What Is Asb Financing

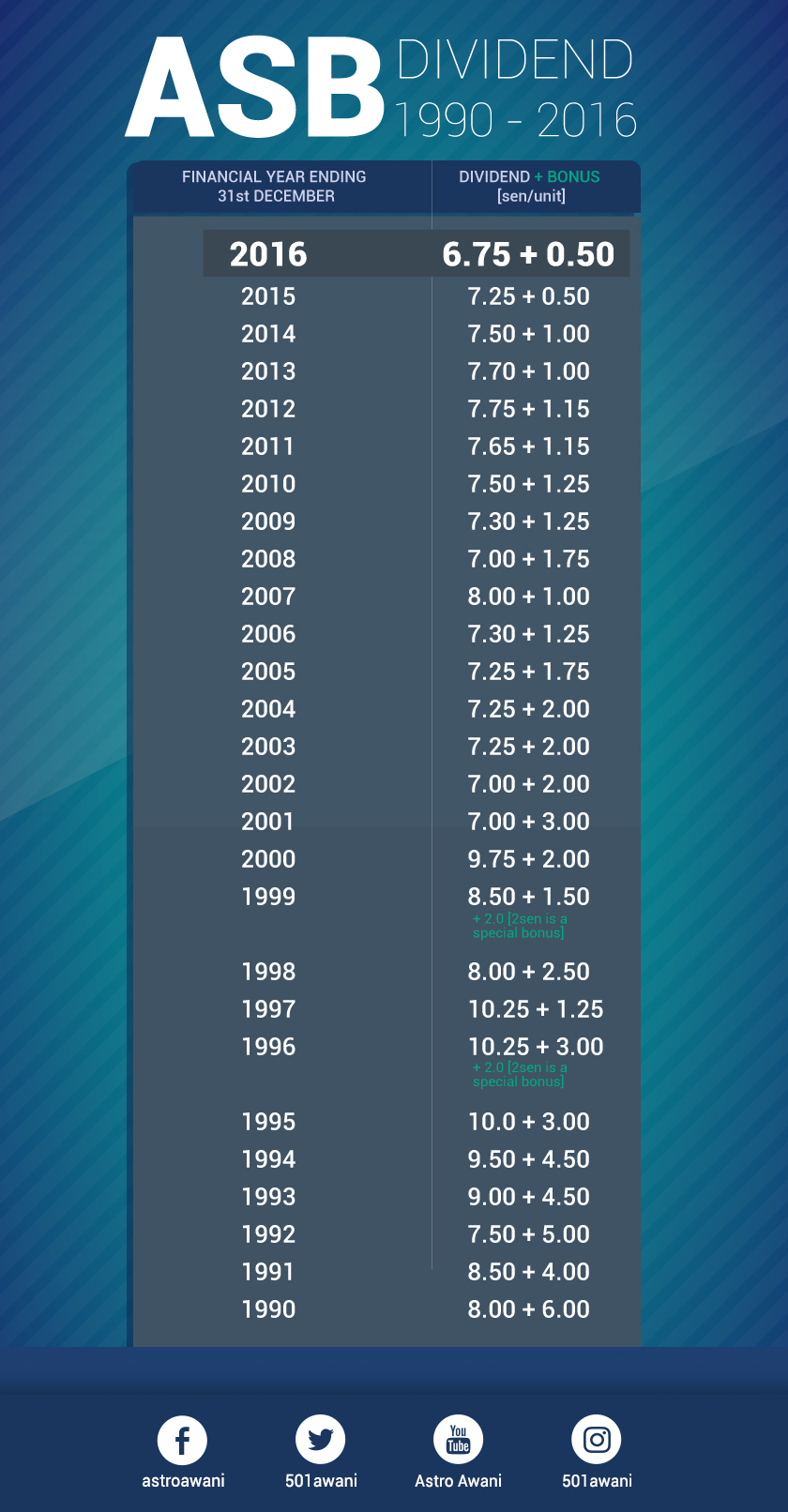

Asb was launched by amanah saham nasional berhad asnb on 2nd january 1990 for all malaysian bumiputeras.

