Types Of Tax In Malaysia

In other words resident and non resident organisations doing business and generating taxable income in malaysia will be taxed on income accrued in or derived from malaysia.

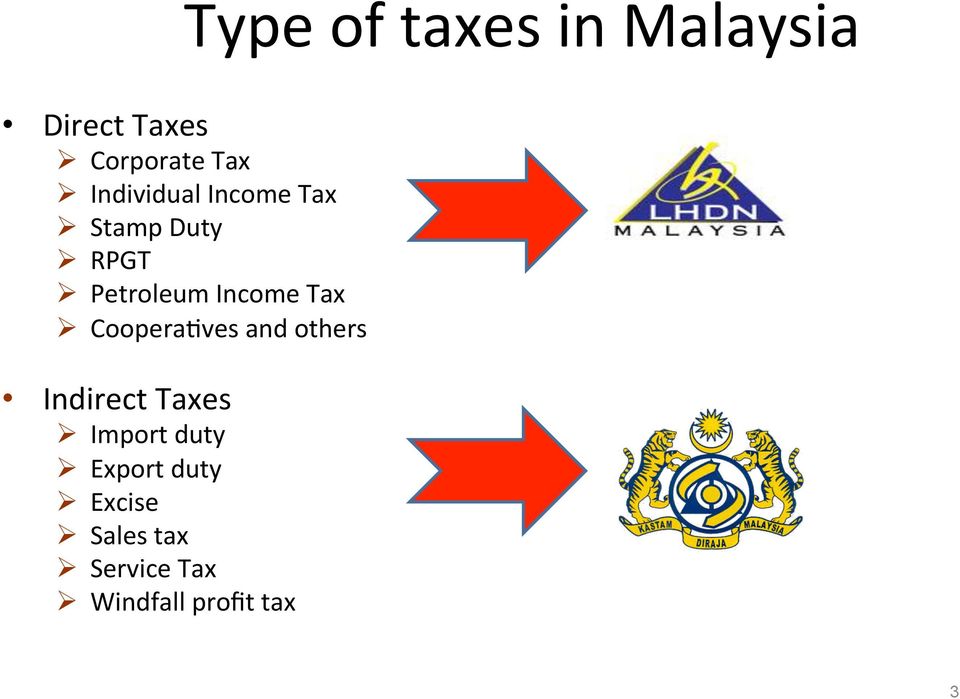

Types of tax in malaysia. The tax system in malaysia personal income tax. What supplies are liable to the standard rate. Filing your tax return and. In malaysia corporations are subject to corporate income tax real property gains tax goods and services tax gst and etc taxes.

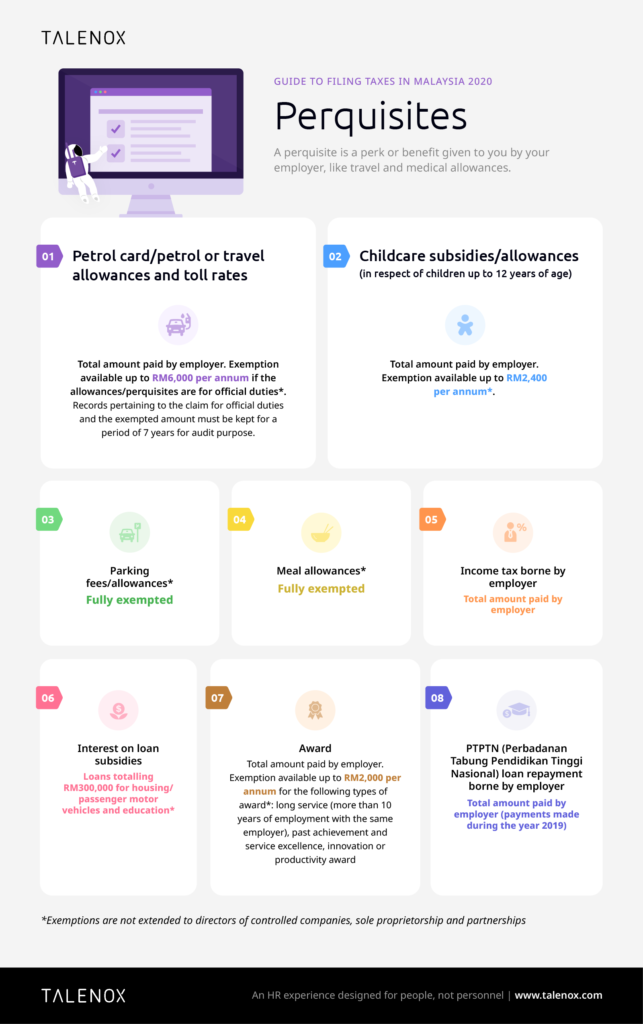

In malaysia employees are allowed to claim tax exemptions for the benefits perquisites below unless the employee has shareholding or voting power in the company. Sales tax and service tax were implemented in malaysia on 1 september 2018 replacing goods and services tax gst. According to section 45 of malaysia s income tax act 1967 all married couples in malaysia have the right to choose whether to file individual or joint taxes. Here are the 14 tax exempt allowances gifts benefits perquisites.

