What Is Ea Form Income Tax Malaysia

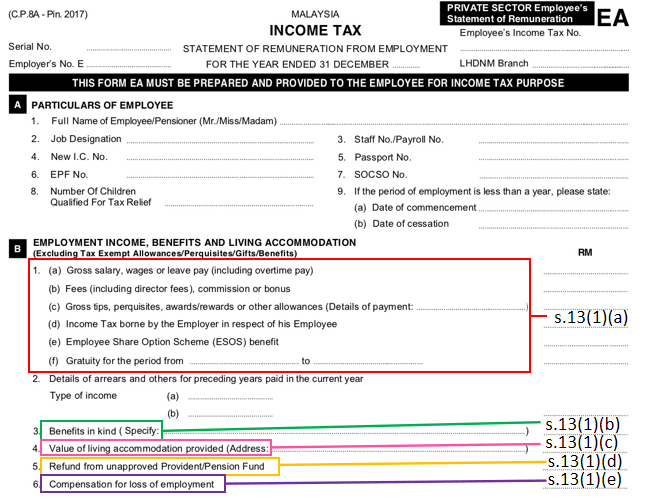

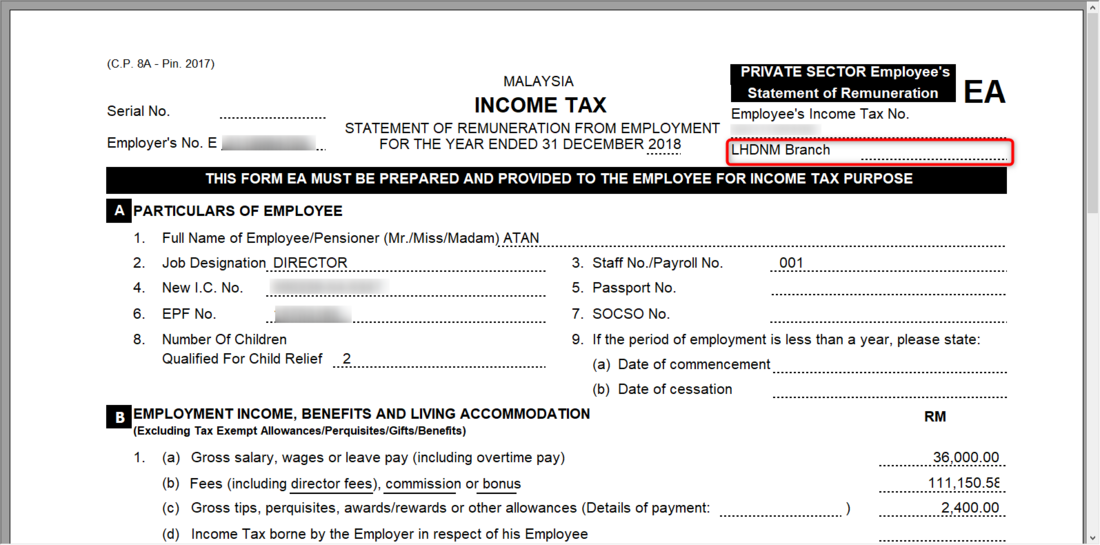

