Travelling Allowance Exemption Malaysia

The exemption is effective from year of assessment 2008 to year of assessment 2010.

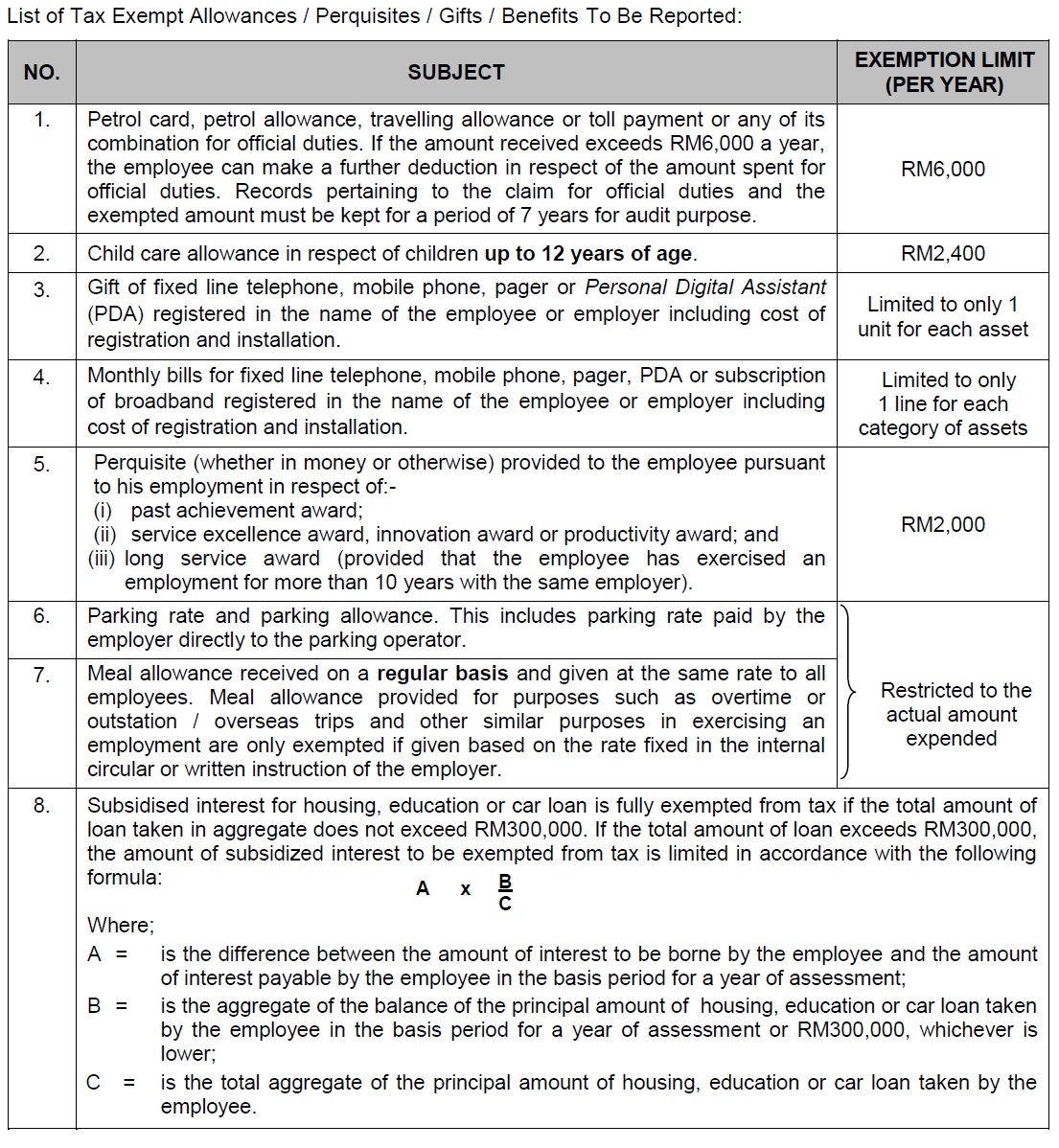

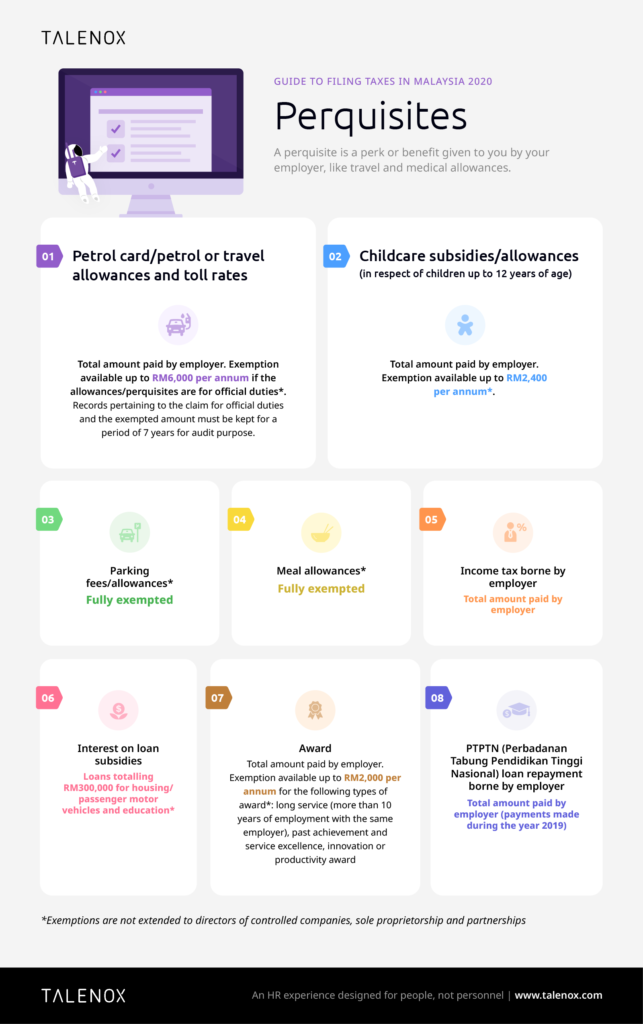

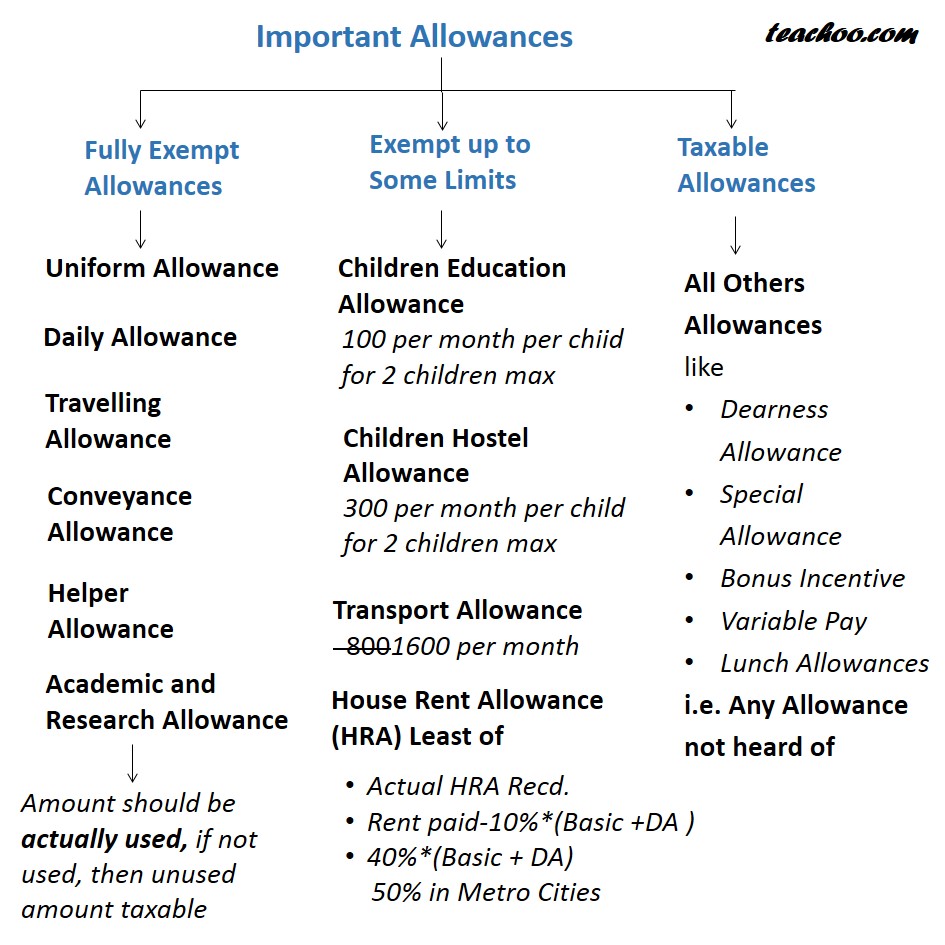

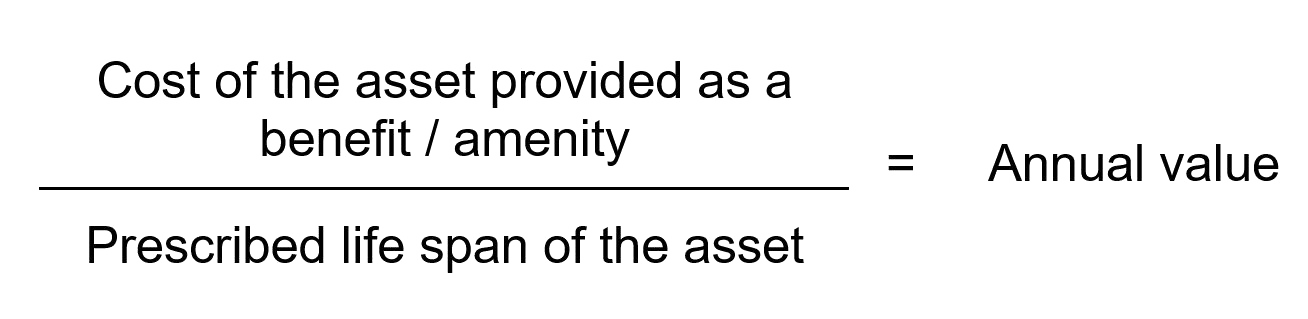

Travelling allowance exemption malaysia. Accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. Here are the 14 tax exempt allowances gifts benefits perquisites. Tax exempt up to rm6 000 per year if used for official duties. Tax exempt as long the amount is not unreasonable.

