Tax Rate Malaysia 2017

There are no other local state or provincial government taxes on income in malaysia.

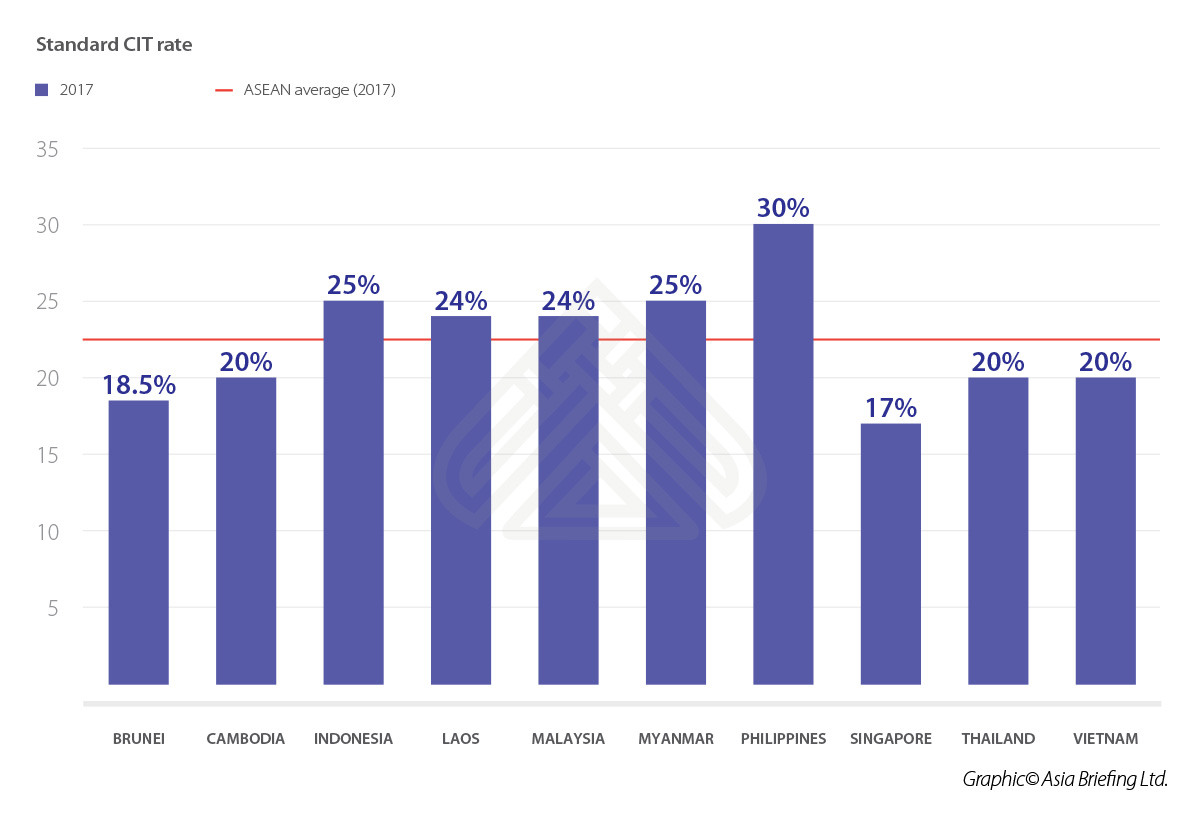

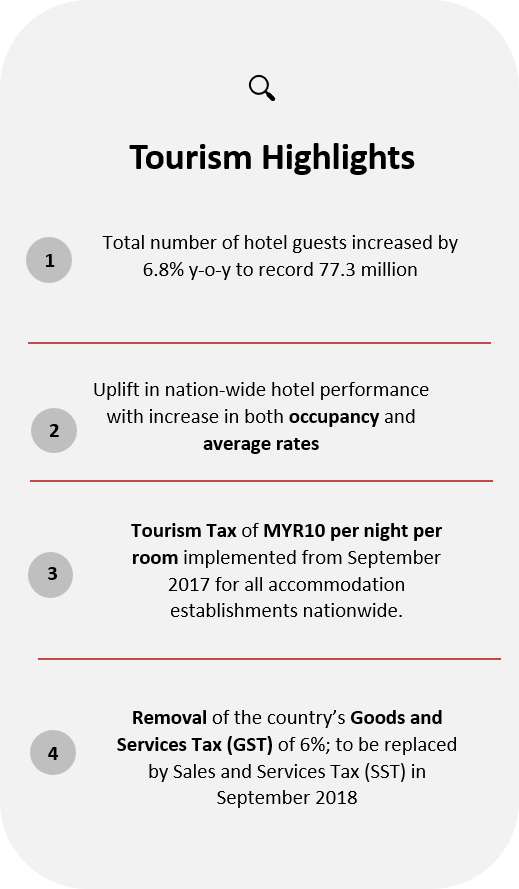

Tax rate malaysia 2017. Malaysia corporate income tax rate for a company whether resident or not is assessable on income accrued in or derived from malaysia. Pwc 2016 2017 malaysian tax booklet income tax scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. On the first 2 500. Income tax rate malaysia 2018 vs 2017.

