Tax Relief 2018 Malaysia

This relief is applicable for year assessment 2013 and 2015 only.

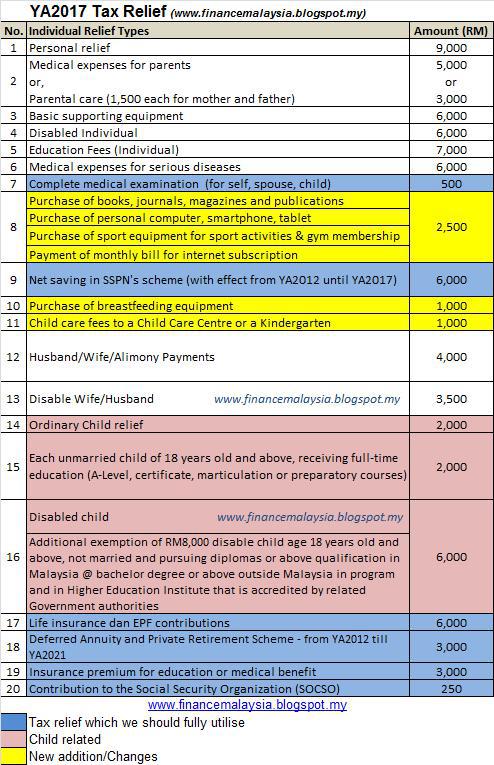

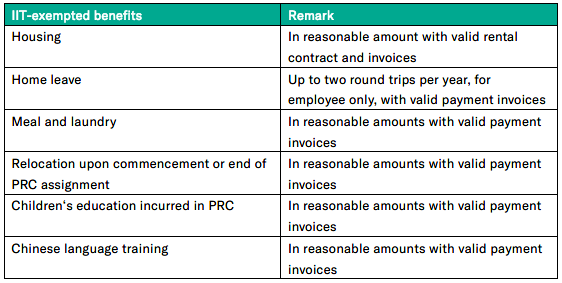

Tax relief 2018 malaysia. Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. Child care fees to a child care centre or a kindergarten. Tax reliefs are set by lembaga hasil dalam negeri lhdn where a taxpayer is able to deduct a certain amount for cash expended in that assessment year from the total annual income. Amount rm 1.

