Takaful Vs Conventional Insurance

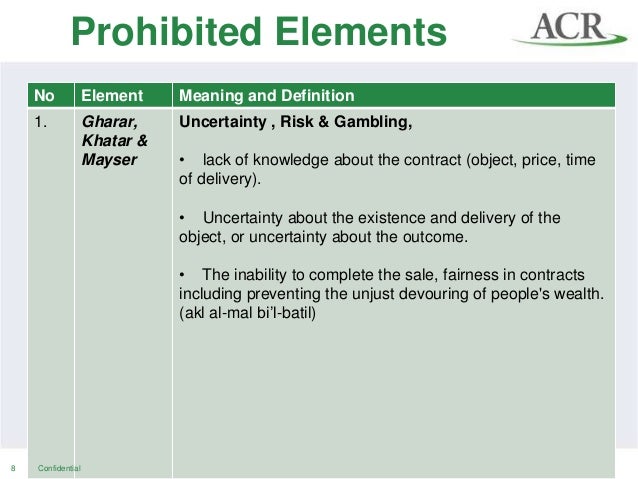

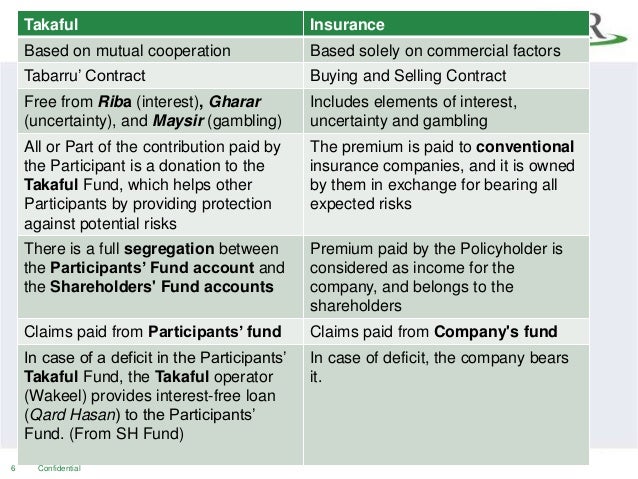

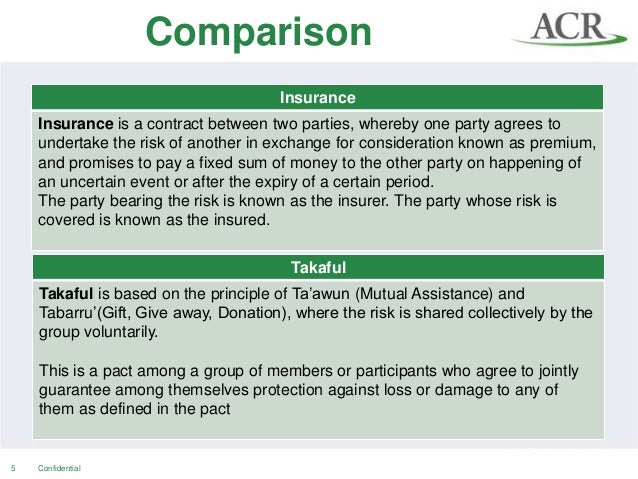

Conventional insurance most islamic jurists conclude that conventional insurance is unacceptable in islam because it does not conform with sharia for the following reasons.

