Third Party Car Insurance Price List 2019

A third party liability car insurance policy offers the following coverage.

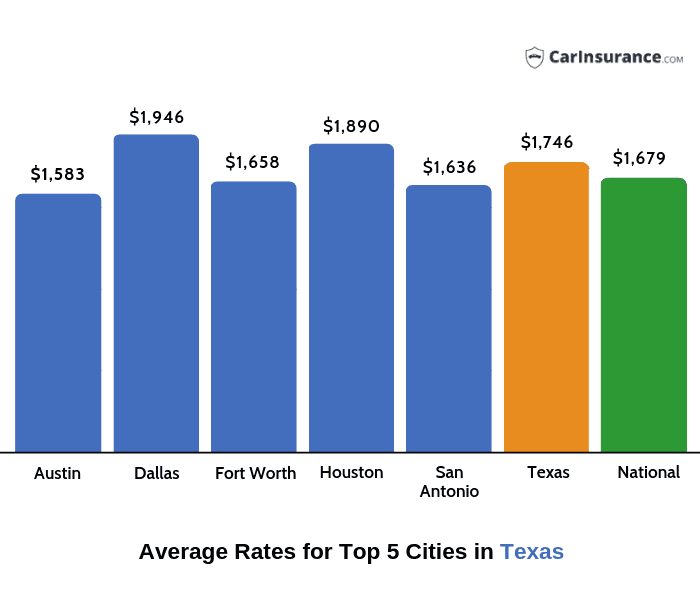

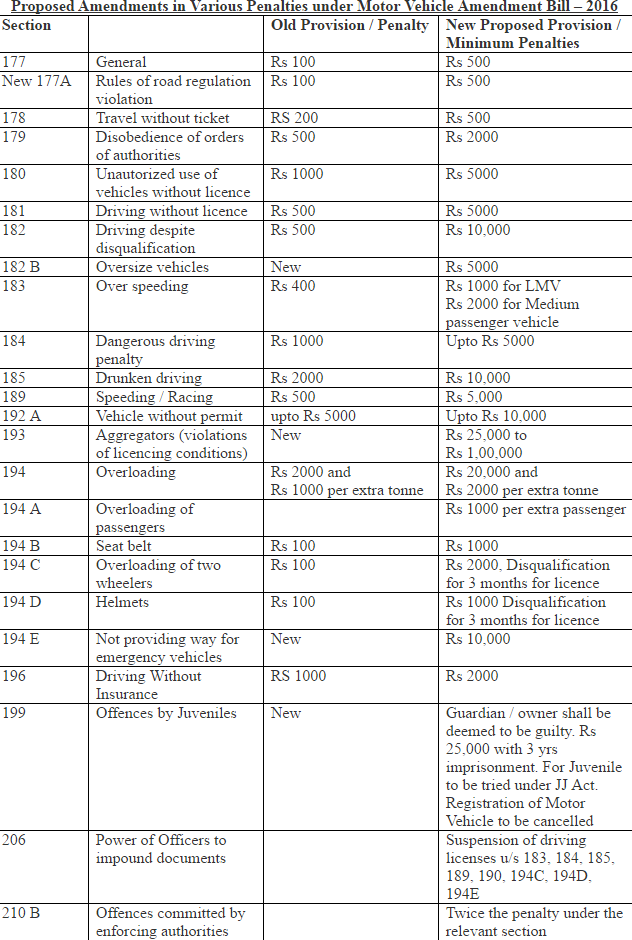

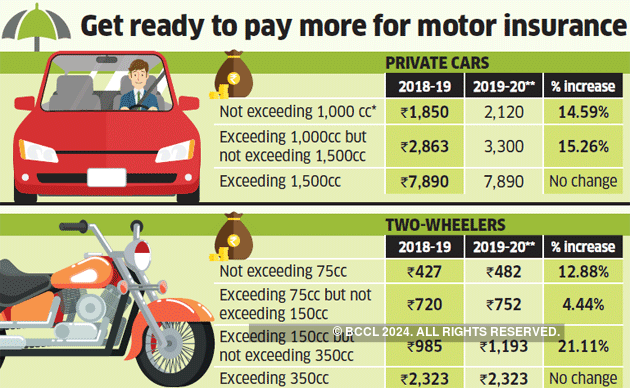

Third party car insurance price list 2019. The regulator has proposed certain changes in premium for 2018 19 w e f 1 april 2018. Third party liability car insurance. Say you have a car whose engine capacity exceeds 1500 cc since the third party car insurance since the third party premium includes cover for personal accident liability too you would be paying the below premium. The highest percentage rise of over 21 will be seen in two wheelers with engine capacities between 150cc and 350cc.

As per the motor vehicles act 1988 section 146 plying an uninsured vehicle on indian roads is an offence. According to the new rates you will have to pay more for your two wheeler and car third party liability covers with effect from june 16 2019. 07 august 2019. Basic tp premium personal accident owner driver gst 18 total third party premium in the fy 2018 19.

The insurance regulatory and development authority of india irdai has notified the premium rates for private two wheeler and car third party liability insurance cover for the financial year 2019 20. Rs 7 890 rs 100 rs. Third party motor liability insurance policy is necessary in india as per section 146 of the motor vehicle act 1988. The insurance regulatory and development authority of india irdai has.

Bodily injuries or loss of one limb one eye sight of a third party. The above mentioned premium costs are in effect from june 16 2019 what all is covered under third party car insurance policy. Find the latest car insurance price list for third party insurance comprehensive policy and learn how to find the premium price for your car make model. Car insurance price list.

The irdai revises the third party premiums payable towards motor insurance plans on a yearly basis as per the claims registered and settled.

/Who-will-my-auto-insurance-check-claim-be-made-out-to-527131-v2-f4edb97fee6f488d969226528a1b55d0.png)

/diminished-car-value-after-accident-2645571_FINAL-03d5b82f0c704c01a43a92a610f1fc3f.png)