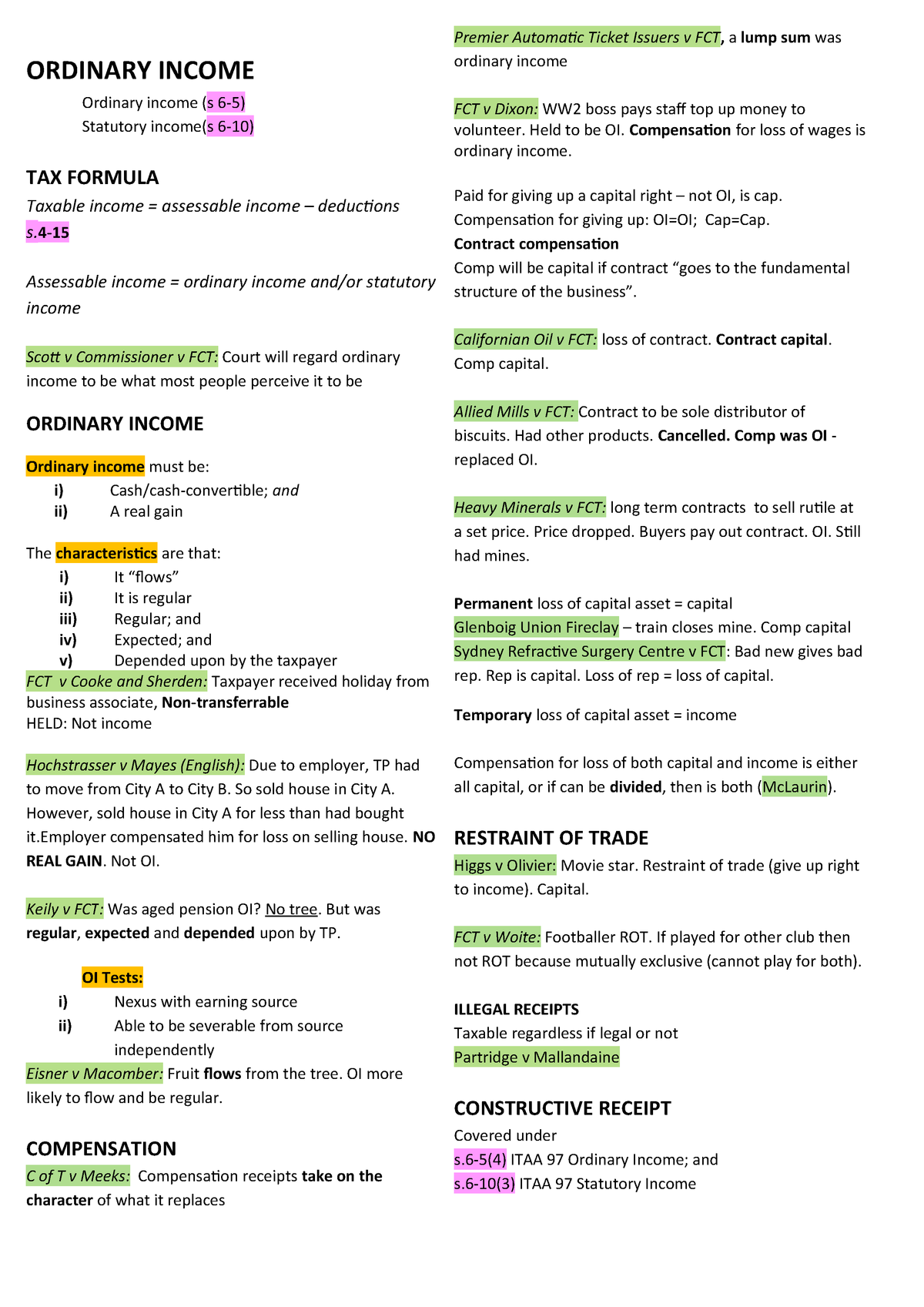

What Is Statutory Income

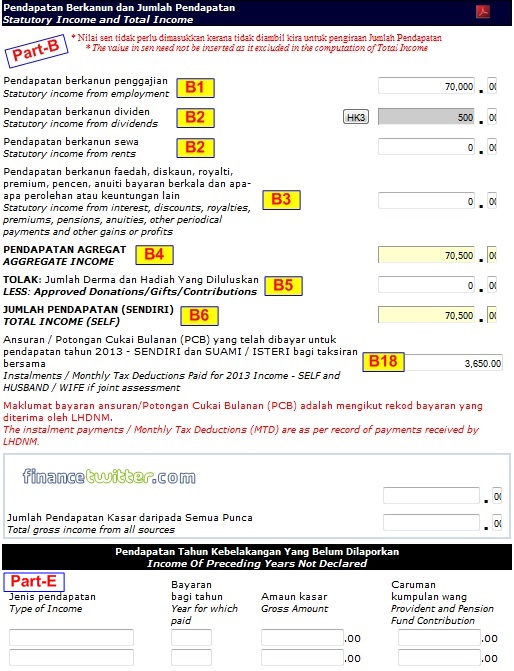

