Stamp Duty Calculation Malaysia

Figures will be rounded up.

Stamp duty calculation malaysia. To know how much down payment lawyer fees and stamp duty needed are so. Lbtt and ltt holidays are also available in scotland and wales until 31st march 2021. Mobile homes caravans and houseboats are exempt. A stamp duty holiday has been introduced until 31st march 2021.

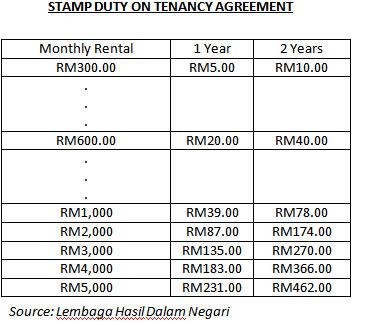

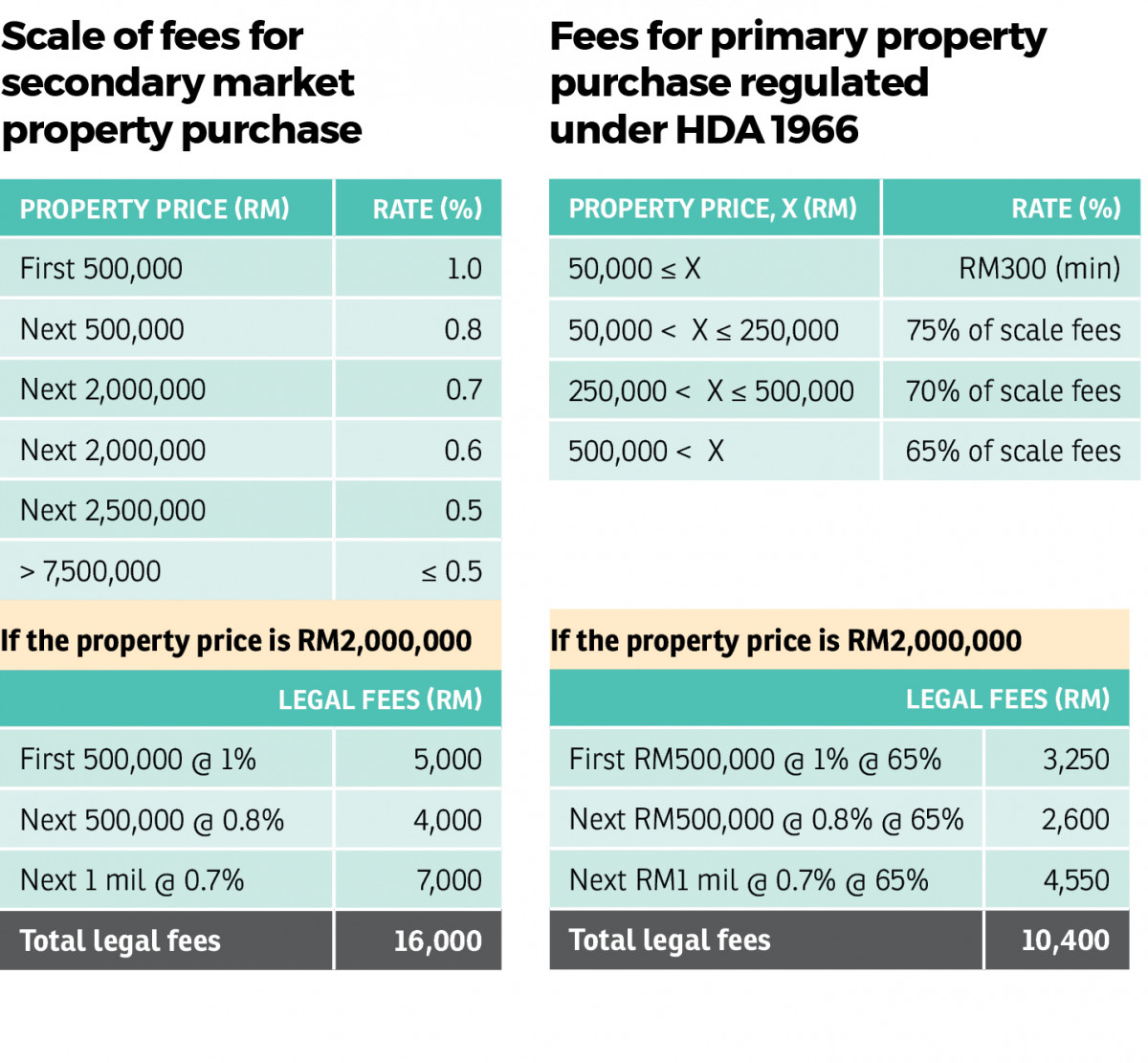

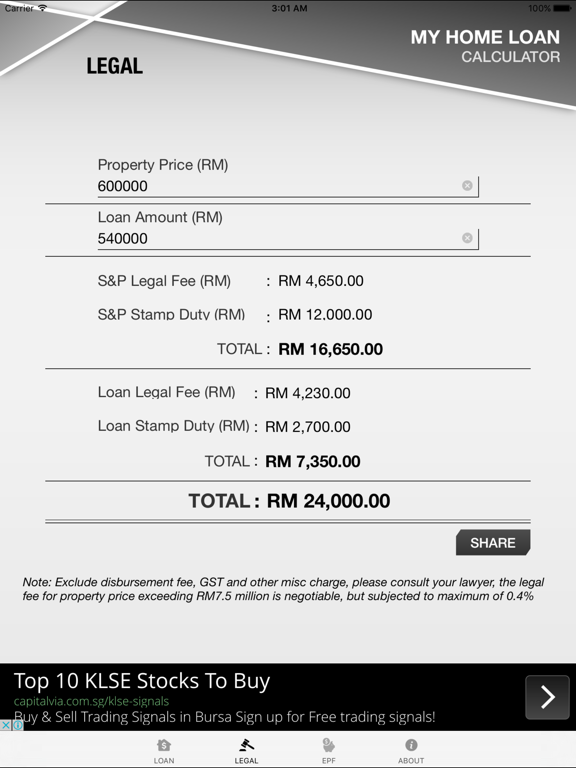

Total cost involved for tenancy period of 1 year diy tenancy agreement stamp duty stamping for 2nd copy. Please