What Is Quit Rent Malaysia

How does the tax work.

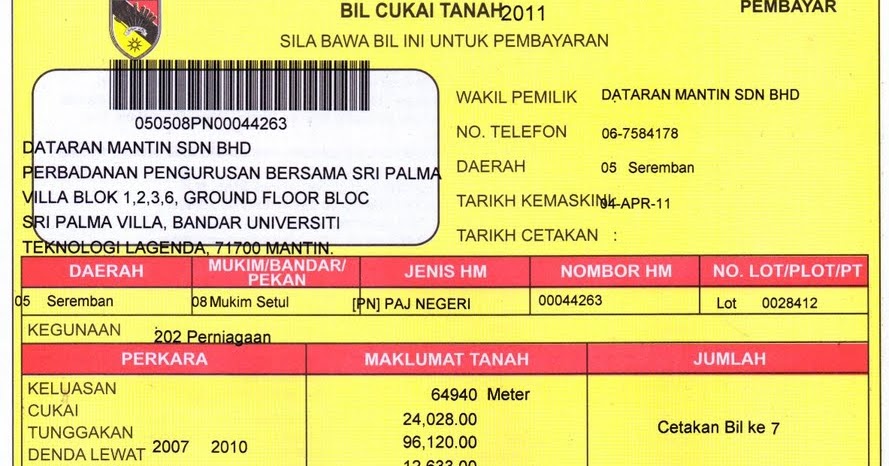

What is quit rent malaysia. Currently unit owners pay quit rent annually to their respective management corporations mc and joint management bodies jmb which in turn pay pptgwp under the master strata title. Parcel rent is not a new tax. It s imposed on owners of both freehold and leasehold land. It will replace quit rent cukai tanah and unit owners will have to pay directly to the federal territories land and mines office pptgwp.

Alienated land constitutes any leased land owned by the government or any land formerly owned by the government. Though mandated by federal law state governments assess and collect all quit rent. Quit rent cukai tanah is a tax imposed on private properties. Quit rent constitutes a form of tax levied against all alienated land in malaysia.

This payment is calculated by multiplying the size of an owned property in square feet or square metres by a specified rental rate. It must be paid by the landlord to the state authority via the land office and is payable in full amount from 1st january each year and will be in arrears from 1st june each year. Nowadays the national land code makes it compulsory for all landowners to pay cukai tanah now also known as quit rent once a year to the relevant land office of their state government. Referred to as cukai tanah in malay quit rent is the payment that owners of local properties make to the malaysian government through the land office or pejabat tanah dan galian ptg.

Quit rent or cukai tanah is a form of land tax collected by your state government for property in malaysia. It is the replacement of a quit rent to property parcel owners with strata title. Since malaysia still has all its kings and the land tax is a healthy source of income for the states we citizens still have to pay it.