What Is Islamic Banking In Pakistan

But as it was a mammoth task the switchover plan was.

What is islamic banking in pakistan. Vision and mission statements of sbp. Pakistanis can choose between the two modes of financing. In pakistan s financial sector as of 2006 a system of islamic banking has been adopted that operates in parallel with the conventional banking system. This bank is formed as the result of merging al baraka bank in bahrain al baraka bank in pakistan and global emirates islamic banks.

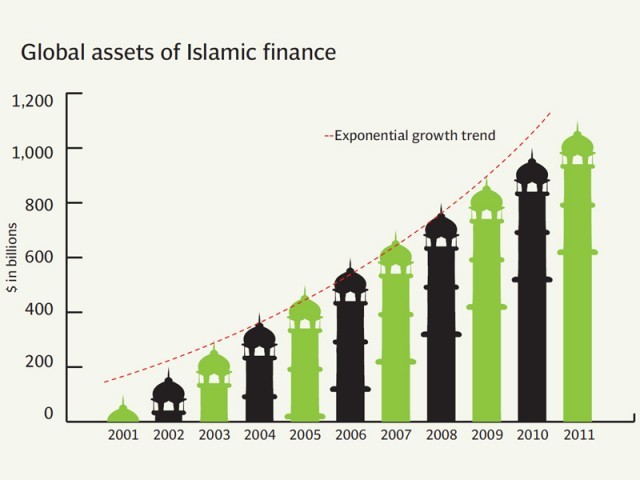

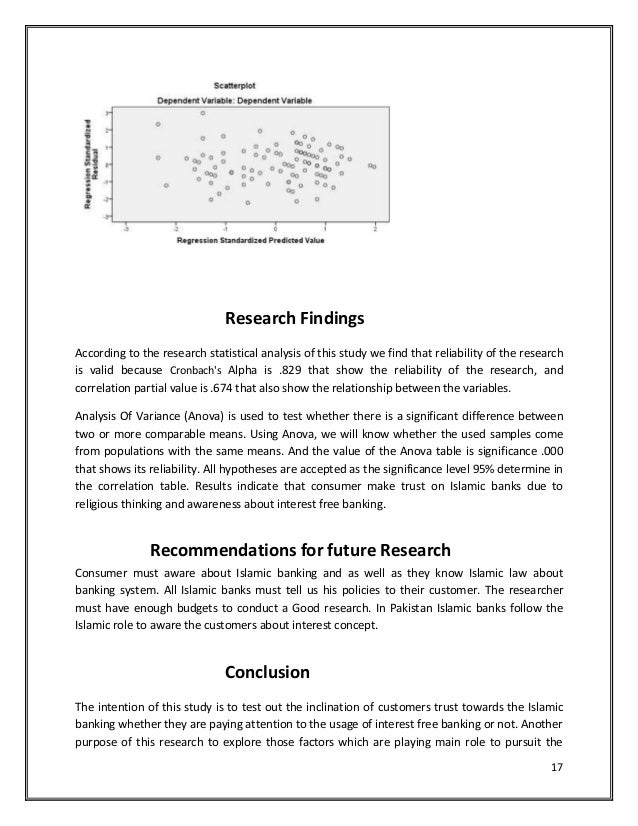

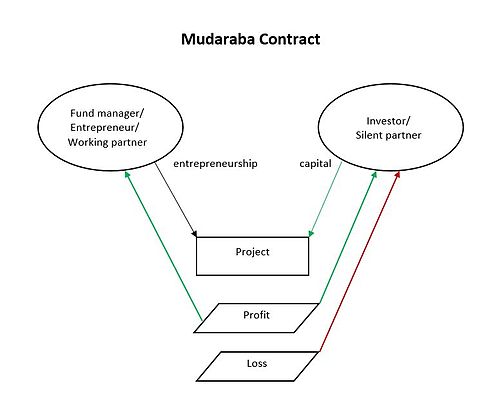

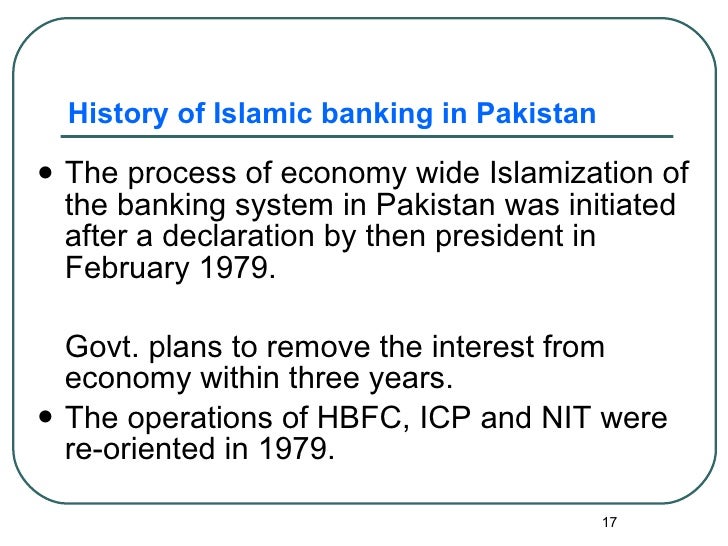

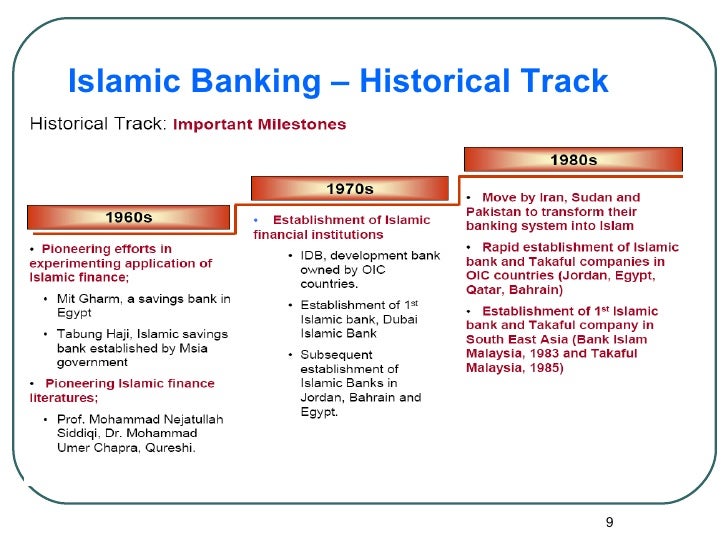

Abstract and figures this research paper suggests that islamic banking is spreading its wings in pakistan and is positioning for growth. مصرفية إسلامية or sharia compliant finance is banking or financing activity that complies with sharia islamic law and its practical application through the development of islamic economics some of the modes of islamic banking finance include mudarabah profit sharing and loss bearing wadiah safekeeping musharaka joint. Pakistan was among the three countries in the world that had been trying to implement interest free banking at comprehensive national level. Clear cut statements in respect of vision and mission were announced.

Islamic banking or islamic finance arabic. Founded in 1997 meezan bank offers islamic services as one of the commercial banks in pakistan. Steps for islamization of banking and financial system of pakistan were started in 1977 78. Islamic banking in pakistan is also facing some challenges.

2 al baraka islamic bank. Islamic banking is a banking system that is based on the principles of islamic or shariah law and guided by islamic economics it is also known as shariah compliant banking. This bank has a vision that it will promote islamic principle teachings in banking industry in all over the world. It operates through corporate finance trading and sales retail banking corporate and commercial banking agency services and payment and settlement segments.

Al baraka islamic bank works on international level to provide world class facilities to its loyal customers. Islamic banking in pakistan has witnessed significant growth during the last decade and now constitutes over 10 percent of the country s banking system with an asset base of over rs 900 billion and a network of more than 1 100 branches. Islamic banking also referred to as islamic finance or shariah compliant finance refers to finance or banking activities that adhere to shariah islamic law. What is the history of islamic banking in pakistan.

Since 1 st nov 2010 this bank is working on global level. These are reproduced below.

:max_bytes(150000):strip_icc()/PROJECT-DEVELOPER-9bddde300c994be3871dd9790d15f7bb.jpg)