What Is Term Life Insurance Used For

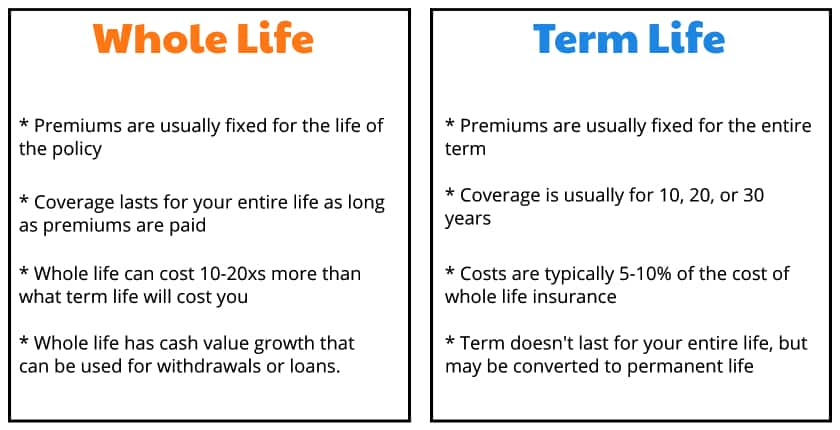

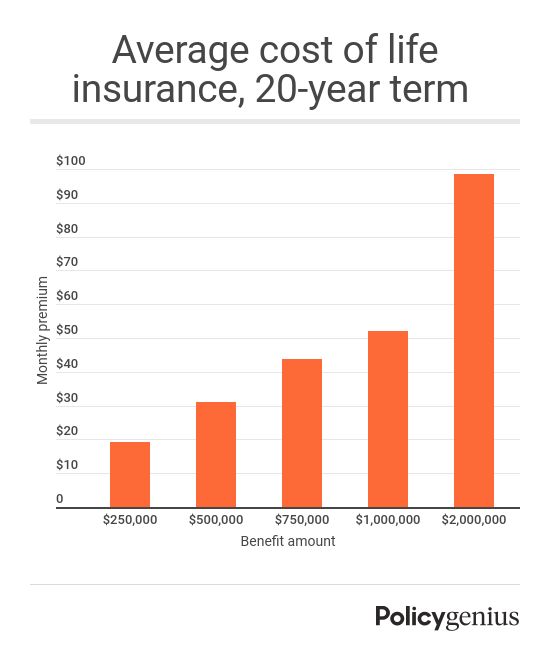

Term life insurance offers essential protection for you and your family without the sky high fees and premiums that come with other kinds of life insurance.

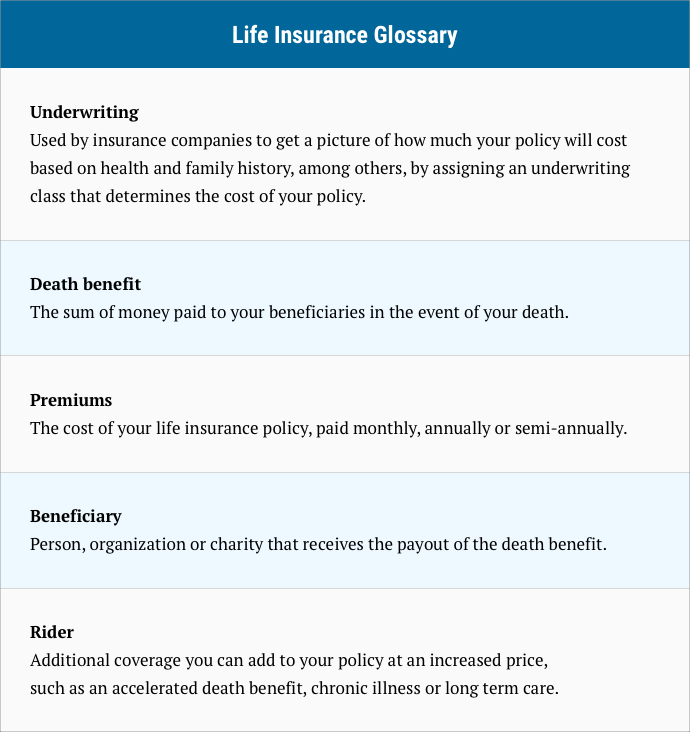

What is term life insurance used for. Years back decreasing term insurance was popular when used to insure a personal debt because the insurance coverage decreased as the debt decreased and the product was a little cheaper than level term. Help your family cover your final expenses and medical bills. To replace your income if you were to die unexpectedly. Life insurance or life assurance especially in the commonwealth of nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money the benefit in exchange for a premium upon the death of an insured person often the policy holder.

