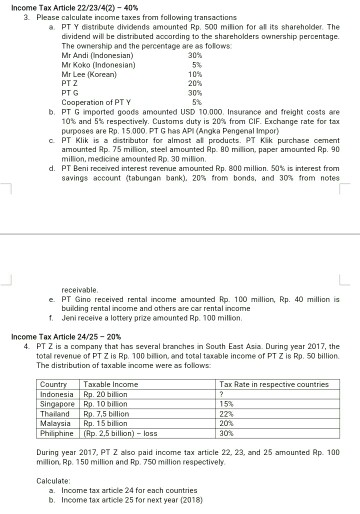

Taxable Income Malaysia 2017

2 order 2017 was gazetted to provide a special income tax exemption for companies limited liability partnerships trust bodies executors of estates and receivers under subsection 68 4 of the income tax act 1967 the act.

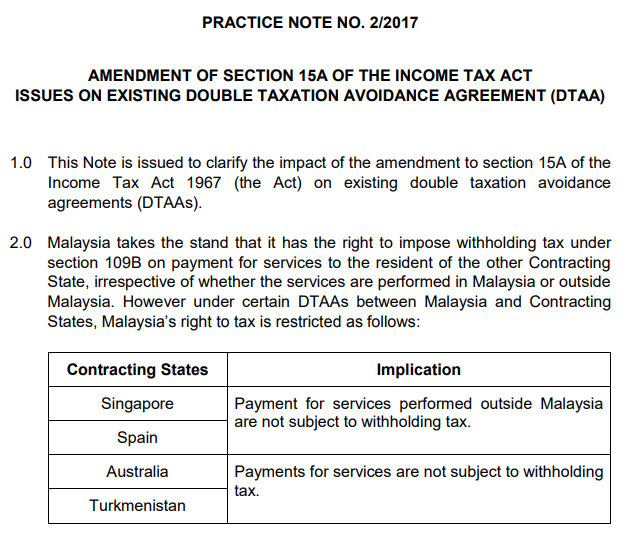

Taxable income malaysia 2017. Such qualifying persons are required to have been carrying on a business for more than two years and earned chargeable. Of course these exemptions mentioned in the example are not the only one. The standard corporate tax rate is 24 while the rate for resident small and medium sized companies i e. Technical or management service fees are only liable to tax if the services are rendered in malaysia.

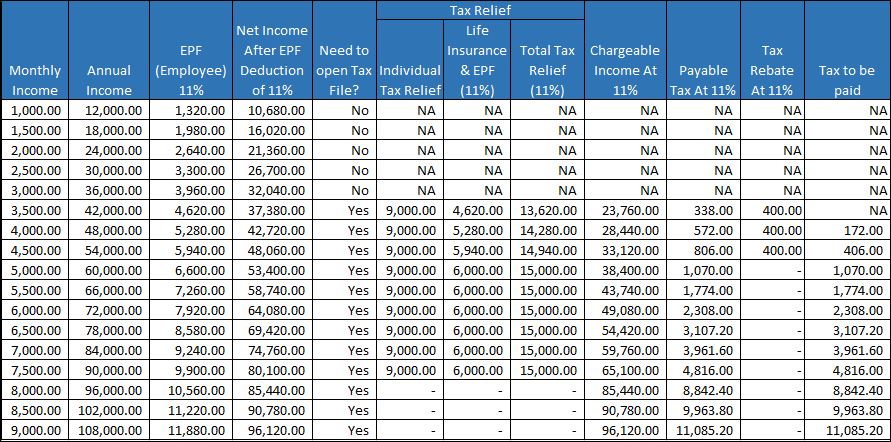

Lembaga hasil dalam negeri malaysia inland revenue board of malaysia. Income tax malaysia 2017 vs 2018 for individuals. While the 28 tax rate for non residents is a 3 increase from the previous year s 25. Which is why we ve included a full list of income tax relief 2017 malaysia here for your calculation.

