What Is Base Lending Rate

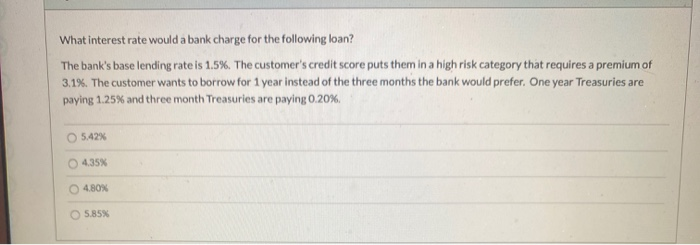

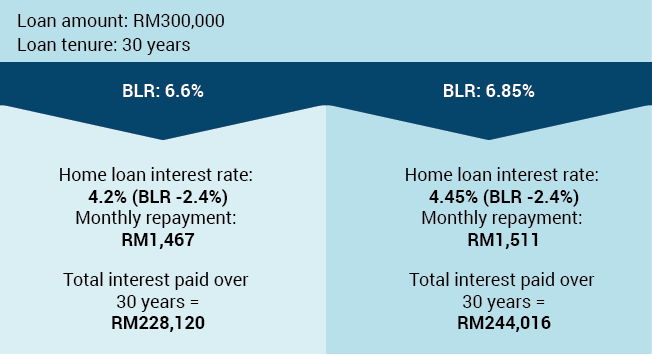

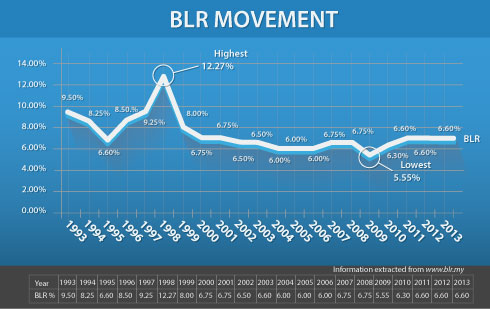

Prior to 2015 that interest rate was referred to as the base lending rate blr.

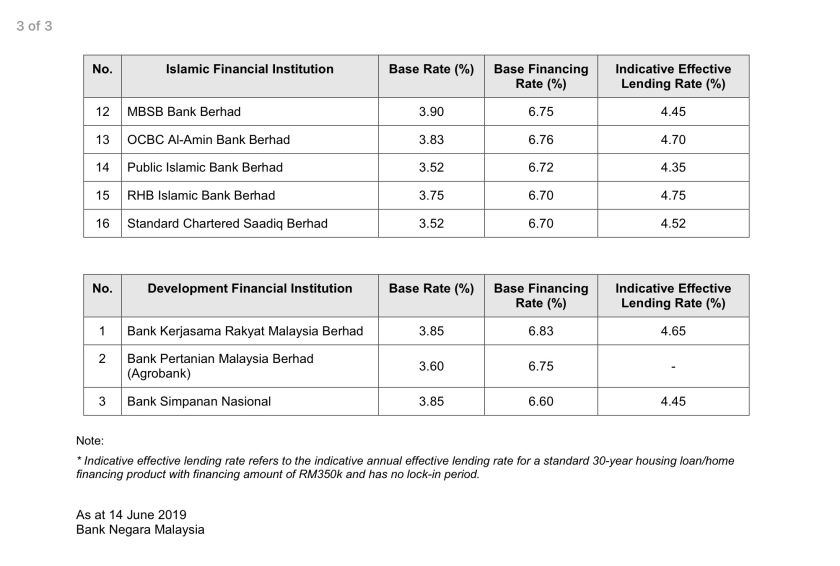

What is base lending rate. Under br which will now serve as the main reference rate for new retail floating rate loans banks in malaysia can determine their interest rate based on a formula set by bank negara the malaysian central bank. Indicative effective lending rate refers to the indicative annual effective lending rate for a standard 30 year housing loan home financing product with financing amount of rm350k and has no lock in period. Beɪs ˈlɛndɪŋ reɪt noun. The base rate br is an interest rate that the bank refers to before it decides on the interest rate to apply to your home loan.

Interest rate for your home loan. Loan pricing will be done by adding base rate and a suitable spread depending on the credit risk premium. Base rates blr and indicative effective lending rates of financial institutions as at 6 august 2020 release date. The base lending rate was set by bnm and is based on how much it costs to lend money to other financial institutions.

Guide to consumer on reference rate bahasa melayu base rates blr and indicative effective lending rates of financial institutions as at 6 august 2020. Under the previous blr the rate was set by bank negara malaysia bnm based on how much it costs to lend money to other financial institutions. A minimum interest rate on which financial institutions base the rates they use for lending. Base lending rate in british english.

Base rate is decided in order to enhance transparency in the credit market and ensure that banks pass on the lower cost of fund to their customers. The base rate is currently 0 1. Effective january 2 2015 the base lending rate blr structure was replaced with a new base rate br system. Under br which now serves as the main reference rate for new retail floating rate loans banks in malaysia can determine their interest rate based on a formula set by the central bank.

In january 2015 the base lending rate blr structure was replaced with a new base rate br system. What you pay for borrowing money and what banks pay you for saving money with them its purpose is to help regulate. Press release on new reference. The bank of england explains the interest as.

Copyright harpercollins publishers. The rate was set by bank negara malaysia bnm based on the overall financial health of all financial institutions in malaysia.

/calculate-Interestrate_393165-76ce02cdd3b0498280004aa12a7596f8.png)