Stamp Duty Calculator Malaysia

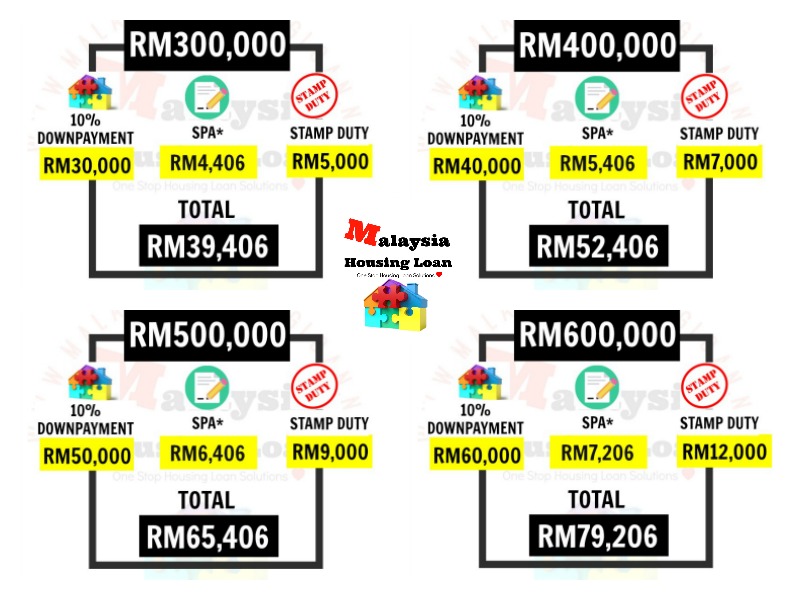

Rm7000 the actual stamp duty rm5000 maximum stamp duty exemption amount rm2000 00 this is because rm5000 is stamp duty for rm300 000 property value and this is also the maximum amount of the exemption.

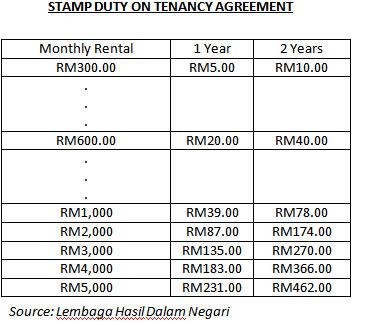

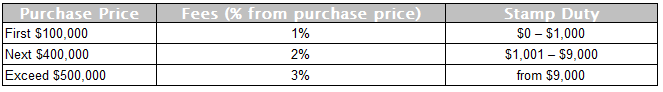

Stamp duty calculator malaysia. Stamp duty loan. The lease or tenancy instrument which secures annual rent not exceeding rm2 400 is exempted from duty and presentation of these instruments at a stamping office or. Find out this spa stamp duty calculator here. The stamp duty fee for the first rm100 000 will be 100 000 1 rm1 000 the stamp duty fee for the remaining amount will be 300 000 100 001 2 rm4 000.