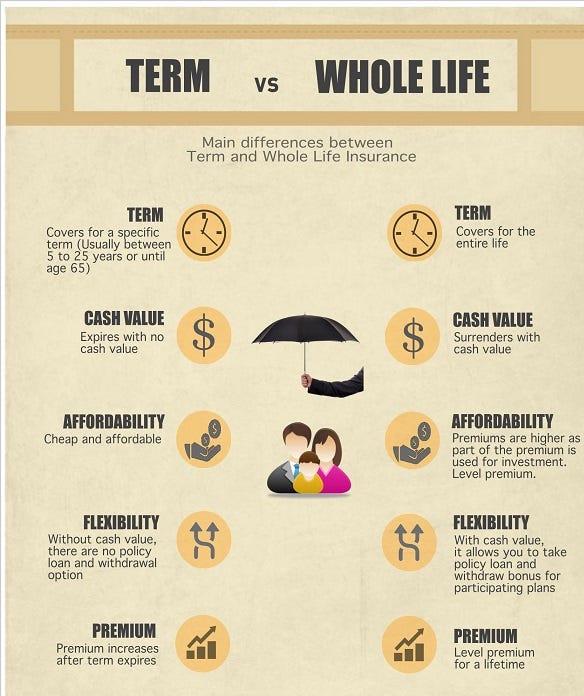

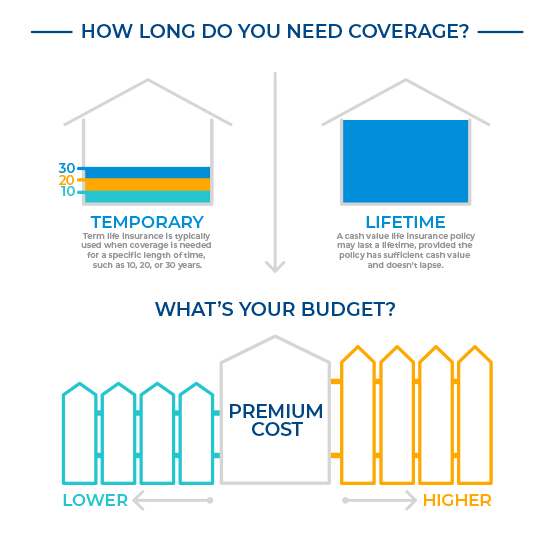

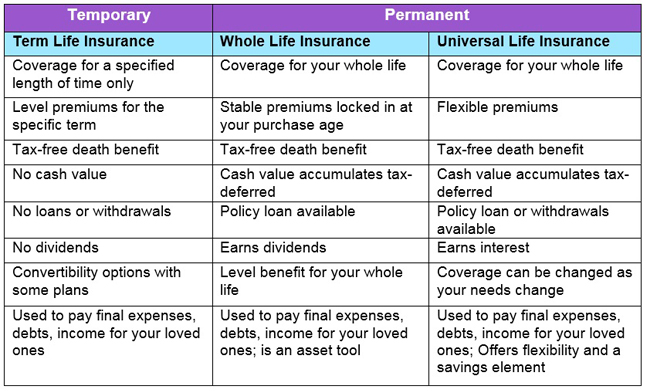

Term life insurance also known as pure life insurance is a type of life insurance that guarantees payment of a stated death benefit if the covered person dies during a specified term. Depending on the contract other events such as terminal illness. As the name implies a term insurance policy is good for a specific period of time. Life insurance that provides coverage at a fixed rate of payments for a limited period of time.

After that period expires coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions. Although level term is the most popular type of term insurance on occasion decreasing term or renewable term is a better choice. Term life insurance provides coverage for a certain time period. Leave your family with enough money to pay off debts such as a mortgage.

It s often called pure life insurance because it s designed only to protect your dependents in case you die prematurely. Given that you generally need life insurance. Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time the relevant term. Some common uses for term life may include.

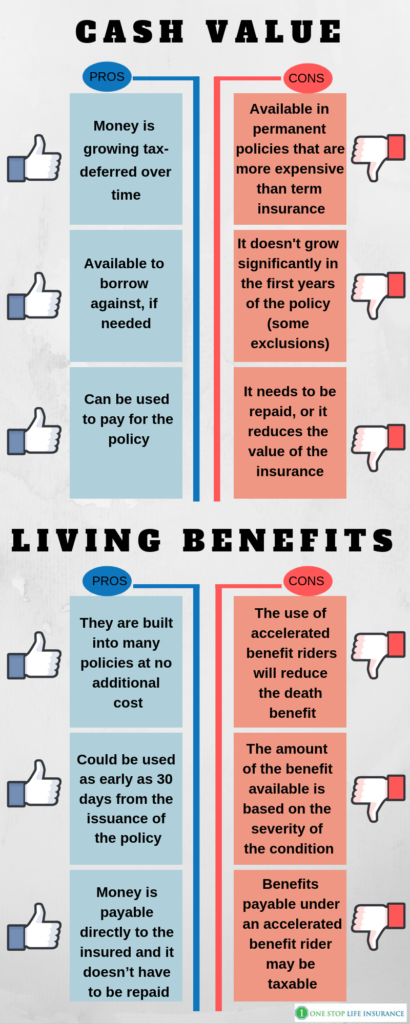

Term life insurance can be used for many different purposes. Life insurance can be used to pay for health care costs and long term health care and can provide a fund for cash withdrawals but many people who hold life insurance policies do not know what. Life insurance policies that include a long term care benefit alleviate the concern about paying for coverage you may never use.