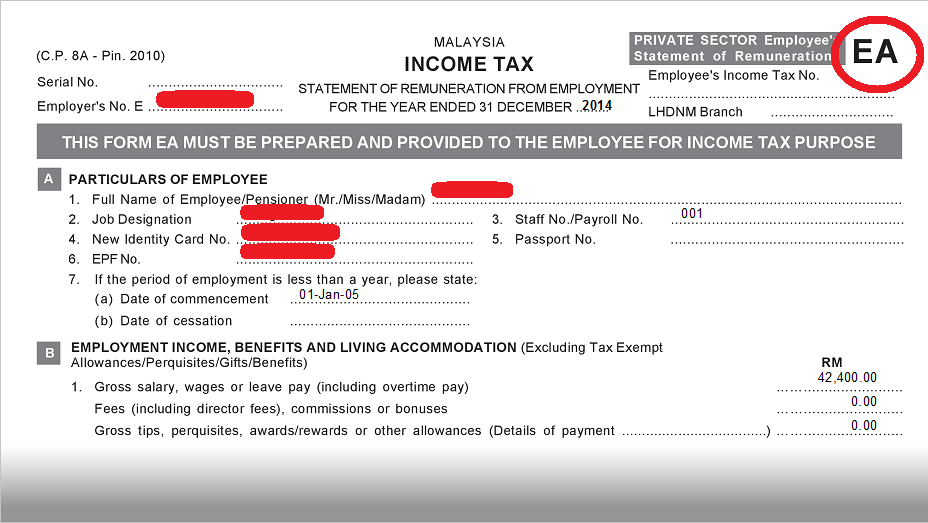

Compute the value of household furnishing and appliance for income tax purpose accruing to farid. 01 01 2014 30 06 2014 rm280 x 6 mths rm1 680 01 07 2014 31 12 2014 rm280 x 6 x rm840 total. How to maximise your income tax refund malaysia 2019 ya 2018 income tax malaysia. Quick guide to tax deductions for donations.

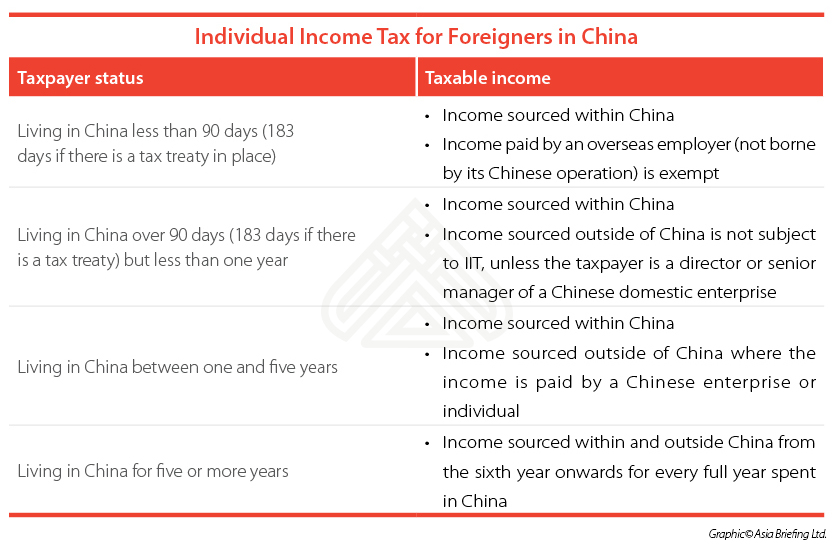

Rm 63 000 rm 1 400 rm 9 000 rm 4 400 rm 48 200. More on malaysia income tax 2019. On 10 april 2017 the income tax exemption no. Non resident individuals pay tax at a flat rate of 30 with effect from ya 2020.

Malaysia personal income tax rate. Inland revenue board of malaysia shall not be liable for any loss or damage caused by the usage of. No guide to income tax will be complete without a list of tax reliefs. But from 01 07 2017 to 31 12 2014 the house was shared with another employee.

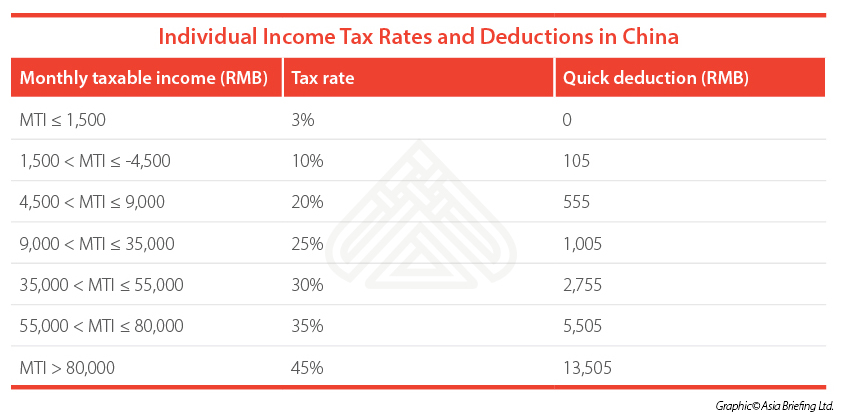

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. Calculations rm rate tax rm 0 5 000. Assessment year 2016 2017. A much lower figure than you initially though it would be.

A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. Calculations rm rate tax rm 0 5 000. On the first 5 000.

Companies incorporated in malaysia with paid up capital of myr 2 5 million or less and that are not part of a group containing a company exceeding this capitalization threshold is 18 on the first myr 500 000 with effect from year of assessment ya 2017 with the balance being taxed at the 24 rate. How to file your taxes for the first time. Green technology educational services. Home income tax rates.