Stamp Duty Calculation Malaysia 2019

The malaysian inland revenue board mirb released on 26 february 2019 guidelines for stamp duty relief under sections 15 and 15a of the stamp act 1949 the guidelines.

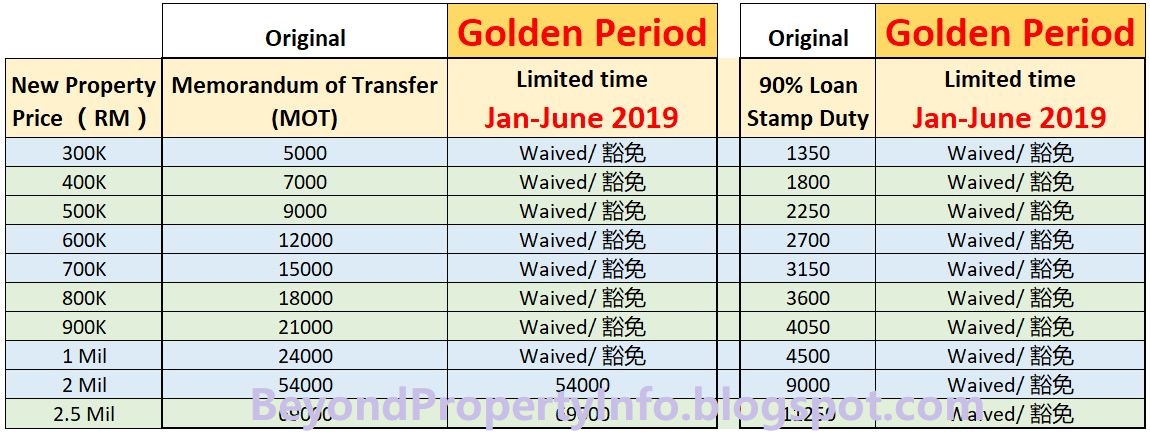

Stamp duty calculation malaysia 2019. Stamp duty now needs to be paid within 14 days after completing on a property purchase. The malaysian inland revenue board mirb released on 26 february 2019 guidelines for stamp duty relief under sections 15 and 15a of the stamp act 1949 the guidelines the guidelines take into account the tightening of the stamp duty relief provisions proposed in the 2019 budget. 2019 stamp duty scale from 1st january 2019 30th june 2019 stamp duty fee 1. Home malaysia law firm malaysia law statutes legal fee stamp duty for sale purchase agreement loan the calculation formula for legal fee stamp duty is fixed as they are governed by law.

