Type Of Allowance For Employees In Malaysia

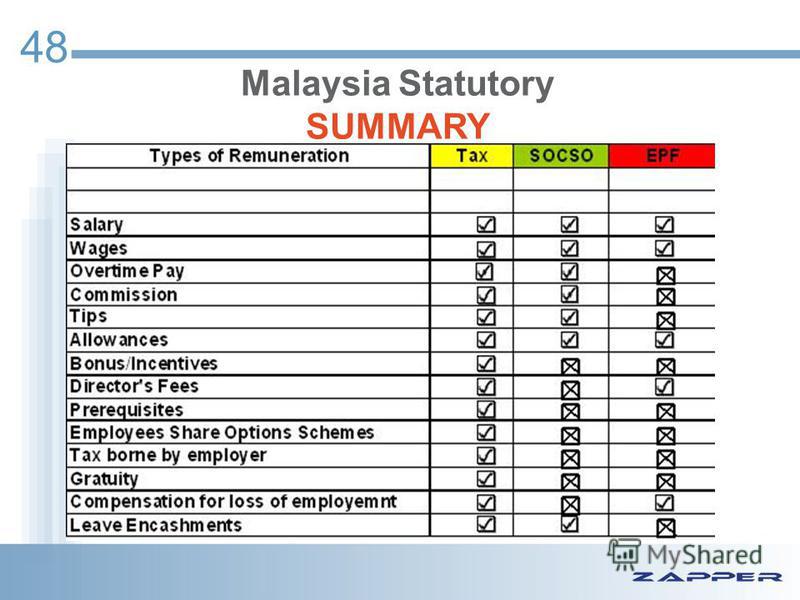

Here are the 14 tax exempt allowances gifts benefits perquisites.

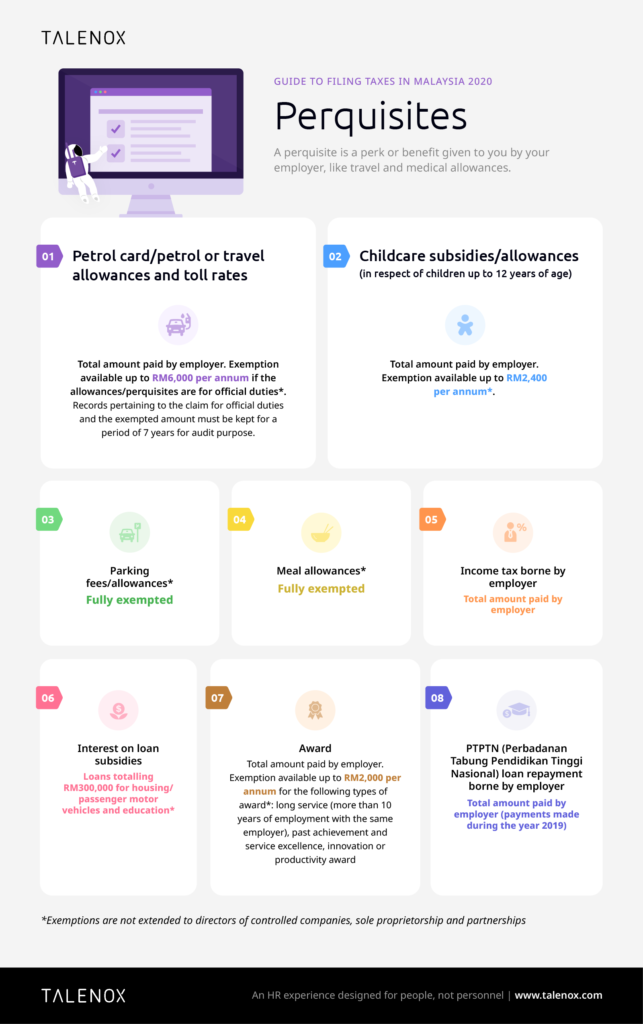

Type of allowance for employees in malaysia. Free lunch meal or dinner. Malaysia keeps a minimum of 11 unofficial holidays with 5 of those being official. Petrol allowance petrol card travelling allowance or toll payment or any combination. Total amount paid by employer.