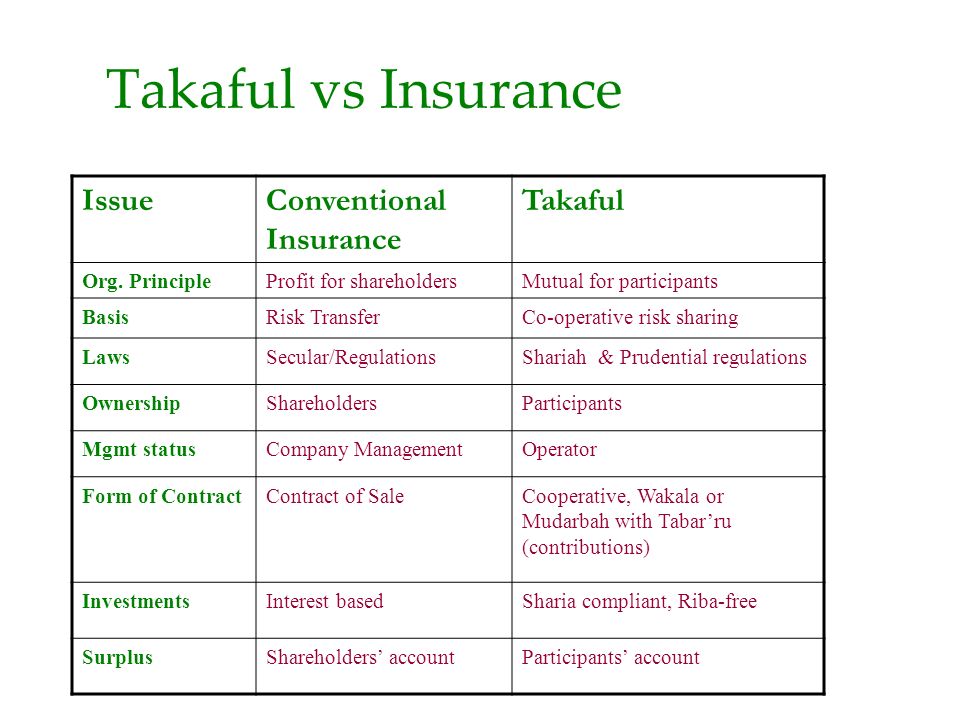

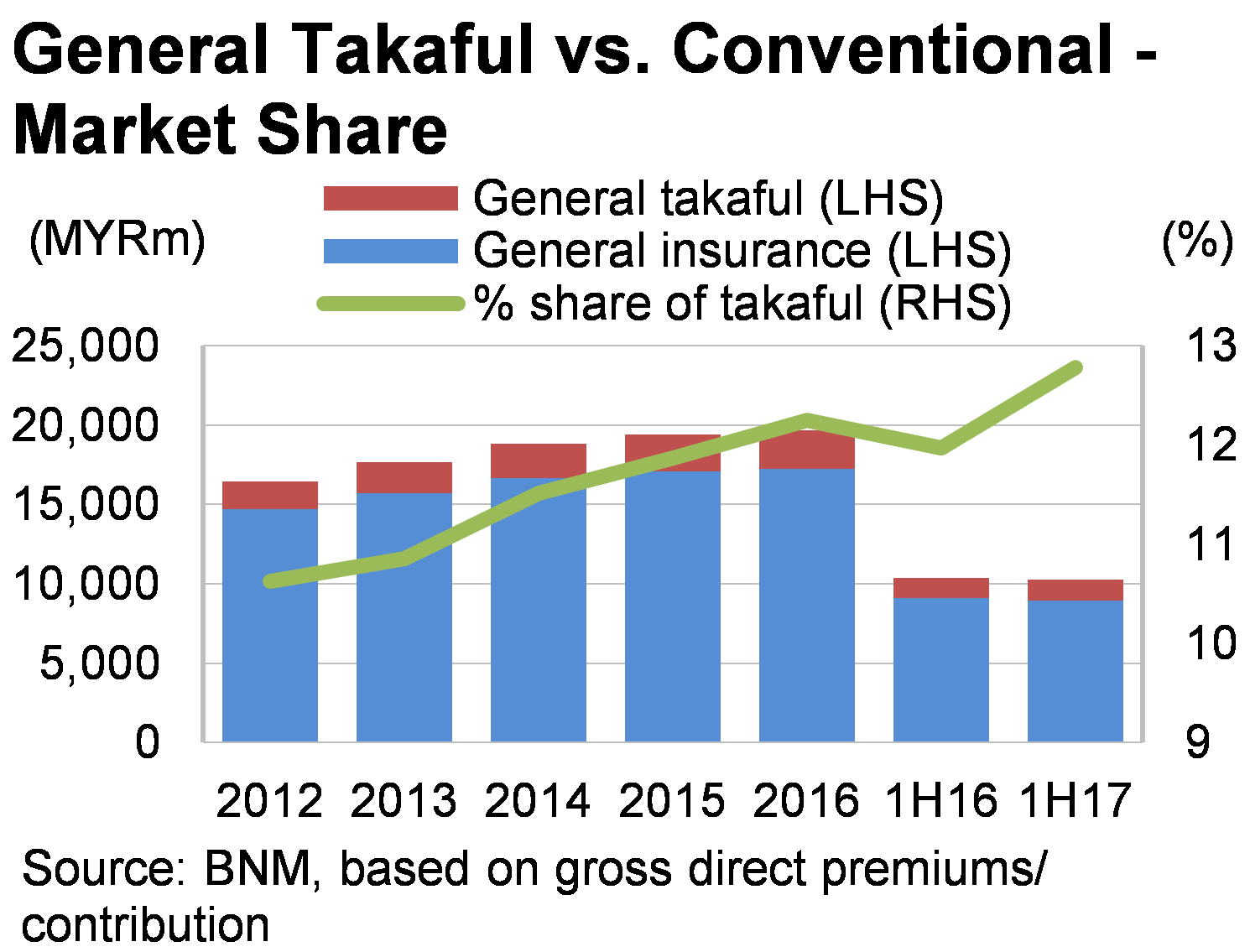

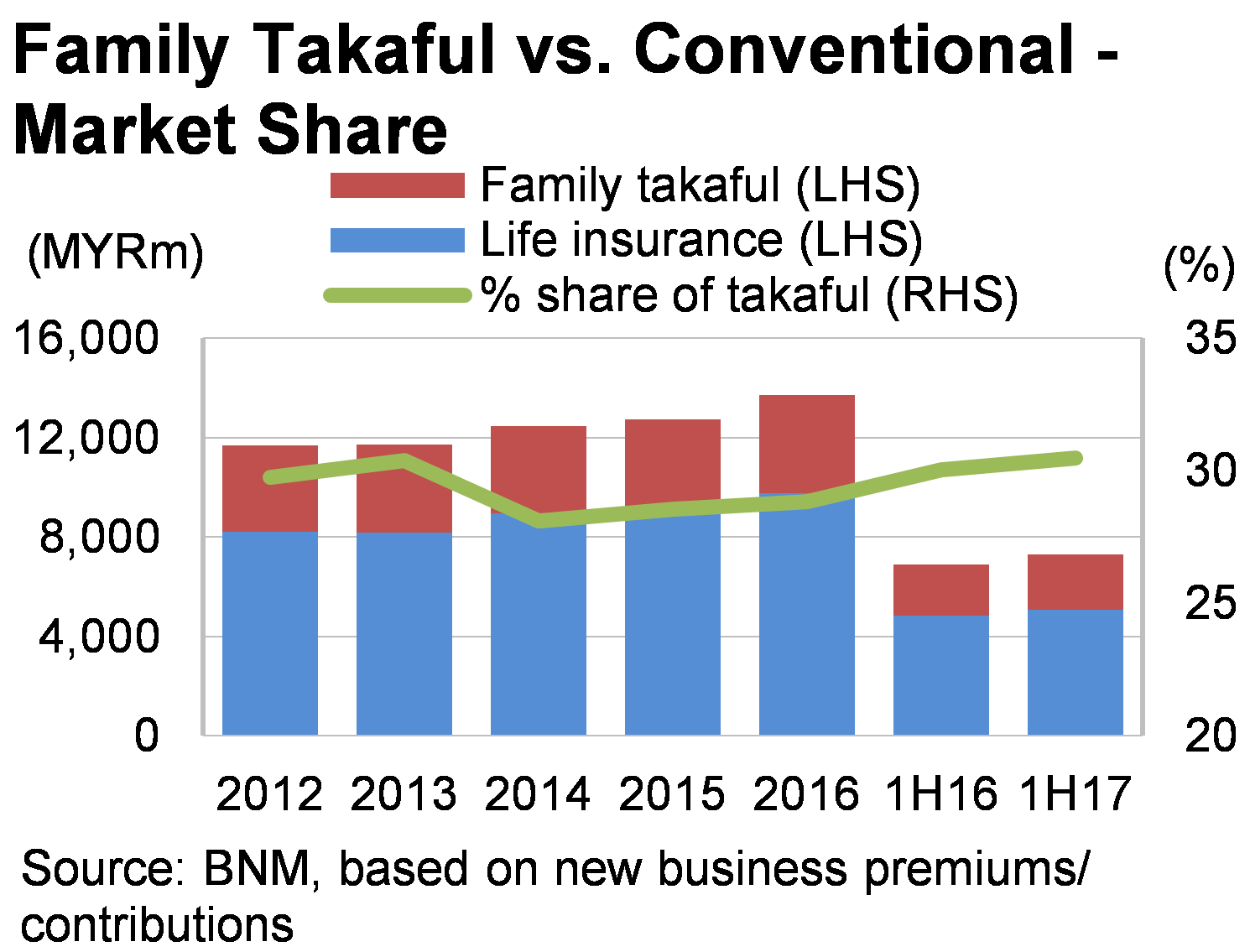

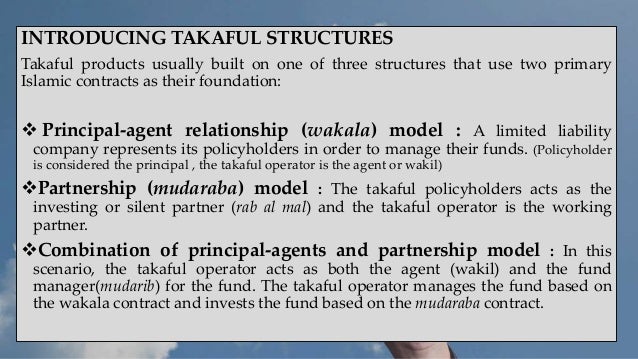

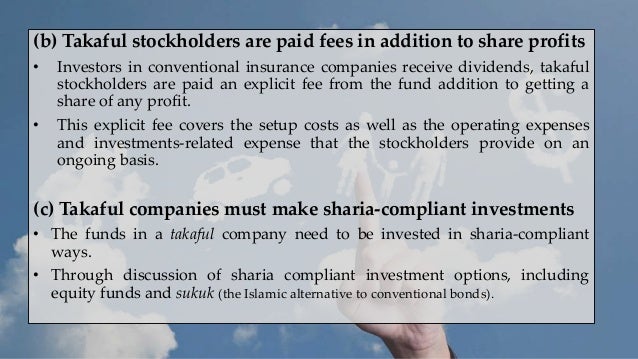

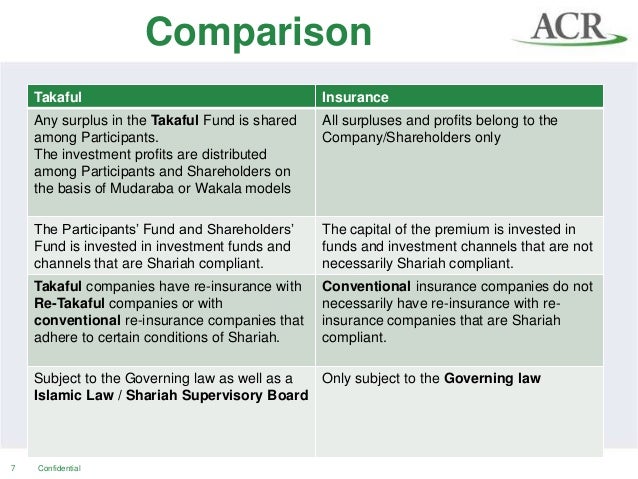

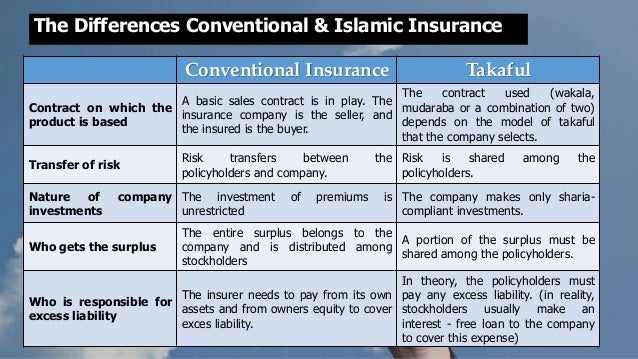

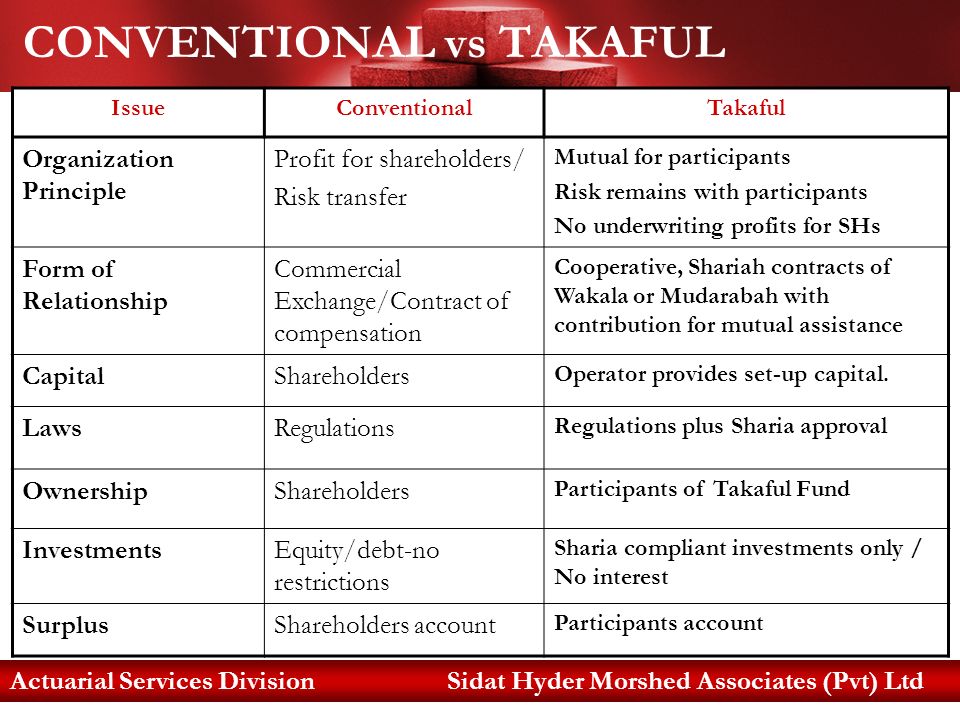

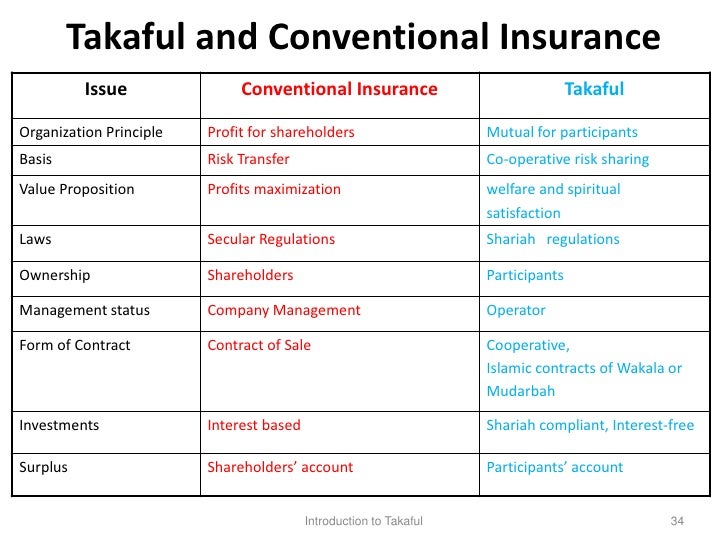

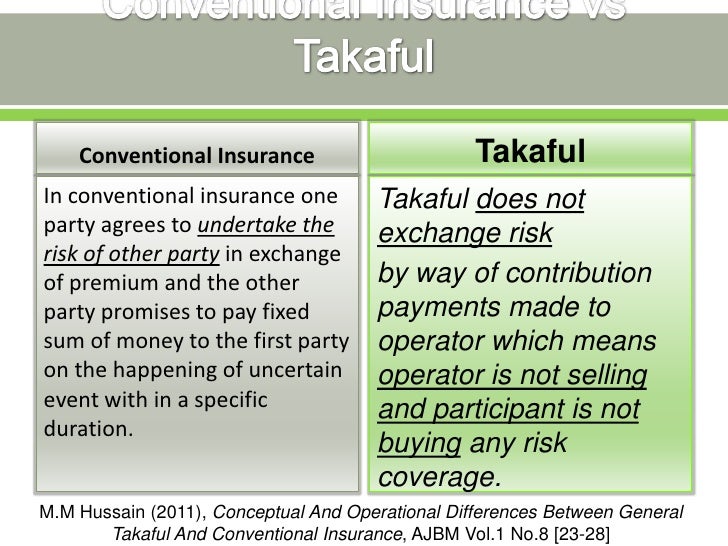

Takaful vs conventional insurance. Conventional insurance involves making investments that can incur risk and generate profits