When Epf Declare Dividend 2018

Petaling jaya feb 7.

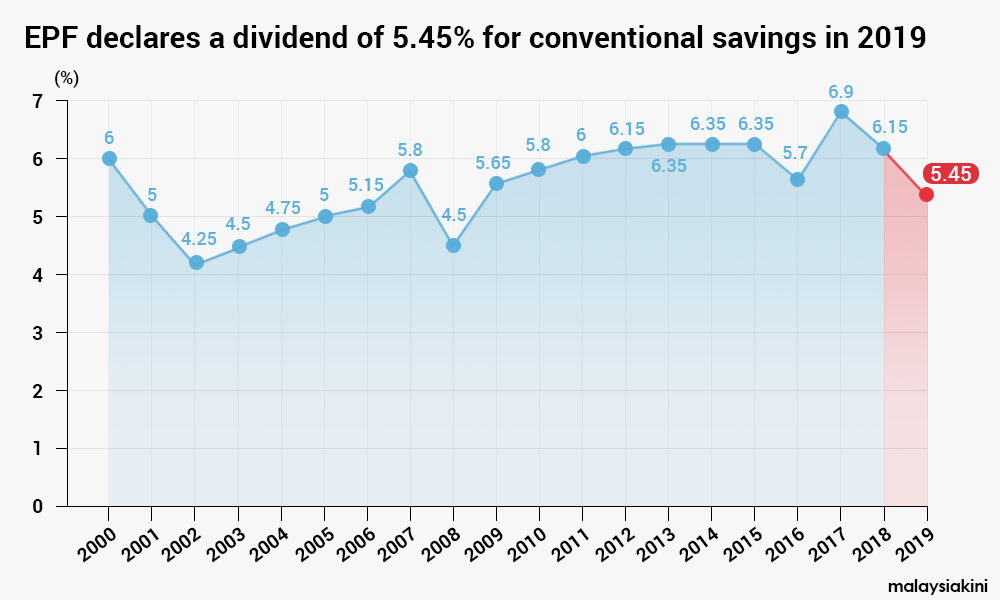

When epf declare dividend 2018. Epf declares 6 15 dividend for conventional savings. Chief epf officer alizakri alias cited a challenging 2019 as the primary reason for the dip in performance with both the global and domestic market taking hits from various fronts. Epf s dividend payouts are derived from total gross realised income for the year after deducting the net impairment on financial assets realized losses on listed. For 2019 the epf dividend rate was 5 45 for conventional and 5 00 for syariah savings for the conventional fund the rate is the lowest it has been since 2008 where the dividend was at 4 5.

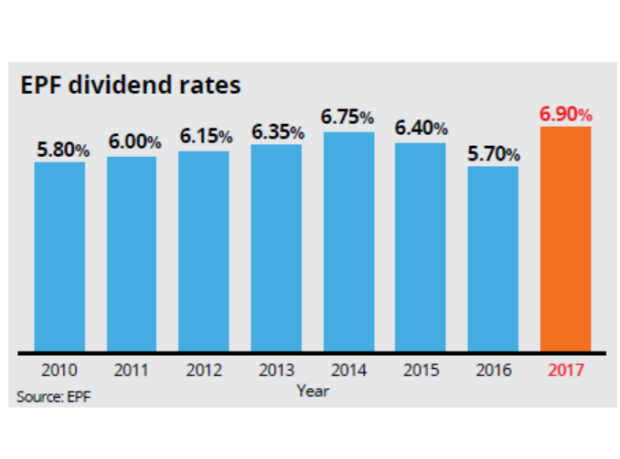

Written by gowri krishnan. The employees provident fund epf is expected to declare a lower dividend than its 6 9 announced for 2017 experts told free malaysia today. Epf pointed out in a statement today that the payout amount required for each 1 of the dividend in 2019 for simpanan konvensional increased to rm7 65 billion from rm6 99 billion in 2018 while for simpanan shariah rose to rm0 83 billion compared to rm0 73 billion in 2018. 5 45 simpanan konvensional 5 0 simpanan shariah 2018.

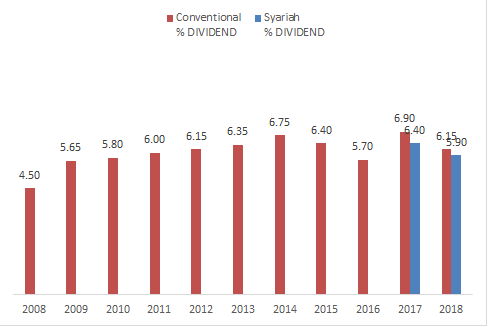

Modified 15 feb 2019 10 07 pm the employees provident fund epf has declared a dividend rate of 6 15 percent for conventional savings 2018 with a payout amounting to rm43 billion and 5 9. They reckon that the returns for 2018 would range from less than 5 to just 6. The employees provident fund epf has declared dividend rates for both conventional and shariah savings in 2018. This article first appeared in the edge malaysia weekly on february 4 2019 february 10 2019.

The epf declares its annual dividend payout based on its net realised income. Dividend kwsp epf tahun 2019. The employees provident fund epf with the approval of the finance ministry has declared a dividend rate of 6 9 for conventional savings simpanan konvensional for 2017 with a. It also highlighted that the dividend of 5 45 declared for.

The employees provident fund epf is set to declare its annual dividend for 2018 anytime now and anyone who has been paying any attention would know that the odds of it outperforming that in 2017 are low. According to epf the dividend rate for conventional savings stands at 6 15 which amounts to rm42 billion in payout while the dividend rate for shariah savings is 5 9 total payout of rm4 32 billion.