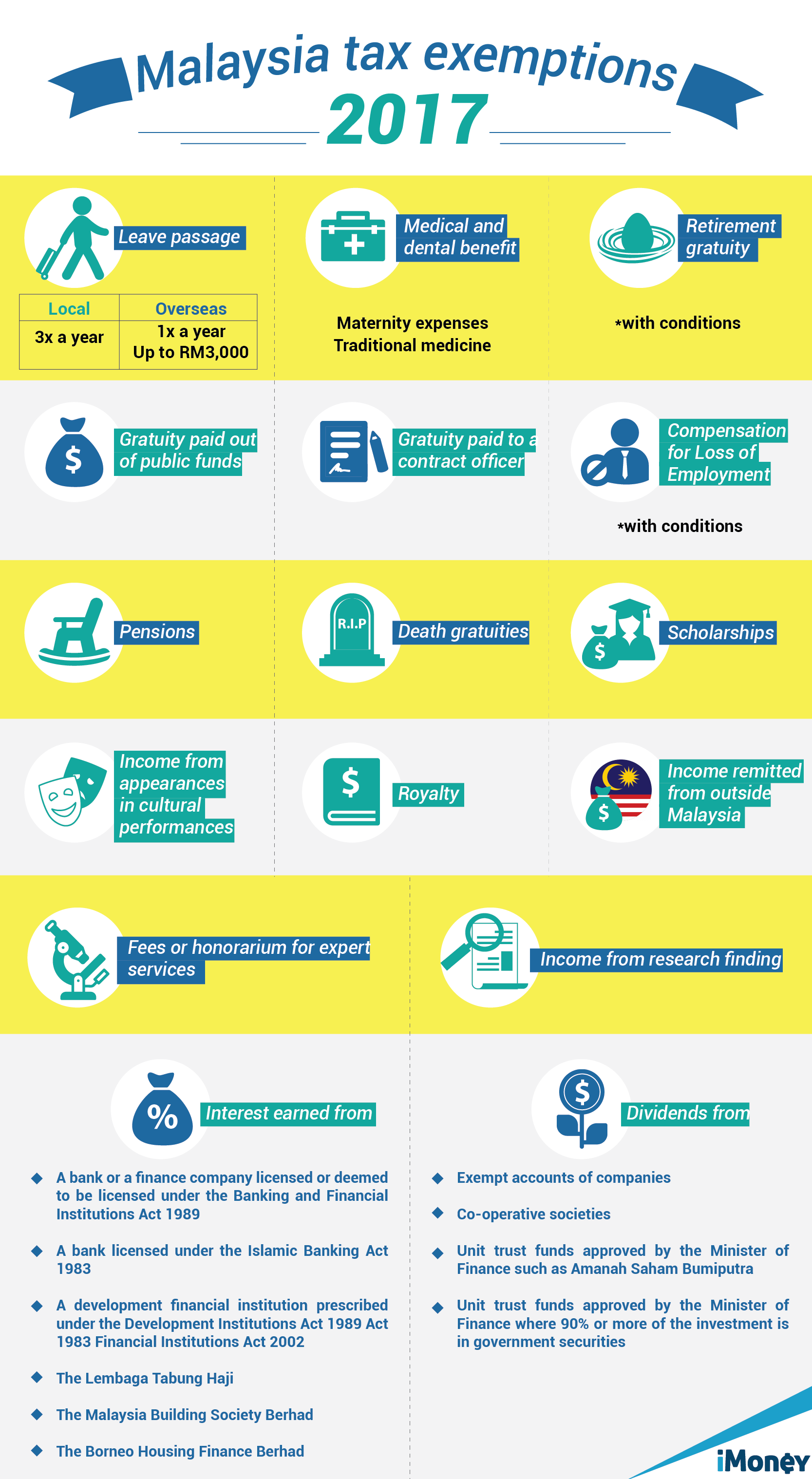

Tax relief for year of assessment 2018 tax filed in 2019 it s the time of the year that as a taxpayer needed to complete in filing their income tax. As announced by the prime minister at budget 2018 the m40 incentive consists of a 2 point tax rate reduction which is aimed to help approximately 2 3 million malaysians earning between rm20 001 and rm70 000. The government allows up to rm500 income tax relief for a complete medical check ups annually so if you haven t had one this year make use that benefit and make an appointment with your doctor today. However any amount that is withdrawn after your first deposit in 2018 is not counted.

From year of assessment 2020 not applicable for 2019 2018 2017 couples seeking fertility treatment such as in vitro fertilisation ivf intrauterine insemination iui or any other fertility treatment approved by a medical practitioner registered under the malaysian medical council mmc can also claim under this income tax relief in malaysia. You can claim for tax relief for your meds therapy and check up that is under the medical expenses for serious disease up to rm6 000. Net saving in sspn s scheme total deposit in year 2018 minus total withdrawal in year 2018 rm6 000. 5 000 limited 3.

Here are all the claimable items divided into categories their breakdowns and qualifications for tax relief. If you have deposited money into your sspn account in 2018 then this amount can be claimed in your e be form as well. If knocks on wood you are diagnosed with a serious disease you can claim up to rm6 000 income tax relief for your medical expenses. If case if you are a noob tax reliefs are set by lhdn where a taxpayer is able to deduct a certain amount for money expended in that assessment year from the total annual income.

There really are a lot of tax reliefs and if you plan your reliefs effectively every year you could be saving thousands in taxes every year. It s tax season in malaysia. As you file your tax you should make sure you know your tax relief for 2018. It should be calculated as the total deposit in the year 2018 minus total withdrawal in the year 2018.

These are for certain activities that the government encourages to lighten our financial loads. Complete your income tax claims before the 30th of april.