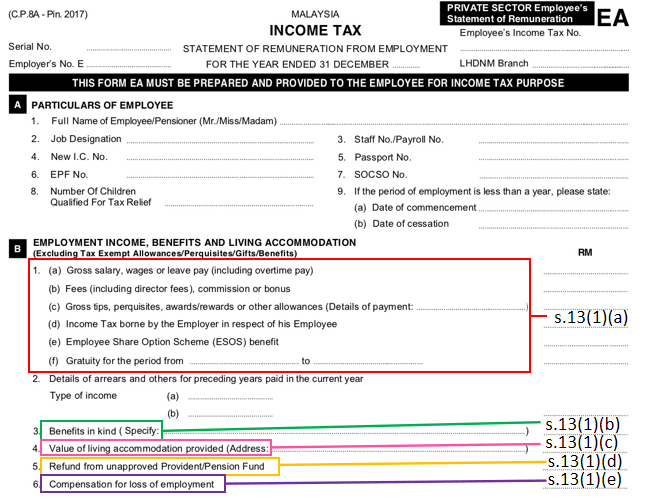

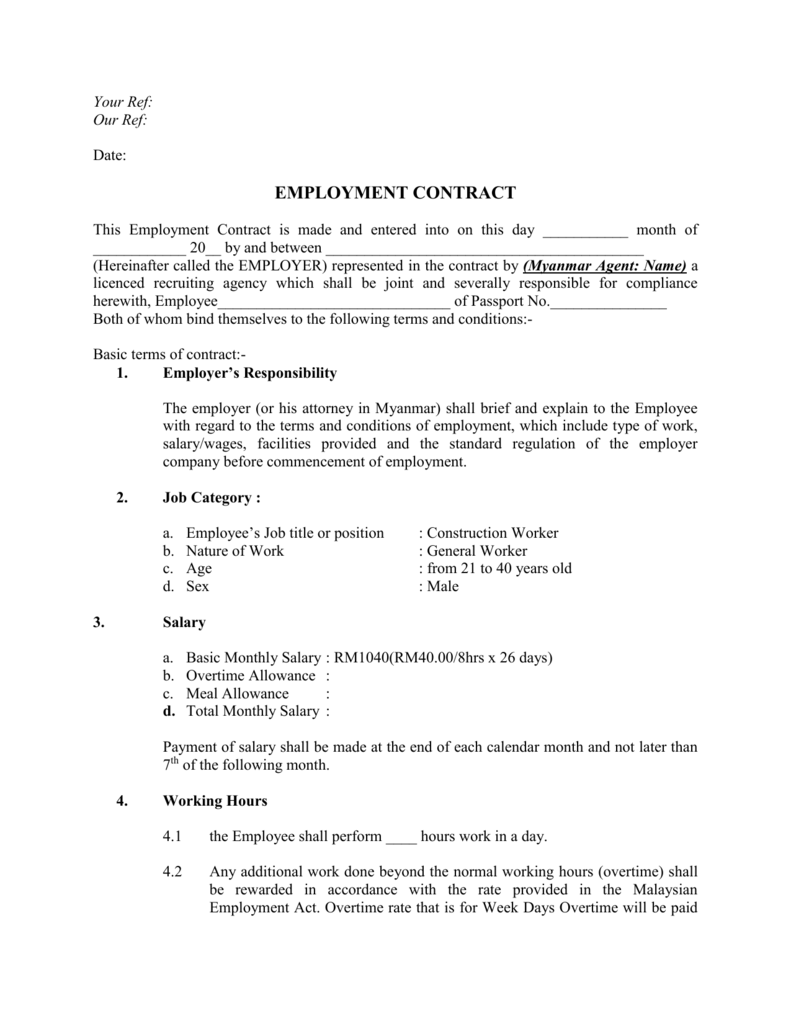

All of these holidays are paid. The income of an employee from an employment includes wages salary remuneration leave pay fee commission bonus gratuity perquisite or allowance whether such items are paid in money or otherwise in respect of having or exercising the employment. Malaysia day national day federal territory day labour day and birthday of the yang dipertuan agong. The scope is very wide and includes virtually all forms of remuneration.

