Tax Rate Malaysia 2018

A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g.

Tax rate malaysia 2018. On the first 5 000. Tax rm 0 5 000. Useful reference information for malaysia s income tax 2018 filing deadline for year of assessment 2017 for be is apr 30 2018 manual form and may 15 2018 e filing. No other taxes are imposed on income from petroleum operations.

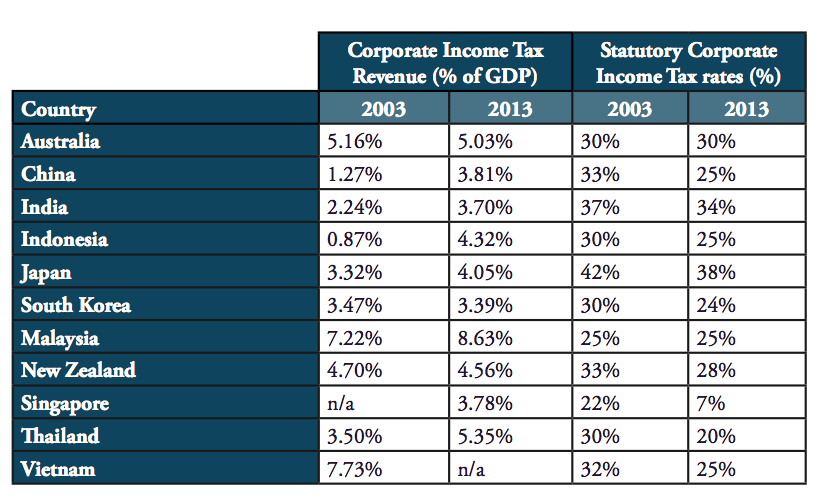

An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. Based on this amount the income tax to pay the government is rm1 640 at a rate of 8. Malaysia personal income tax rate is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a max of 28. What is income tax.

The more you reduce your chargeable income through tax reliefs and such the lesser your final tax amount will be. For example let s say your annual taxable income is rm48 000. Income tax is a type of tax that governments impose on individuals and companies on all. Goods are taxable unless they are specifically listed on the sales tax exemption list.

