Type Of Unit Trust

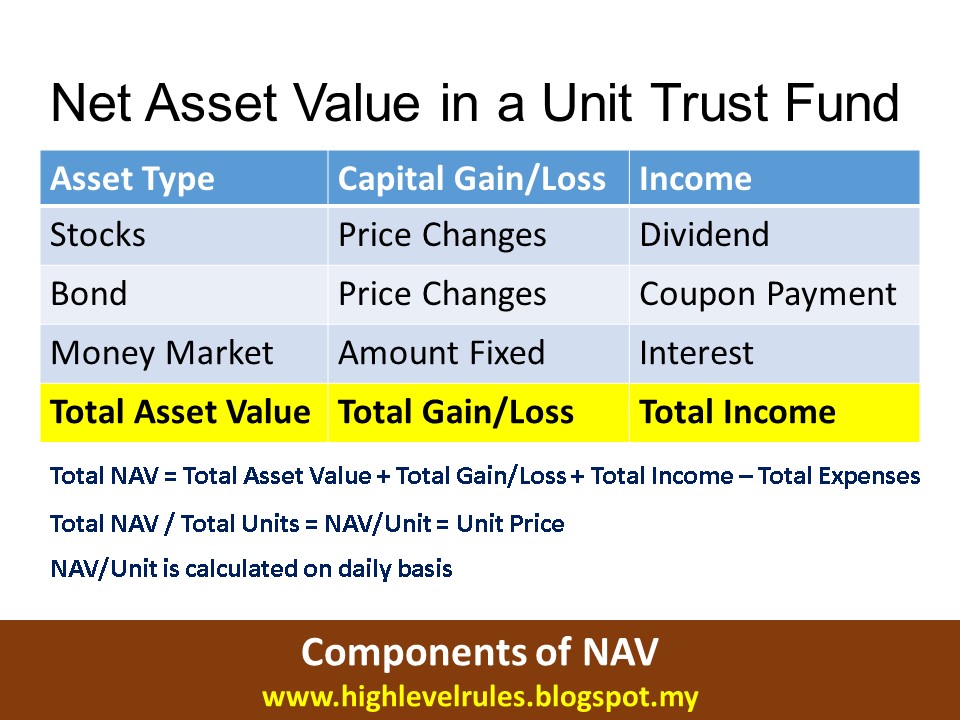

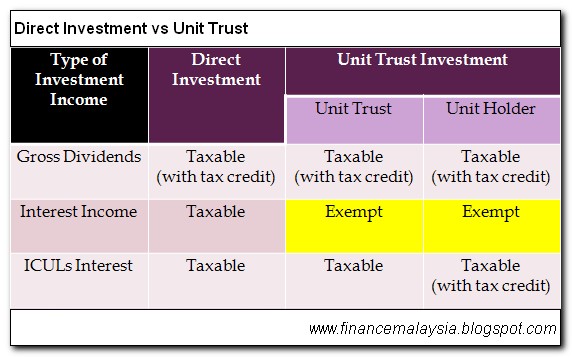

Tax income earned in the form of interest and dividends.

