Uob Credit Card Interest Rate

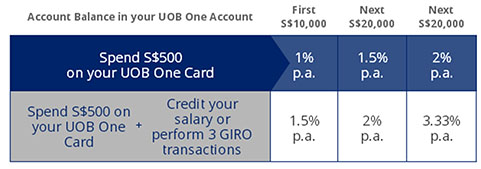

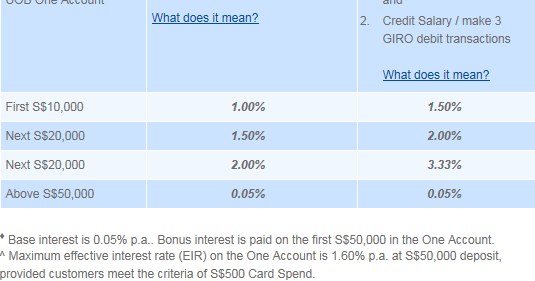

Previously the effective interest rate is now around 1 796 p a.

Uob credit card interest rate. Limited to the first 200 new to uob cardmembers who successfully apply for a uob credit card from 1 to 30 sep 2020 and spend a minimum of s 1 500 within 30 days from the approval date of the credit card. Uob credit card promotions 2019. A s 150 cash credit. You draw down on a s 100 000 limit and top up the account after 30 days.

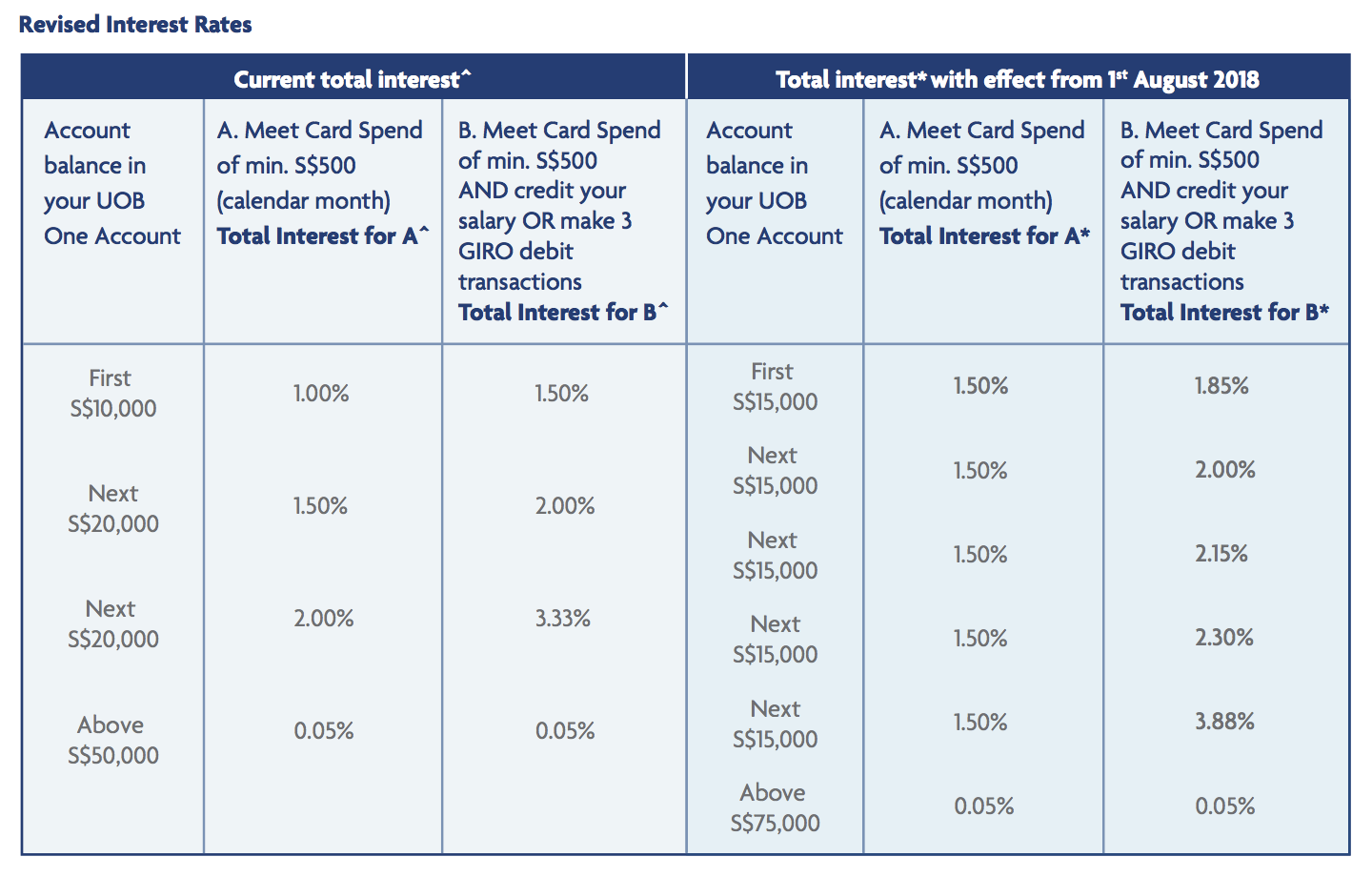

Despite the drop in interest rates for the uob one account it still serves a purpose. Uob spells out the revised interest rates clearly. This is lower than the 1 796 p a. If you do not meet any of the stated conditions for the month.

