What Wages Are Subject To Eis Contribution

Payments exempted from socso contribution.

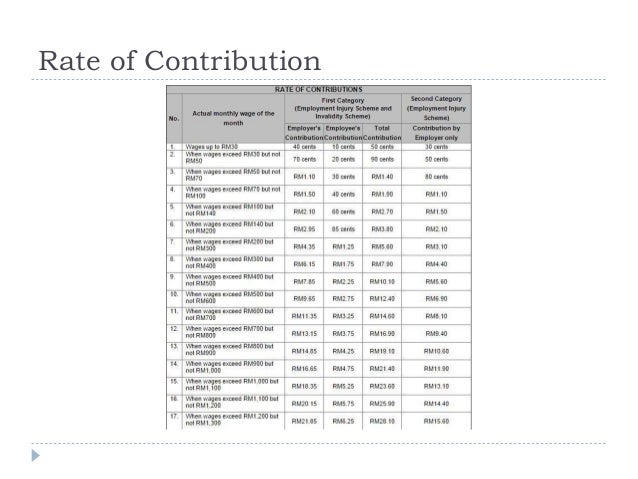

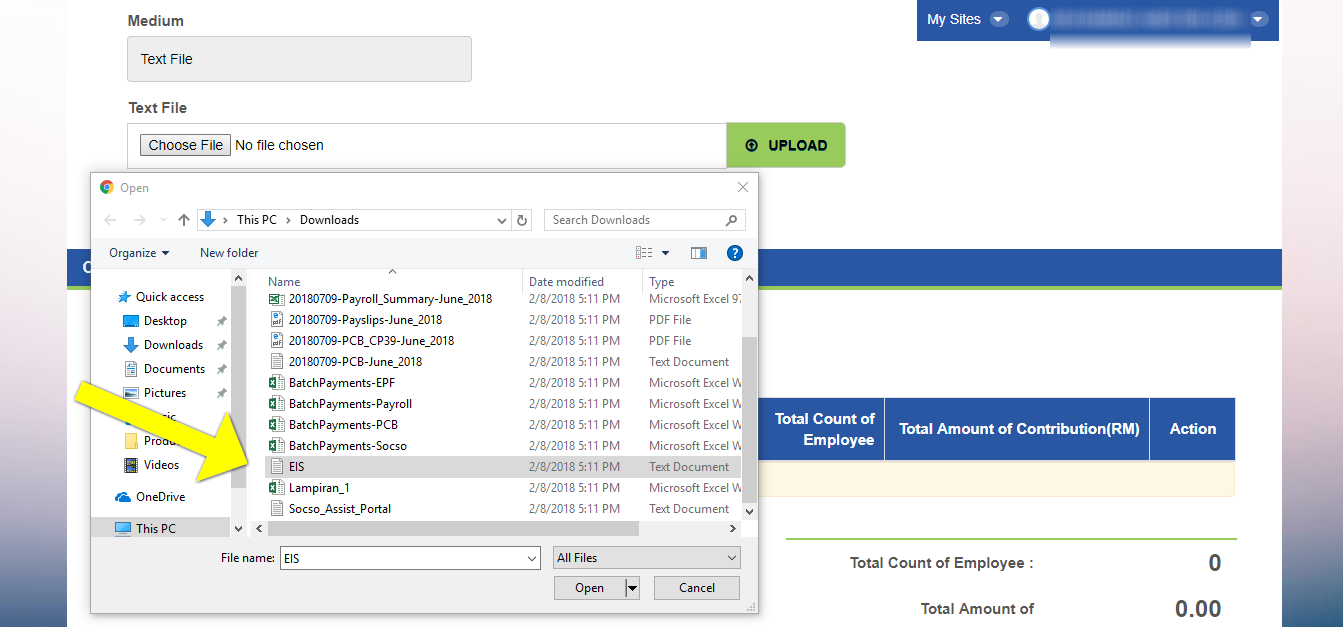

What wages are subject to eis contribution. Wages for study leave. 0 2 will be paid by the employer while 0 2 will be deducted from the employee s monthly salary. Payments in respect of leave. Under the initial bill employers and employees will contribute rm0 10 each for those with monthly wages of not more than rm30 and rm19 75 each for employees with monthly wages of more than rm4 000.

The minimum eligible monthly salary can be as low as rm30 where the 0 4 will see them contributing just rm0 10 each month. The contribution rate for employment insurance system eis is 0 2 for the employer and 0 2 for employee based on the employee s monthly salary. This system is introduced by the malaysian government to provide workers who lost their jobs with temporary financial assistance. Payments subject to socso contribution wages for contribution purposes refers to all remuneration payable in money by an employer to an employee.

