Visa Debit Card Vs Credit Card

/difference-between-a-credit-card-and-a-debit-card-2385972-Final-5c4731cbc9e77c00018a49e9.png)

When you open a credit card you re approved for a certain line of credit.

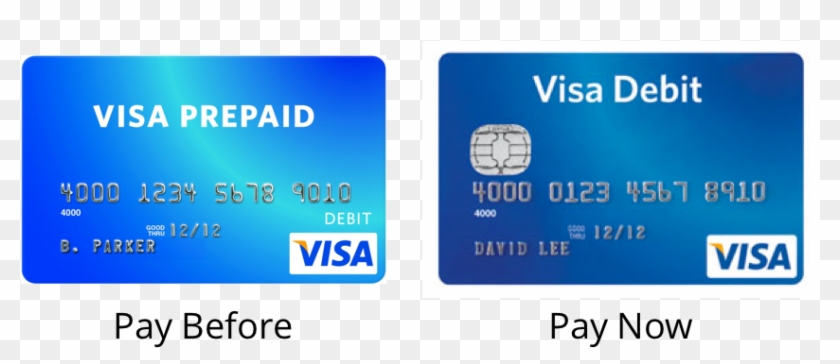

Visa debit card vs credit card. Benefits of the prepaid card. A prepaid card is different from a debit card based on the fact that you don t need a bank account to have a prepaid card. Transactions made with debit cards are paid for immediately while credit cards can be paid off over time. As you can see there are quite a few key differences between the three cards above so let s discuss them in more detail.

Your credit card unlike a debit card is like a loan. Debit cards offer the convenience of credit cards. This is only available on cards with the visa or mastercard logos though you can run your debit card as credit you are still using your own money to pay for the purchase unlike a credit card where you re using the bank issued line of credit. When you use a credit card you are borrowing money.

With a debit card you must fight to get your money back. This can be confusing because both types of cards may have a card network logo such as visa mastercard american express or discover on them. Unlike debit cards credit cards are not connected to a checking account. Debit cards are linked to a bank account and are available without a credit check.

With a credit card the card issuer must fight to get its money back. A debit card is issued by a bank to their customers for the purpose of accessing funds without having to write a paper check or make a cash withdrawal. A debit card is linked to one s checking. Debit cards make it more difficult to overspend since you re limited to only the amount available in your checking account.

A debit card is a payment card that makes payment by deducting money directly from a consumer s checking account rather than via loan from a bank. With a credit card you run the risk of spending beyond your means. What are credit cards. Whereas a debit card transaction is mainly between the buyer and seller a credit card transaction specifically involves a third party.

Prepaid cards are very different from credit cards. Instead they are tied to a financial institution such as a bank or credit company that is in the business of issuing revolving lines of credit to consumers. Just because your credit limit is 1 000 doesn t mean you can afford that sort of spending in your monthly budget.

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/cloudfront-us-east-1.images.arcpublishing.com/gmg/QTLUPRBKDZDQHNZ7AUVJXVXHMU.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/11818357/starling2.jpg)

/stacked-credit-cards-480920118-00ee729e90f544cb8fdb3e246effb2bc.jpg)

:strip_icc()/can-i-use-a-debit-card-online-315325-v6-5b6891cd46e0fb00253b6efe.png)