Sole Proprietorship Income Tax

The main difference between reporting income from your sole proprietorship and reporting wages from.

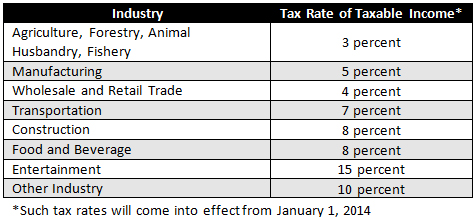

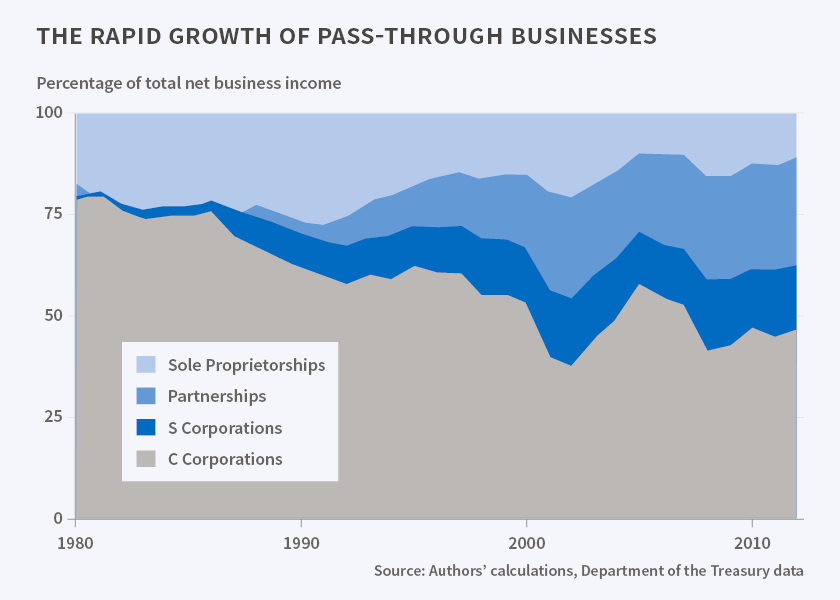

Sole proprietorship income tax. How sole proprietors are taxed filing a tax return. Sole proprietorships are subject to pass through taxation meaning the business owner reports income or loss from their business on their personal tax return but the business itself is not taxed separately. Additionally social security contributions max out when your income reaches 127 200 note. However if you are the sole member of a domestic limited liability company llc you are not a sole proprietor if you elect to treat the llc as a corporation.

