Study Loan In Malaysia

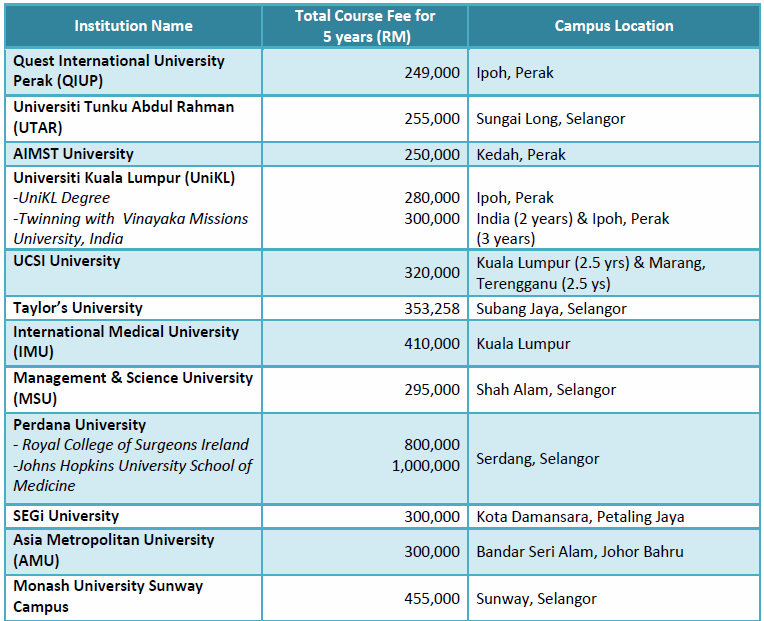

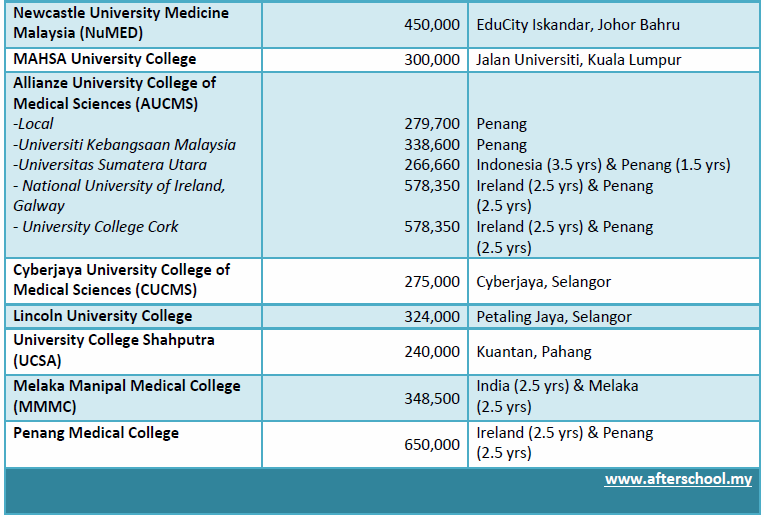

Applicable for undergraduate and postgraduate programmes.

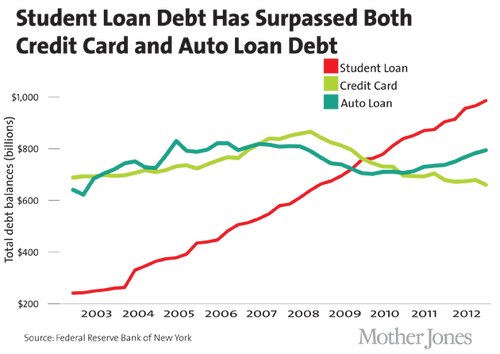

Study loan in malaysia. Mied offers a maximum of rm50 000 study loans to recognized universities in the public higher education institutions ipta private higher education institutions ipts and overseas or foreign universities recognized by jabatan perkhidmatan awam jpa. The university college or other education institution must be acceptable to the bank. Means that if you borrow rm10 000 then you will owe the lender the original rm10 000 plus rm100 per year as an interest payment. All applications for maybank education loan financing i are subject to maybank s credit assessment approval and other applicable terms and conditions.