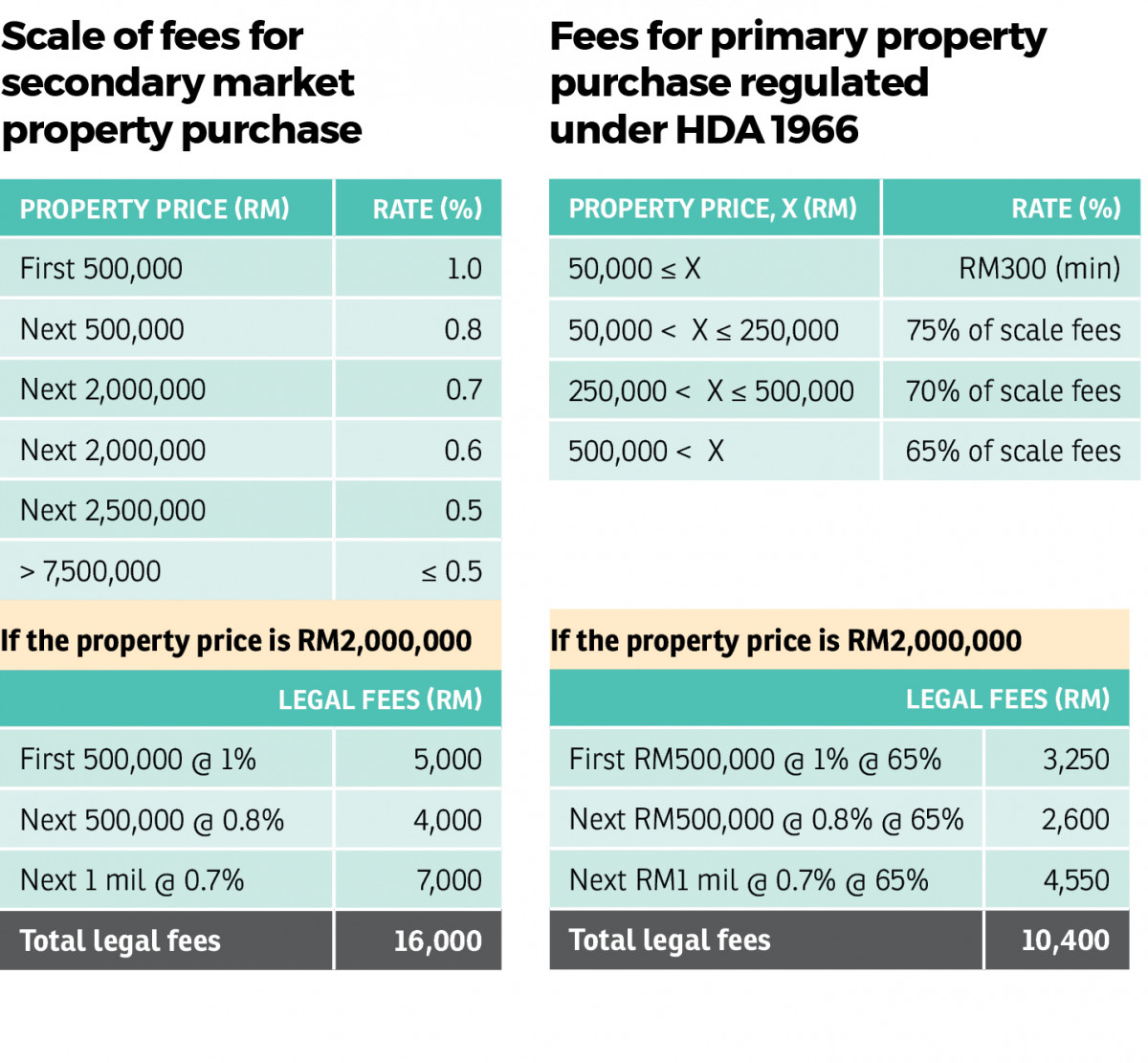

Spa loan agreement quotation include legal fees amount disbursement fees 6 sst and stamp duty. 1 this alert summarizes the key aspects of the guidelines. 1 subject to a minimum fee of rm500 00 for the next rm500 000. Legal fee and stamp duty calculator calculation of legal fees is governed by solicitors remuneration amendment order 2017 and calculation of stamp duties is governed by stamp act 1949.

100 on the first rm300 000 and excess is subject to the prevailing rate of stamp duty. Rm500 001 and above 2019 stamp duty scale from 1st july 2019 stamp duty fee 1. Here is the stamp duty scale. Please contact us for a quotation for services required.

The 14 day period for submitting a stamp duty return has been effective from march 2019 and has been reduced from 30 days. For the next rm2 000 000. For first rm100 000 stamp duty fee 2. Value of instruments of transfer and loan agreement for the purchase of first home.

1 this alert summarizes the key aspects of the guidelines. How to calculate stamp duty. In reality the reduced time frame should not have a significant impact on individuals. Ringgit malaysia loan agreements generally attract stamp duty at 0 5 however a reduced stamp duty liability of 0 1 is available for rm loan agreements or rm loan instrument without security and repayable on demand or in single bullet repayment.

Both quotation will have slight different in terms of calculation. Exemption given on stamp duty. For the first rm500 000. 1st july 2019 31st december 2020.

The guidelines take into account the tightening of the stamp duty relief provisions proposed in the 2019 budget. Please contact us for a detailed quotation as the following tables exclude any taxes disbursements and reimbursement charges. Below are the legal fees stamp duty calculation 2019 when buying a house in malaysia.