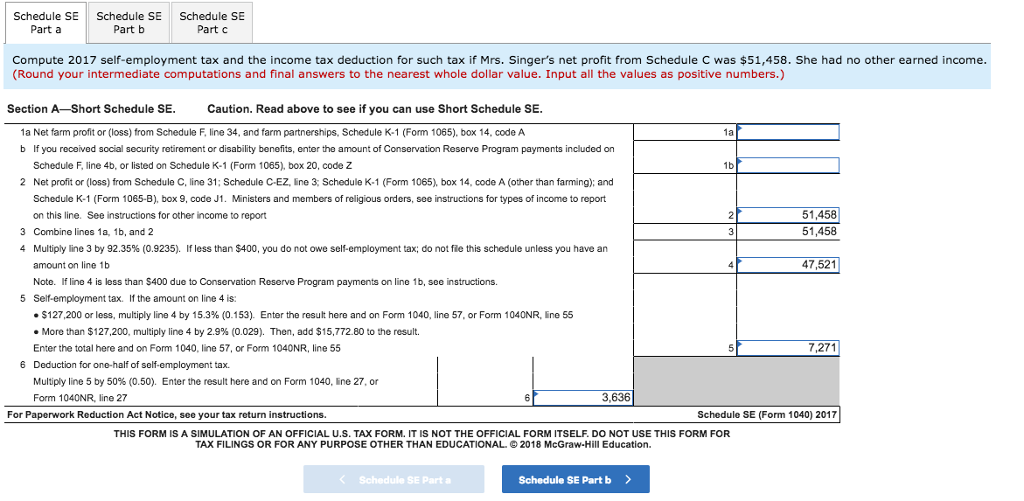

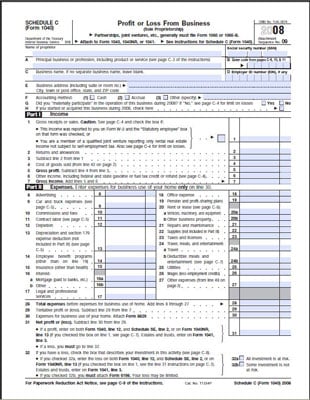

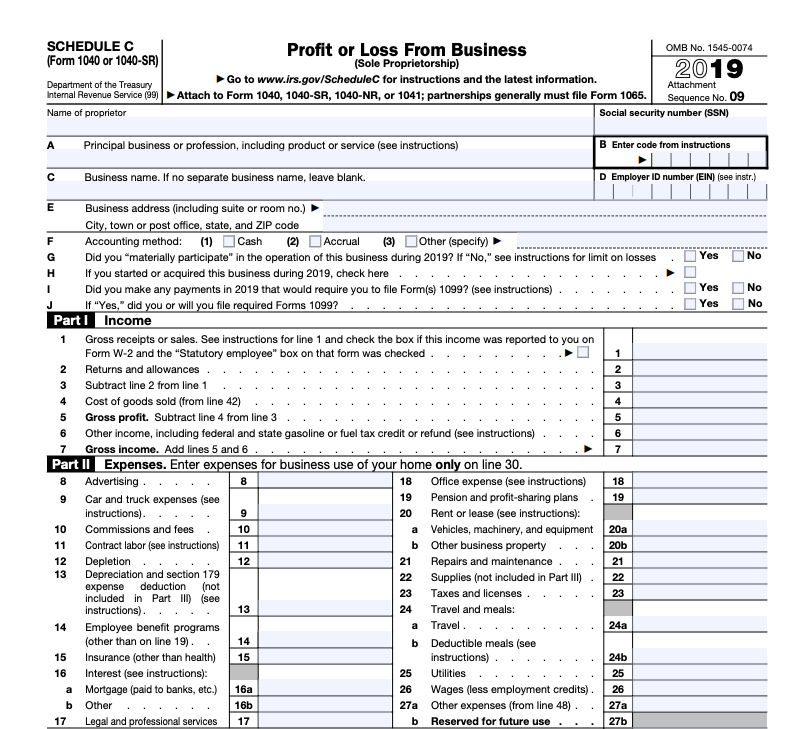

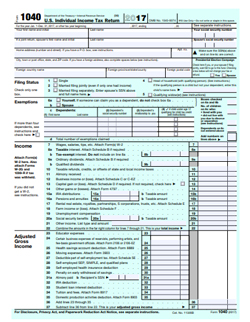

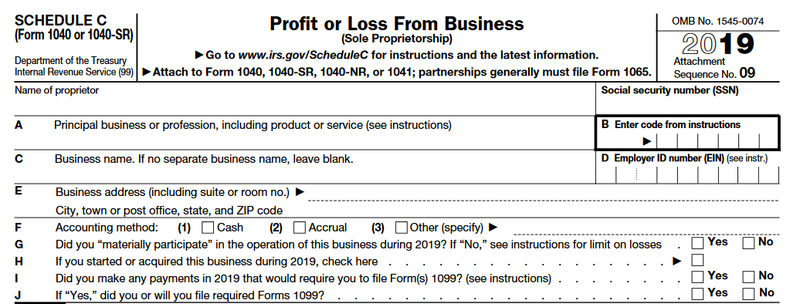

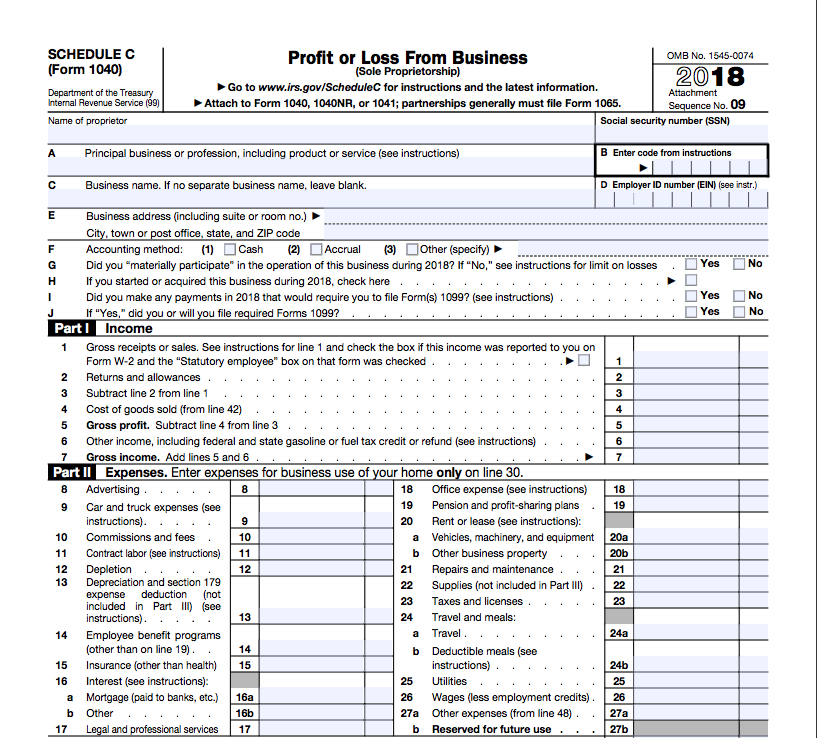

Secondly there s schedule c which reports business profit and loss. As a sole proprietorship you can claim 50 of self employment tax costs as income tax deductions. Find the definition of a sole proprietorship and the required forms for tax filing. Firstly there s form 1040 which is the individual tax return.