contact us for a quotation for services required. For first rm100 000 rm1000 stamp duty fee 2. Legal fees stamp duty calculation 2020 when buying a house in malaysia.

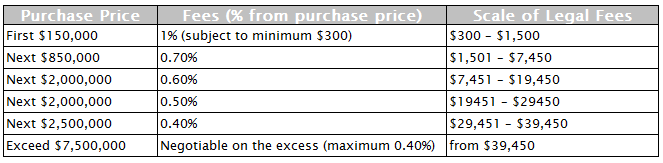

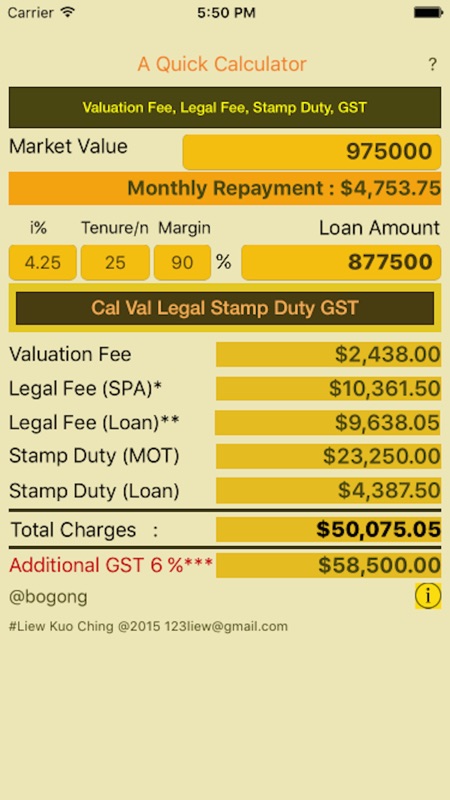

Stamp duty fee 1. Stamp duty for buy to let property has increased substantially from april 2016. The stamp duty fee for the first rm100 000 will be 100 000 1 rm1 000. Legal fee and stamp duty calculator calculation of legal fees is governed by solicitors remuneration amendment order 2017 and calculation of stamp duties is governed by stamp act 1949.

