What Is Overnight Policy Rate

As of 7th of july bank negara malaysia has decided to reduce the overnight policy rate opr by 25 basis points to 1 75.

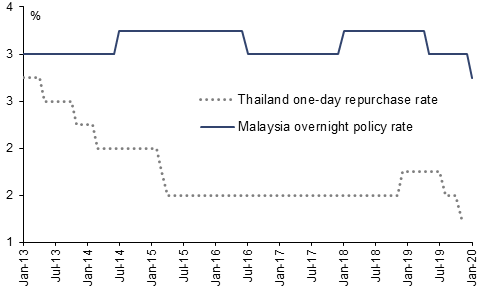

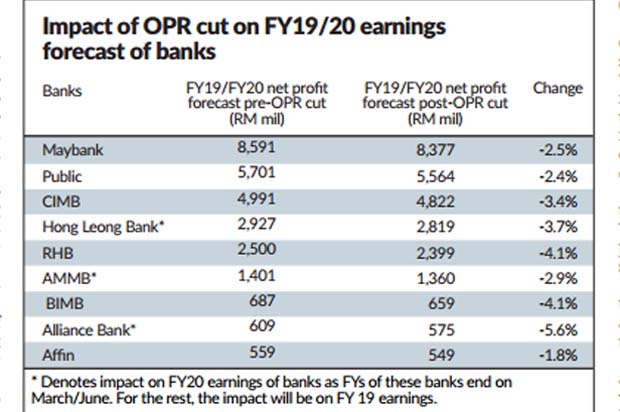

What is overnight policy rate. The overnight policy rate opr is the minimum interest rate charged amongst banks in the interbank market which they borrow funds from each other. Bank negara malaysia bnm announced another reduction of the overnight policy rate opr by 25 basis points to 1 75 on july 7 2020. This overnight policy rate or interest rate is a rate a borrower bank has to pay to a leading bank for the funds borrowed. It is the target rate for the day to day liquidity operations of the bnm.

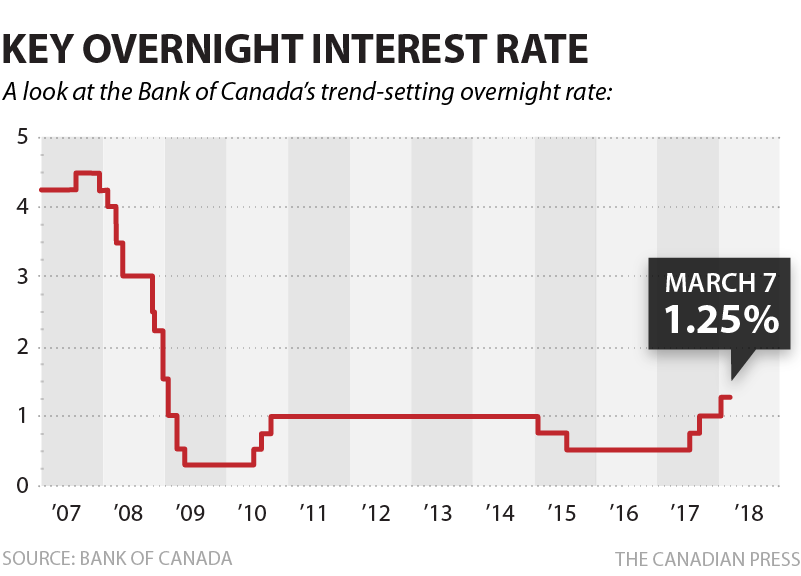

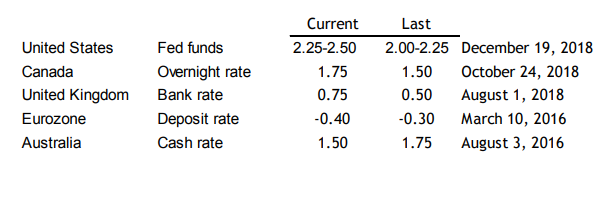

The overnight policy rate opr is the interest rate at which a depository institution lends immediately available funds balances within the central bank to another depository institution overnight. This is the fourth time the opr has been decreased this year pushing it to a record low. Banks also borrow from each other to cover daily shortfalls and are charged the federal funds rate suggested but not set by the fed. The overnight rate is the interest rate at which a depository institution generally banks lends or borrows funds with another depository institution in the overnight market.