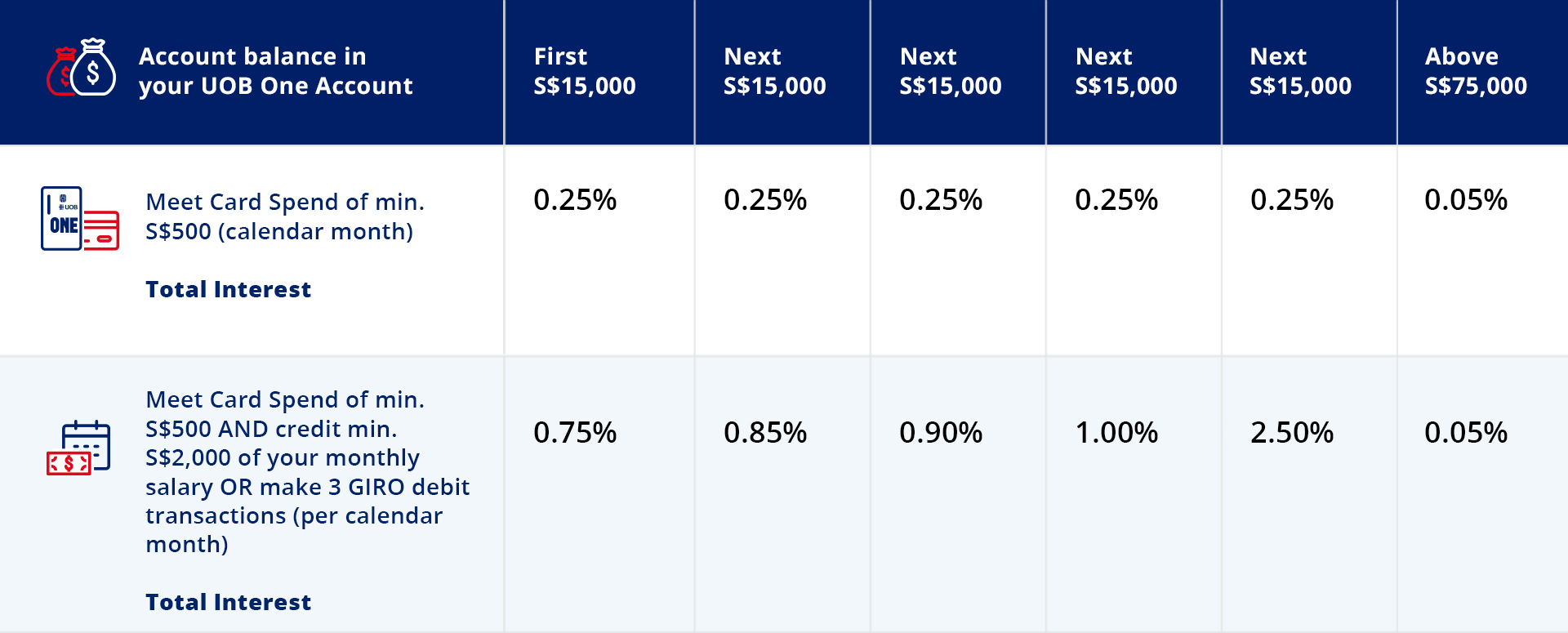

During the may 2020 adjustment. What to do now. From about 2 44 p a. Uob does not impose a one time upfront fee on transferred amount but a minimum transfer amount of rm1 000 is required.

Assuming you max out the s 75 000 account balance on your uob one account. Product name uob credit cards. Click here for full terms and conditions. General information on uob credit cards.

The revised effective interest rate starting 1st august 2020 is now at 1 20 p a. Base interest rate is still 0 05 p a. Interest on purchases where applicable 26 9 per annum subject to a minimum charge of s 3 00 calculated on a daily basis from the date of the transaction on any amount remaining unpaid including late payment charges until such outstanding is paid in full. Transfer tenure ranges from 6 months with an interest rate of 7 77 p a 12 months with an interest rate of 7 88 p a and 18 months with an interest rate of 7 99 p a.

Interest calculation assuming an interest of 6 5.

.jpg)