Tax Planning In Malaysia

Let s start from the perspective of the rakyat then zoom out to how it affects business in particular visit malaysia year 2020 and the economy at large.

Tax planning in malaysia. Tax planning in malaysia the best tax filing practices start with the right tax planning in malaysia. Tax planning in malaysia refers to the methods applied by the company s management alongside tax experts who can establish a taxation strategy that can reduce the costs of the business. This is important to estimate your income taxes for the particular year qualify for the right tax deductions and ultimately to reduce your taxable income and pay less taxes. Our malaysian company incorporation agents main focus is to provide specialized tax services and planning efficiently and effectively.

We wish to refer to a report in the chinese newspaper today which has caused confusion regarding basic questions of income derived from singapore and tax residence status generally income taxable under the income tax act 1967 ita 1967 is income derived from malaysia such as business or employment income. How does budget 2020 impact the rakyat. How to calculate tax for businesses and individuals. Although you can find numerous resources such as an article about tax planning in search engines such as google professional assistance is indispensable.

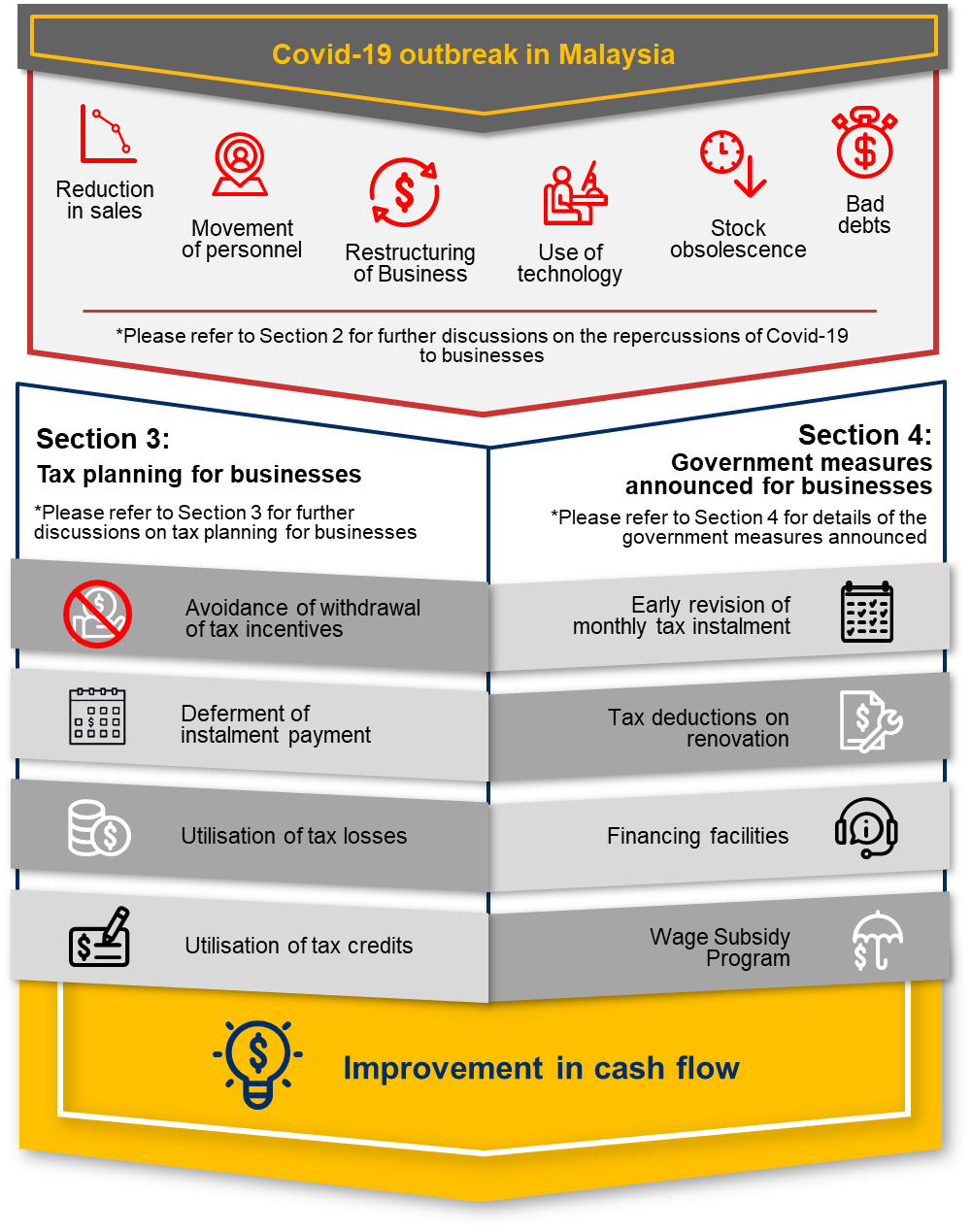

Income tax scale rates the income tax scale rates remain at 0 to 28 for the first rm2 million in chargeable income. Tax tax is a compulsory payment to a government from individual income business profit and charged on sales of goods and services. Our tax planning specialists in malaysia help identify the proper tax planning opportunities for your company and maximize the tax efficiency in order to save additional revenue. Below are some pointers which companies may note for tax considerations depending on its tax position.

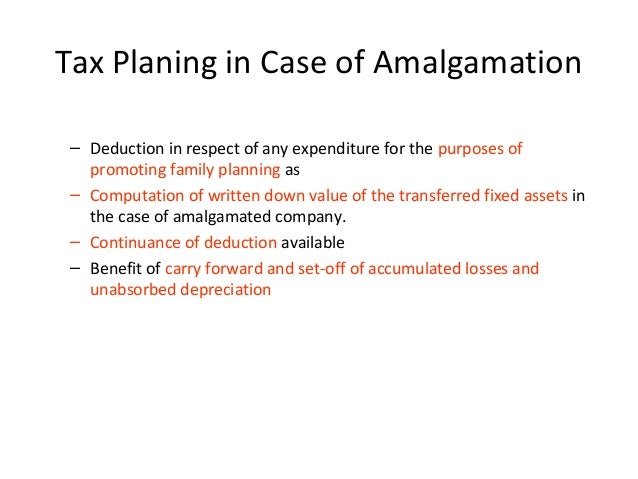

Tax planning is the process of looking at the available tax options in order to determine how the company can conduct the business transactions so that taxes are eliminated or reduced. On march 10 the inland revenue board issued the following clarification. Tax planning for individual income tax in malaysia individual tax planning how to save more taxes individual tax planning can be done before end of any financial year. How to maximise your tax planning efficiently.

The impact on the man in the street 1. Corporate tax planning in malaysia.