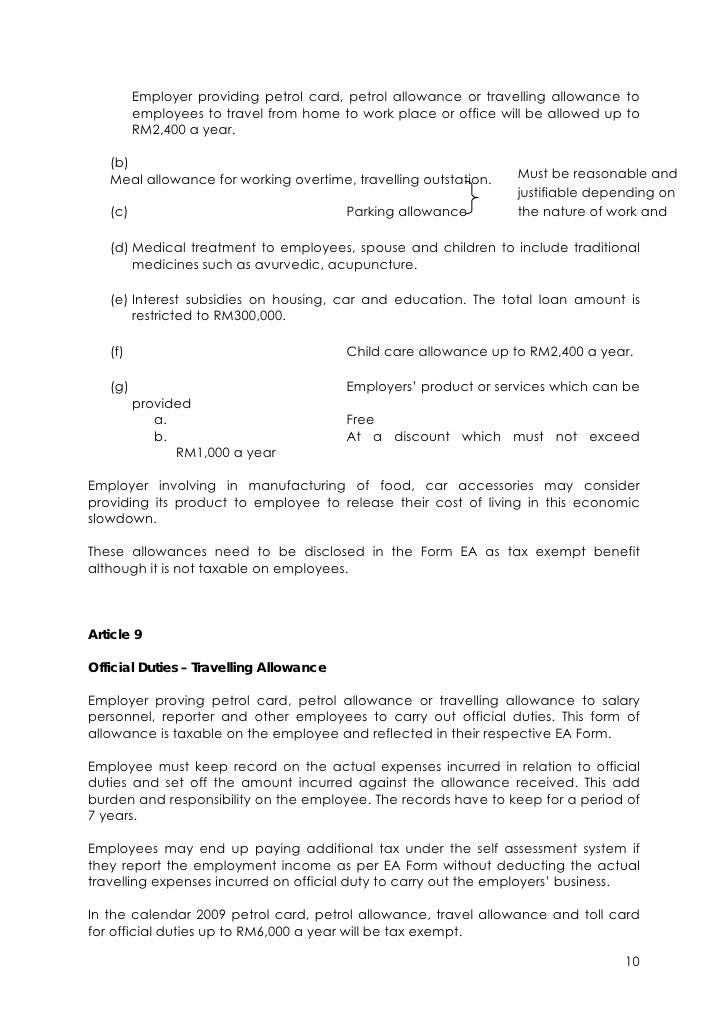

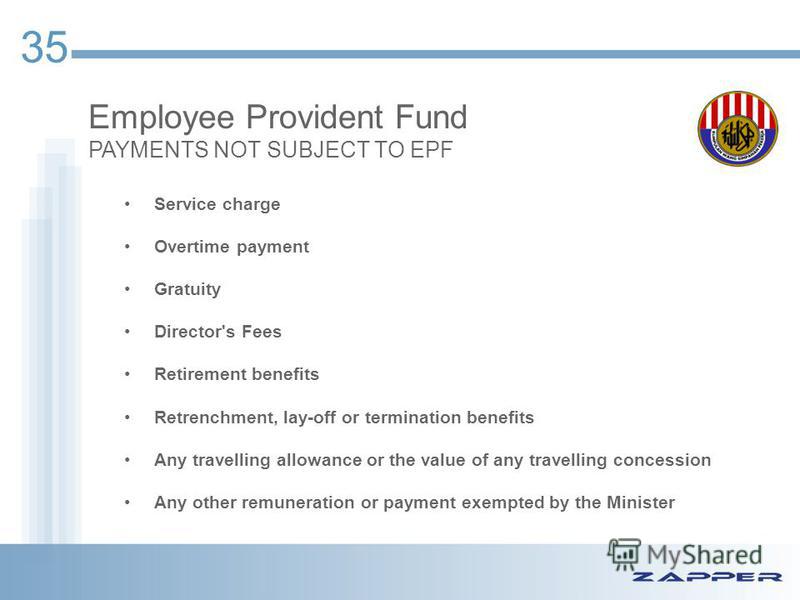

Includes payment by the employer directly to the parking operator. If the amount received exceeds rm6 000 a year the employee can make a further deduction in respect of the amount spent for official duties. Alliance bank cashfirst personal loan enjoy 40 cash back when you apply now. Travelling allowance or petrol allowance received by an employee for travelling from home to place of work and from place of work to home is exempted up to an amount of rm2 400 per year.

Parking allowance including parking rate paid by employer directly. Petrol allowance petrol card travelling allowance or toll payment or any combination. If the amount exceeds rm6 000 further deductions can be made in respect of amount spent for official duties. Starting in 2013 the malaysian government determined that any annual income falling below the cut off of rm 34 000 after epf deductions about rm2 800 per month or less shall not be taxable.

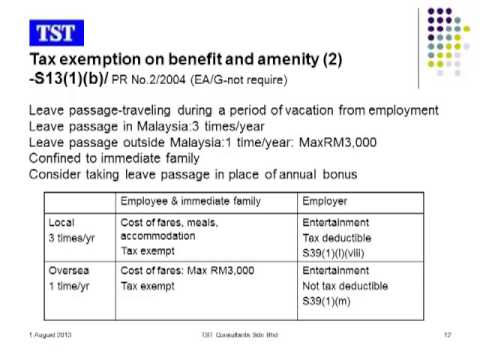