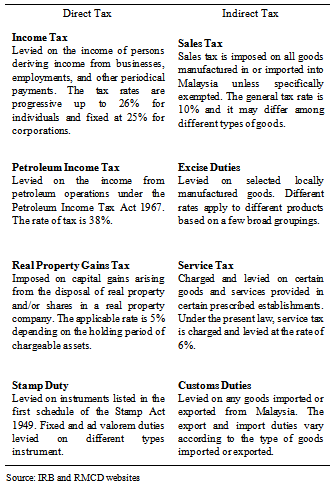

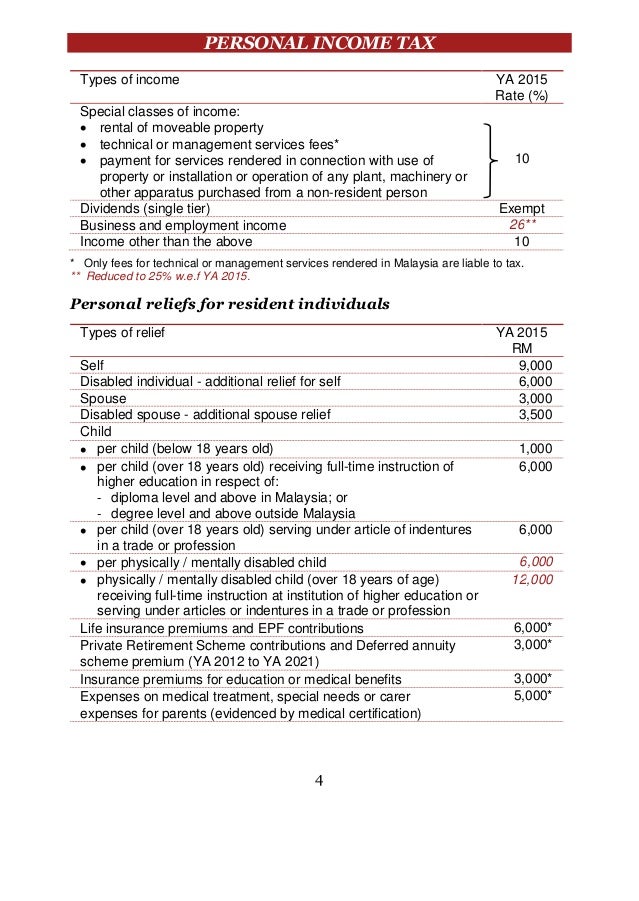

Special classes of income paid to nr payee. Taxpayer is responsible to submit income tax return form itrf and make income tax payment yearly prior to due date. Type of indirect tax. Examples of direct tax are income tax and real property gains tax.

Petrol allowance petrol card travelling allowance or toll payment or any combination. Choosing the appropriate filing status is a major tax decision for newlyweds. One such decision relates to taxes more specifically whether to file separate or joint tax returns. Tax deductions in malaysia are available in numerous cases including medical expenses purchase of books computers and sport equipment or education fees.

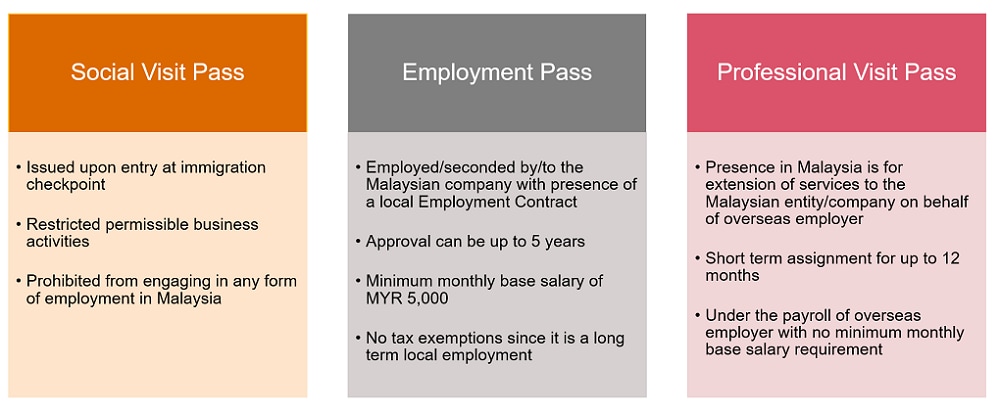

The tax is paid directly to the government. In malasia there are three types of specific incentives 1 pioneer status ps 2 investment tax allowances ita 3 reinvestment allowance ra 1 pioneer status ps this is tax usually a partial exempt view the full answer. A direct tax is a tax that is levied on a person or company s income and wealth. Not all expatriates in malaysia are required to file personal income tax.

Everyone working in malaysia is required to pay income tax and all types of incomes are taxable. This is a final tax. Similar to interest payments the gross amount of royalty paid to a nr payee is subject to a 10 withholding tax or any other rate as prescribed under the double taxation agreement between the malaysia and the country where the nr payee is a tax resident. 10 for sales tax and 6 for service tax.

There are two different kinds of taxes in malaysia which are a direct and indirect tax.