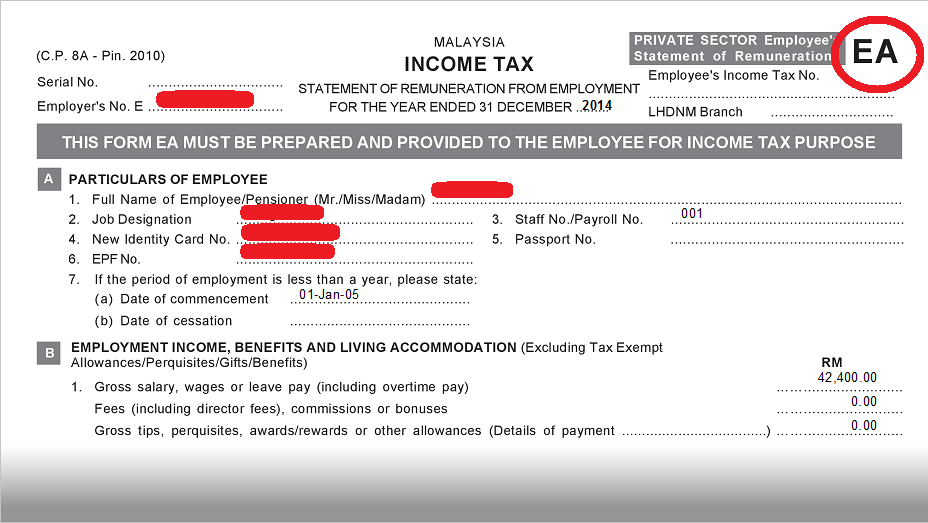

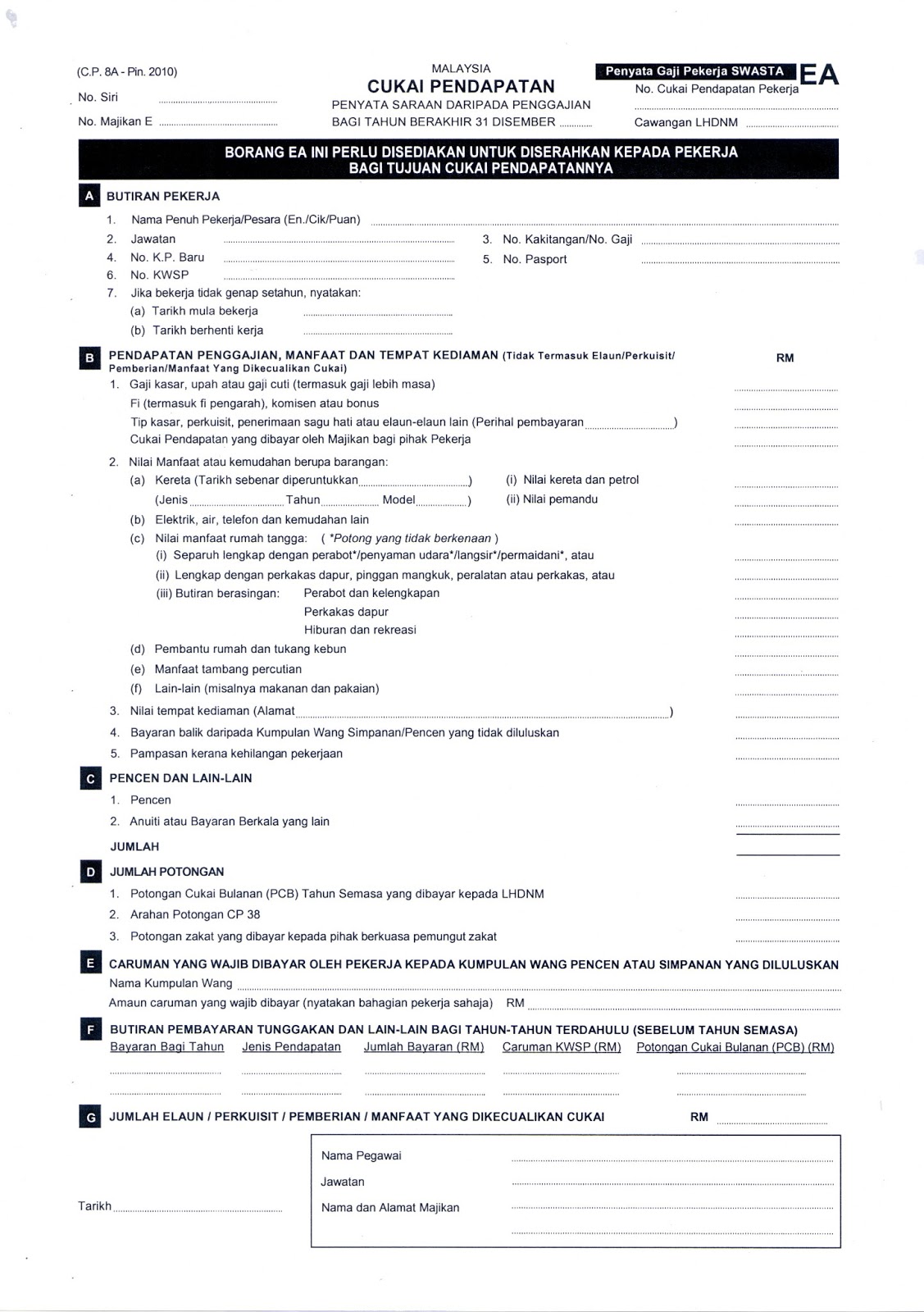

Ea remuneration statement for private employees.