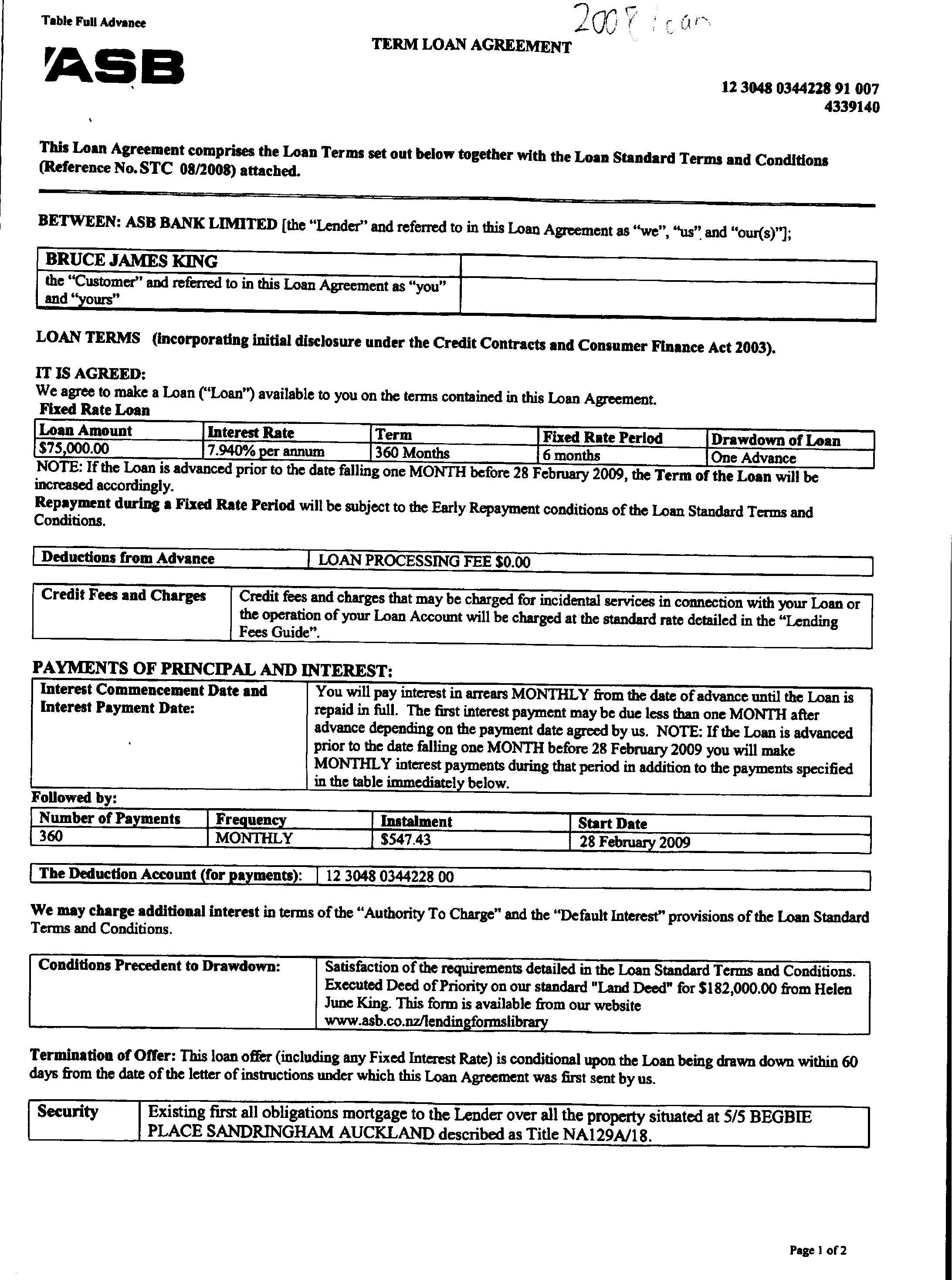

What is asb financing. Asb financing is a simple concept. Min financing amount. Financing for asb unit trust financing tenure. Enjoy a stable interest rate throughout your loan tenure.

Most asb loans today use floating interest rates so interest rates will change according to blr. High margin of financing. Written by iris lee launched in 1990 amanah saham bumiputera asb changed the landscape of investment for bumiputera in malaysia. It is one of the best performing funds under pnb management.

Up to rm200 000 per customer at any one time including the balance outstanding of the existing asb financing if any or up to maximum investment amount allowed by asnb whichever is lower. A leading provider of comprehensive financial medicare retirement planning services for individuals living in the state of florida for every individual protecting their family their legacy and their hard earned assets are of the utmost importance. When you look at your asnb account there will be a split between your cash investments and loan certificate. It aims to generate long term consistent and competitive returns for investors.

