What Is Income Tax

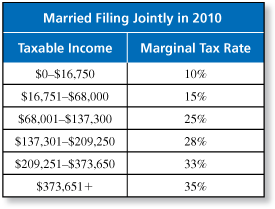

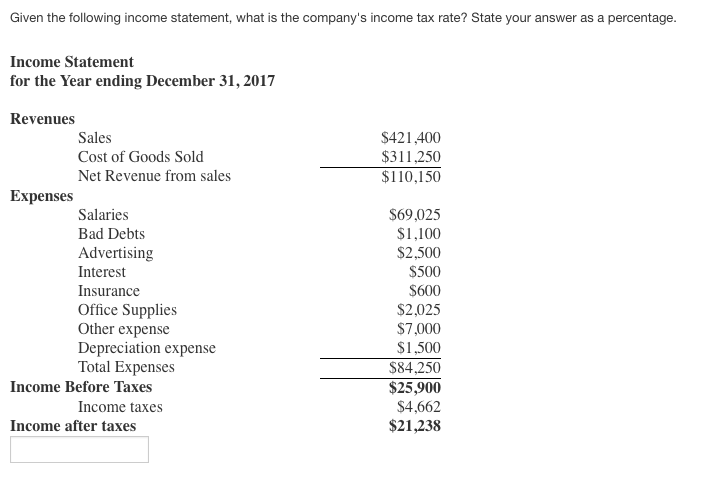

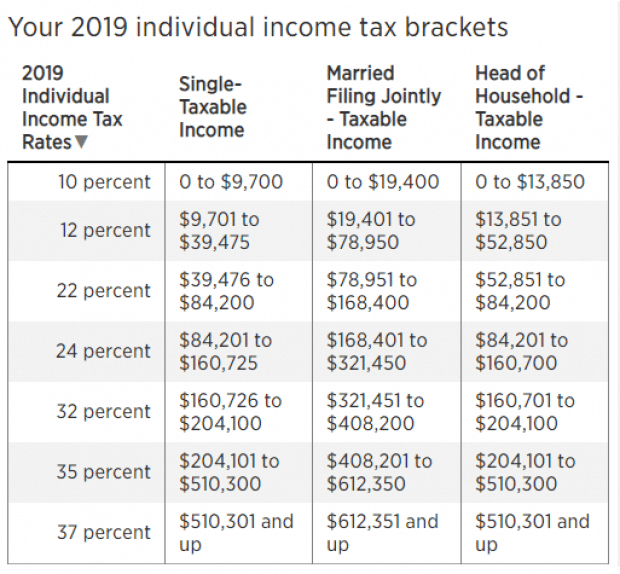

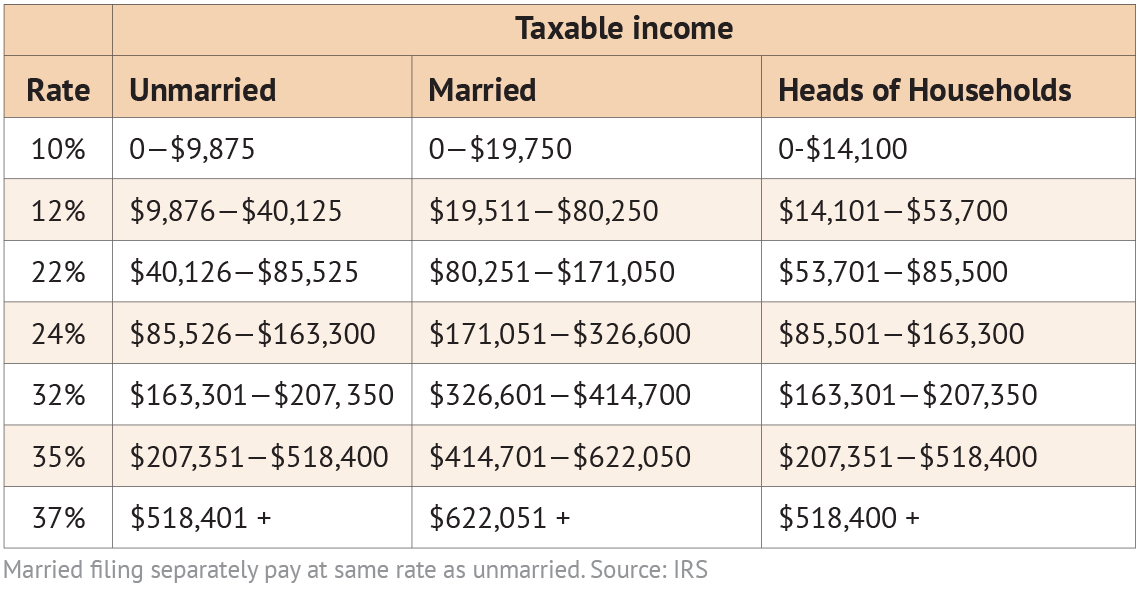

Income tax generally is computed as the product of a tax rate times taxable income.