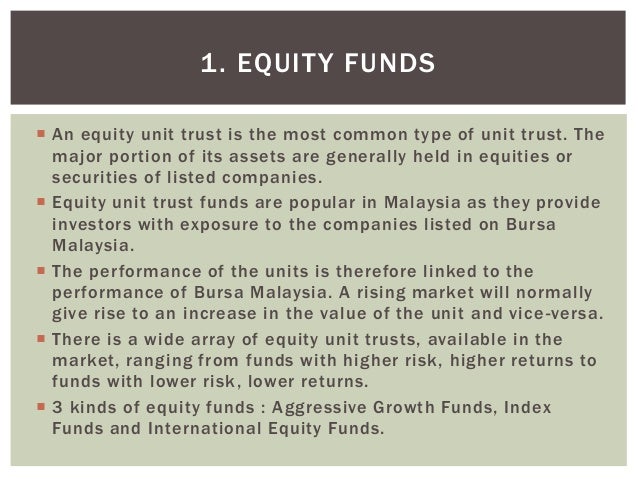

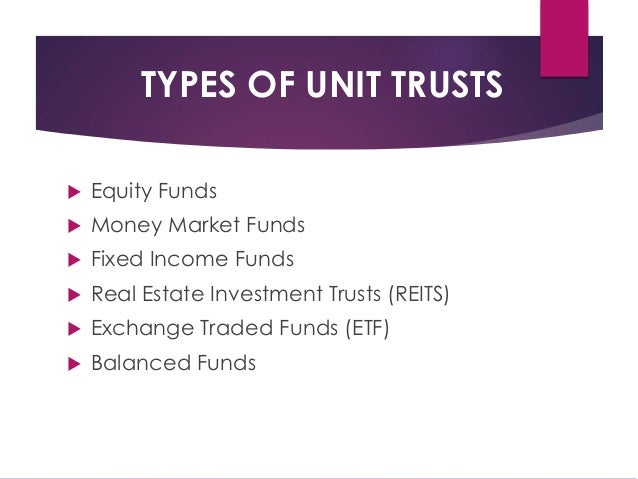

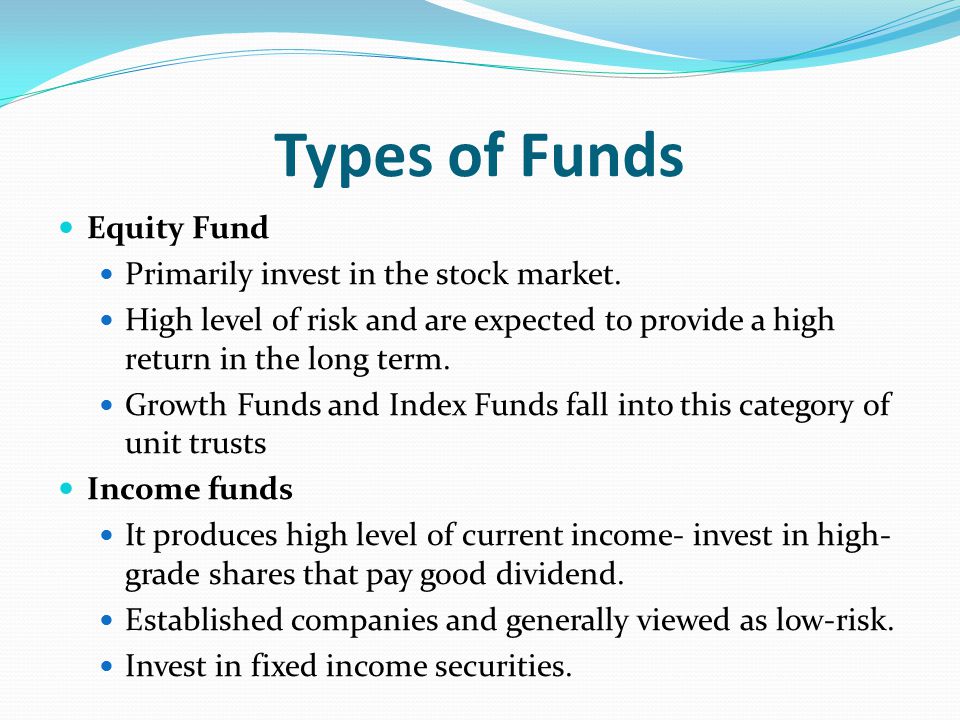

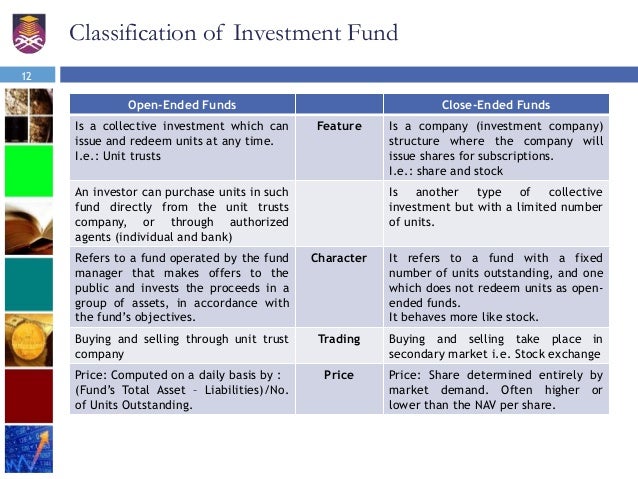

Type of unit trust. Balanced funds a balanced unit trust fund has a portfolio comprising of a mix of equities fixed income securities. Investing in income units means you receive a pay out up to several times a year. Equity funds these are the most. Common types of investments undertaken by unit trusts are properties securities mortgages and cash equivalents.

A unit trust pools investors money into a single fund which is managed by a fund manager. Unit trusts are subject to two types of taxes. It states how much interest was earned during the tax year. Special needs trust 7.