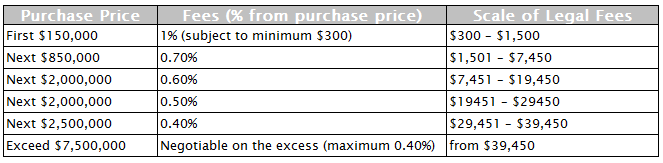

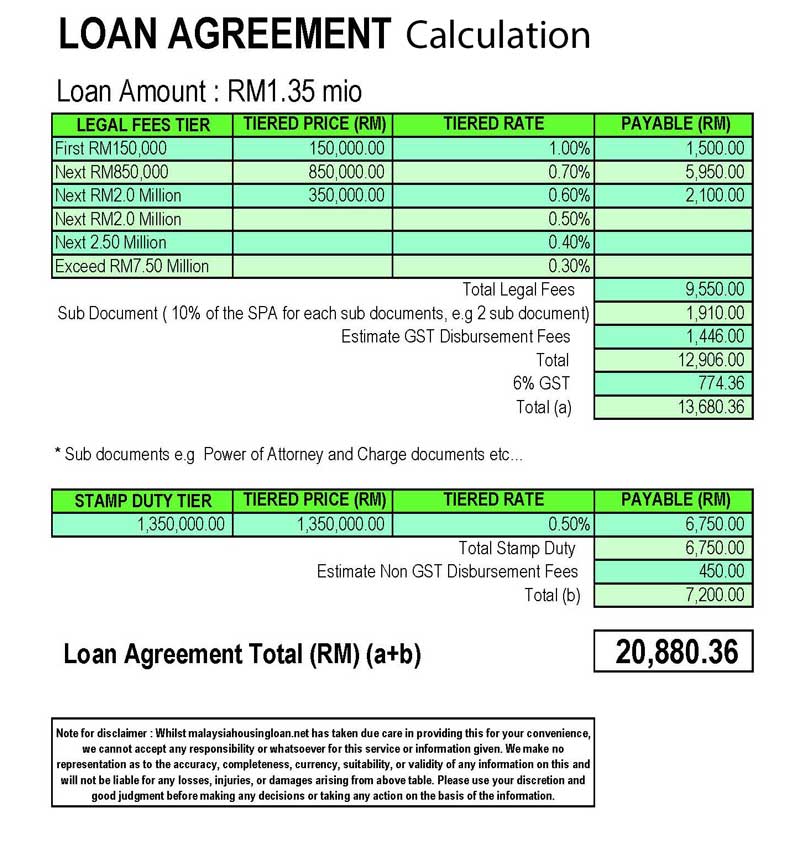

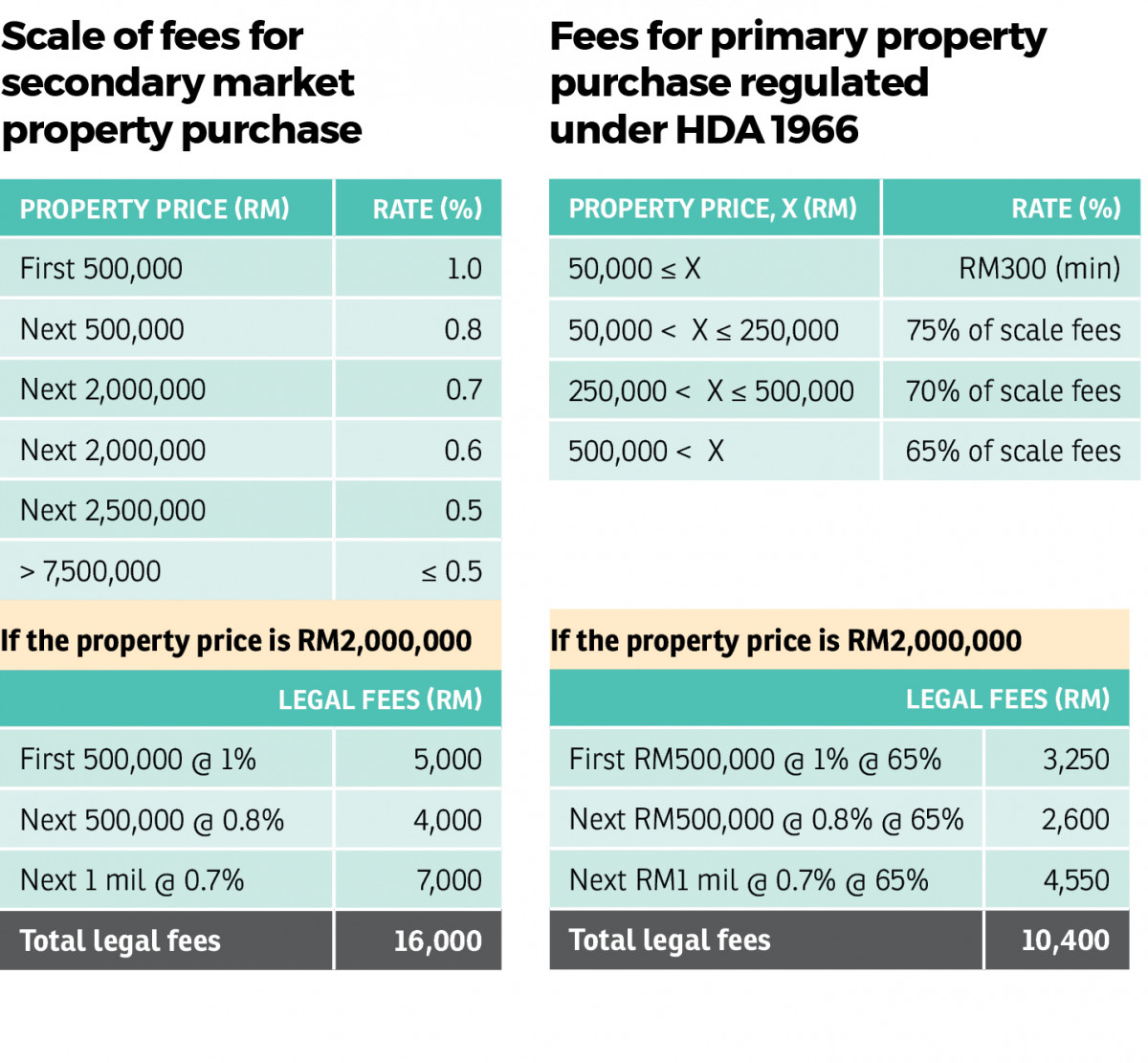

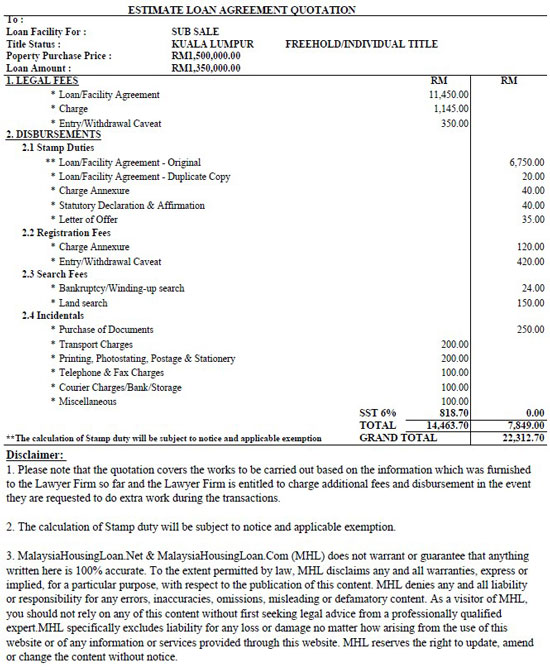

Legal fee and stamp duty calculator calculation of legal fees is governed by solicitors remuneration amendment order 2017 and calculation of stamp duties is governed by stamp act 1949. This is the official statement from lhdn inland revenue board of malaysia. Home malaysia law firm malaysia law statutes legal fee stamp duty for sale purchase agreement loan the calculation formula for legal fee stamp duty is fixed as they are governed by law. Please contact us for a detailed quotation as the following tables exclude any taxes disbursements and reimbursement charges.

Feel free to use our calculators below. Rm300 001 to rm500 000 purchase price stamp duty exemption only applicable after 1st july 2019. This means that for a property at a purchase price of rm300 000 the stamp duty will be rm5 000. Use legal fees calculator to calculate legal fees stamp duty malaysia.

603 4280 6202 email. So how much stamp duty will my rental unit incur. Legal fees stamp duty calculation 2020 when buying a house we give free quotation. Please contact us for a quotation for services required.

You can calculate how much spa stamp duty you need to pay for your house. Calculating stamp duty payable.