that will be retained by the company while under takaful investment profits are distributed among both participants and shareholders on the basis of mudaraba or wakala models. However net investment income shows statistical significance for both industries. Furthermore our results indicate that unlike in the case of conventional insurance the macro economic variables have no impact on the growth of takafulcompanies as measured by the net premiums contributions. Conventional insurance typically charges a fixed commission fee of 2 whereas takaful operators might impose a wakalah charge depending on the product and model.

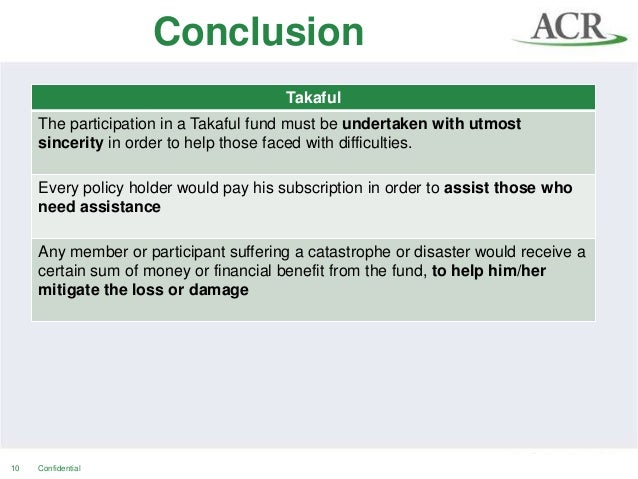

The takaful motor insurance uses syariah compliant laws as well as islamic teachings to form its policies. Hence it obviates the element of maisir while at the same time without losing the benefit of takaful in the same way as conventional insurance. Unlike conventional insurance which risk is transferred from the insured to the insurer the takaful insurance mutual risk is shared amongst the participants. 4 funds are only invested in non interest bearing i e.