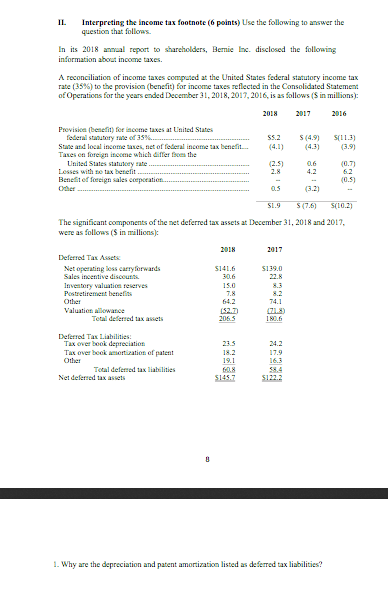

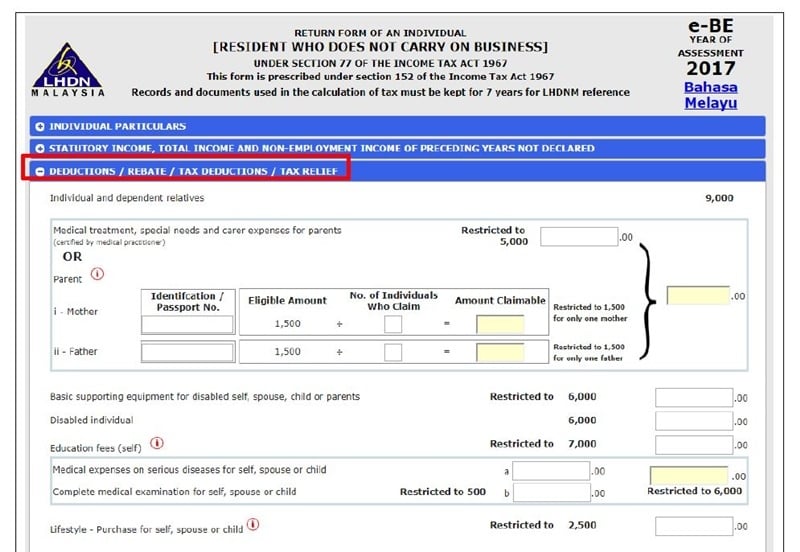

Deductions 10 part e.

