Sole Proprietorship Malaysia Tax

/GettyImages-539358257-5a7cd1c2eb97de0037c6f4e1.jpg)

Sole proprietorships in malaysia.

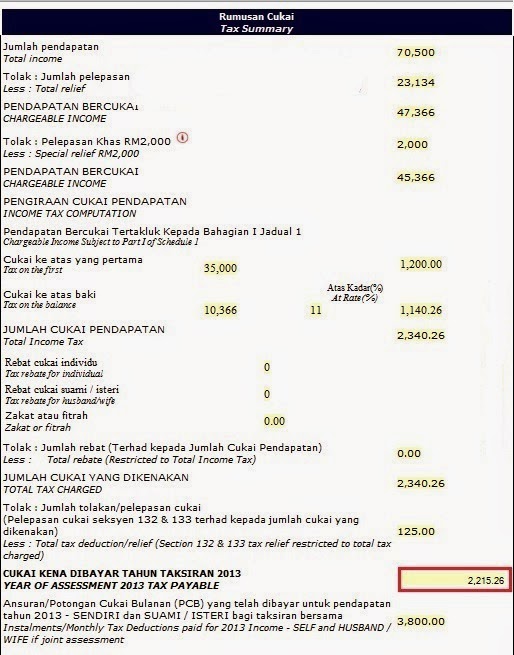

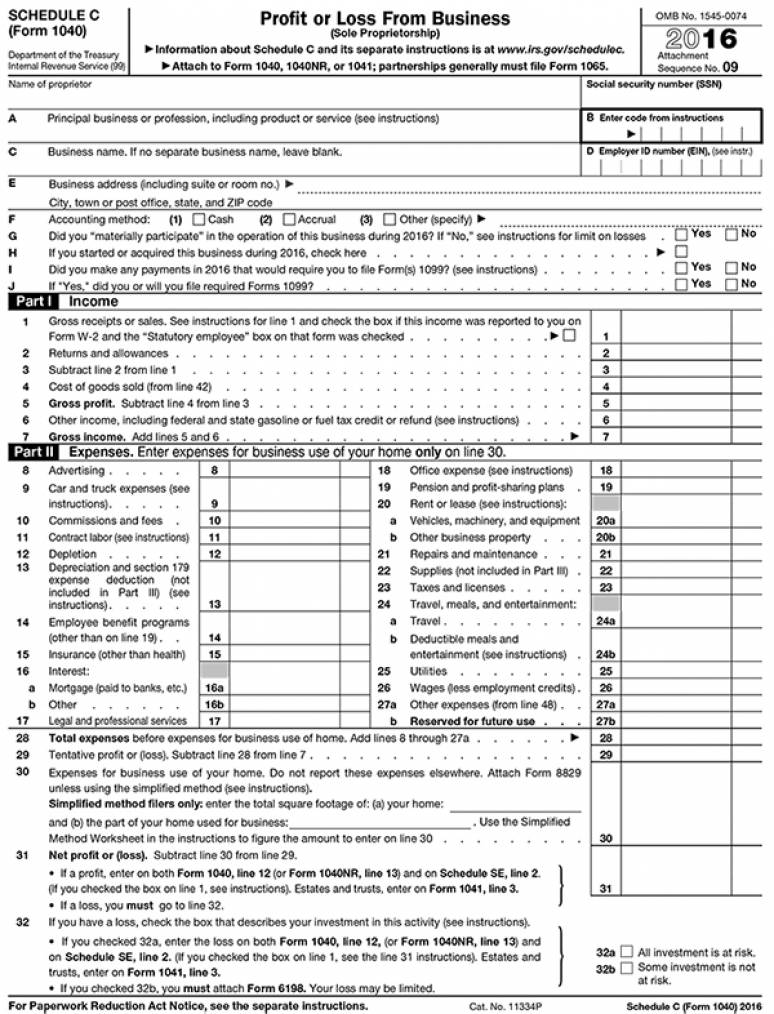

Sole proprietorship malaysia tax. Foreigner and corporate legal entity are not allowed to register sole proprietorship in malaysia. Teri is a sole proprietor single tax filer. She completes her schedule c which shows her net business income as 10 000. Sole proprietorship are businesses in malaysia which are owned by just one individuals.

She must pay self employment tax of 15 3 on this income or 1 530. The following are the common forms of business organization in malaysia. Business wholly owned by a single individual using personal name as per his her identity card or trade name. Sole proprietorships in malaysia are charged the income tax on a gradual scale applied to individual income from 2 to 26.

Corporate income tax in malaysia is applicable to both resident and non resident companies. Other taxes paid by a sole proprietorship comprise of self employment taxes social security taxes and property taxes. Companies are taxed at the 24 with effect from year of assessment 2016 while small scale companies with paid up capital not exceeding rm2 5 million are taxed as follows. This page is also available in.