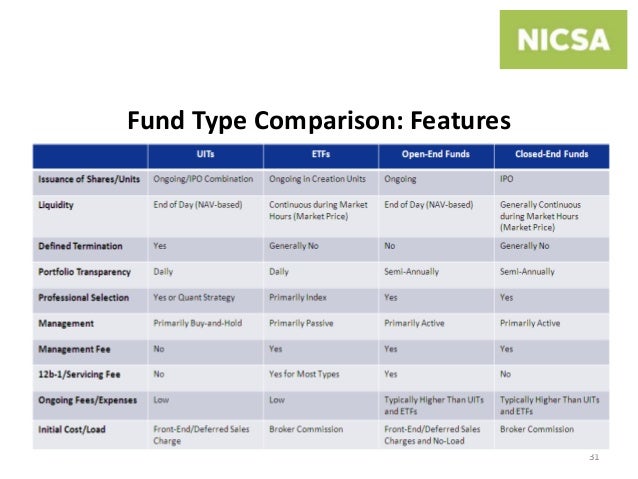

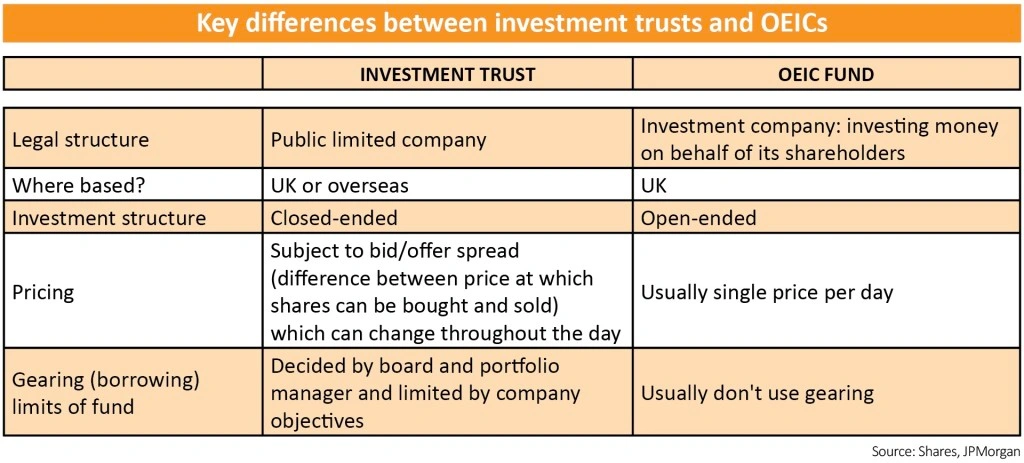

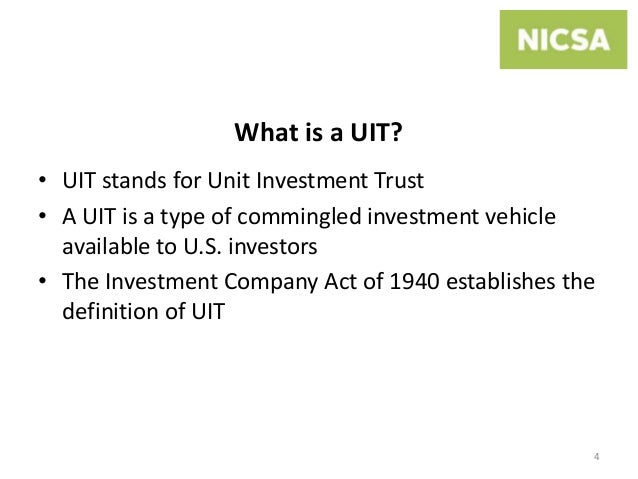

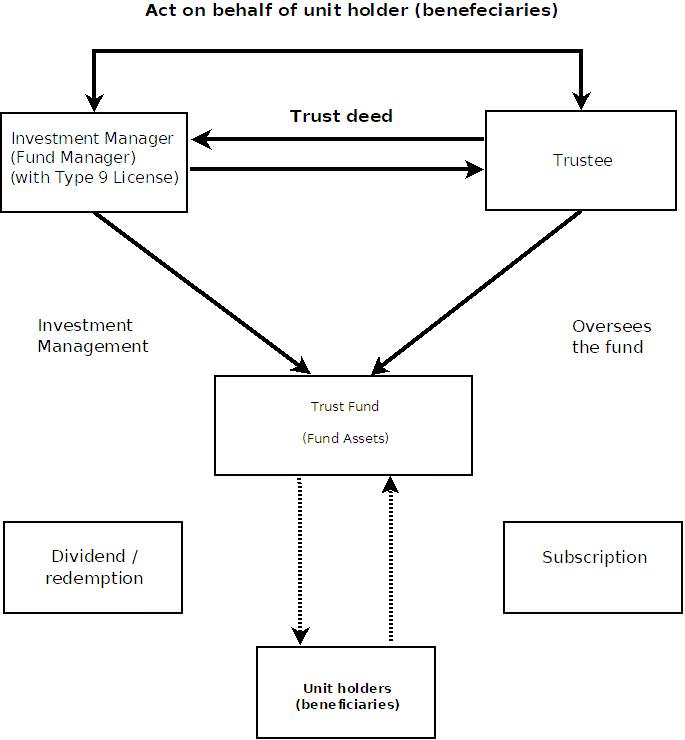

A unit investment trust uit is an investment company that offers a fixed portfolio generally of stocks and bonds as redeemable units to investors for a specific period of time. September 2007 a unit trust is a form of collective investment constituted under a trust deed. Special types of trusts 1. The term unit trust is also used in the united kingdom u k as a mutual fund.

Marital trusts a trust 2. This depends on whether your unit trust is making money or not and the unit type you invest in such as. Bypass trusts b or credit shelter trusts 3.