Types Of Unit Trust

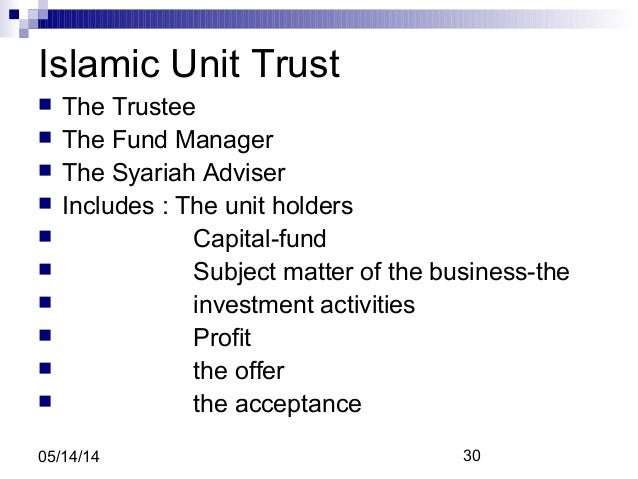

Fund managers run the unit trust and trustees are often assigned to ensure that the fund is run according to its goals and.

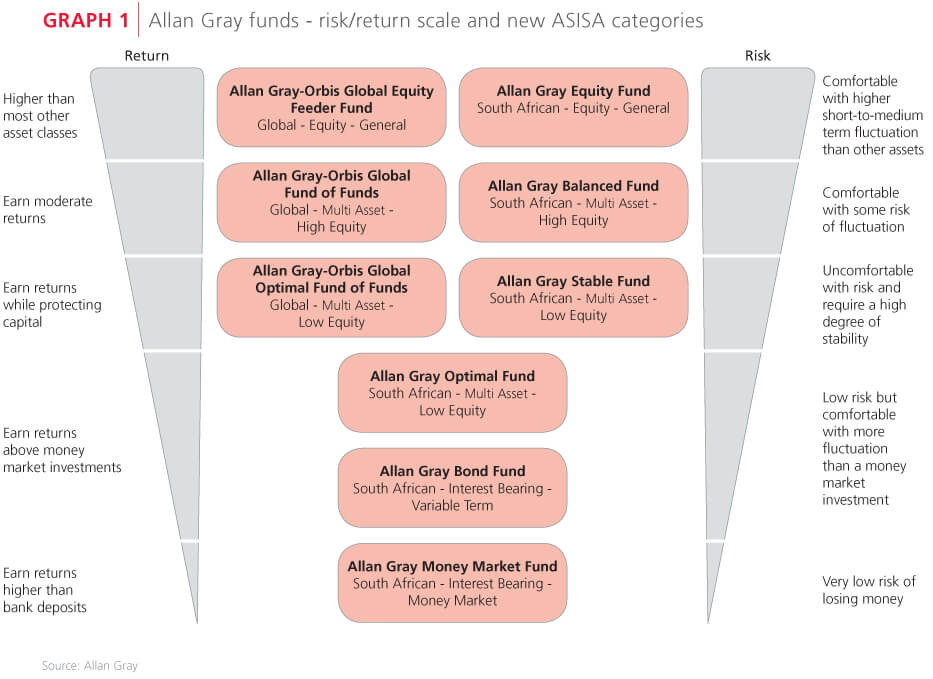

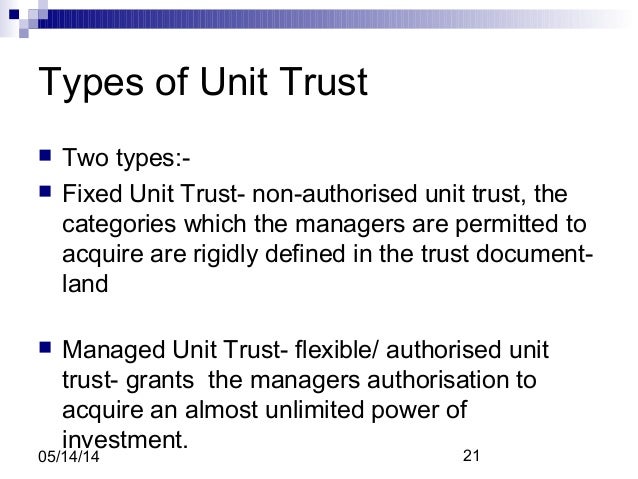

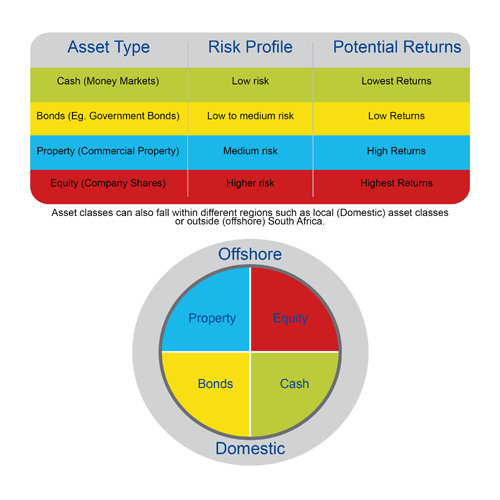

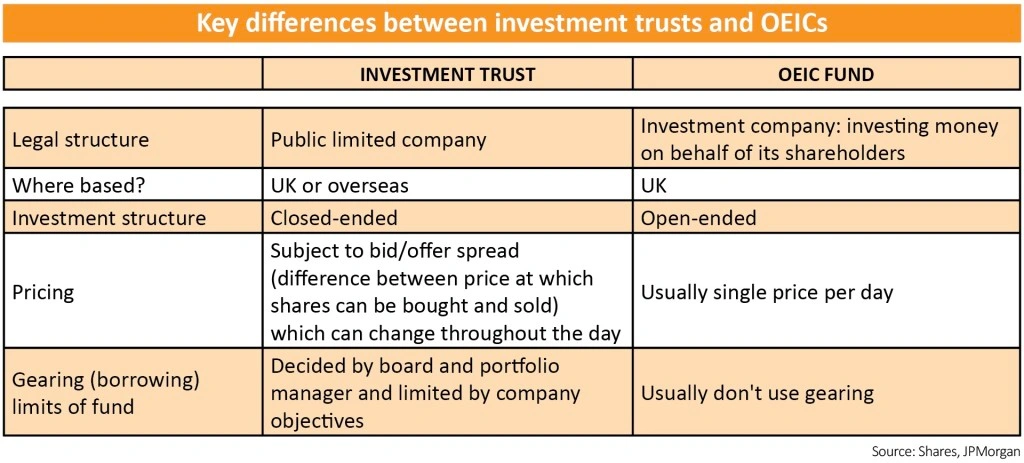

Types of unit trust. There are a number of collective investment schemes unit trust open ended investment company mutual fund unit investment trust closed end fund with similar objectives and or names sometimes confused with each other. Marital trusts a trust 2. Other notable specialist unit trusts include property unit trusts that only invest in property related companies. Global funds that are domiciled in south africa meaning the administration of the fund is in sa and investments in the unit trust are made in zar buy assets on foreign stock exchanges like the london stock exchange and new york stock exchange.