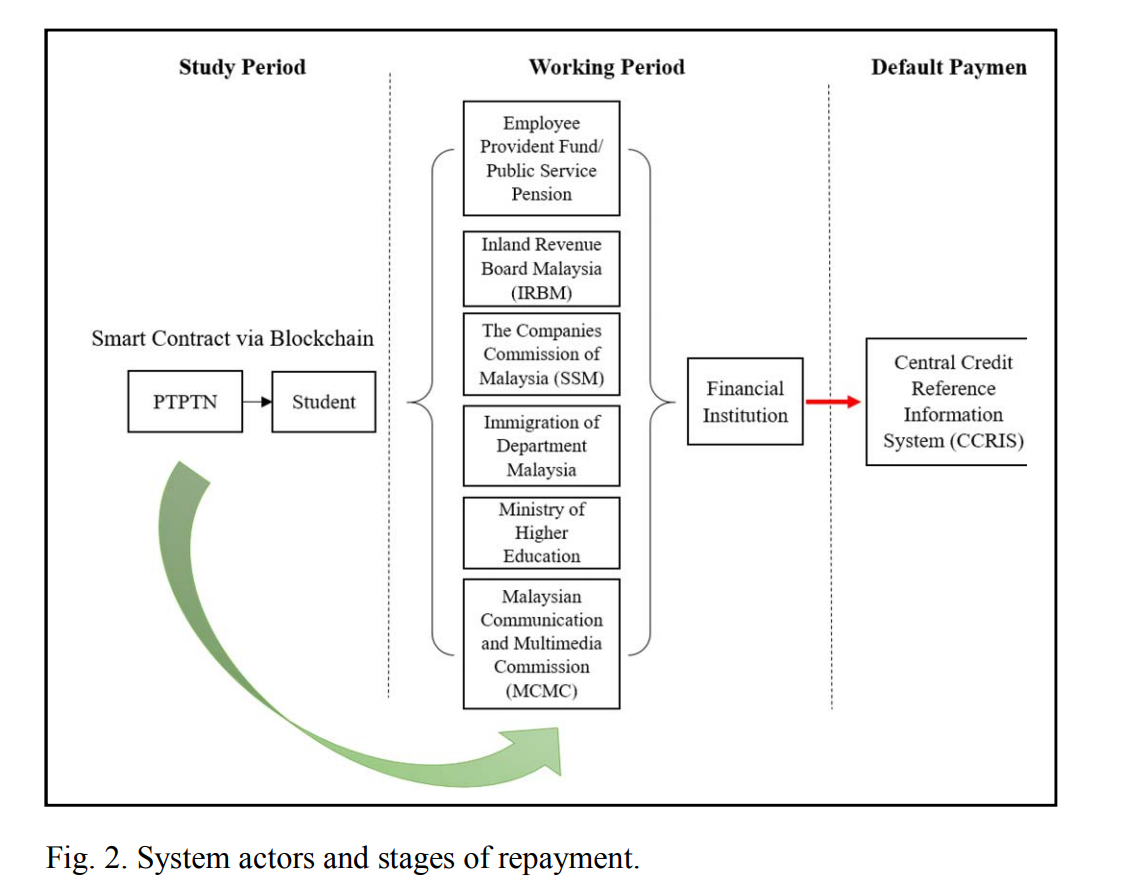

The foundation awards scholarships and interest free education loans to deserving students pursuing their first degrees in the local public institutions of higher learning. Perbadanan tabungan pendidikan tinggi nasional ptptn is probably the most well known government loan unless you ve been living under a rock. Currently more than 500 fresh study awards are budgeted each year for tertiary education at institutions of higher learning in malaysia and singapore. Loans are awarded based on the applicant s course and financial position.

Borrower is a malaysian resident with minimum monthly income of rm7 500. Stands for per annum which is latin for per year basically an interest rate of 1 p a. Study loan fund tabung pinjaman pelajaran this is offered to students taking the certificate course for a duration of four semesters or two years at polytechnics and community colleges that are managed by the department of polytechnic and community college education. Koperasi jayadiri malaysia berhad or kojadi was established in 1981 where its objective is to extend an effective student loan facility to enable students in need to pursue higher education and to shape students into well trained manpower to meet the demand for skilled human resources in the country.

List of courses or programmes are subject to changes by maybank. Borrower is aged between 21 and 60 years old both years inclusive. The interest rate is extremely low only 1 fixed rate per annum which is lower than most conventional loans.

/arc-anglerfish-arc2-prod-mco.s3.amazonaws.com/public/655BU2IZOVBPBHUAS3YXZOQB4A.jpg)