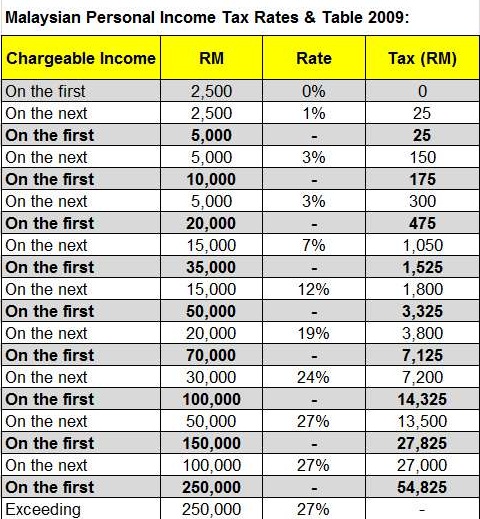

Not only are the rates 2 lower for those who has a chargeable income between rm20 000 and rm70 000 the maximum tax rate for each income tier is also lower. Other rates are applicable to special classes of income eg interest or royalties. Calculations rm rate. Tax rm 0 5 000.

Assessment year 2016 2017. Jadual average lending rate bank negara malaysia seksyen 140b sekatan ke atas kebolehpotongan faedah seksyen 140c akta cukai pendapatan 1967 edisi bahasa inggeris sahaja study group on asian tax administration and research sgatar. Not only are the rates 2 lower for those who has a chargeable income between rm20 000 and rm70 000 the maximum tax rate for each income tier is also lower. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020.

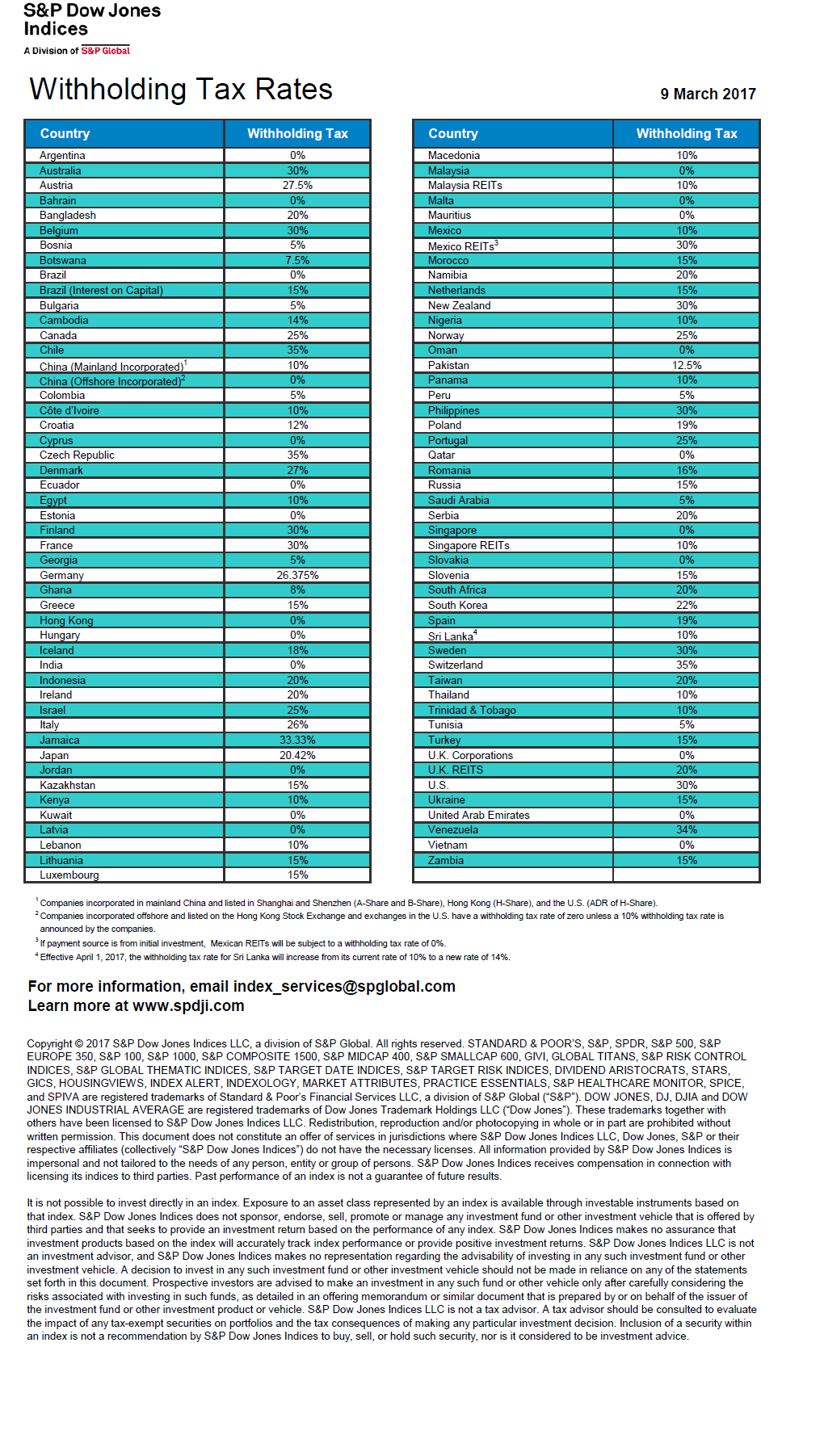

Non resident individuals pay tax at a flat rate of 30 with effect from ya 2020. No other taxes are imposed on income from petroleum operations. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g. Malaysia brands top player 2016 2017.

With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. While the 28 tax rate for non residents is a 3 increase from the previous year s 25. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in malaysia. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields.

Income tax rate malaysia 2018 vs 2017. Technical or management service fees are only liable to tax if the services are rendered in malaysia. For assessment year 2018 the irb has made some significant changes in the tax rates for the lower income groups. As featured in channel newsasia.

Income attributable to a labuan. For assessment year 2018 the irb has made some significant changes in the tax rates for the lower income groups. Malaysia personal income tax rate.