Tax Installment Payments Malaysia

E balance of tax if any has to be settled upon the submission of the income tax return.

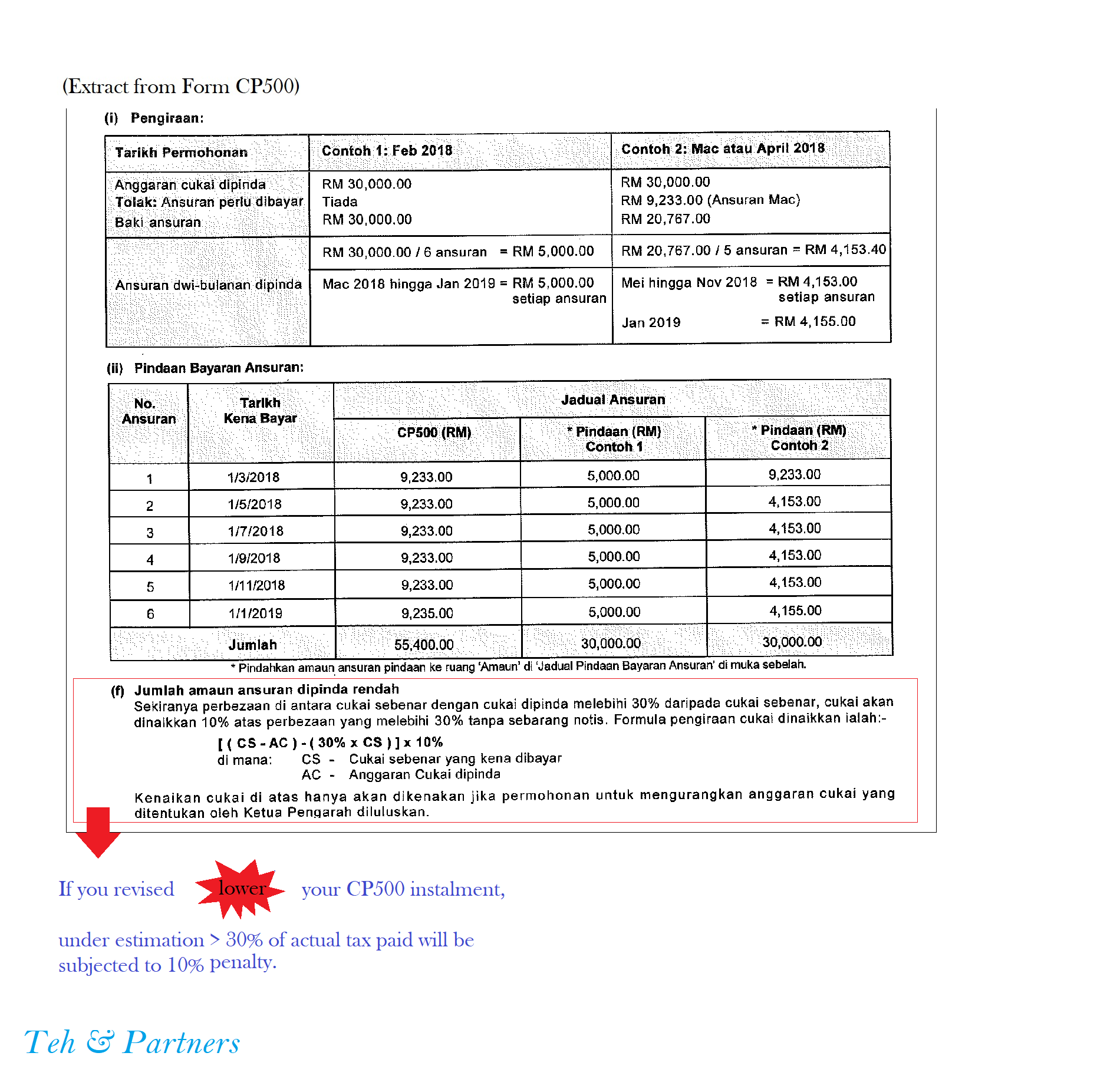

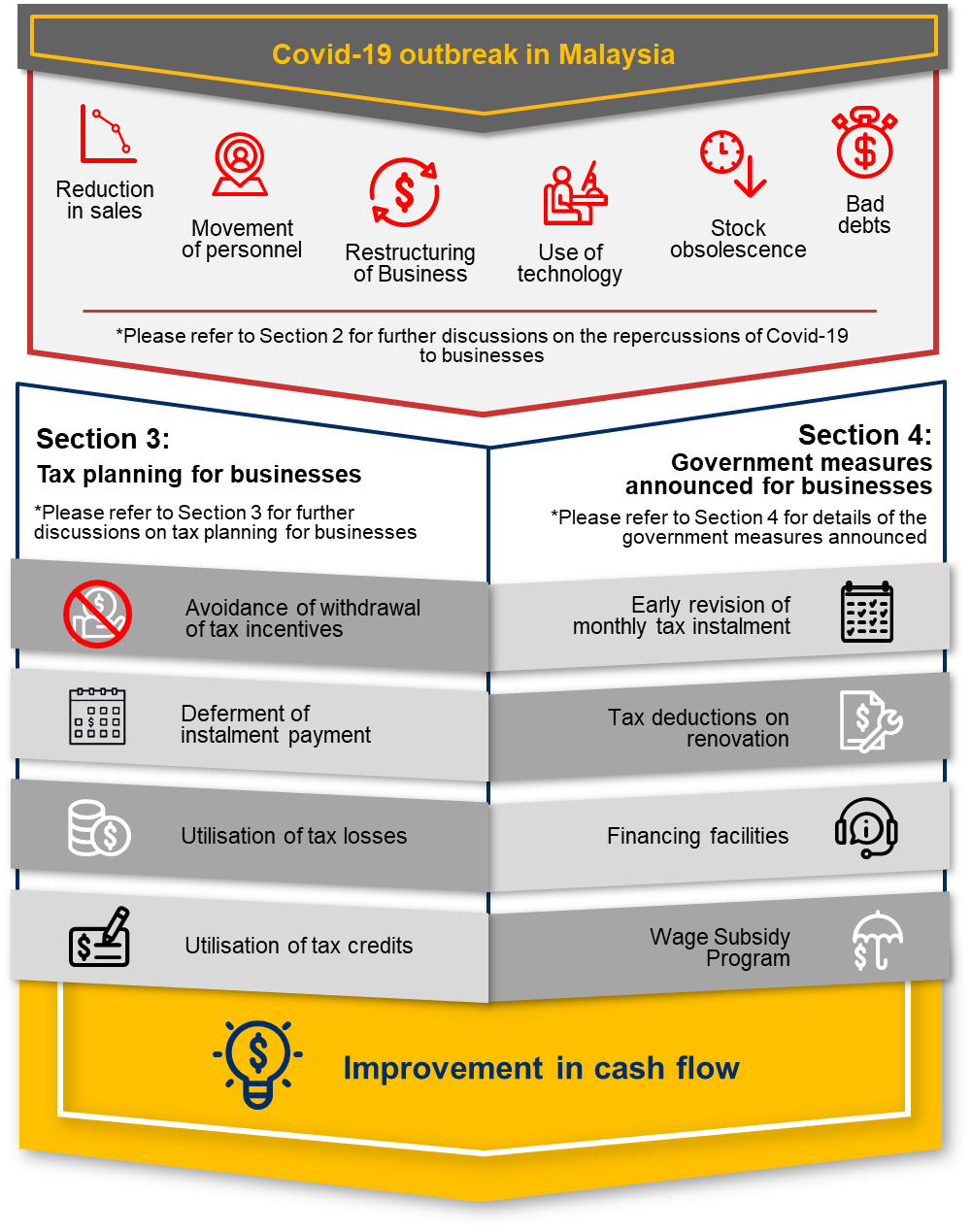

Tax installment payments malaysia. An extension of time is given until 31 may 2020 for revision in the third month of instalment that falls in april 2020. If you find yourself struggling to fork out the full tax payable amount and is unable to meet the payment deadline of april 30 of the year of assessment you can apply for payment of the balance of tax in installments. The deadline for the submission of the revised tax estimate in the third month instalment in 2020 is based on the company s basis period. If the taxpayer has yet to receive the e mail taxpayer need not make the payment for the instalment which is due on 15 april 2020.