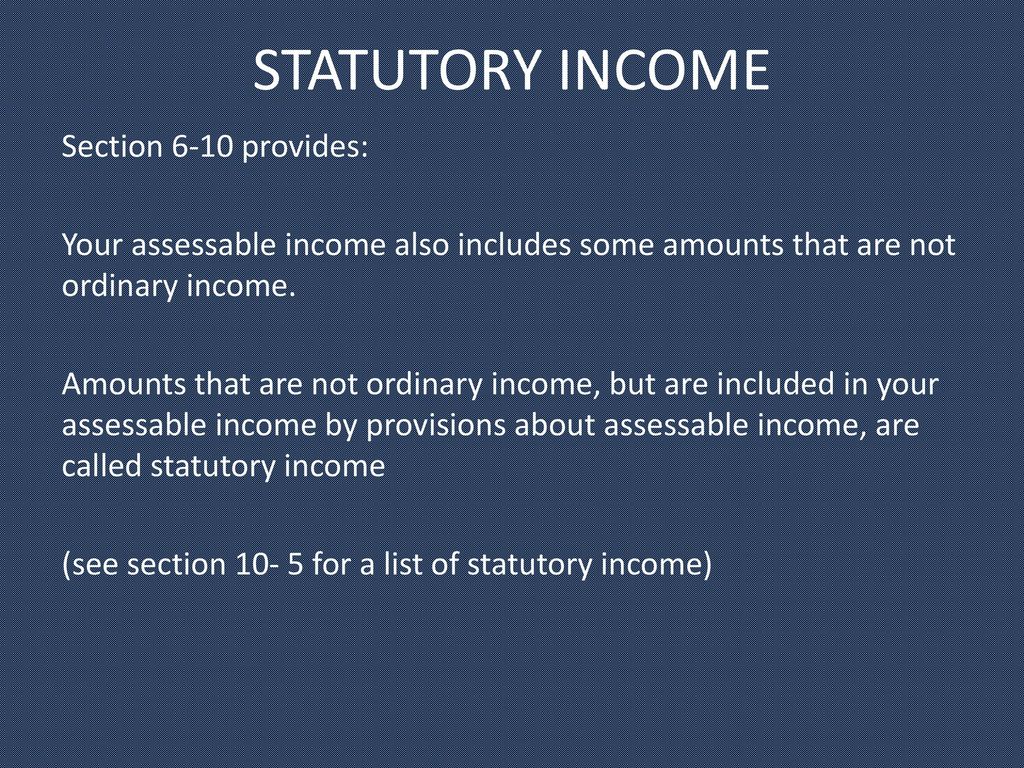

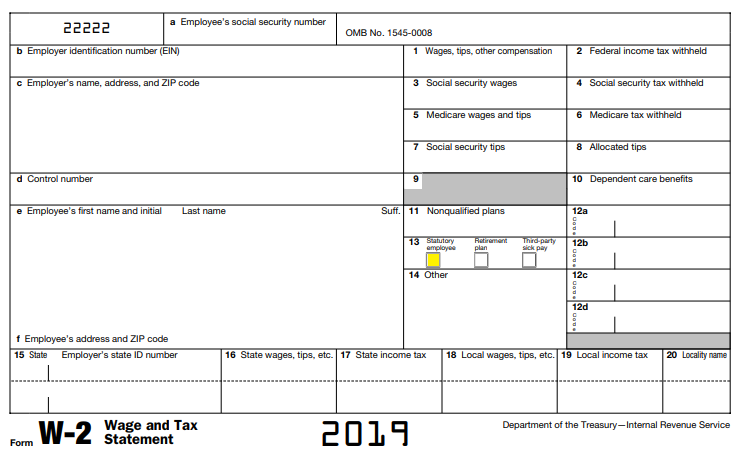

What is statutory income. Statutory income are amounts outside the. Ordinary concepts of income that have been. Enter your statutory employee income from box 1 of form w 2 on line 1 of schedule c or c ez and check the box on that line. If you received a form w 2 and the statutory employee box in box 13 of that form was checked report your income and expenses related to that income on schedule c or c ez.