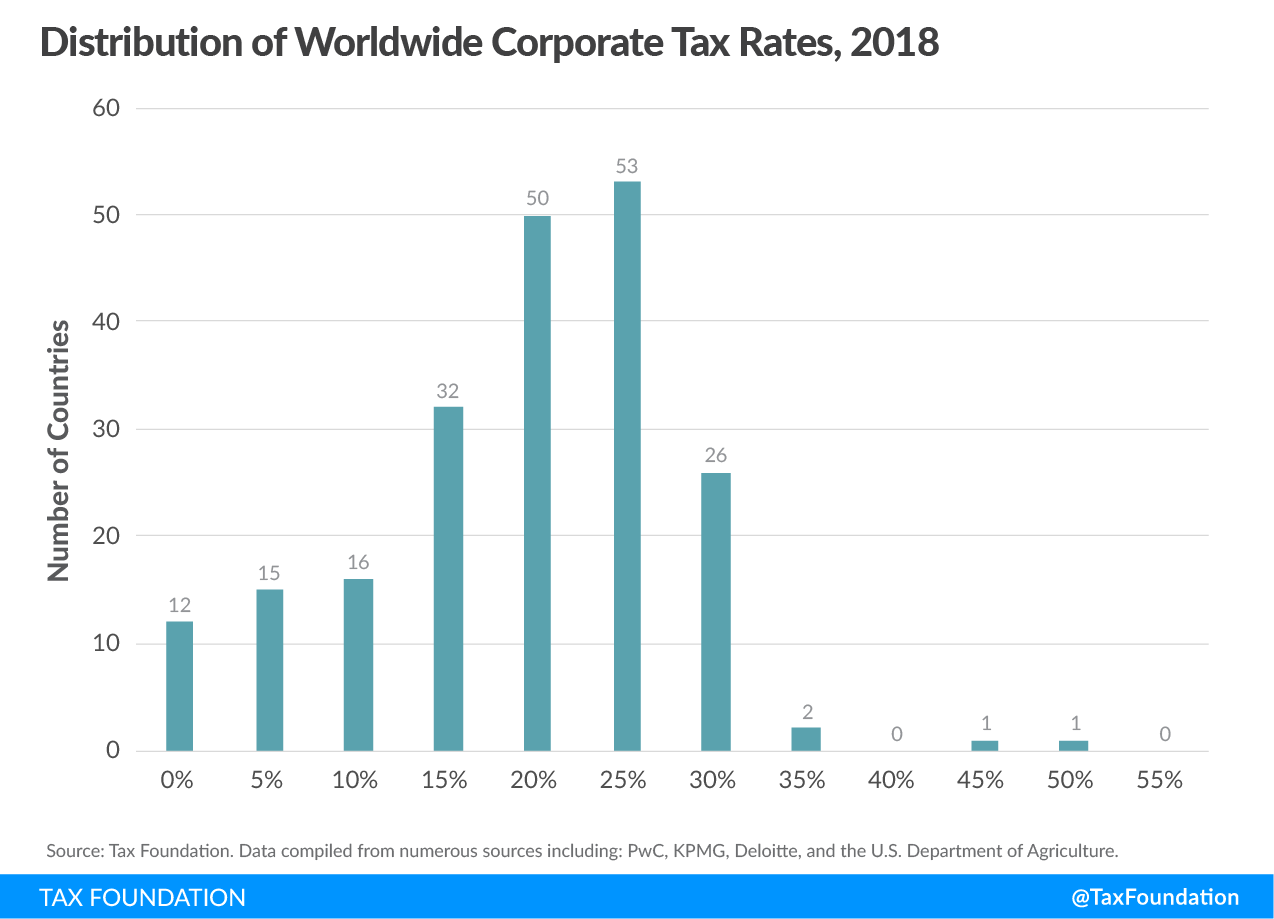

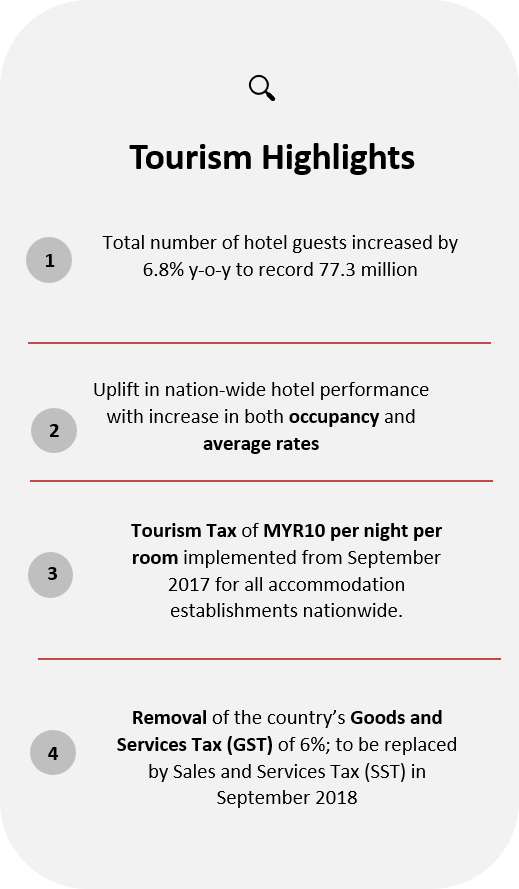

Malaysia is to reintroduce its sales and services taxes sst from 1 september 2018 with a likely standard rate of 10. These new rates will apply for those who have accumulated their income from january 2018 to december 2018 and are filing their taxes from march april 2019. For year of assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018. The sales tax is being reimposed to reassure financial markets that the country can cope with the lose of the gst revenues the planned high speed railway link to singapore has already been cancelled because of fiscal concerns.

There are no other local state or provincial government taxes on income in malaysia. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in malaysia. The proposed sales tax will be 5 and 10 or a specific rate for petroleum. The new sales tax will be levied on taxable goods that are imported into or manufactured in malaysia.