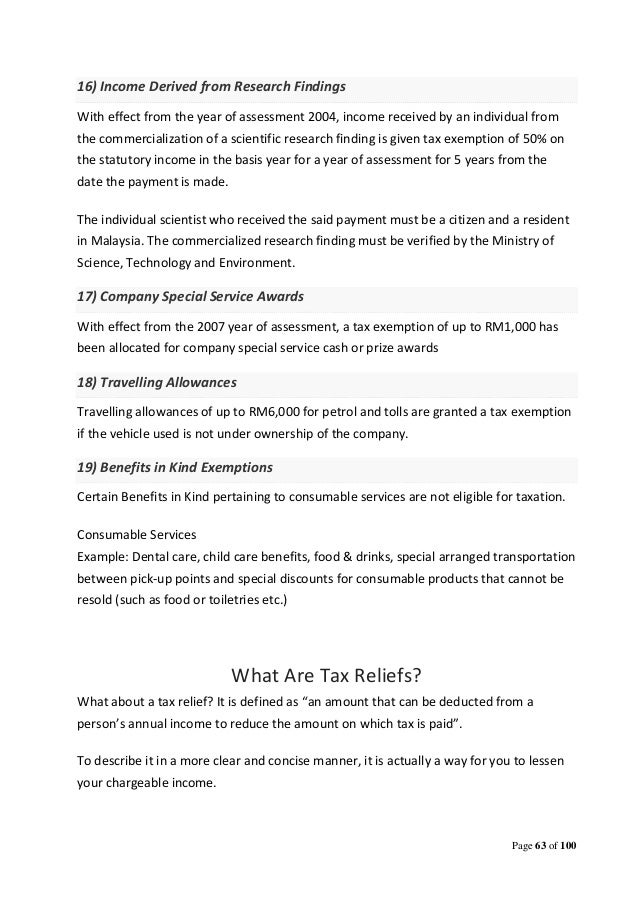

Exemption limit per year 1. Travelling allowances of up to rm6 000 for petrol and tolls are granted a tax exemption if the vehicle used is not under the ownership of the company. Petrol card petrol allowance travelling allowance or toll payment or any of its combination for official duties. Examples of such entertainment expenses are expenditure incurred on samples of products of the business small souvenirs bags and travel tickets provided as gifts to customers or visitors at the trade fairs or trade exhibitions or industrial exhibitions held outside malaysia.

Tax exemption limit per year petrol travel toll allowances. Meal allowance received on a regular basis. More than rm 6 000 may be claimed if records are kept for 7 years. This refers to the claims made by employees who are using their personal vehicle for official duties.

Petrol allowance petrol card travelling allowance or toll payment or any combination. Income that is attributable to a place of business as defined in malaysia is also deemed derived from malaysia w e f the.