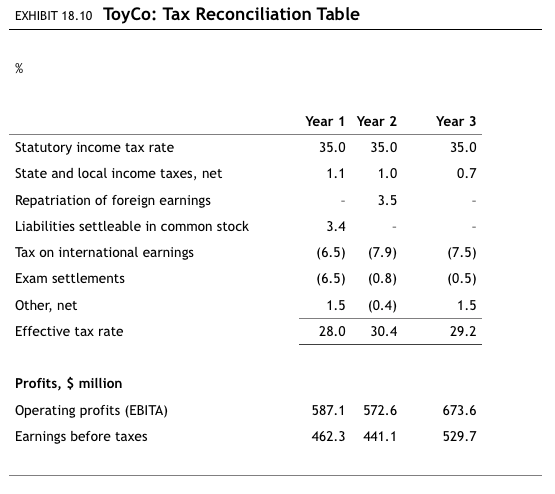

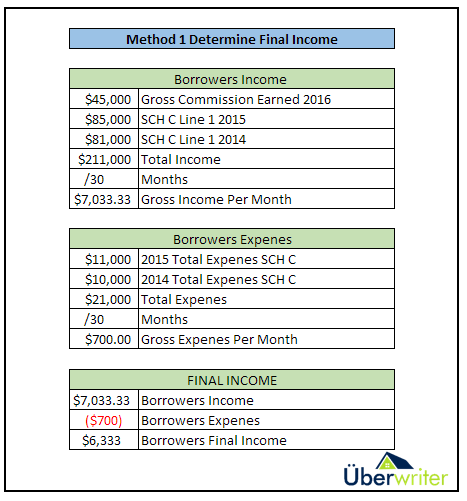

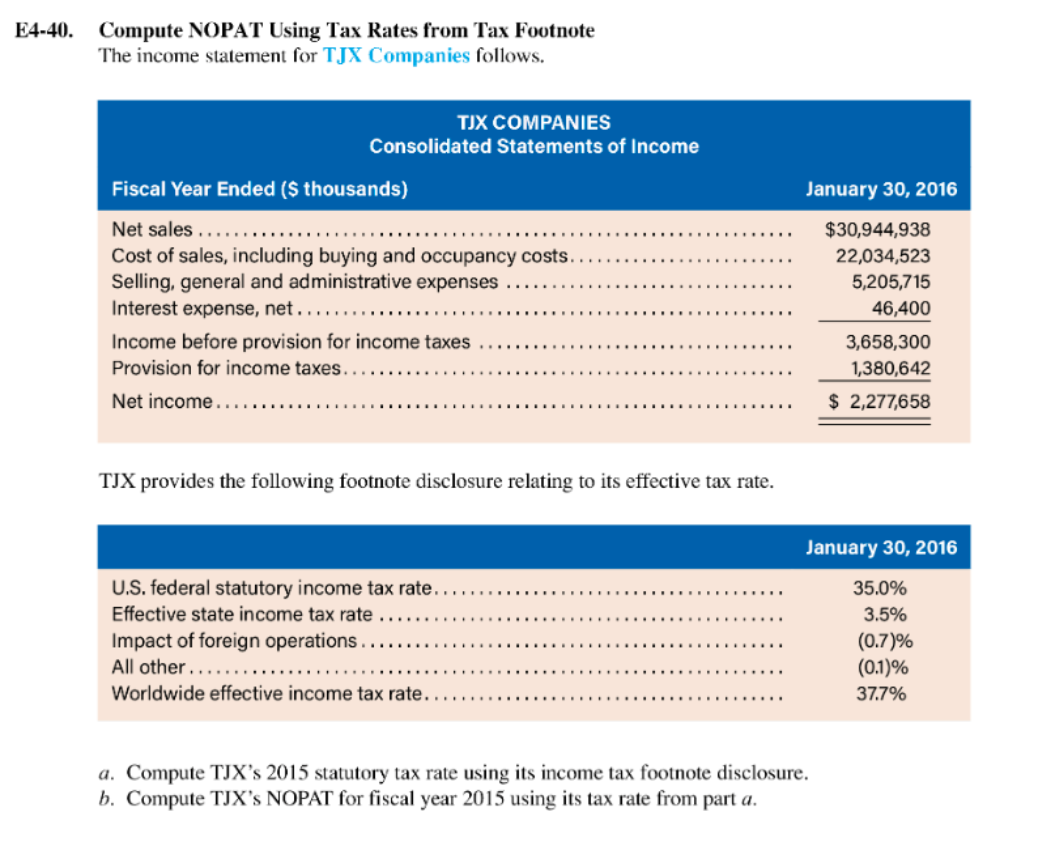

The effective tax rate is the percentage of income actually paid by an individual or a company after taking into account tax breaks including loopholes deductions exemptions credits and preferential rates. Some types of statutory income are commission lump sum payments for termination of a job royalties and. Statutory income is income that is not part of the income from an hourly or salary job. If workers are independent contractors under the common law rules such workers may nevertheless be treated as employees by statute statutory employees for certain employment tax purposes if they fall within any one of the following four categories and meet the three conditions described under social security and medicare taxes below.

Income of preceding years not declared 22 part h. Earnings as a statutory employee are reported as income on line 1 of schedule c rather than form 1040 line 1 wages salaries tips etc. Statutory income reported on schedule c. The statutory employee can deduct their trade or business expenses from the earnings shown on form w 2.

The exercise of statutory stock options will not result in immediate declarable taxable income to the employee one of the. The taxation of statutory stock options can be somewhat complicated. Statutory income is also reffered to as take home pay as it is the amount of money you take home after all deductions. The statutory tax rate is the rate imposed by law on taxable income that falls within a given tax bracket.

Statutory income and total income 7 part d. Specifically included in assessable income. Status of tax for year of assessment 2011 21 part g. Tax payable 17 part f.

Statutory income is the combined income of any person from all sources remaining after allowing for the appropriate deductions and exemptions given under the income tax act. Particulars of executor of the deceased person s estate 22 declaration 23 particulars of tax agent who completes this return form 23. For example a net capital gain is statutory income. If a receipt is classed as both ordinary income and statutory income the statutory rule prevails.