What Is Variable Life Insurance

Variable life insurance is a type of permanent life insurance with a flexible death benefit the amount paid when you die.

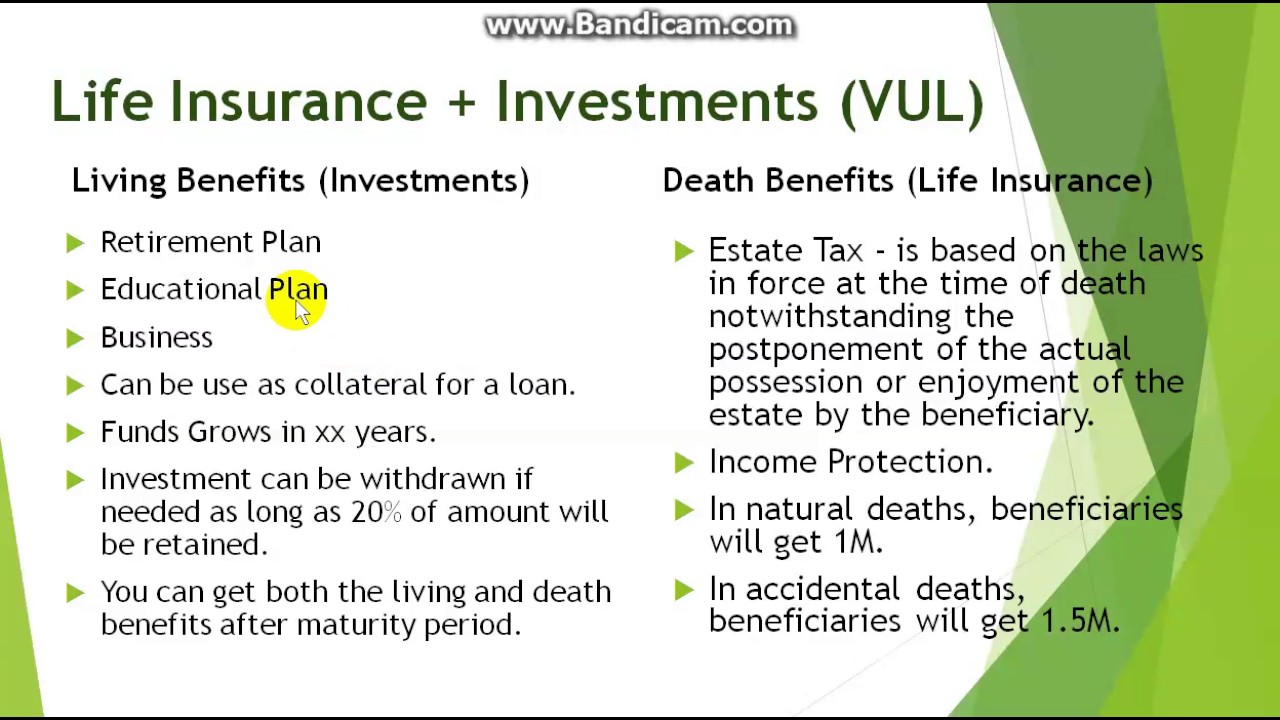

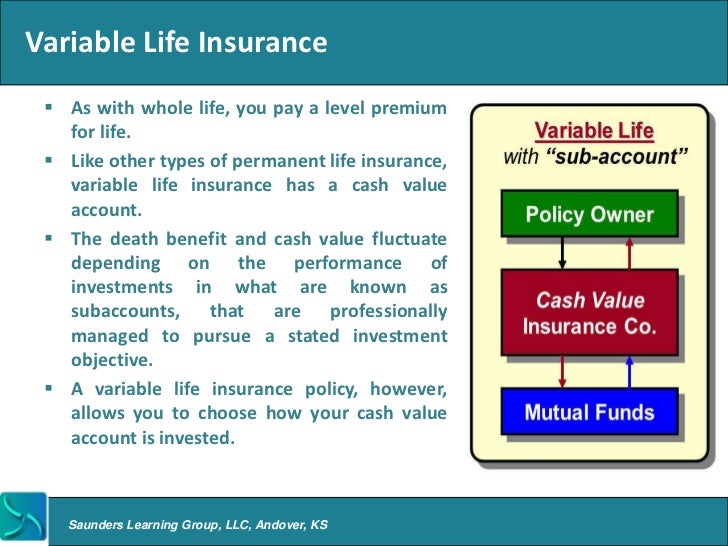

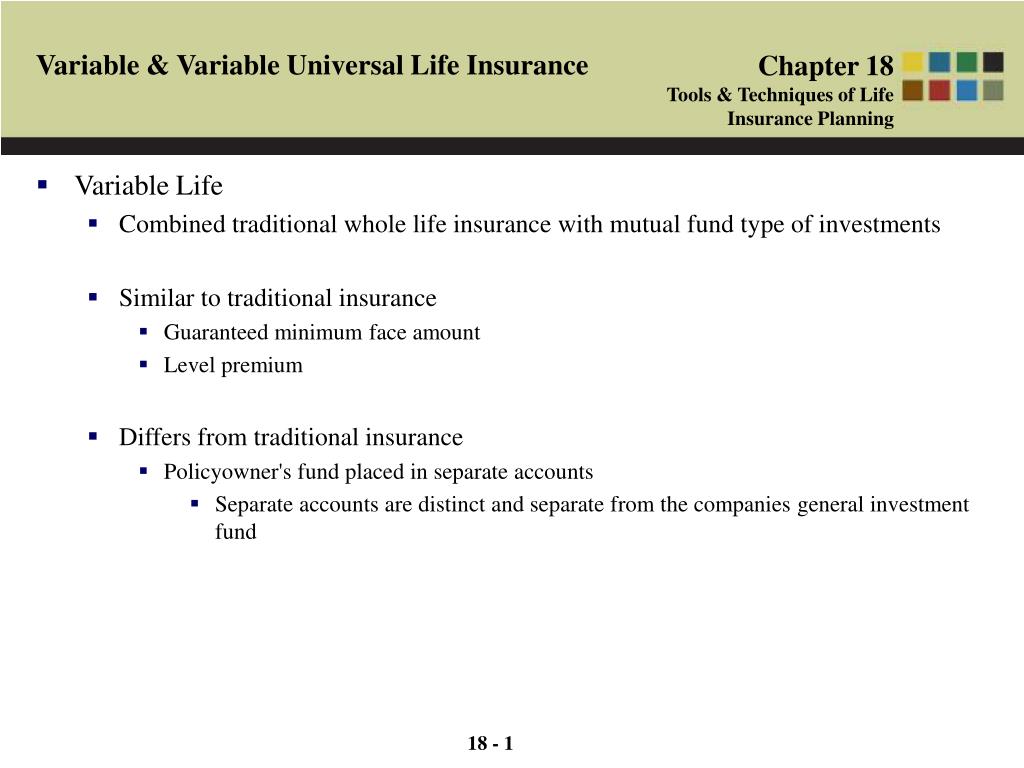

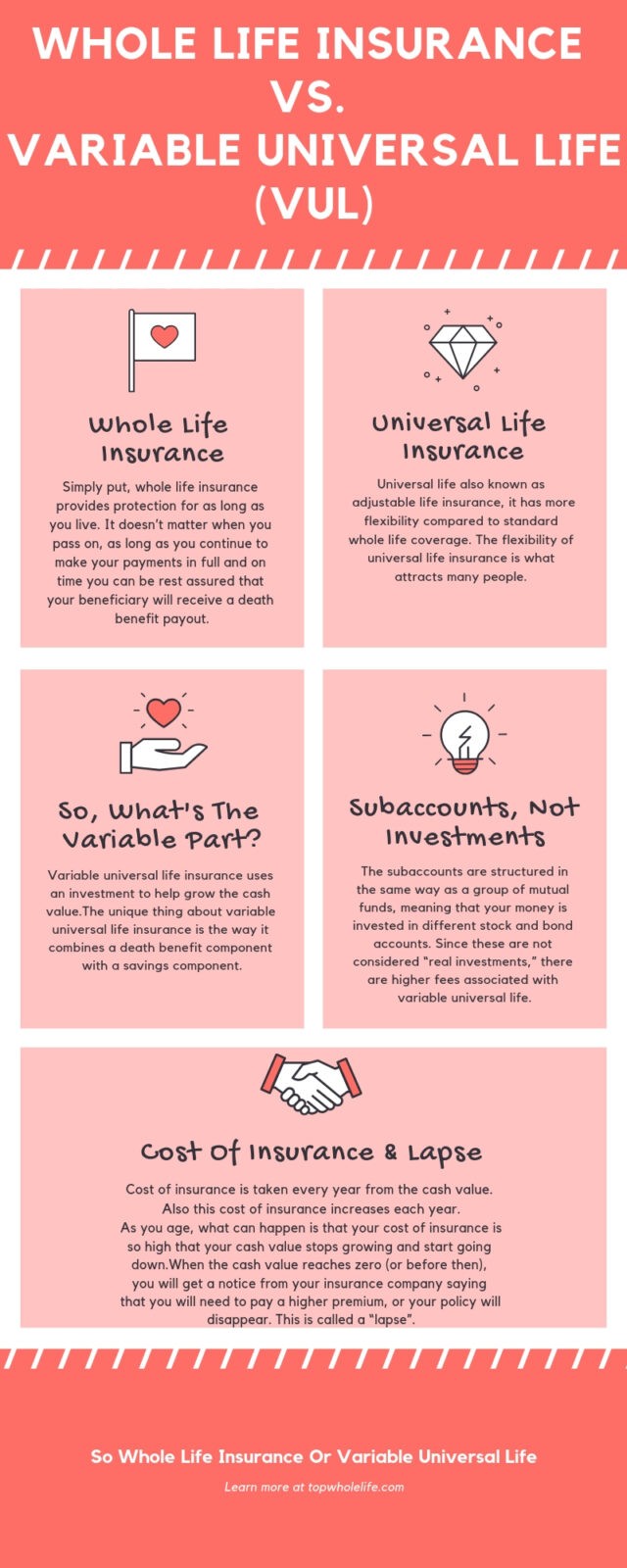

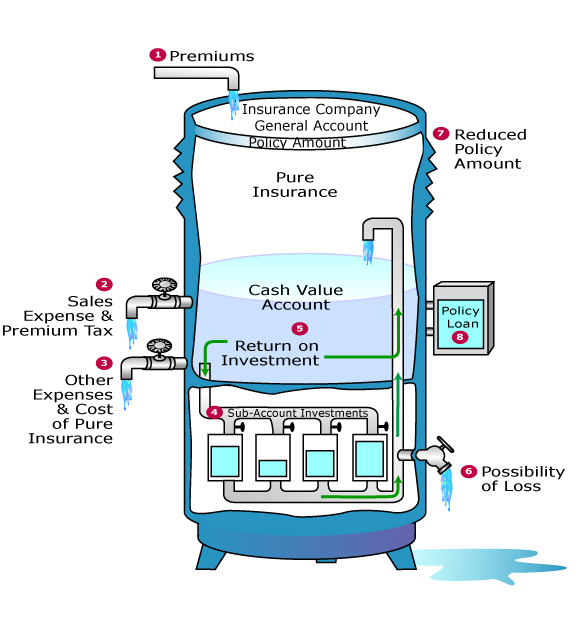

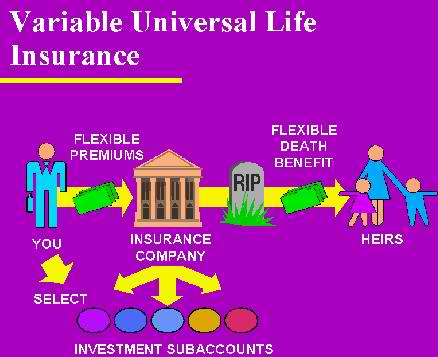

What is variable life insurance. It is intended to meet certain insurance needs investment goals and tax planning objectives. In a vul the cash value can be invested in a wide variety of separate accounts similar to mutual funds and the choice of which of the available separate accounts to use is entirely up to the contract owner. Whether