What Is Unit Trust

In this guide the term fund will also refer to a unit trust.

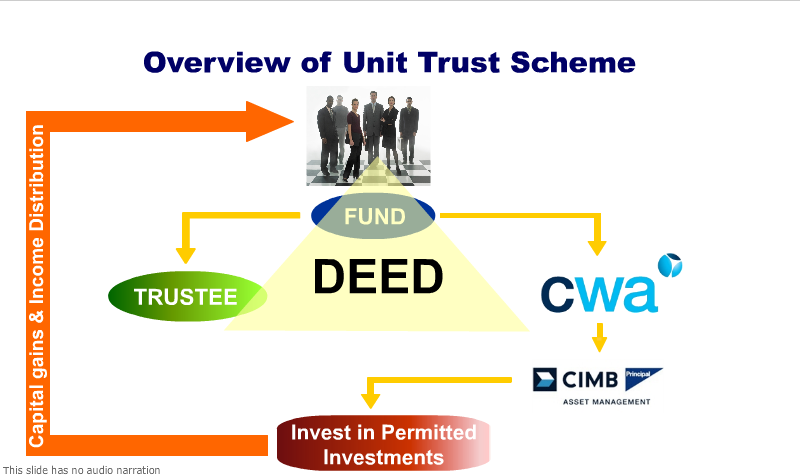

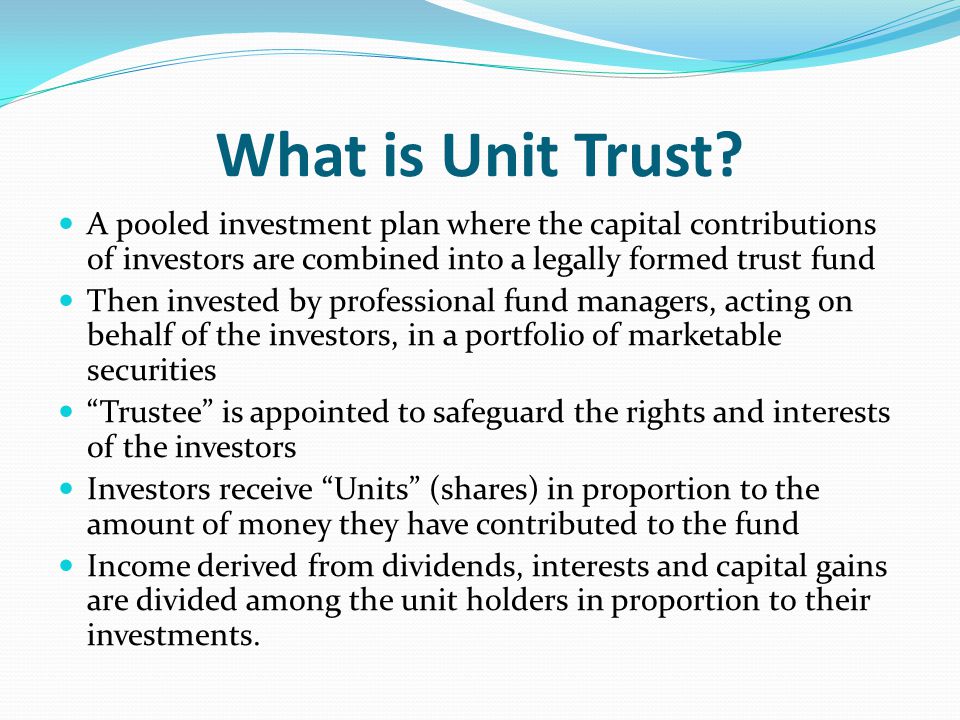

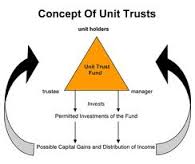

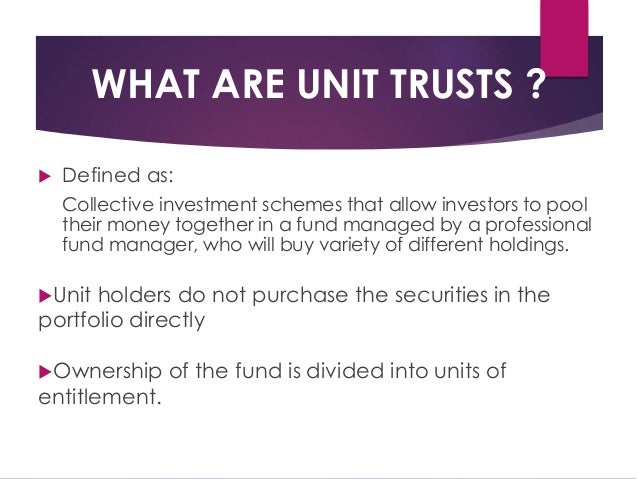

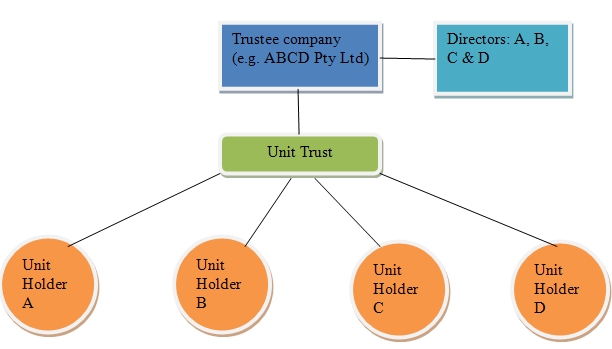

What is unit trust. You buy units with the investment you make in a unit trust. Investment linked insurance policies ilps are another way to invest in funds. Investors can sink their funds into these investments using a range of financial service providers. A unit trust is a form of collective investment constituted under a trust deed.

