Why Malaysia Currency Drop

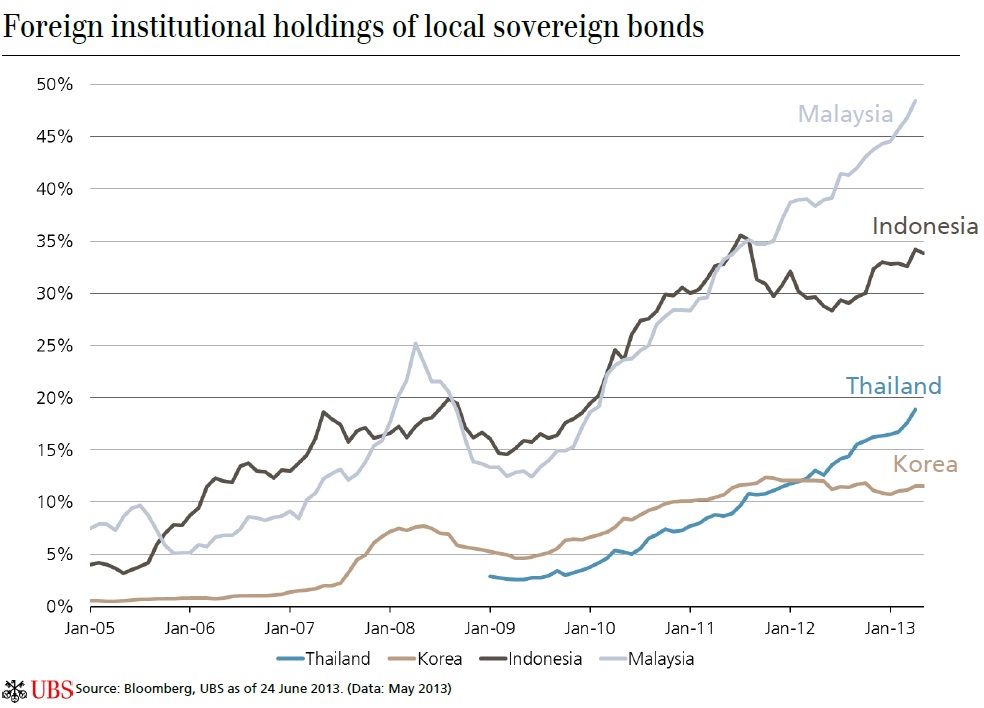

Like most of its asian peers the ringgit has benefited from a weak dollar and robust demand for higher yielding debt.

Why malaysia currency drop. While rm is dropping against the federal reserves the singapore dollar is becoming stronger against the federal reserves the chief economist said. A major contribution to the malaysian currency s drop is due to the depreciating global oil prices. What lies behind the latest market sell off. Ftse russell said monday it may drop malaysian debt from the ftse world government bond index because of concern about market liquidity roiling the asian nation s currency and bonds on tuesday.

The downward pressure on malaysian government bonds and the currency since mid march intensified this week after a warning on monday by ftse russell of the possible exclusion of malaysian government debt from its world government bond index. To make matters worse the export dependent economy is also threatened by a rout in commodity prices and the devaluation of the chinese s yuan. As oil is one of malaysia s main exports the declining price of brent crude oil will reduce the demand of her currency. South korea indonesia and thailand had to borrow money from the international monetary fund imf.

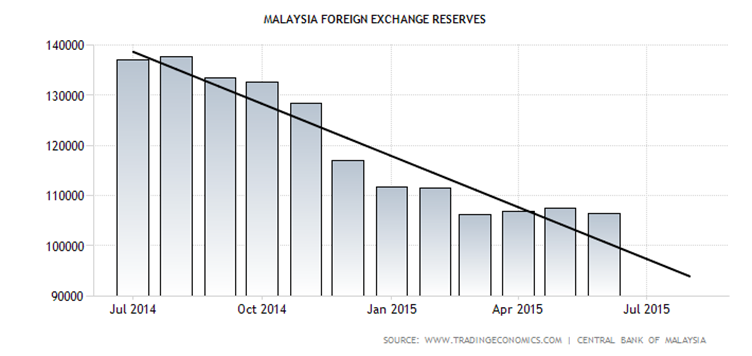

This is due to the fact that malaysia is a major oil producer. Another reason to beware of capital controls is that malaysia s reserves have dropped to 96 7 billion as of july 31. As oil is one of malaysia s main exports the declining price of brent crude oil of 38 from its june 2014 high is affecting the currency as questions over malaysia s 1mdb debts have gained global attention this has also affected confidence in the ringgit. Malaysia imposed strict capital controls and fixed the exchange rate at 1 usd 3 80 myr for a couple of years.

It has gained more than 3 since the start of july to outperform all but one of its asian peers. If malaysian bonds are removed from ftse s index debt inflows could dry up depriving the currency of a key source of support. The index provider cited worries about market liquidity. The good news is that we have recovered from that bout of ringgit tumble.

Firstly the lower value of oil. This decline is attributed to low oil prices and also efforts by its central bank to defend its currency unsuccessfully.