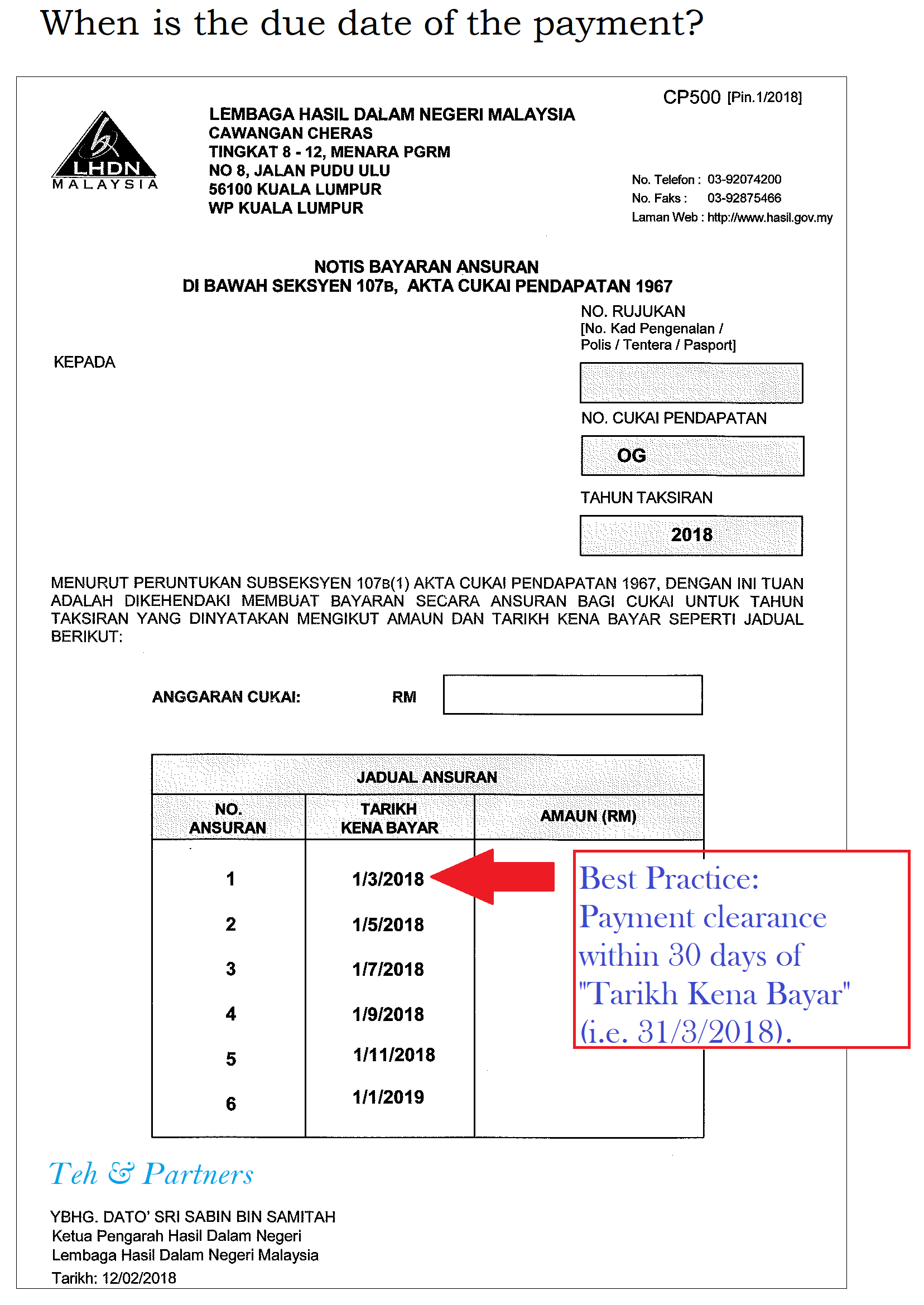

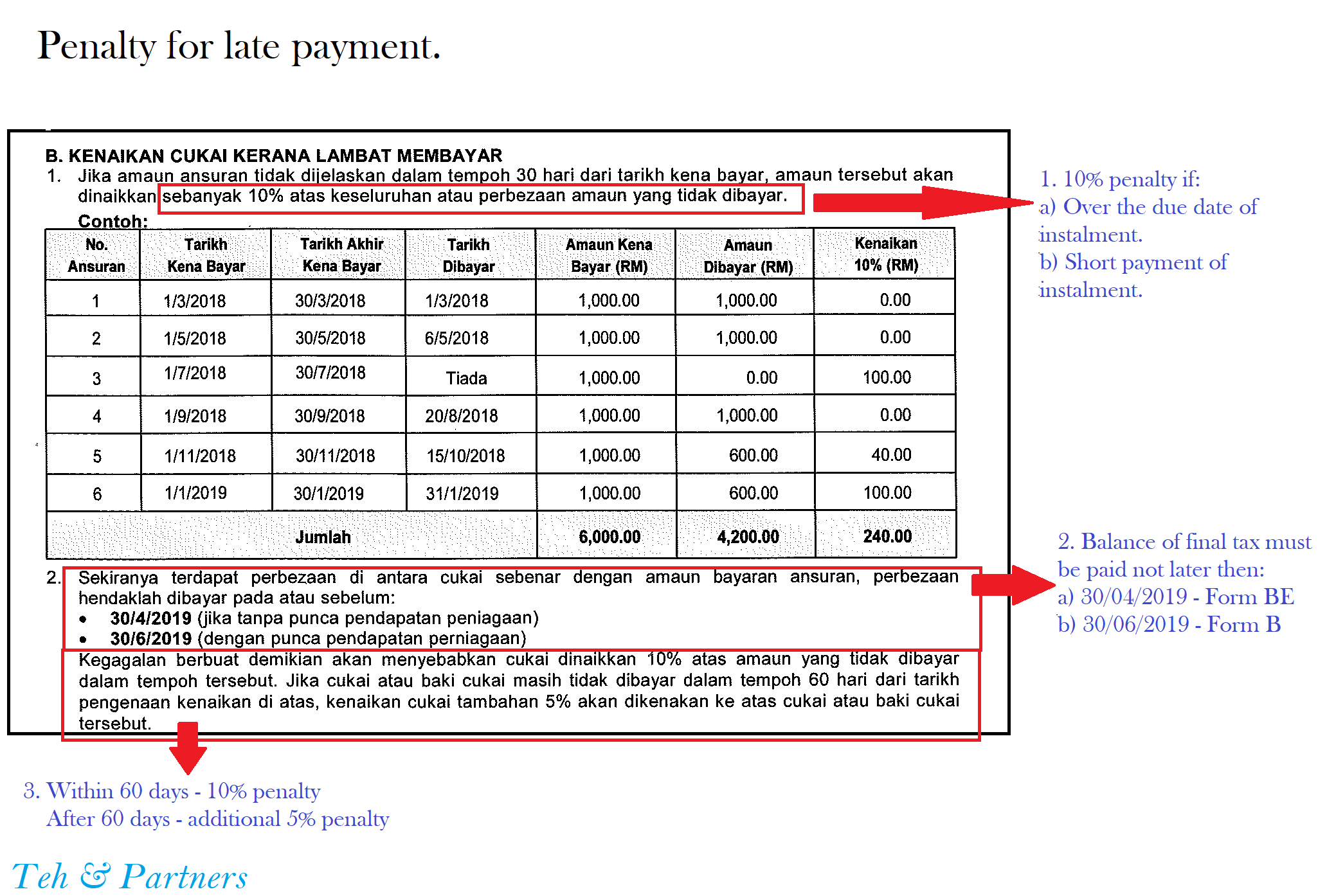