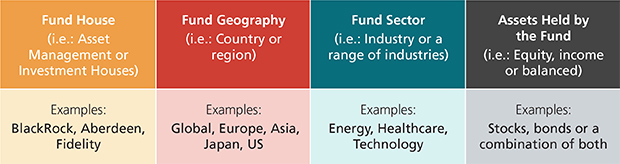

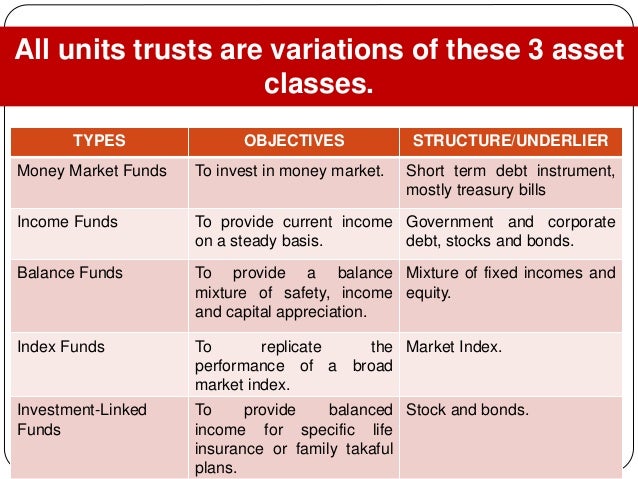

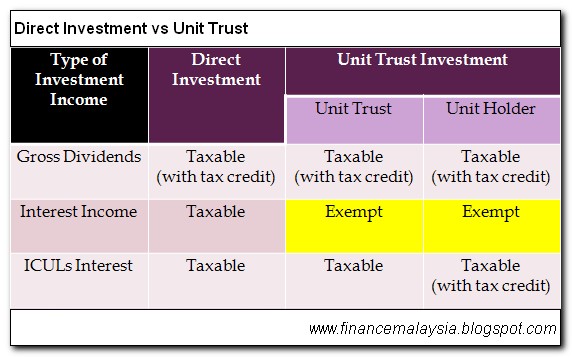

The investor is the trust s beneficiary. Special types of trusts 1. A fund house s fund name would reflect these. So it s best you understand the common types of unit trust funds available and how they complement your financial goals to know which to put your money in.

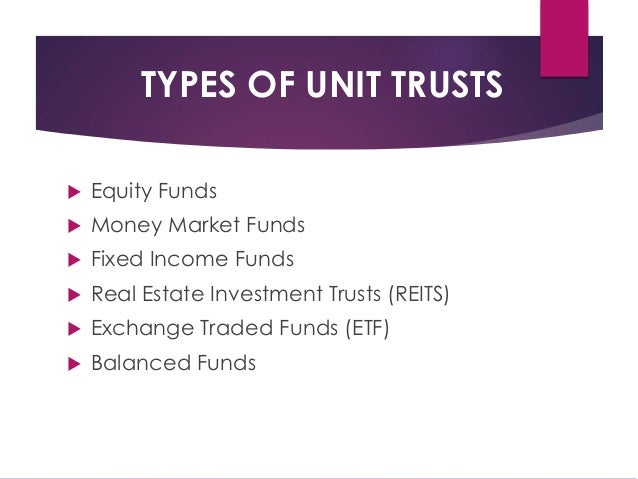

The five main types of trusts are living. Life insurance trust 6. There are also different types of unit trust funds you can invest in. A ric is a corporation in which the investors are joint owners and a grantor trust grants investors proportional.

