Tax Law In Malaysia

Residents according to malaysian tax law have to fill in a be form non residents an m form.

Tax law in malaysia. The standard corporate tax rate is 24 for malaysian companies as well as for branches that operate here. You have to fill the respective forms completely and to return them within 30 days to an irbm inland revenue board of malaysia office. After your declaration has been processed your credit in the account will be refunded to you automatically. These proposals will not become law until their enactment and may be amended in the course of their passage through parliament.

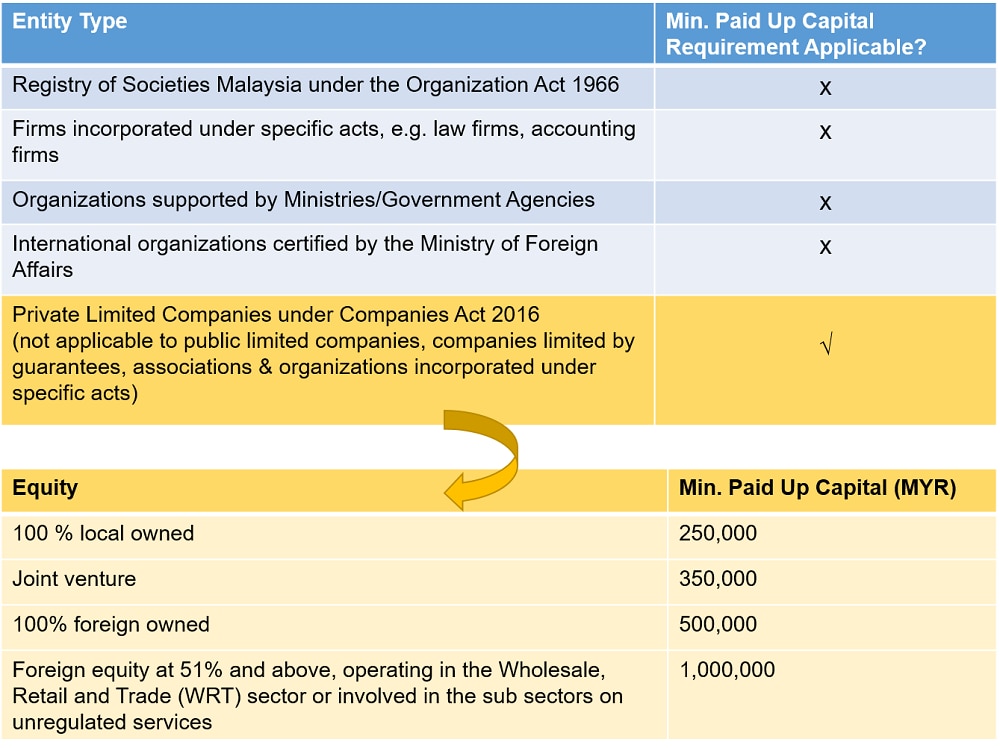

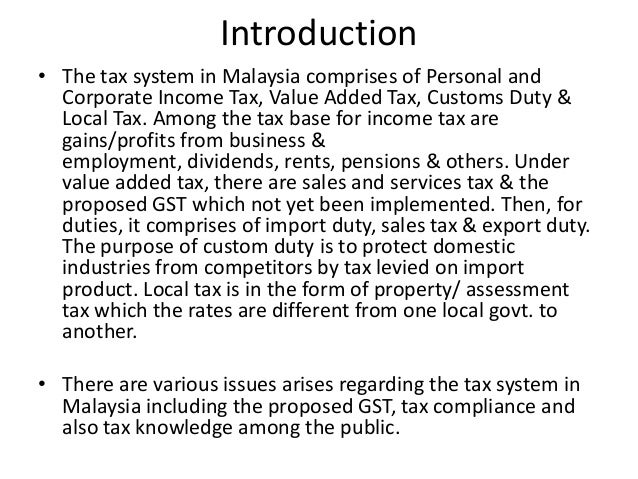

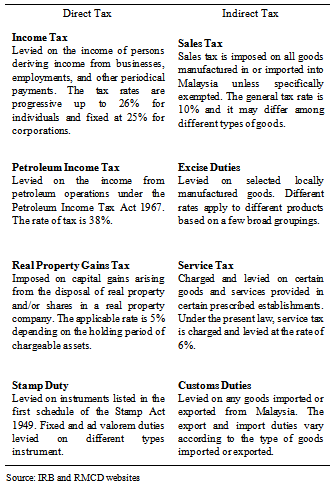

Charge of income tax 3 a. Laws of malaysia act 53 income tax act 1967 arrangement of sections part i preliminary section 1. Small and medium companies are subject to a 17 tax rate with the balance in this case being subject to the 24 rate. Income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope.

Foreign workers should seek help from registered local tax advisors to better understand their tax liabilities. Expatriates working in malaysia for more than 60 days but less than 182 days are considered non tax residents and are subject to a tax rate of 30 percent. Income taxes in malaysia for non residents you are regarded as a non resident under malaysian tax law if you stay in malaysia for less than 182 days in a year regardless of nationality. This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019.

This publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices. Non chargeability to tax in respect of offshore business activity 3 c. Under malaysian law the test to determine the tax residence of a company is based on the control and management test. You ll still need to pay taxes for income earned in malaysia and will be taxed at a different rate from residents.

Malaysia adopts a territorial principle of taxation meaning only incomes which are earned in malaysia are taxable. Short title and commencement 2.