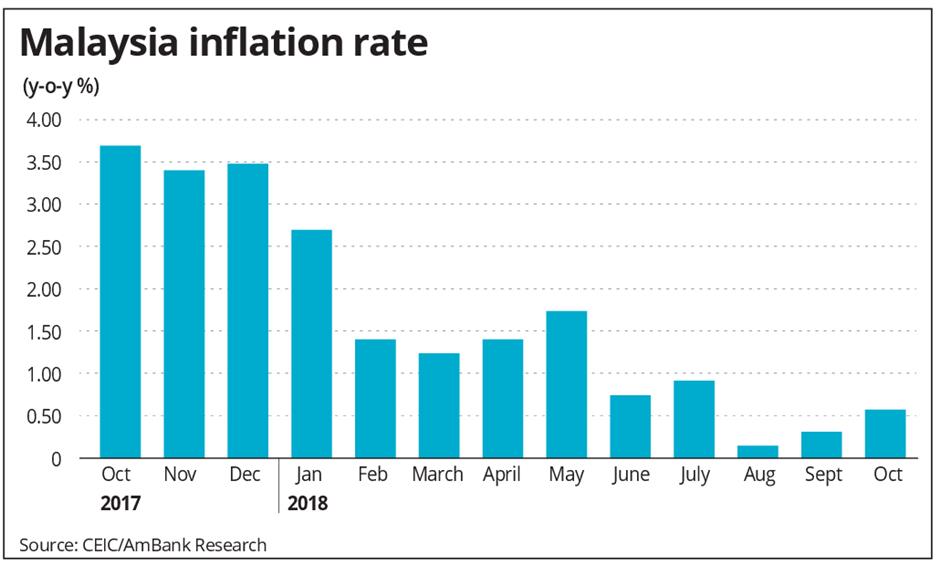

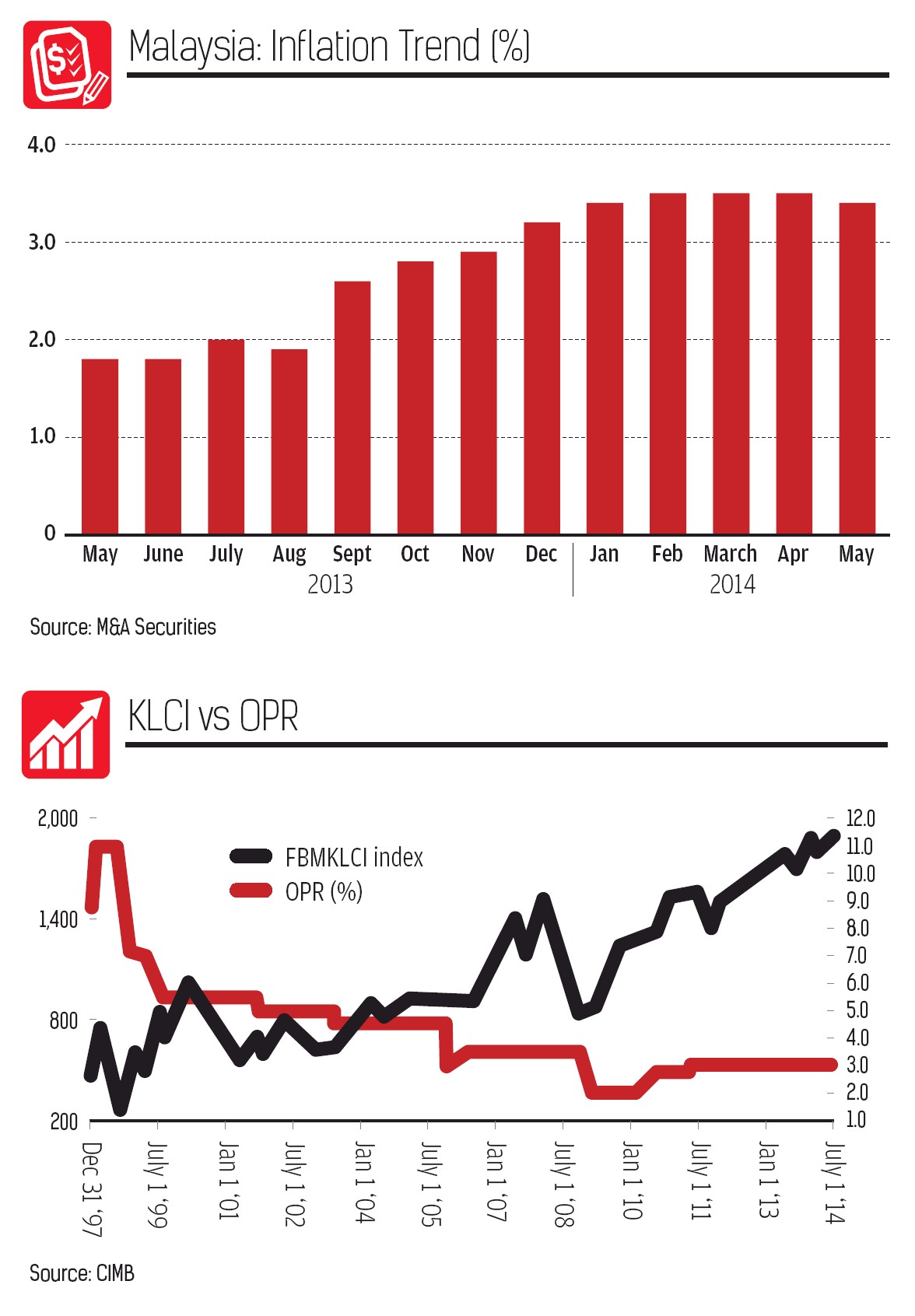

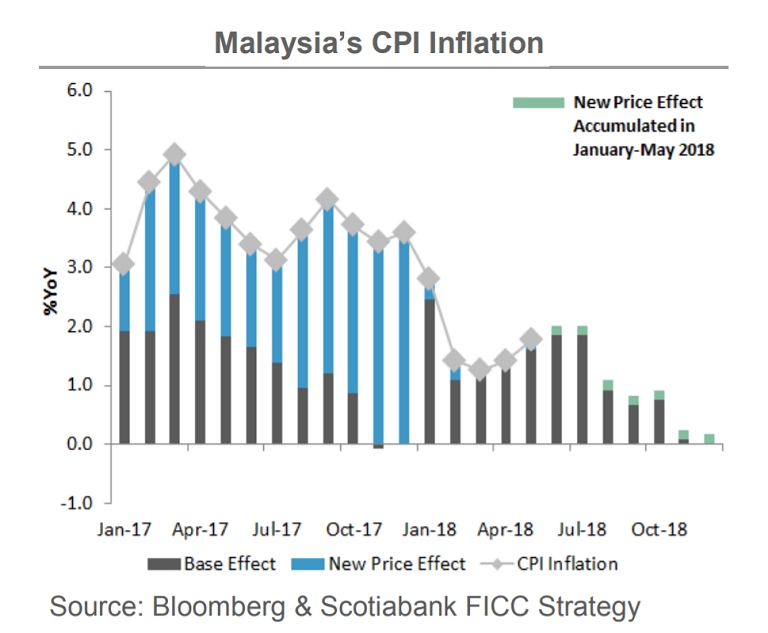

Central banks manipulate the overnight lending rate to implement their monetary policies. The overnight policy rate is an overnight interest rate set by bank negara malaysia bnm used for monetary policy direction. A central bank can indirectly influence interest rates through open market operations. The overnight rate is one of the most important macroeconomic variables.

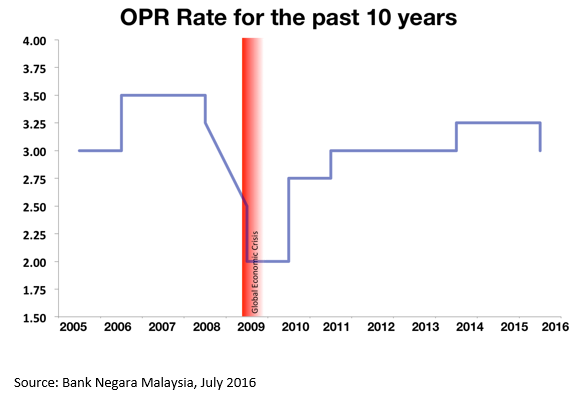

When a bank has a fund deficit to meet the withdrawal demand from depositors the bank will borrow from another bank with an excess fund. You may wonder why a bank would be borrowing from another bank but you must understand that bank makes money by lending money out and not by keeping money. The current opr set by bank negara is 3. Changes in the overnight lending rate may also influence other macroeconomic factors including the unemployment rate inflation and economic growth rate.

The fed charges a discount rate on funds it loans banks overnight.

-in-Malaysia/OPR-(Banner).png.aspx?width=700&height=162)