Tax Rebate For Individual

R7 794 r7 713 r7 479 r7 407 r7 407 r7 110 tertiary 75 and older r2 736 r2 601 r2 574 r2 493 r2 466.

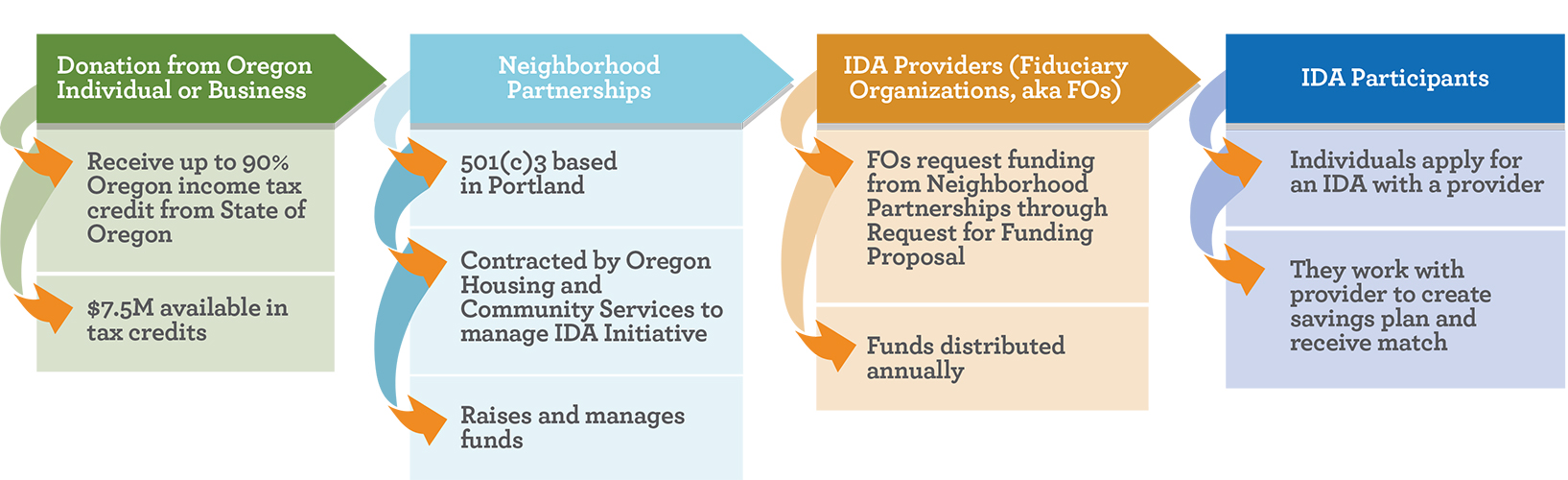

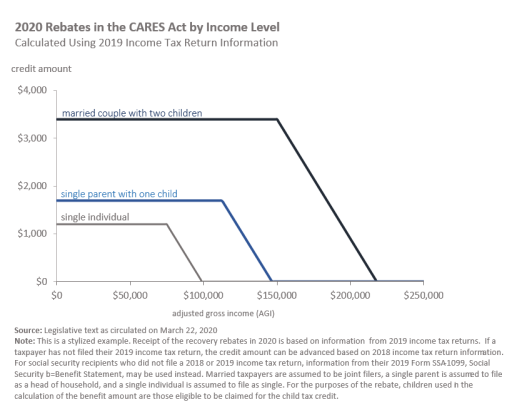

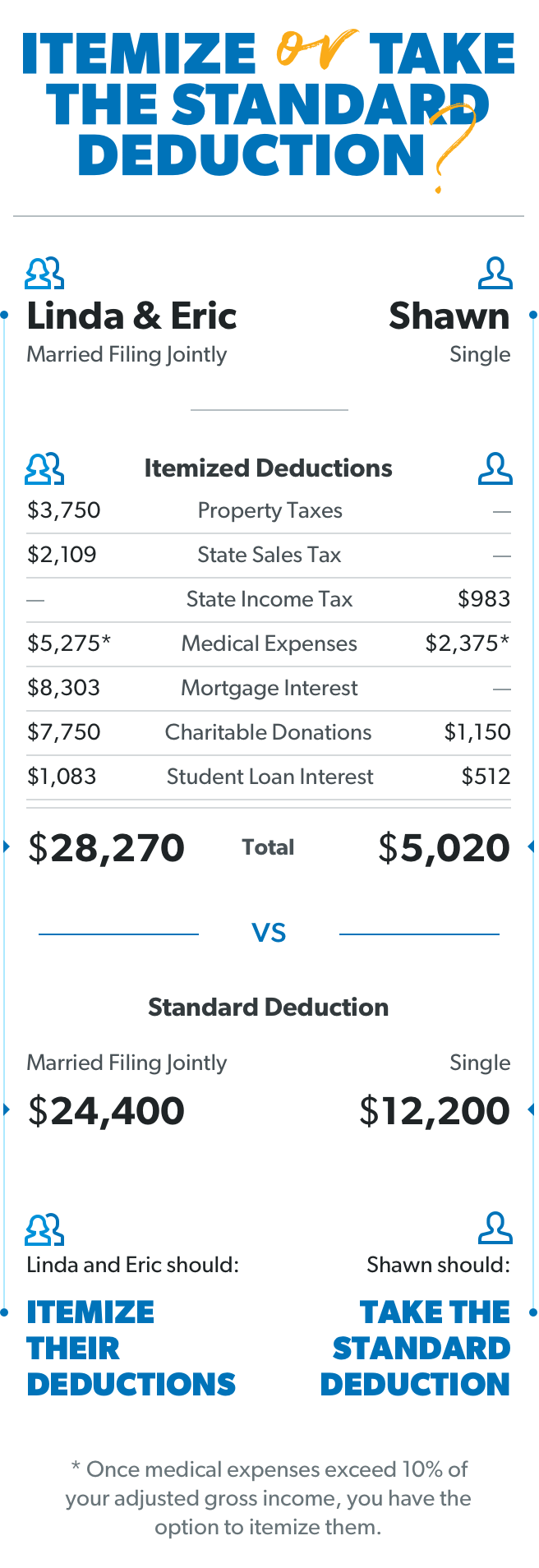

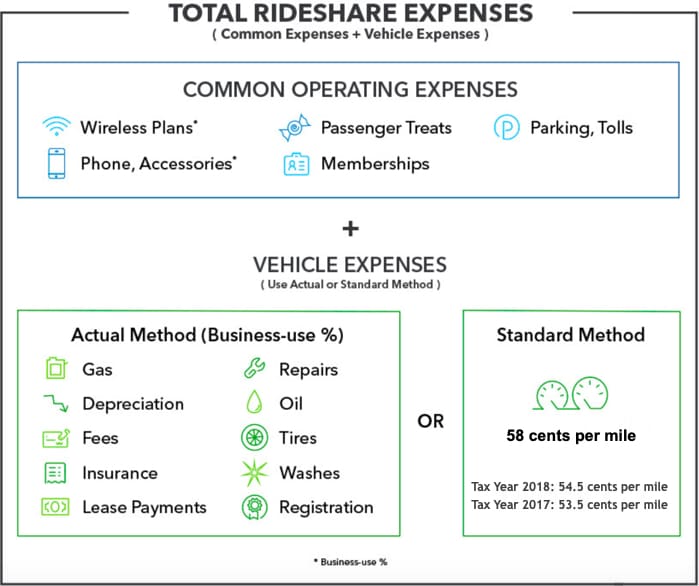

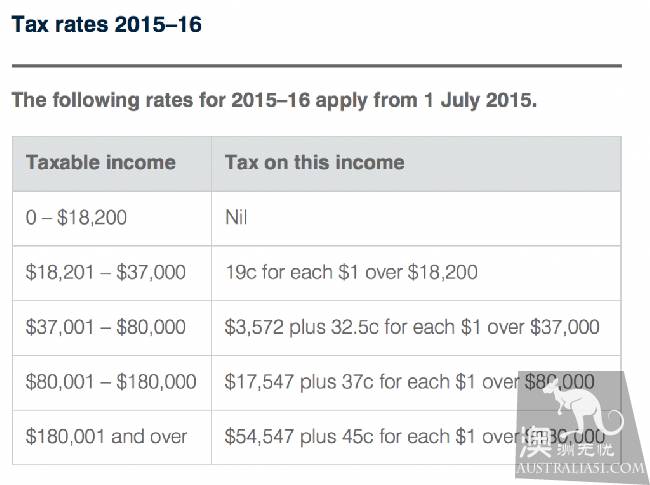