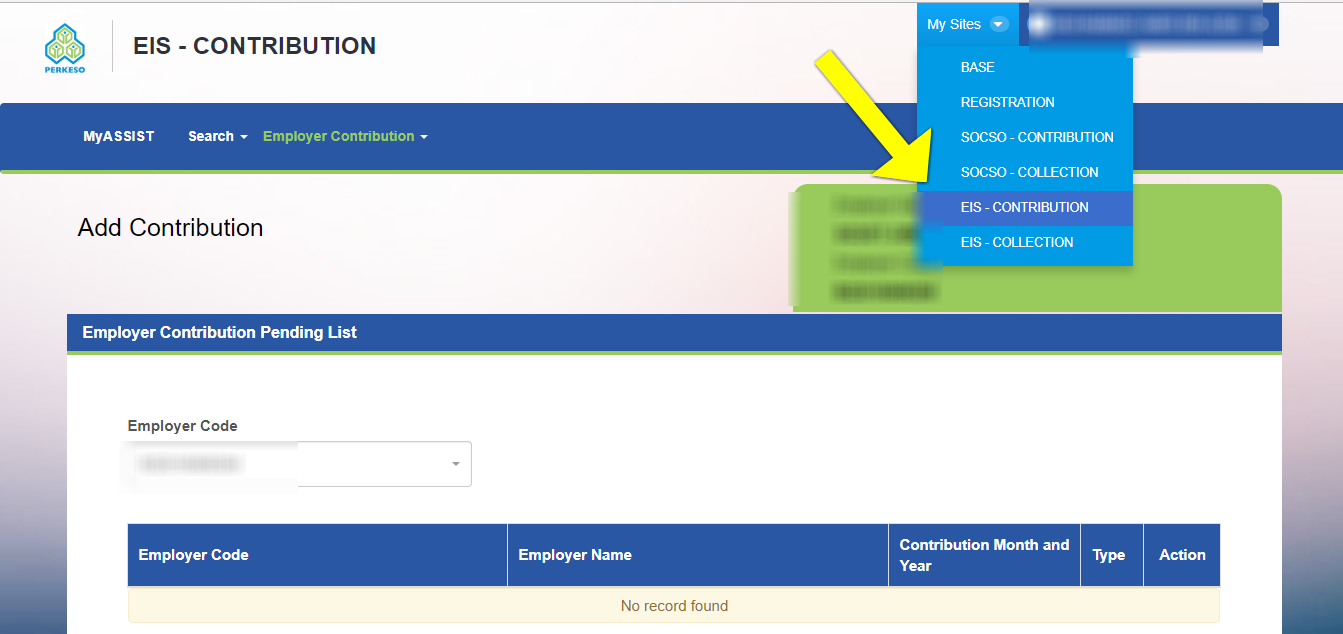

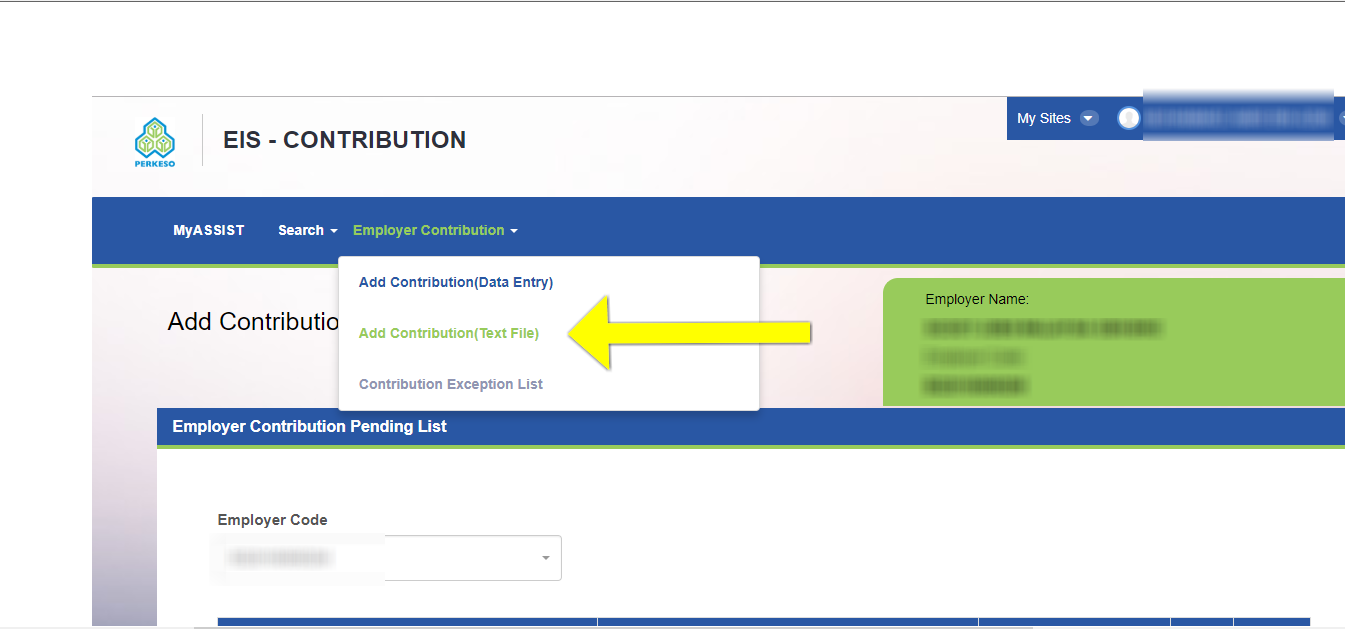

Eis contribution rate the contribution rate for employment insurance system eis is 0 2 for the employer and 0 2 for employee based on the employee s monthly salary. The contribution rate is based on section 18 and schedule 2 of the employment insurance system act 2017. This means that the total contribution would be 0 4 of an employee s monthly salary. Starting with the wages of employees for the month of january 2018 all employers and employees are required to contribute a total of 0 4 out of the assumed monthly wages for eis.

For example if an employee s gross monthly wages is rm2 900 but less than rm3 000 then the eis contribution would look like this employee contribution rm5 90 employer contribution rm5 90 total contribution rm11 80 it is noted that the contributions to eis is capped at a monthly salary level of rm4 000. This simply means that if a person earns more than rm4 000 a month the contribution is still fixed at rm7 90. Wages subject to epf contribution. The average contribution is expected to be around 0 2 contributed by both employees and employers based on wages and the level of wages.

In general all payments which are meant to be wages are accountable in your monthly contribution amount calculation. Contribution rates contributions to the employment insurance system eis are set at 0 4 of the employee s assumed monthly salary. Contribution rates are capped at an assumed monthly salary of rm4000 00. Payment for unutilised annual or medical leave.

Wages for maternity leave.