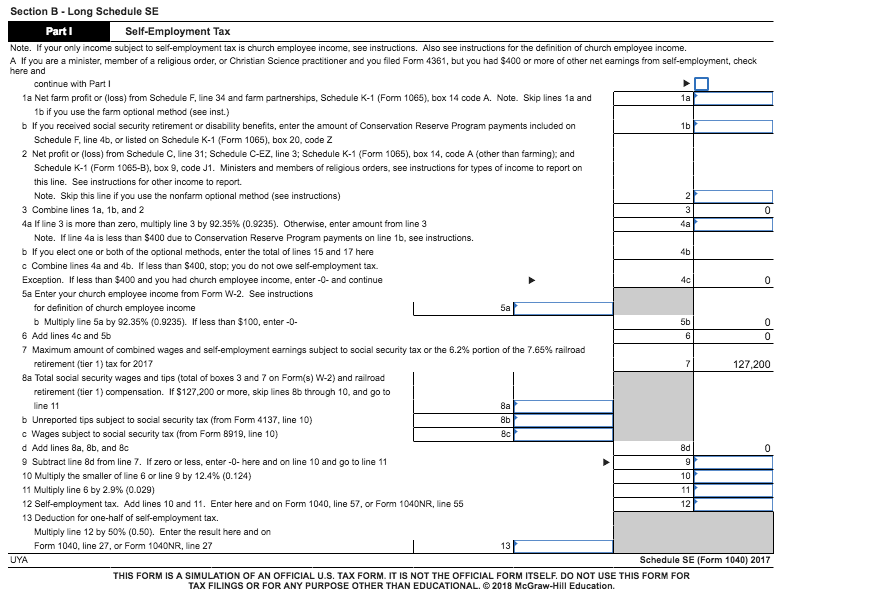

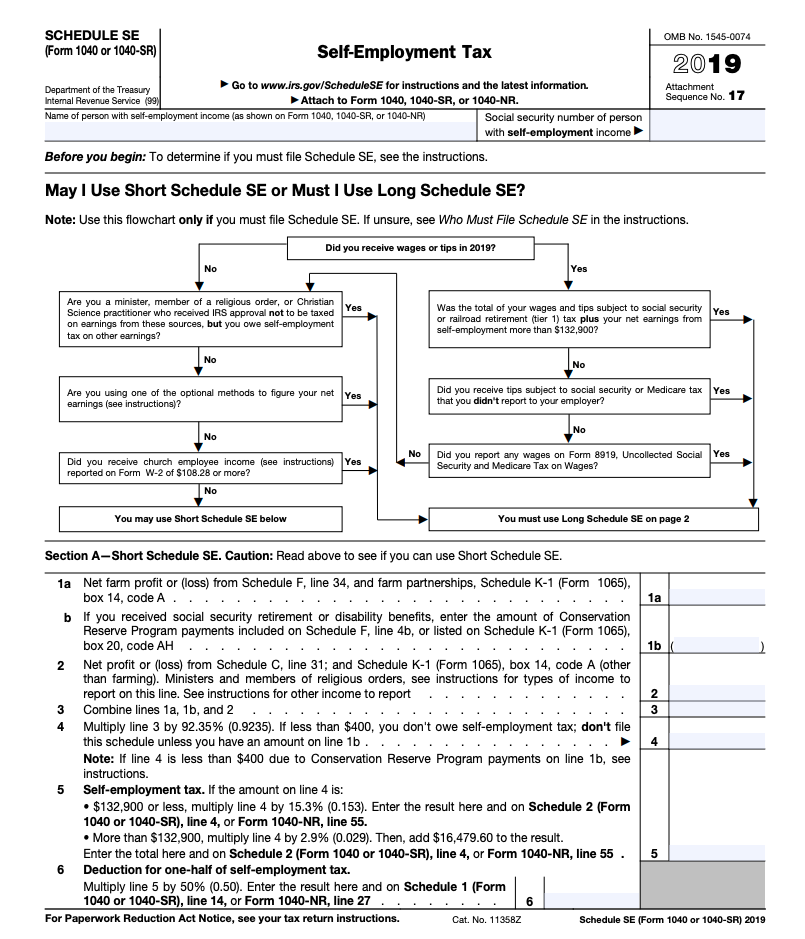

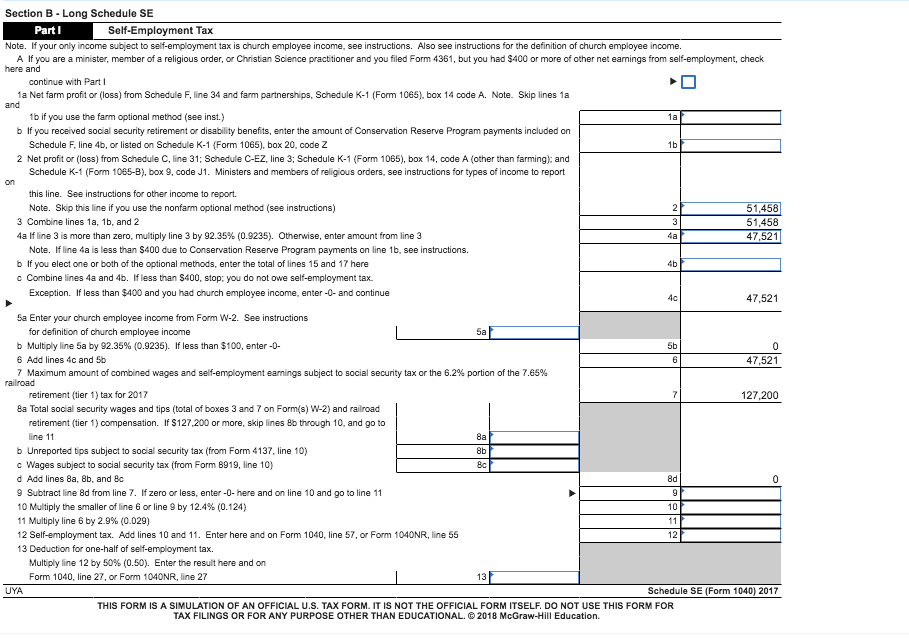

Self employment tax is included in form 1040 for federal taxes calculated using schedule se and the total self employment tax liability is included on line 57 of form 1040. Luckily there are ways for sole proprietors to minimize their self employment tax burden. Because you don t have an employer to withhold income taxes from your paycheck it s your job to set. A sole proprietor is someone who owns an unincorporated business by himself or herself.

Form 1040 reports your personal income while schedule c is where you ll record business income. A sole proprietor is a self employed individual and must pay self employment taxes social security medicare tax based on the income of the business. This limit increases in tax year 2018 to 128 400.

/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/496082201-sole-prop-56a0a4543df78cafdaa388c3.jpg)

.png)