Tax rebate for individual. Tax rebate tax year 2021 2020 2019 2018. That means for those without children an individual will not receive any rebate if their income exceeds 99 000. Subtract tax deductions from your income before you figure the amount of tax you owe. It will amount to.

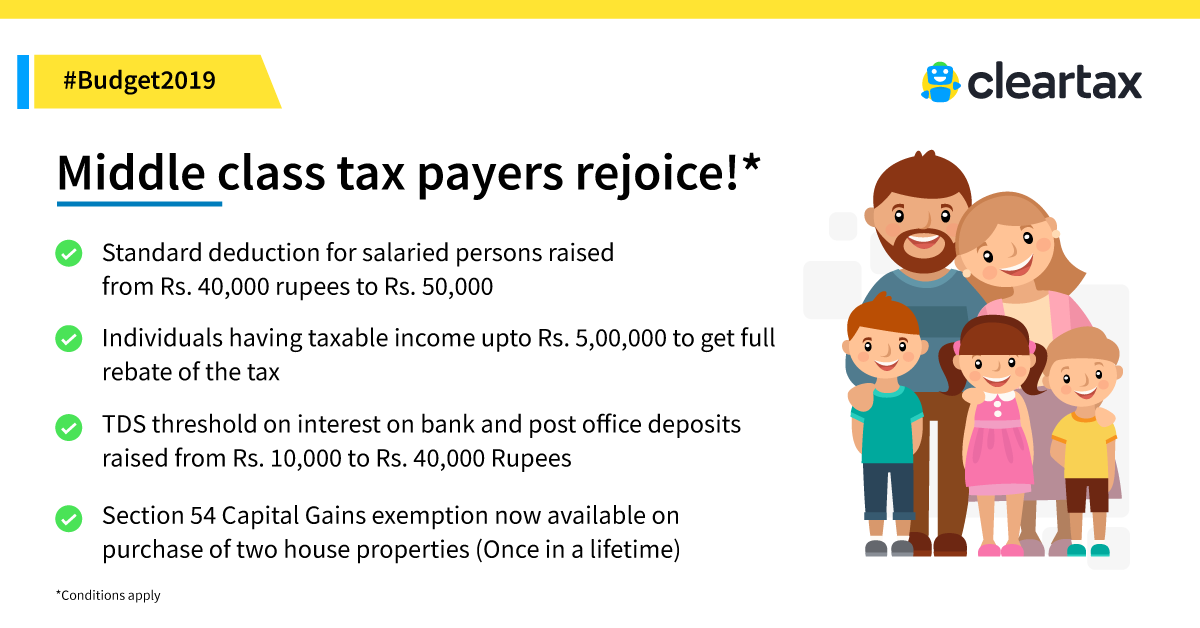

Generally individual taxpayers have ten 10 years to file a claim for refund of u s. Under current law a tax credit of up to 2 100 is allowed to cover expenses to care for a qualifying dependent including an eligible child or up to 4 200 for expenses to care for two or more. A refundable tax credit means you get a refund even if it s more than what you owe. Instructions for form 1040.