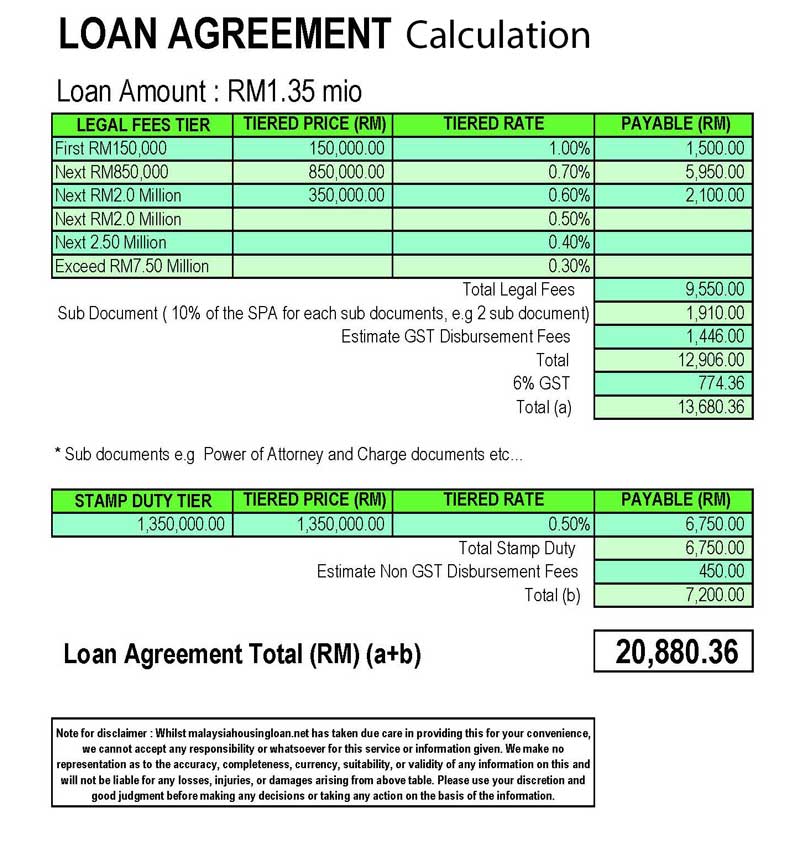

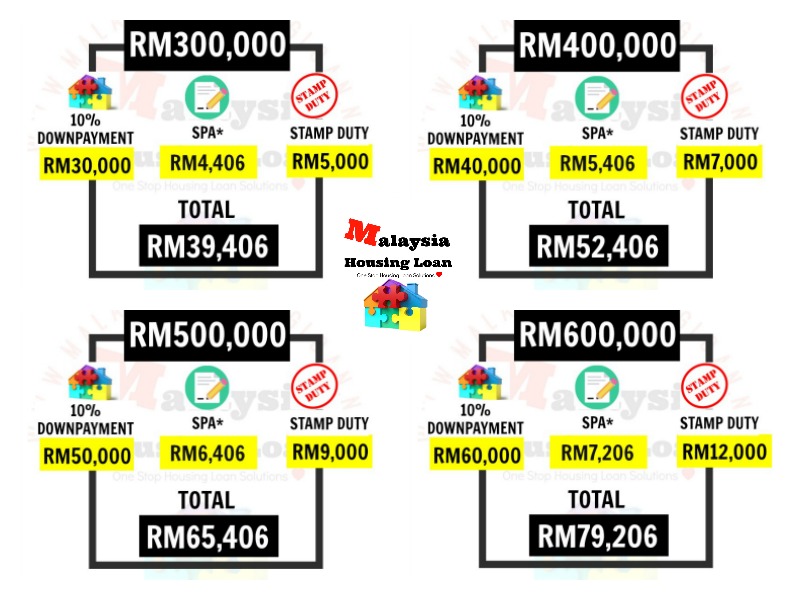

Payable stamp duty rm30 000 rm250 x rm4 120 x rm4 rm480. Next rm 500 000 3. This means that for a property at a purchase price of rm300 000 the stamp duty will be rm5 000. Ringgit malaysia loan agreements generally attract stamp duty at 0 5 however a reduced stamp duty liability of 0 1 is available for rm loan agreements or rm loan instrument without security and repayable on demand or in single bullet repayment.

For certain people buying a house is a major milestone that tops many people s lifetime to do lists. For second copy of tenancy agreement the stamping cost is rm10. Purchasing and hunting for a house can be exciting and stressful experience. The stamp duty for loan agreements is at a fixed rate of 0 5 of the loan amount.

First rm 100 000 1. Home malaysia law firm malaysia law statutes legal fee stamp duty for sale purchase agreement loan the calculation formula for legal fee stamp duty is fixed as they are governed by law. Stamp duty for second homes also attracts a 3 percent surcharge from april 2016. Rm120 rm10.

Rm100 001 to rm500 000 rm6000 total stamp duty must pay is rm7 000 00 and because of the first time house buyer stamp duty exemption you only need to pay. The actual calculation of stamp duty is before first time house buyer stamp duty exemption.