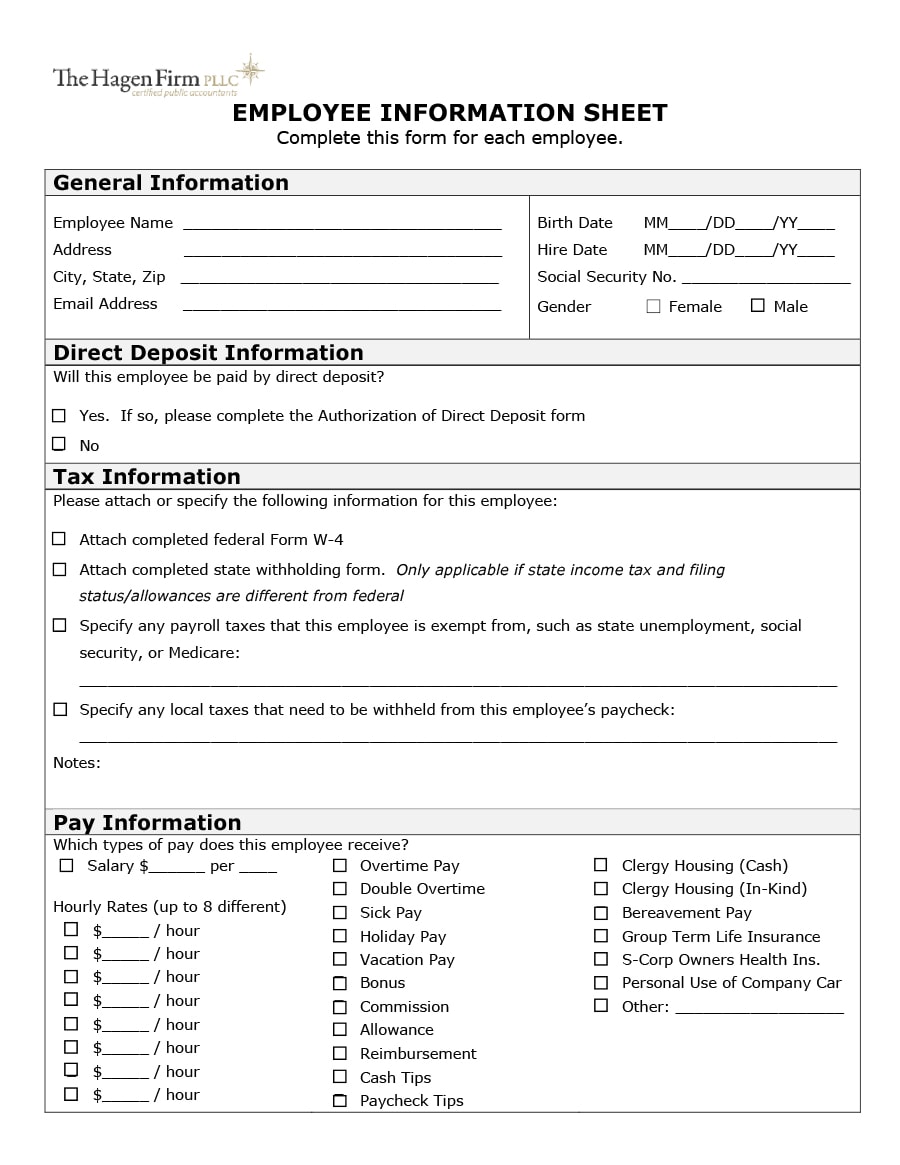

Fully exempted meal allowances. Parking fees allowances. Da is fully taxable with salary. Employees are eligible for most benefits programs on the first day of employment.