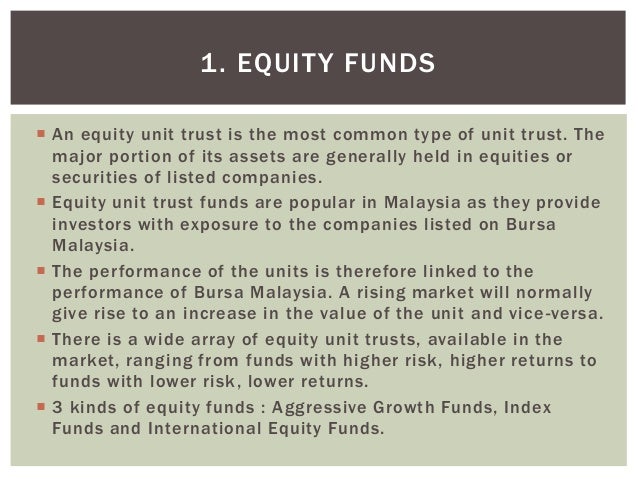

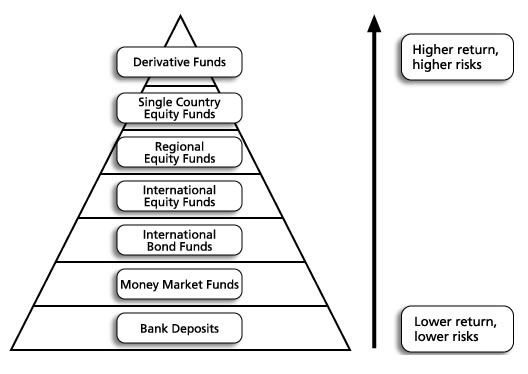

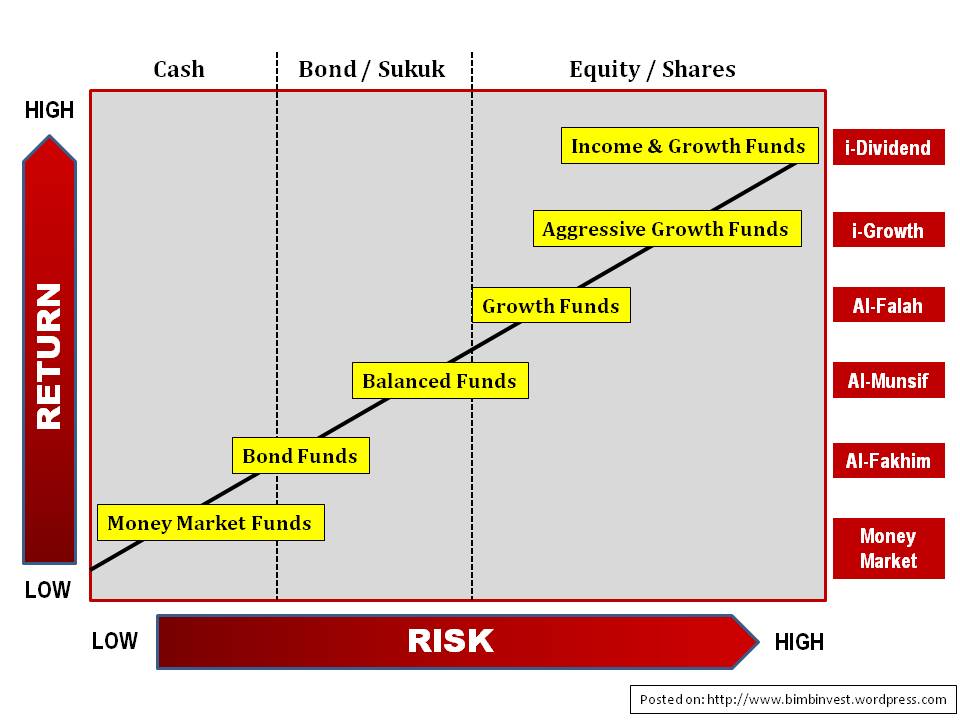

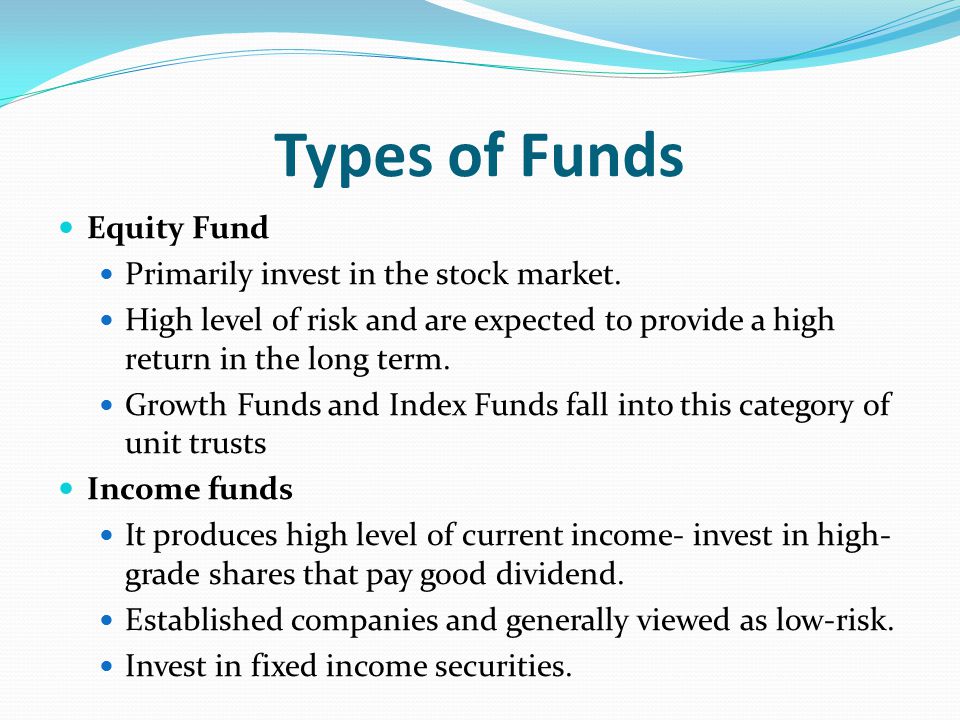

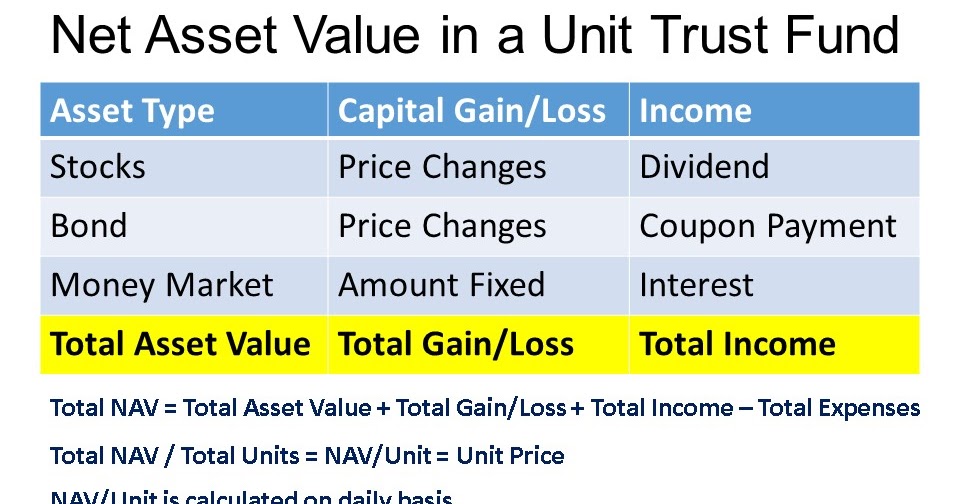

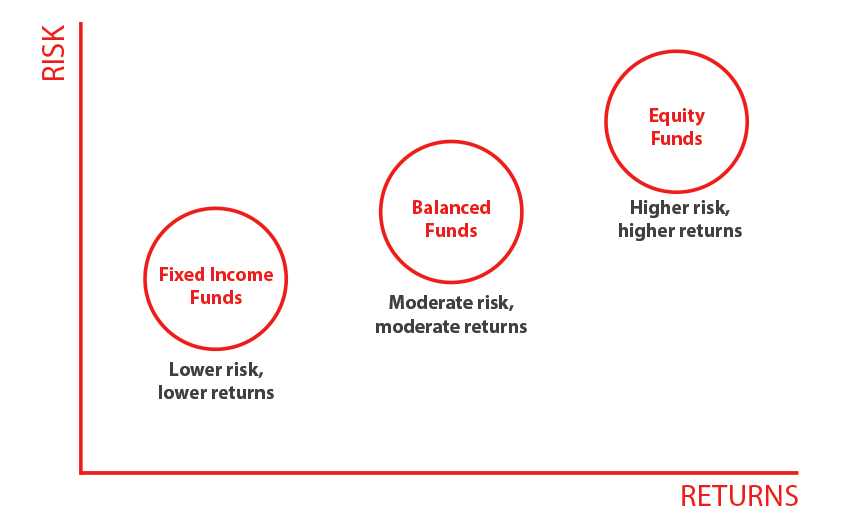

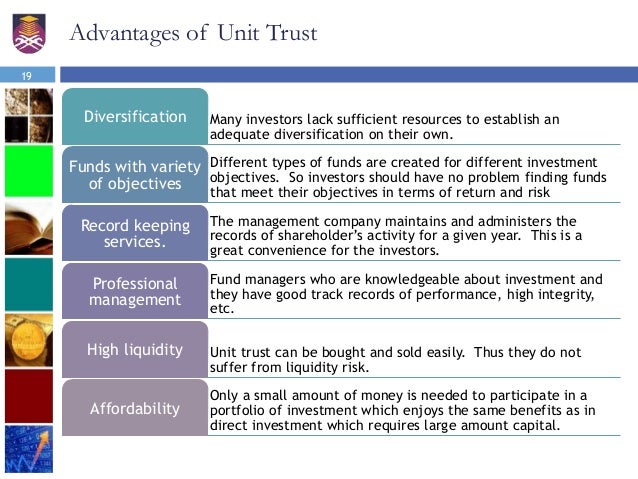

Unit trusts are typically classified by geography sector and type of assets held. Not all unit trusts are created equal each fund is complemented with different assets. Special needs trust 7. Equity funds these are the most.

Bypass trusts b or credit shelter trusts 3. While the basic structure of a trust remains pretty much the same there are several different types of trusts with different purposes and specifics. Unit trusts are unincorporated mutual funds that pass profits directly to investors rather than reinvesting in the fund. While there are a number of different types of trusts the basic types are revocable and irrevocable.

Balanced funds a balanced unit trust fund has a portfolio comprising of a mix of equities fixed income securities. The trustee is the one who holds title to the trust property and the beneficiary is the person who receives the benefits of the trust.