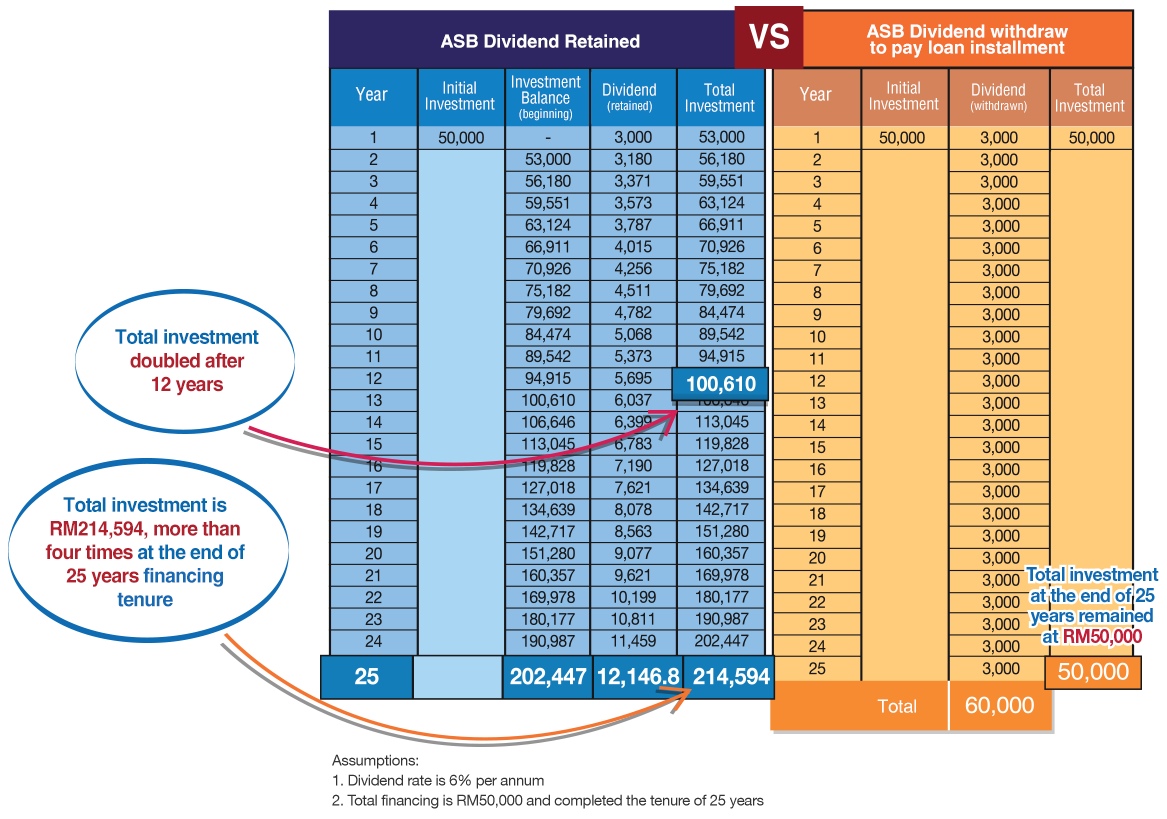

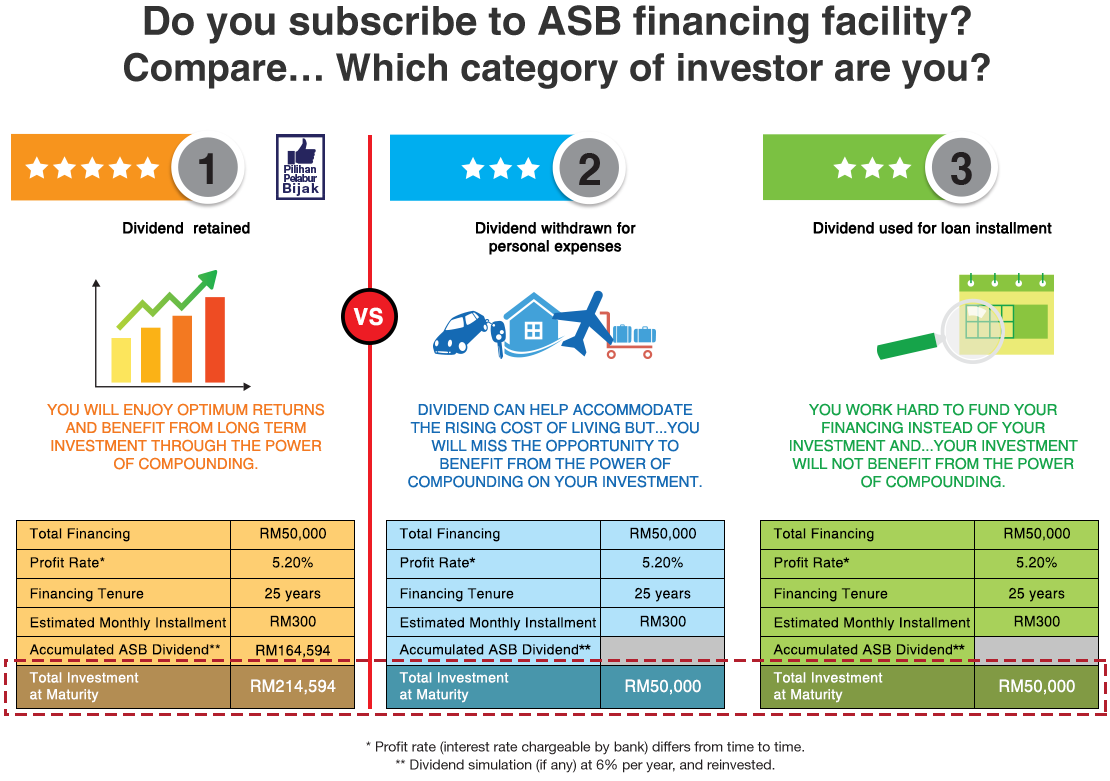

Banks provide loans at a br x rate depending on bank that will automatically be put into your amanah saham account as an investment in asb. From 5 years up to maximum 35 years or 65 years of age whichever is earlier. Asb financing is basically borrowing an initial capital from banks to invest into amanah saham bumiputera then use the returns generated to pay down the bank borrowings while keeping the balance. When you look at.

An income equity fund with a fixed price per unit at rm1 00. I have an asb loan of rm100k. Up to 30 years or age 65 min financing amount. How to apply asb financing.

Interest rate of br 1 55 p a. Asb financing is a simple concept.