Income taxes paid if they find they paid or accrued more creditable foreign taxes than what they previously claimed. R14 067 r13 635 r13 500 r13 257 r12 726 secondary 65 and older r8 199. Request for taxpayer identification number tin and certification. Your tax rebate amount will be reduced by 5 for each 100 your income exceeds the above income limits.

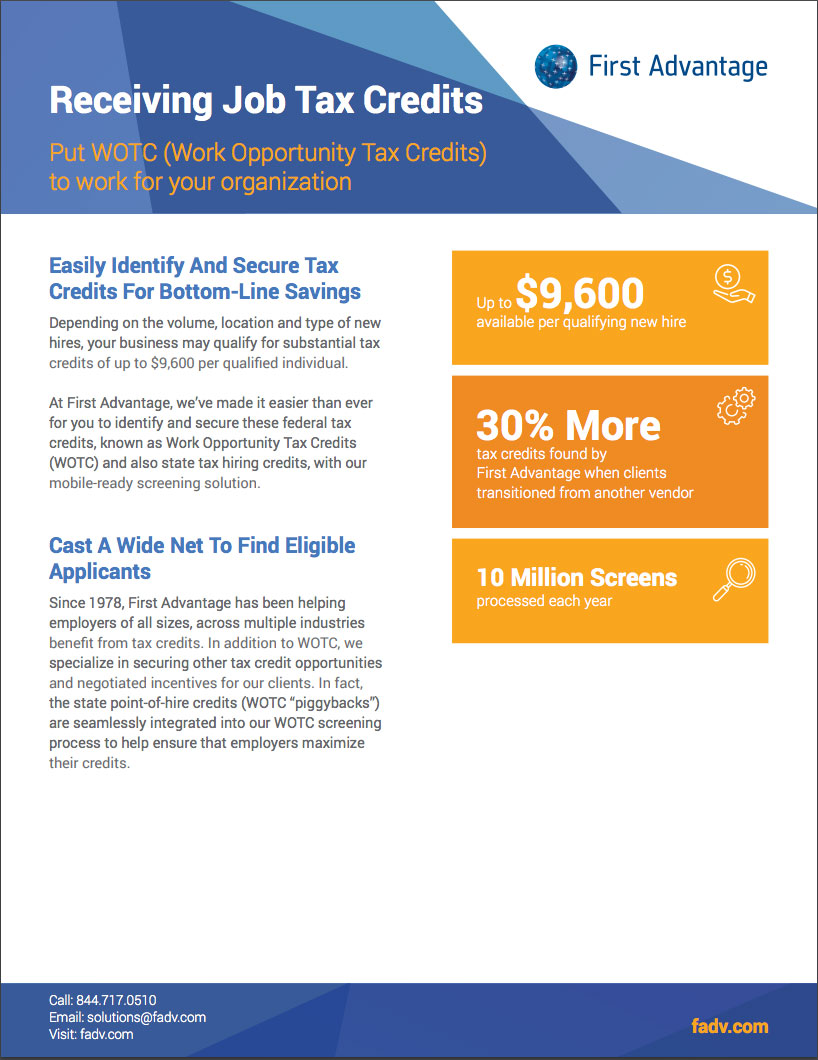

Many businesses that have been severely impacted by coronavirus covid 19 will qualify for new employer tax credits. In 2018 and 2019 an individual may claim a credit for 1 10 percent of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500. Find credits and deductions for businesses. The american opportunity tax credit also known as the hope credit is a tax credit that helps parents and students pay for their post secondary education with a maximum of 2 500 for the credit.

1 200 per individual 2 400 per couple and. If you haven t filed for an extension to submit your 2019 income tax return and you still owe uncle sam the minimum penalty you ll face in addition to the tax owed is about to go up. There are two types of tax credits. What is a tax deduction.

Usually you are allowed to claim your own tuition and the required enrollment fees as well as those that come along your dependents. 2017 2016 2015 primary r14 958 r14 220.

/state-income-tax-deduction-3192840_FINAL_v2-e43549dd9f264eab947794daf86ae338.png)