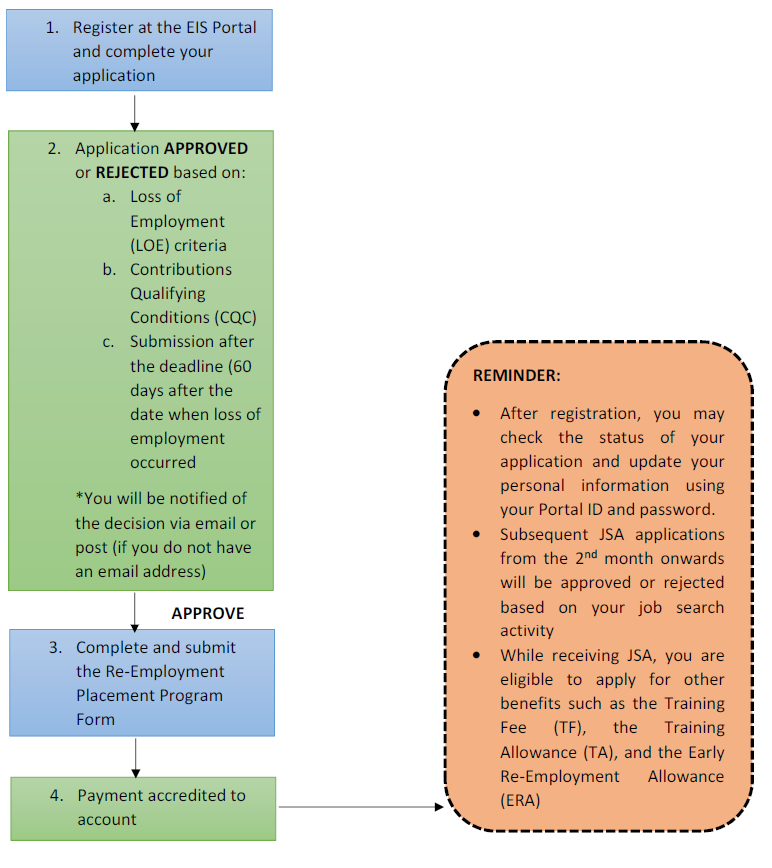

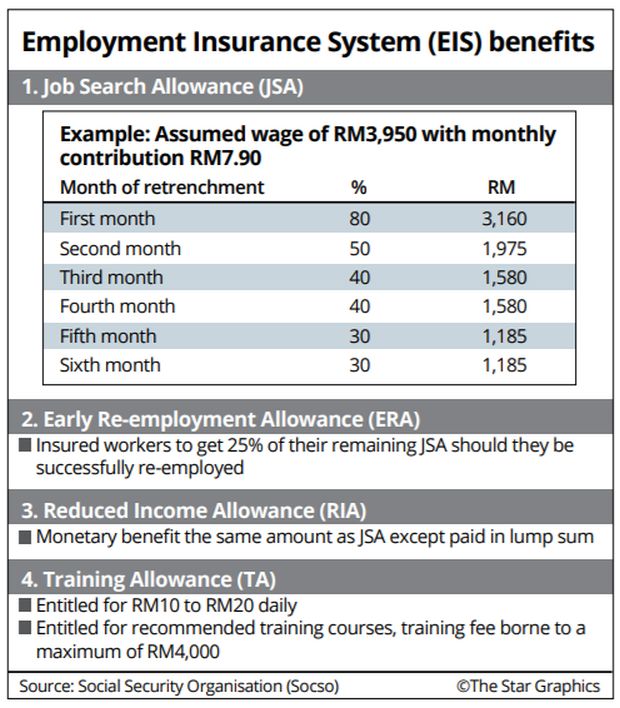

Kuala lumpur aug 1 the government has listed four types of allowances for retrenched workers under the newly proposed employment insurance scheme eis hoped to take effect beginning january 1 next year. Child care allowance for children up to 12 years of age. Under section 45 of the employees provident fund act 1991 epf act employers are statutorily required to contribute to the employees provident fund commonly known as the epf a social security fund established under the epf act to provide retirement benefits to employees working in the private sector. Loans totalling rm300 000 for housing passenger motor vehicles and education income tax borne by employer.

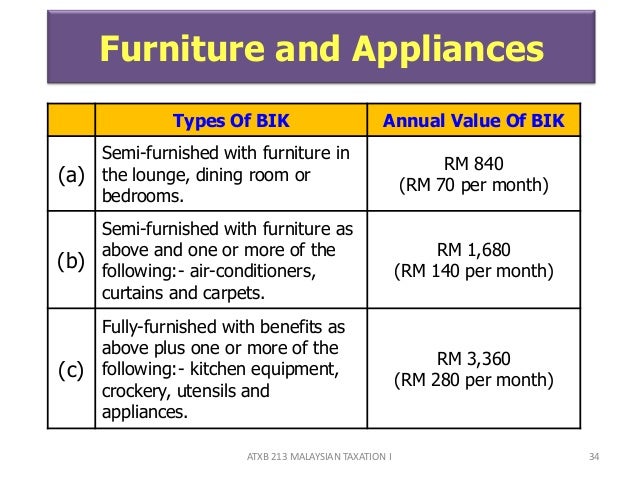

Studies have revealed that a personal allowance of five percent per shift is necessary under normal conditions. Family benefits company doctor driver or security. 1 travel meal allowance outstation or oversea. Uniforms protective gears googles shoes or gloves.

Job search allowance early re employment allowance reduced income allowance training allowance and training fee. The allowance is paid to the employees to manage the inflation. Exemption available up to rm2 000 per annum for the following types of award. The types of general employees remuneration.

Employees shall be granted 12 vacation days on a prorated basis for less than 2 years of service. Dearness allowance da is an allowance paid to employees as a cost of living adjustment allowance. Employees in malaysia may receive 60 days of paid maternity leave. Total amount paid by employer.

However for tasks performed under adverse environments operators may be given 50 percent allowance i e 240 minutes per shift of 8 hours. Allowances to non executive directors for attending during the agm or egm.