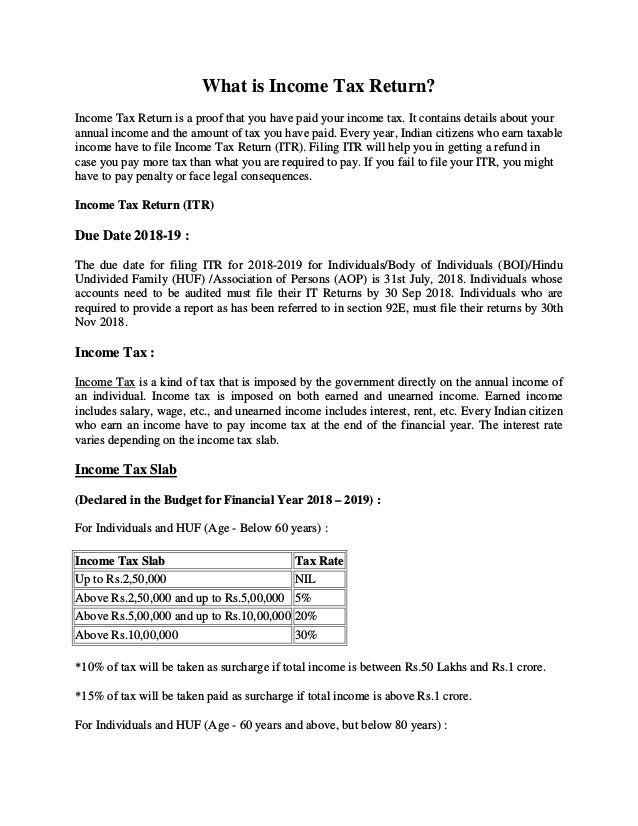

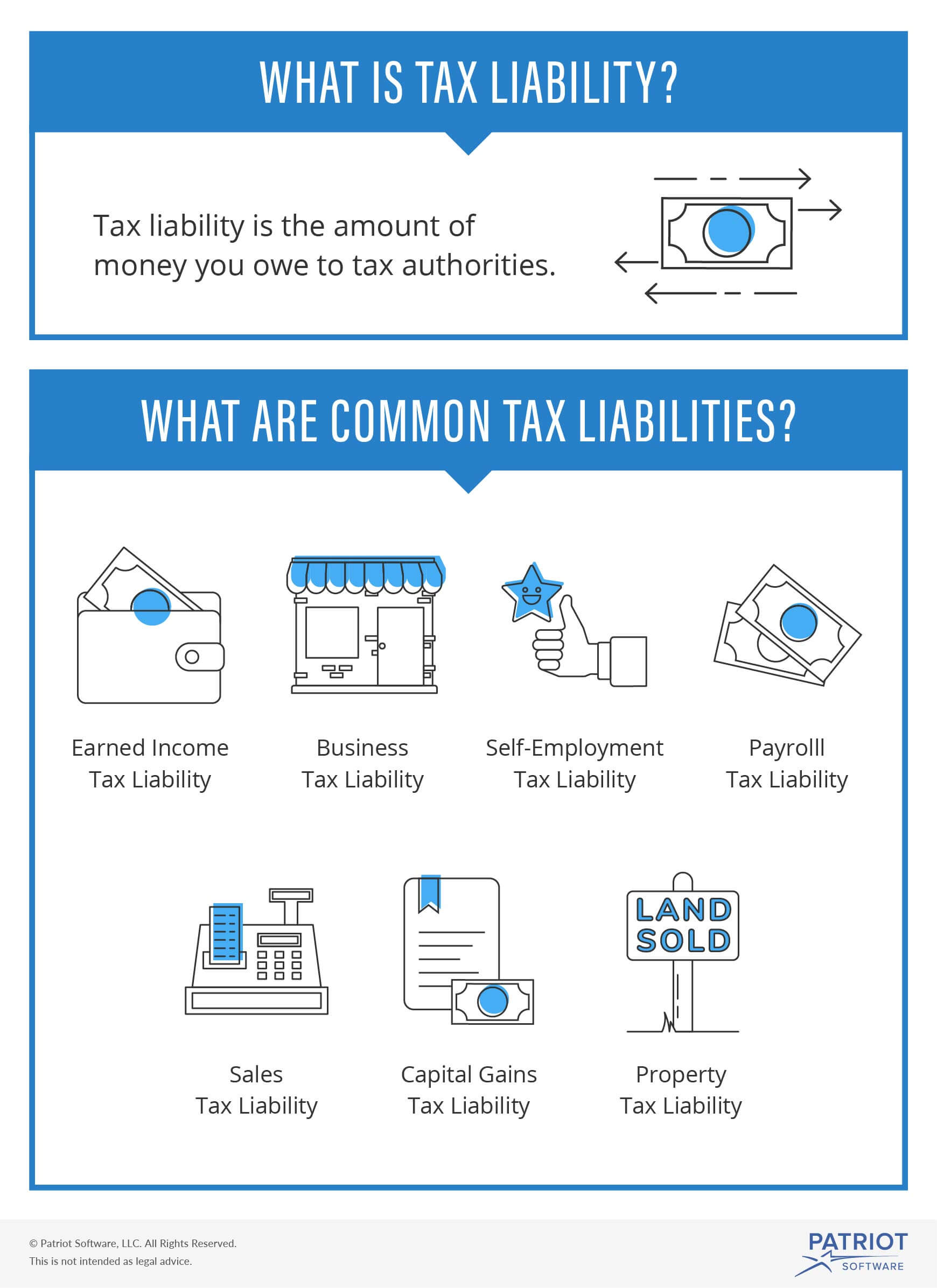

What is income tax. In 2017 for example individuals are expected to have paid about 1 66 trillion in income taxes amounting to 48 percent of federal revenue. An income tax is a tax imposed on individuals or entities taxpayers that varies with respective income or profits taxable income. A tax is imposed on net taxable income in the united states by the federal most state and some local governments. Income tax is imposed on individuals corporations estates and trusts.

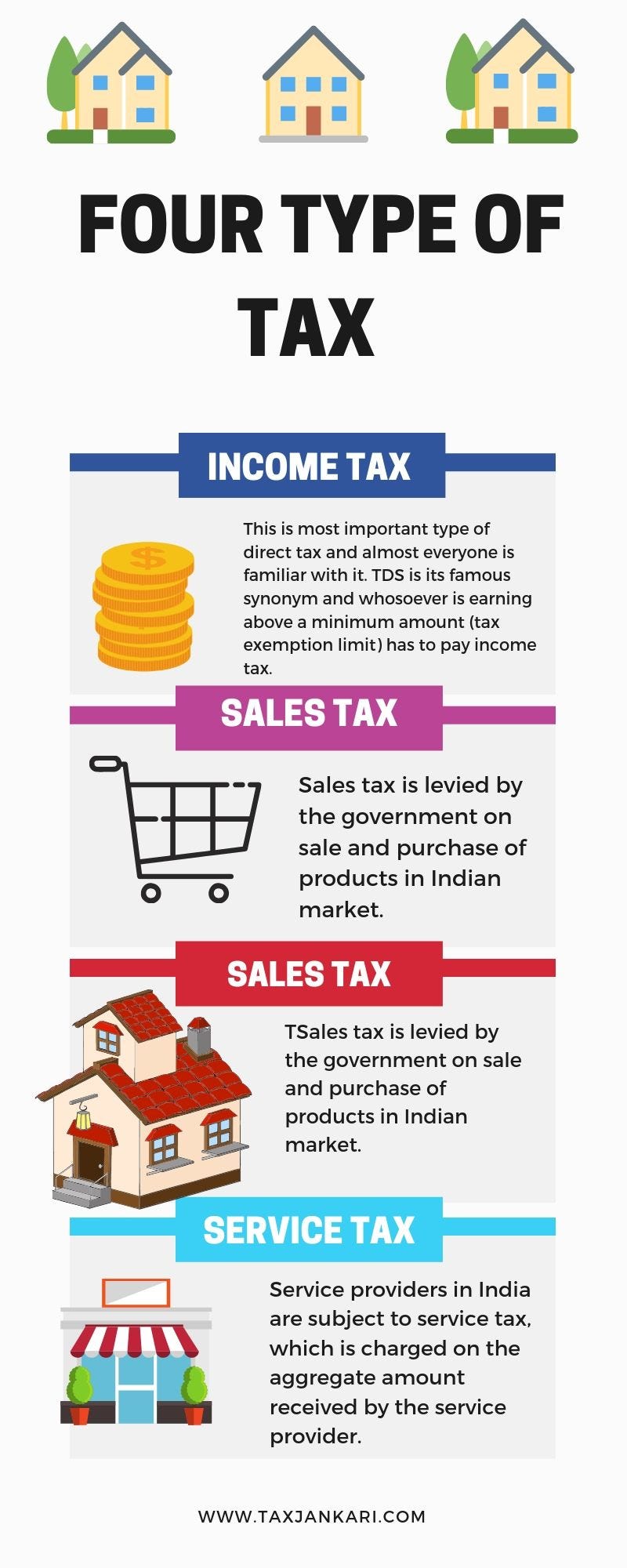

Taxation rates may vary by type or characteristics of the taxpayer. The definition of net taxable income for most sub federal jurisdictions mostly follows the federal definition. To put it simply income tax is the tax on your earnings. Purpose of income taxes according to the congressional budget office individual income taxes are the federal government s top source of revenue.

Definition of income tax. Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction. Income tax is a tax levied directly on personal income.

/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)

/w2-9ca13523f4d74e958b821aab63af2e60.png)