A unit trust is a fund which adopts a trust structure. Unit trusts versus ilps. A unit trust is an open ended grouped investment product which means there is no limit to how many people can invest in it or how much can be invested. The value of investments unit prices and income distribution may go down or up and the investor may not get back the original sum invested.

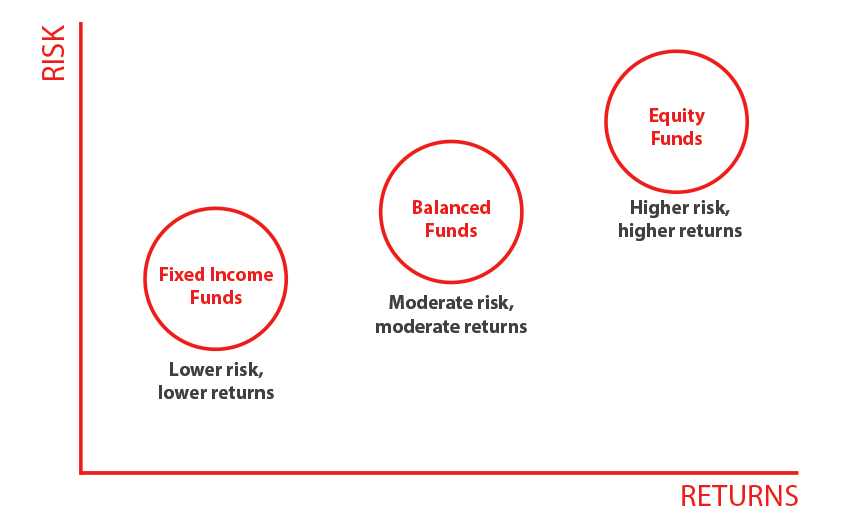

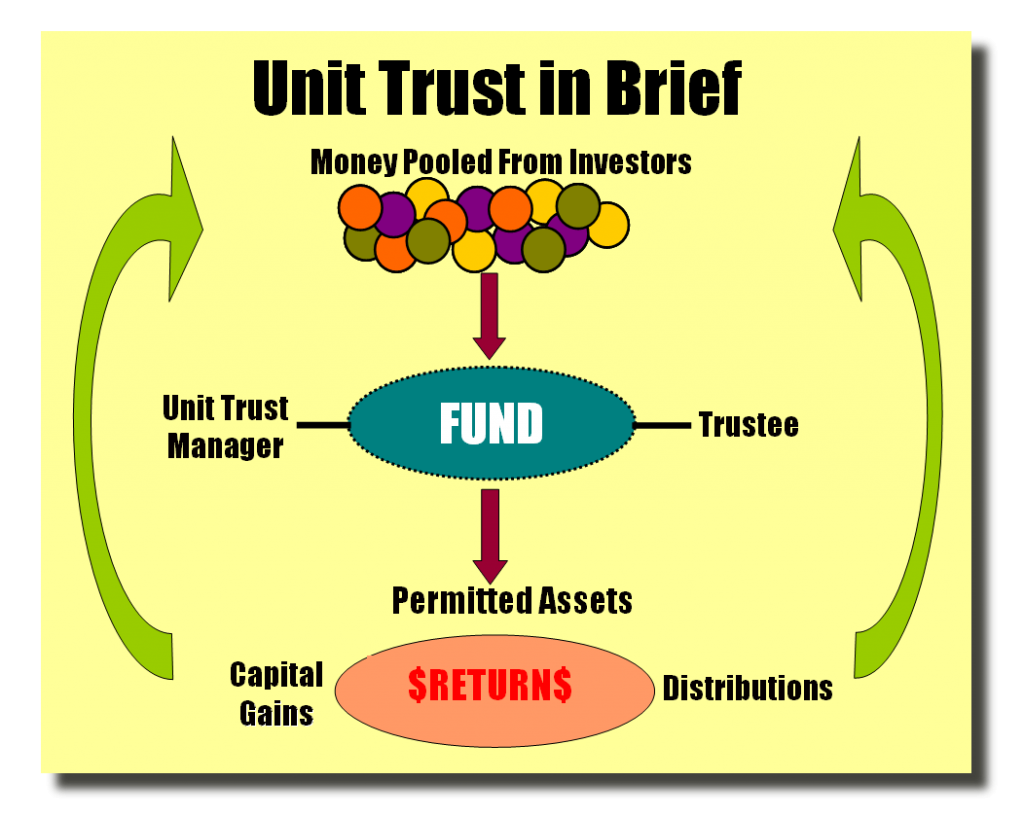

Not all funds use a trust structure. Past performance of a fund should not be taken as indicative of its future performance. A unit trust pools investors money into a single fund which is managed by a fund manager. A unit trust is an unincorporated mutual fund structure that allows funds to hold assets and provide profits that go straight to individual unit owners instead of reinvesting them back into the.

In the case of a trust fund various holdings instead of fruits make up the investment. These include an investment management company a stock broker and even sometimes a local or larger bank. Uitf is a pool of investments funded by various investors. You can think of it as a basket with different fruits one basket may contain mangoes the other with pineapples and a third basket contains a combination of two fruits.

A unit trust fund is effectively a vehicle in which individuals can invest their money.