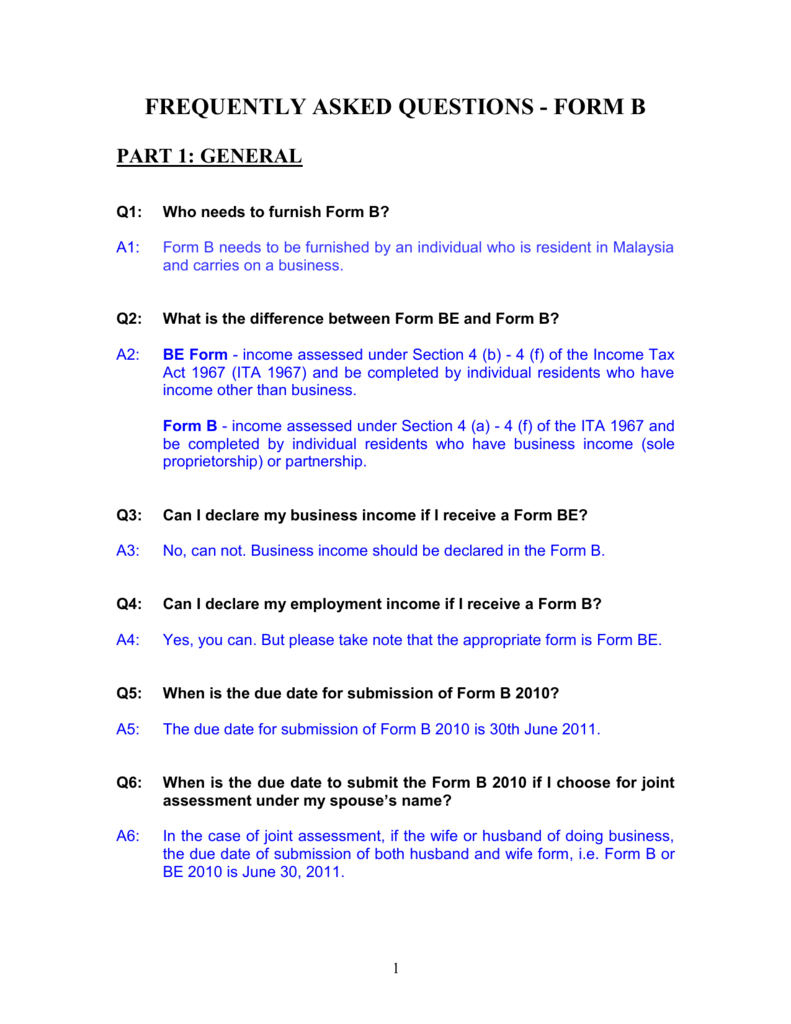

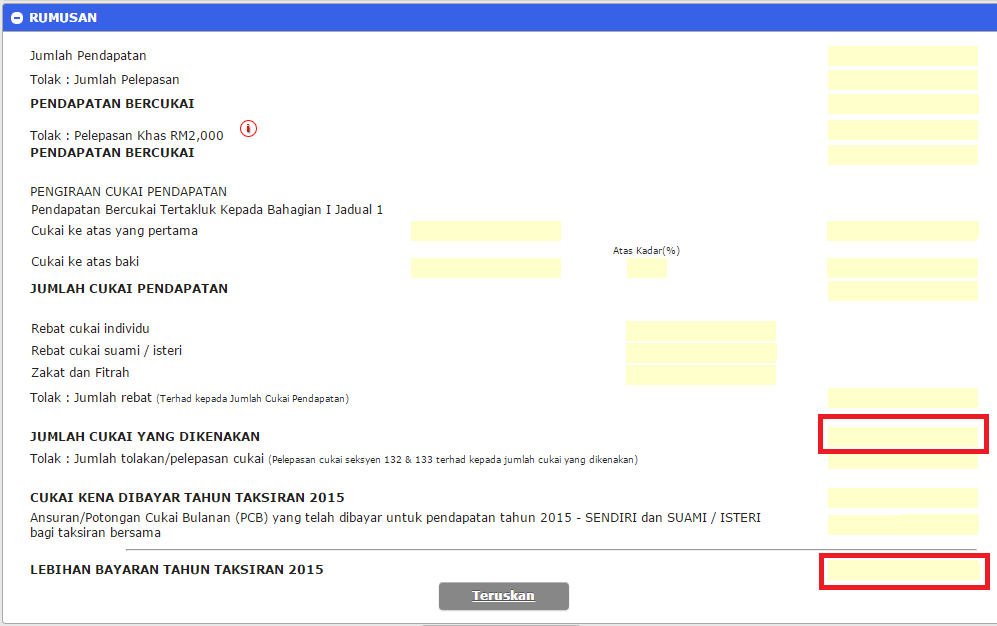

This is her taxable business income. Bhd or limited liability partnership. Husband and wife have to fill separate income tax return forms. Suruhanjaya syarikat malaysia ssm companies commission of malaysia ccm where you register your llp get its birth certificate and do your annual declarations.

The easiest type of company to register is a sole proprietorship which only costs rm30 if you use your own name as per your identification card. Melayu malay 简体中文 chinese simplified sole proprietor vs llp vs general partnership vs company in malaysia types of business entities. If you choose to use a trade name or have a partner that you d like to register your business with then the fee will be rm60. Identity card name can t be used as business name.

She gets a deduction of half this amount so she must pay 765 for this tax. To compute their tax payable. Business owned by two or more persons but not exceeding 20 persons. Owners of sole proprietorship experience unlimited liability which means that if the business fails to survive or declares bankruptcy creditors will be able to sue the business owners for all the debts.

Unique features of a sole proprietorship like fast and easy registration no corporate tax payments less formal business requirements winding up easily and lowest annual maintenance compare to other business vehicle such as private limited company sdn. Sole proprietorships are high risk but high reward business structures. To check and sign duly completed income tax return form. Tax rate for sole proprietorship or partnerships.