What Is Quit Rent And Assessment

That is discharged from any other rent.

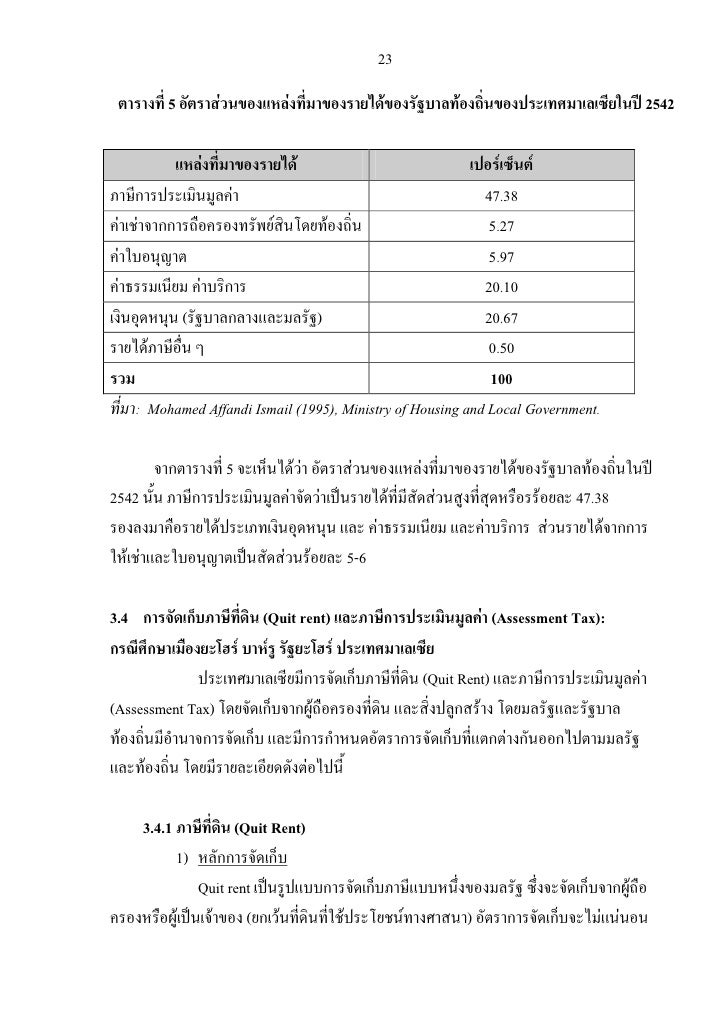

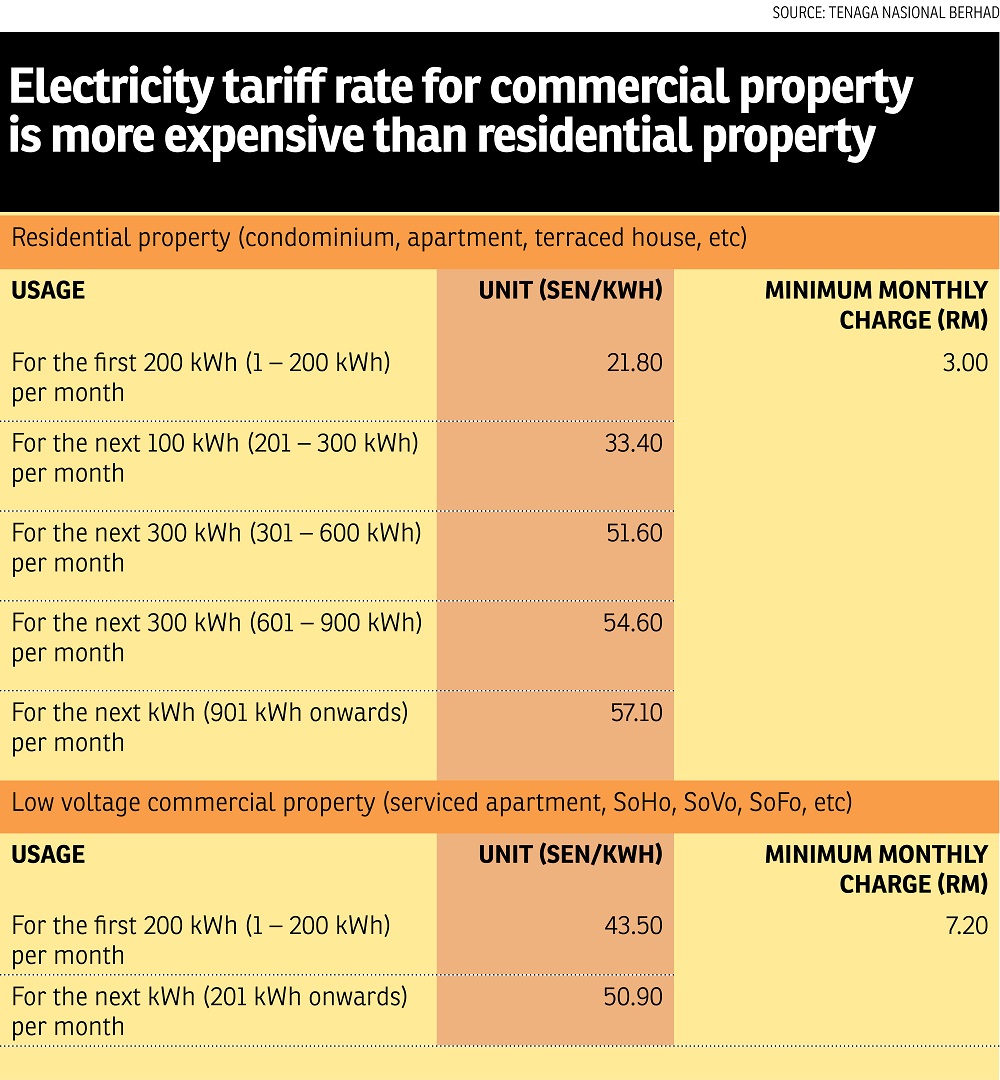

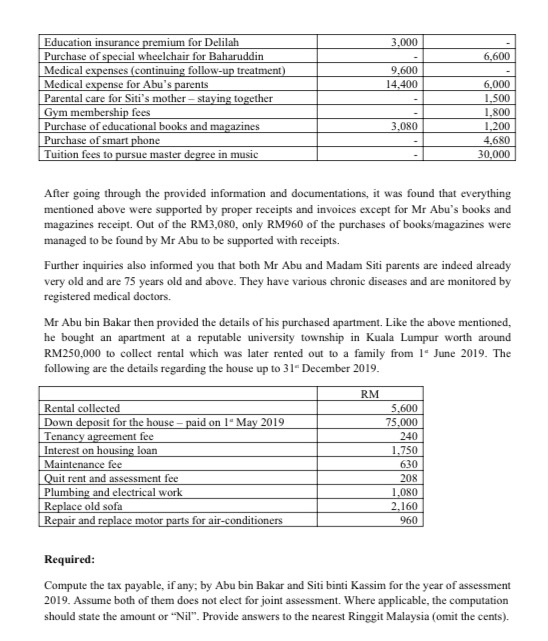

What is quit rent and assessment. Quit rent is a form of levy or land tax imposed on freehold or leased land by a higher landowning authority usually government or its assigns. Quit rent also applies to strata buildings. Both are paid to the state government where your property is situated but at different departments. Nowadays the national land code makes it compulsory for all landowners to pay cukai tanah now also known as quit rent once a year to the relevant land office of their state government.

A rent paid by the tenant of the freehold by which he goes quit and free. Land and property owners must known state due dates and assessment rates and act of their own volition in paying the tax. Quit rent quit rent or quitrent is a tax or land tax imposed on occupants of freehold or leased land in lieu of services to a higher landowning authority usually a government or its assigns. Quit rent cukai tanah is a tax imposed on private properties.