you pass at 49 or 99 if your premiums are paid up your heirs will receive a death benefit. This product contains separate accounts comprised of various instruments and investment funds.

Variable life insurance is this type of policy that has permanent death benefit proceeds whereby funds will be available to a beneficiary or beneficiaries for final expenses and other needs of the insured s survivors. A variable life insurance policy is a contract between you and an insurance company. It is a policy that pays a specified amount to your family or others your beneficiaries upon your death. Variable universal life insurance often called vul has a similar.

Variable life insurance is a permanent life insurance product. Every variable life insurance policy has three primary components. Variable life insurance is a type of permanent life insurance policy meaning coverage will remain in place for your lifetime so long as premiums are paid. Variable policies are considered.

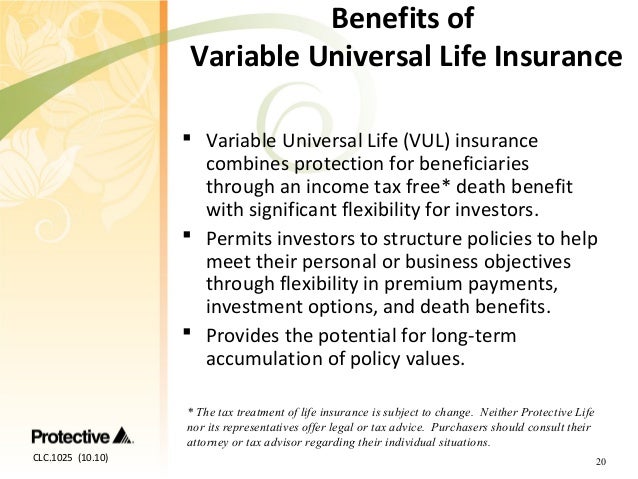

You receive life insurance coverage for your entire life. The other component that is found in variable life insurance is used for investing. To some the benefits seem attractive. Variable universal life insurance often shortened to vul is a type of life insurance that builds a cash value.

The variable component in the name refers to this ability to invest in separate accounts whose values vary they vary because they are invested in stock and or bond markets.