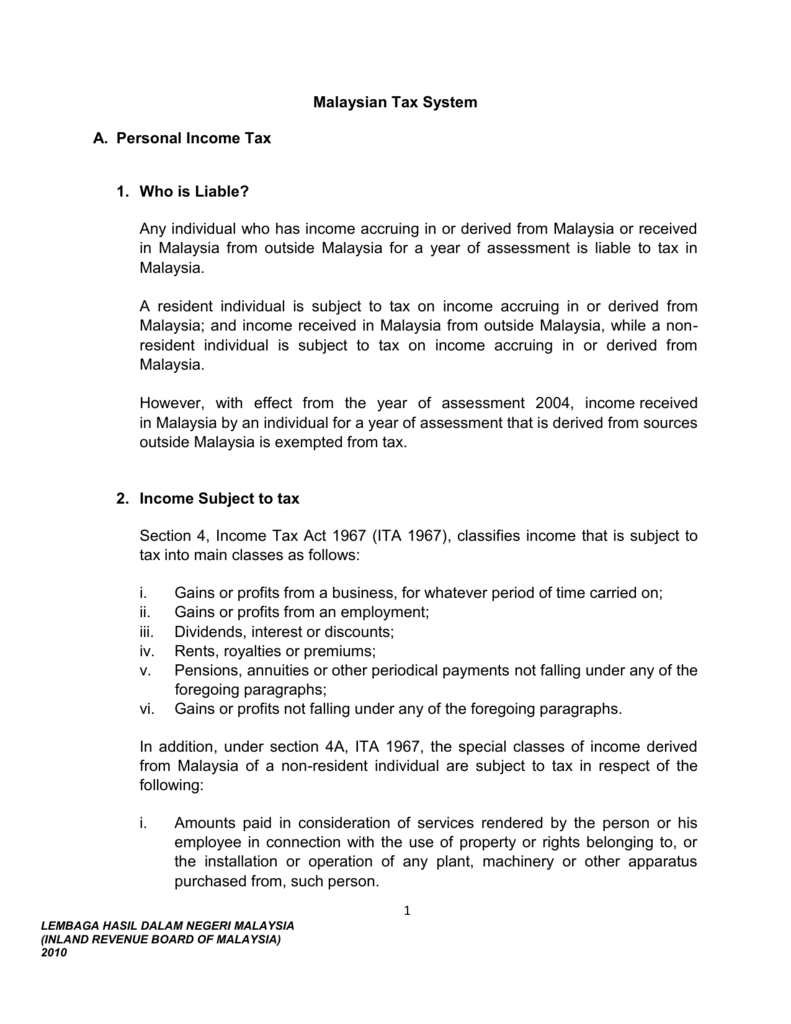

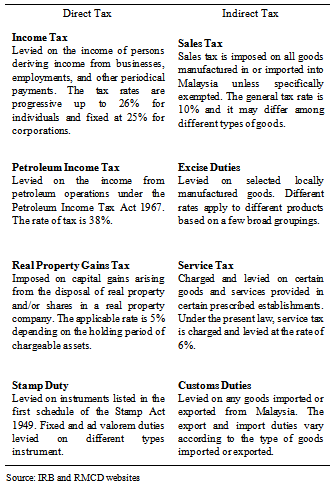

The responsibility for collecting tax revenue falls on lembaga hasil dalam negeri lhdn and royal customs and excise department.

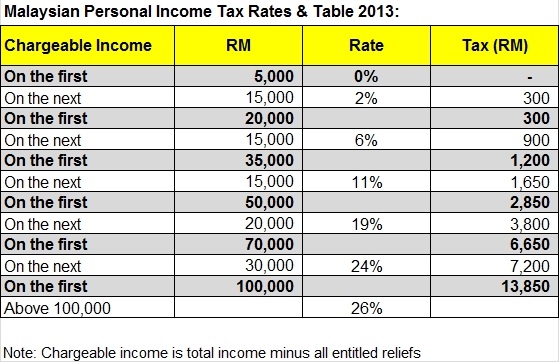

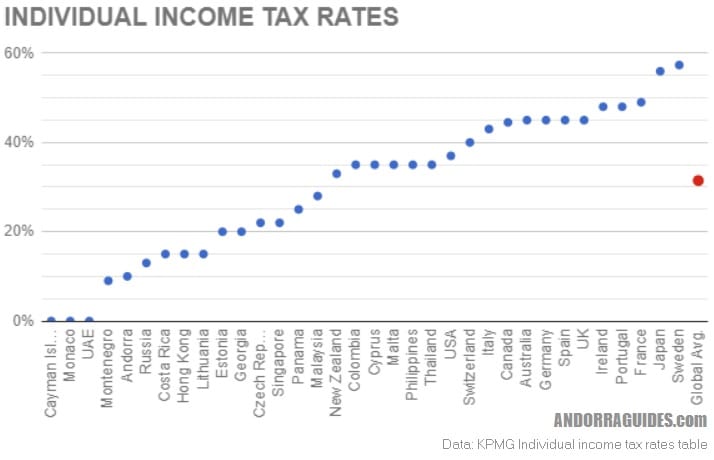

Tax system in malaysia. Worldwide basis for taxation this applies to income from specific industries such as banking and air transport where malaysia does not use a territorial tax system. However the income tax of non residents is calculated on a three step tax rate 27 15 and 10 depending on the type of income. The income is classified into 8 different tax groups ranging from 0 to 26. All income accrued in derived from or remitted to malaysia is liable to tax.

However malaysia has signed double taxation agreements with more than 70 countries to avoid taxing people twice. Double taxation agreements if an expat is a tax resident of two different countries they may have to pay taxes in both countries on the same income meaning they ll be taxed twice in the same year. Malaysia s taxes are assessed on a current year basis and are under the self assessment system for all taxpayers. That said income of any person other than a resident company carrying on the business of banking insurance or sea or air transport derived from sources outside malaysia and received in malaysia is exempted from tax.

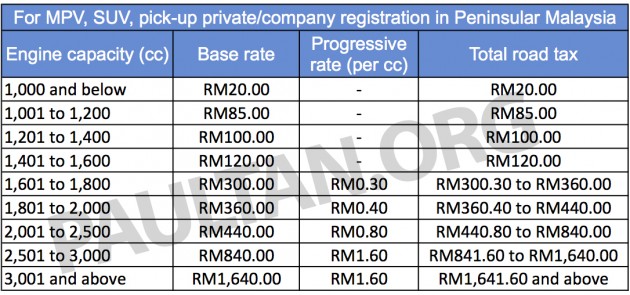

The personal income tax is liable for the individual who has income that derived from malaysia or received in malaysia from outside malaysia for a year of assessment. In malaysia tax system it comprises of corporate and personal income tax custom duty and local tax. In malaysia the income tax rate for residents is calculated on the amount of income and is much more precise.