What Is Disposal Of Asset Under The Real Property Gains Tax Act 1976

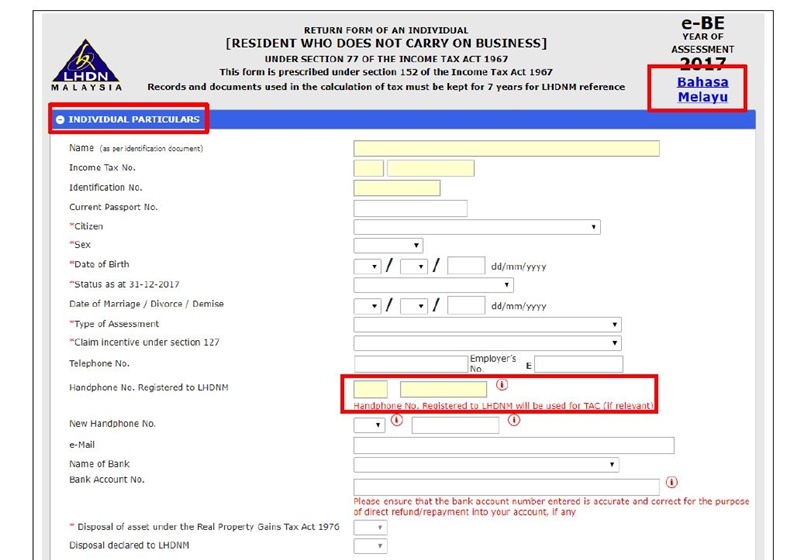

Real property gains tax act rpgt 1976 is tax charged by the lhdn on gains derived from the disposal of property.

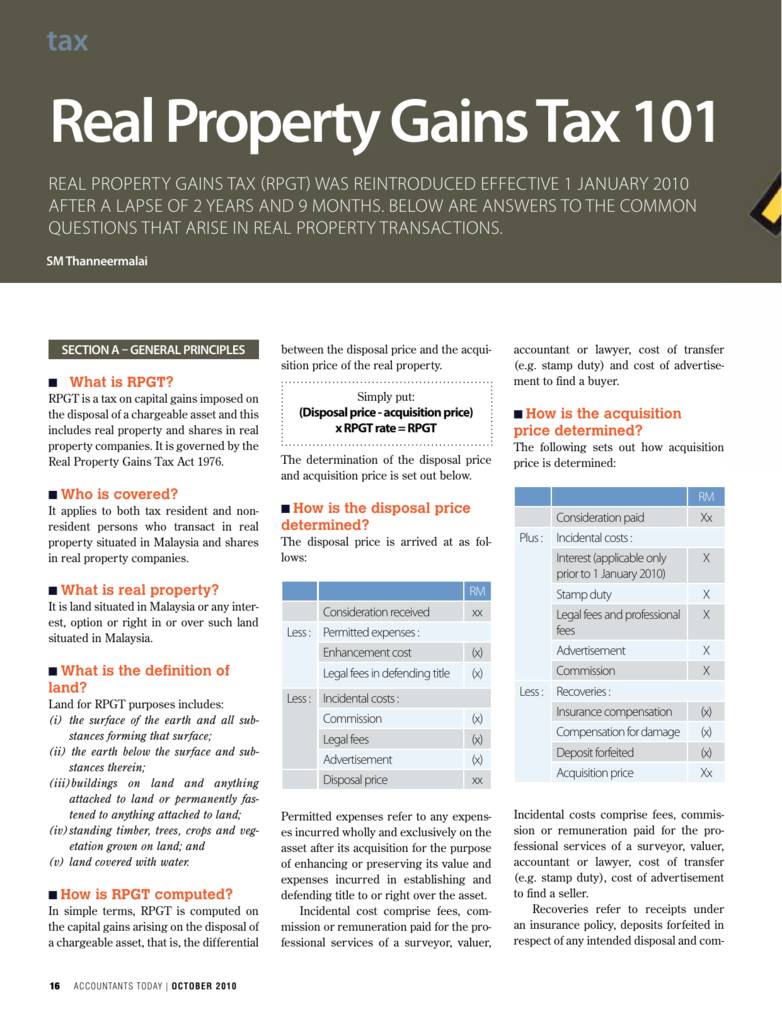

What is disposal of asset under the real property gains tax act 1976. In 1976 the real property gains tax rpgt act was introduced to contain speculative activities in the real property market which had led to spiraling prices. Disposal is generally triggered upon transfer of ownership from one person to another whether by way of sale conveyance assignment settlement alienation etc. The disposer and the acquirer are exempted from completing and submitting the relevant disposal and acquisition forms if the disposal of the assets subject to the income tax act 1967. Real property means any land situated in malaysia and any interest.

Although capital gains are generally not taxed in malaysia one exception to this is the gains arising from the disposal of either real property or shares in a real property company rpc. The disposal is a disposal of a chargeable asset under paragraph 34a. In addition the rpgt act has been further amended by the finance act to provide that the market value of the property as at 1 january 2000 will be used as the acquisition price in calculating the real property gains tax for the disposal of chargeable assets that were acquired before the year 2000. Under the real property gains tax act 1976 rpgt act an rpc is a controlled company which the defined value of its real property or shares in another rpc or both is at least 75 of the value of its tangible assets.

Unannotated statutes of malaysia principal acts real property gains tax act 1976 act 169 real property gains tax act 1976 act 169 37 additional provisions as to offences under section 30 32 33 or 36. Transfer of assets to controlled companies. What most people don t know is that rpgt is also applicable in the procurement and disposal of shares in companies where 75 of their tangible assets are in properties a k a. A controlled company is essentially a company owned by not more than 50 members and controlled by not more than 5 persons.

The act featured progressively stepped tax rates corresponding to the holding period. 1 rates a there have been no changes to the rpgt rates under the budget 2015 announcement. Real property gains tax act 1976 laws of malaysia reprint act 169 real property gains tax act 1976 incorporating all amendments up to 1 january 2006 published by. Real property gains tax act 1976 an act to provide for the imposition assessment and collection of a tax on gains derived from the disposal of real property and matters incidental thereto.

Real property companies rpc. The longer the property was held before disposal the lower the tax rate. A chargeable gain is a profit when the disposal price is more than the purchase price of the property. The rpgt is applicable for individual and companies.

.jpg)