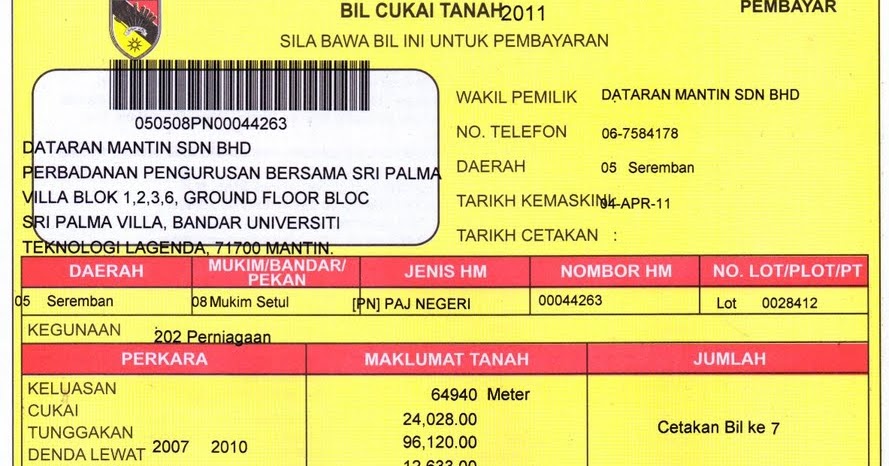

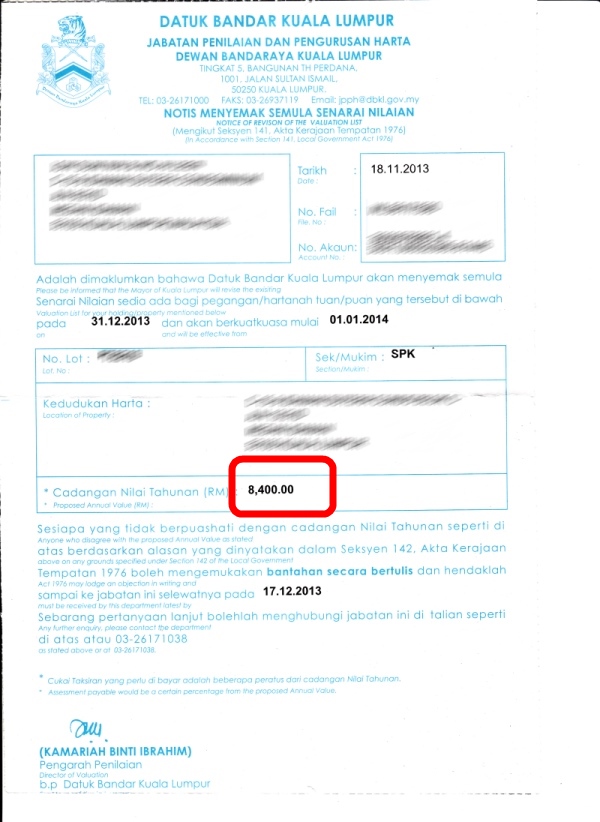

The assessment tax bill is blue in colour. Referred to as cukai tanah in malay quit rent is the payment that owners of local properties make to the malaysian government through the land office or pejabat tanah dan galian ptg. Those who pay either tax after the due date must pay a fine. Quit rent is a tax charged on privately owned land and must be paid once a year to the state authority.

The quit rent bill is yellow in colour. Assessment tax is paid to the local authority and must be paid twice a year. Quit rent and assessment tax is due by a certain date each year without demand from the government. The bill is yellow in colour.

Quit rent or cukai tanah is a form of land tax collected by your state government for property in malaysia. Under feudal law the payment of quit rent freed the tenant of a holding from the obligation to perform such other services as were obligatory under feudal tenure. This payment is calculated by multiplying the size of an owned property in square feet or square metres by a specified rental rate. It s assessed and imposed by the local state government via the country s land office.

It s imposed on owners of both freehold and leasehold land.