Third Party Car Insurance

Car insurance is of two types.

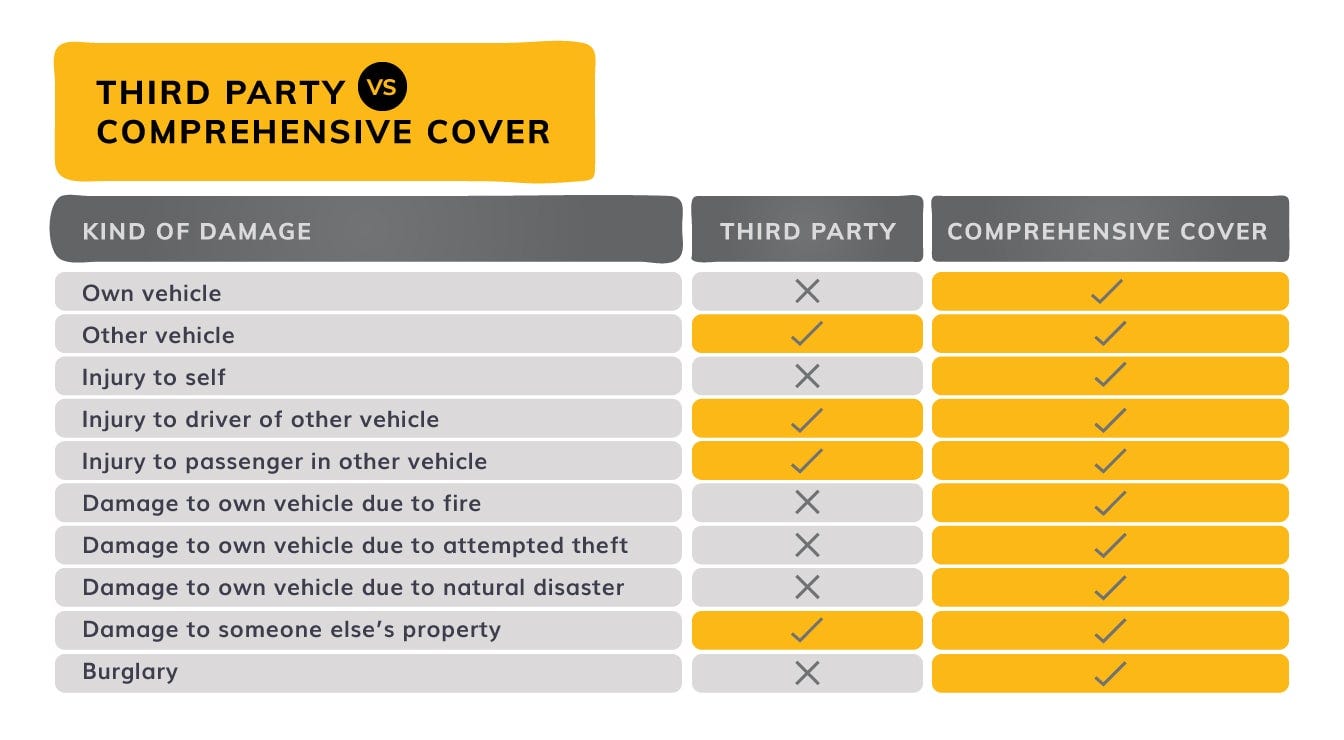

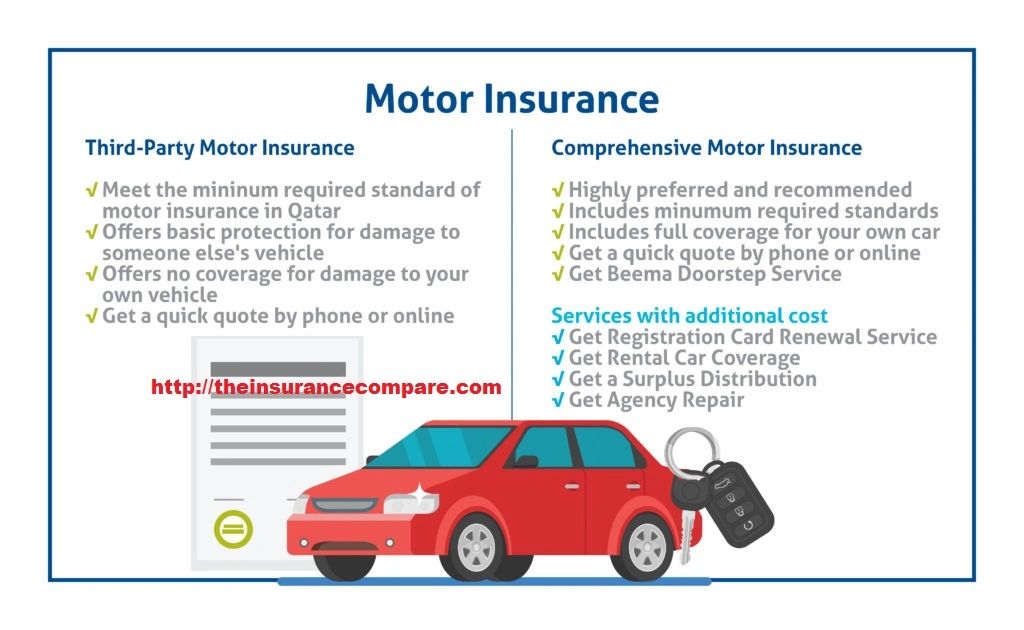

Third party car insurance. Rs 7 890 rs 100 rs. The other driver s insurance company is on their driver s side. The other driver may not have insurance or enough insurance to pay for your damages. Third party car insurance online protects you from any third party insurance claims arising out of death or bodily injury or damages to that person s property in an accident.

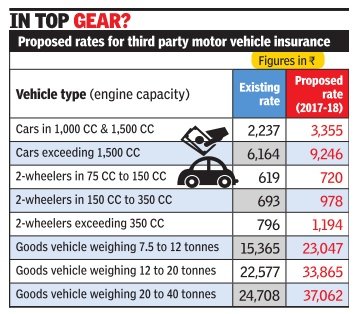

In the event you cause damage to someone else s property or injure them while driving that person will receive appropriate compensation. Third party only tpo cover meets the minimum legal requirement to drive under mauritian law. Third party insurance and comprehensive car insurance. Say you have a car whose engine capacity exceeds 1500 cc since the third party car insurance since the third party premium includes cover for personal accident liability too you would be paying the below premium.

Third party insurance is legally mandatory to ply your car on roads. Basic tp premium personal accident owner driver gst 18 total third party premium in the fy 2018 19. Potential problems with filing a third party claim. In such a scenario the third party will most likely demand compensation to treat injuries or repair damages from the car s owner.

Third party car insurance works by insuring the policyholder against liabilities arising due to injury sustained by a third party or damage to a third party s property by the insured car.