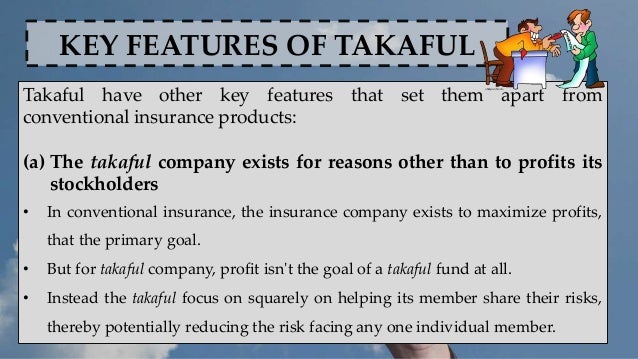

Takaful operations are based upon the principles of mutuality whereby each participant makes a donation to a takaful fund. Takaful insurance works on the same concept as conventional insurance but on a different ideology. Although both offers the same purpose which is to protect the insurer there are some major differences between both. If you re not sure what this means check out our beginner s guide to syariah compliant banking.

Conventional insurance most islamic jurists conclude that conventional insurance is unacceptable in islam because it does not conform with sharia for the following reasons. In the event of its. Other differences are the relationship between the operators and the participants. The wakalah charge is similar to a service fee.

The main different between conventional insurance and takaful is the way in which the risk is handled and assessed along with the management of the takaful fund.

:max_bytes(150000):strip_icc()/PROJECT-DEVELOPER-9bddde300c994be3871dd9790d15f7bb.jpg)