Tax Rate 2018 Lhdn

These new rates will apply for those who have accumulated their income from january 2018 to december 2018 and are filing their taxes from march april 2019.

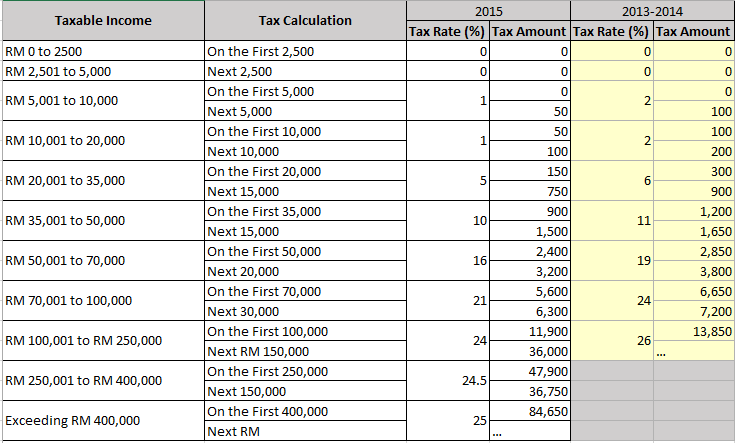

Tax rate 2018 lhdn. 5 000 pertama 15 000 berikutnya. For year of assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018. Tax administration diagnostic assessment tool tadat. On the first 5 000 next 15 000.

On the first 2 500. Pengiraan rm kadar cukai rm 0 5 000. Calculations rm rate tax rm 0 5 000. Company with paid up capital not more than rm2 5 million.

Year assessment 2017 2018. The tax cuts and jobs act of 2017 otherwise knows as tax reform reduced the amount of tax brackets for individuals and lowered the rates. Lembaga hasil dalam negeri malaysia tidak bertanggungjawab terhadap sebarang kehilangan atau kerosakan yang dialami kerana menggunakan maklumat dalam laman ini. Home tax rate of company.

Company with paid up capital not more than rm2 5 million on first rm500 000 subsequent balance. Pengiraan rm kadar cukai rm 0 5 000. Tahun taksiran 2018 2019.