What Is Tax Relief

Each time you save into your plan you ll receive extra contributions from the government which will boost your retirement savings.

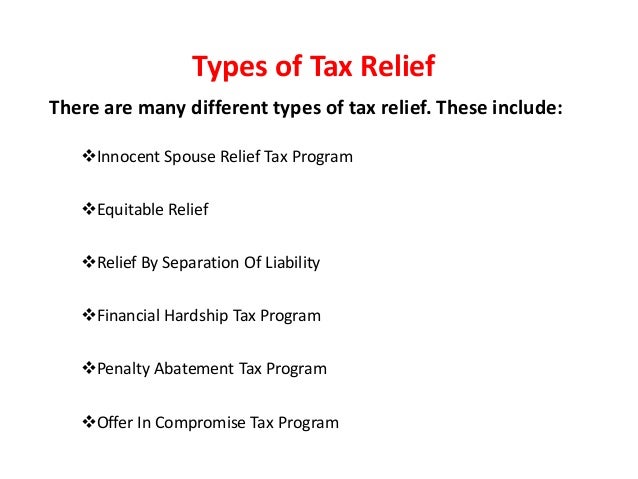

What is tax relief. Tax relief is any government program or policy initiative that is designed to reduce the amount of taxes paid by individuals or businesses. In a nutshell tax relief is an incentive or system that lets you pay less income tax. Rather it s about making it easier to take care of the tax debt you owe. One of the executive orders actually an executive memorandum suspends the collection of social security payroll taxes from september 1 until the end of the year for workers making less than.

For example a tax credit can incentivize homeowners to make. Tax relief really means setting up a payment plan or negotiating a settlement with the irs it s not about erasing your tax obligation. The term tax relief refers to tax breaks and write offs that reduce the amount of tax due or otherwise provide concessions for taxpayers. Certain requirements must be met to obtain some form of tax relief.

In the united states however the term is most often used in conjunction with federal taxes. For example the state of virginia provides car tax relief to residents that own or lease a car that is not used more than 50 of the time for business purposes. Reduction of taxes that are owed to a local state or federal taxing authority. Tax relief is any reduction in taxes owed by an individual taxpayer or business entity including tax deductions and tax credits.

Victims of natural disasters such as hurricanes and wildfires are sometimes offered special tax relief as well. Instead tax relief is about finding a way to set up a payment plan that works for you or alleviating some of that debt. If you receive basic rate tax relief this means a 25 boost on top of your contributions. Tax relief isn t necessarily about eradicating your monetary obligation to the irs.

Tax relief is given in 2 ways. It may be a universal tax cut or a targeted program that.

/GettyImages-1153812676-0ac08ff7c07b4cd2842e24f081ab6d9b.jpg)