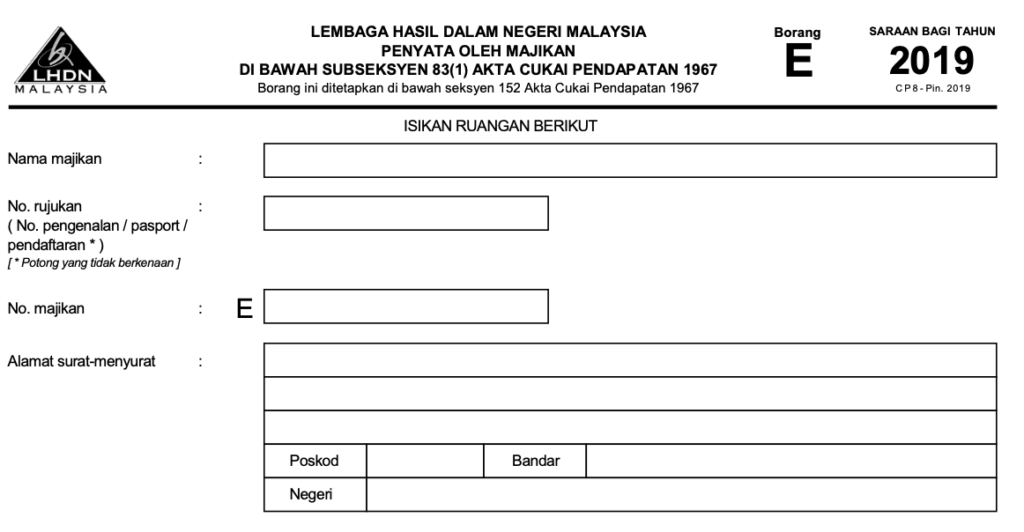

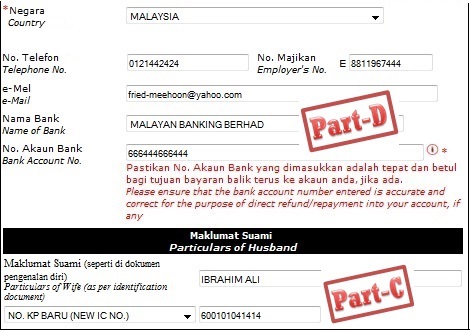

What is ea form income tax malaysia. Example scenario your annual taxable income is rm48 000. Don t be confused by the multiple things you see. In accordance with subsection 83 1a of the income tax act 1967 ita 1967 the form c p 8a c p 8c must be prepared and rendered to the employees on or before end of february the following year to enable them to complete and submit their respective return form within the stipulated period. The following information are required to fill up the borang e.

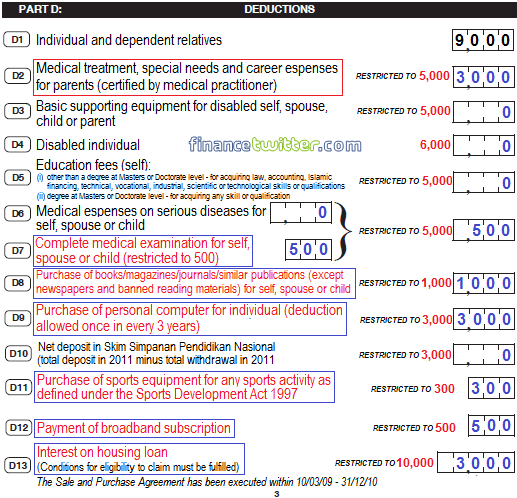

Here are the income tax rates for personal income tax in malaysia for ya 2019 i e. As hr my already supports malaysian payroll calculation which automatically calculates monthly pcb epf socso and eis deductions for employees therefore you may. Yearly remuneration statement ea ec form refer to section 83 1a income tax act 1967 with effect from year of assessment 2009 every employer shall for each year prepare and render to his employee statement of remuneration of that employee on or before the last day of february in the year immediately following the first mentioned year. The form will automatically calculate your aggregate income for you.

Every individual in malaysia including resident or non resident who is liable to tax is required to declare his income to inland revenue board of malaysia irbm or lembaga hasil dalam negeri malaysia ldhn. All you need to care about to begin filing your tax is clicking on e form which is under e filing. Once you click on e form you ll see a list of income tax forms. Ea form borang c p 8a.

This is where your ea form comes into play as it states your annual income earned from your employer. You will usually use this form to file personal taxes during tax season. Taxpayer is responsible to submit income tax return form itrf and make income tax payment yearly prior to due date. Claim for double deduction on research and development expenditure under section 34a of the income tax act 1967.

For individuals with no business income make sure to choose income tax form be e be and choose the assessment year 2016. This is where your ea form comes into play as it states your annual income earned from your employer. Statement of remuneration from employment private sector. Form e borang e is required to be submitted by every employer company enterprise partnership to lhdn inland revenue board irb every year not later than 31 march.

According to the inland revenue board of malaysia an ea form is a yearly remuneration statement that includes your salary for the past year. However there are two reasons why you shouldn t accept the annual income stated on your ea form as the final figure for your statutory income from employment. Year of assessment 2019. Lembaga hasil dalam negeri malaysia.

Claim for special deductions double deductions under section 34b of the income tax act 1967.