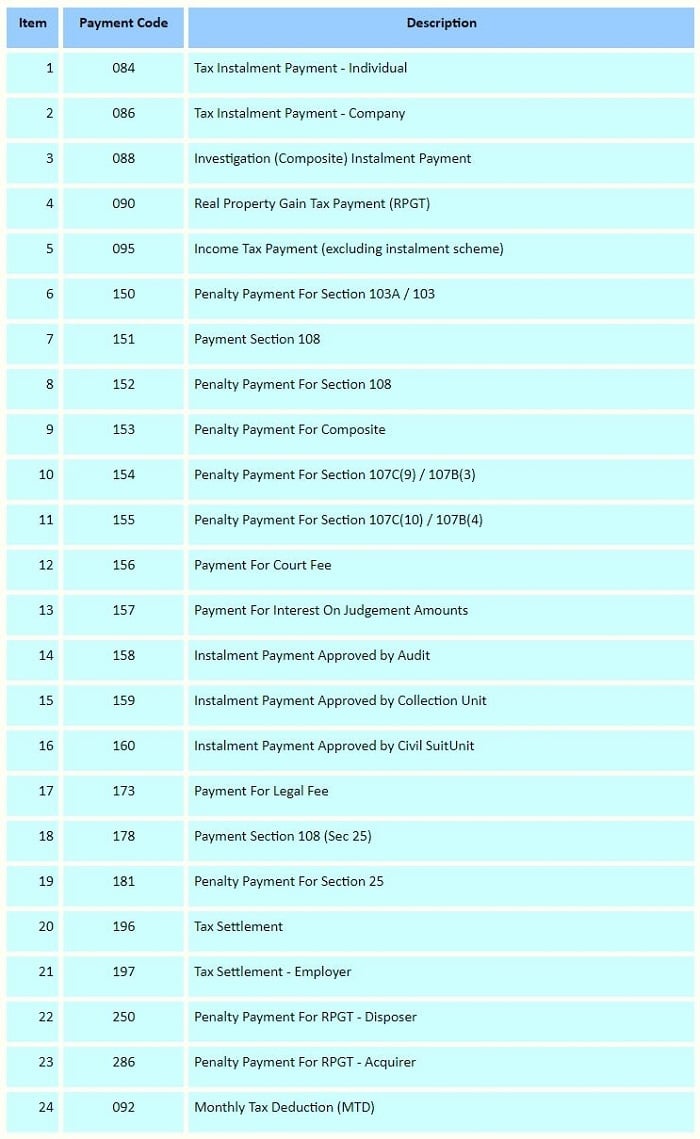

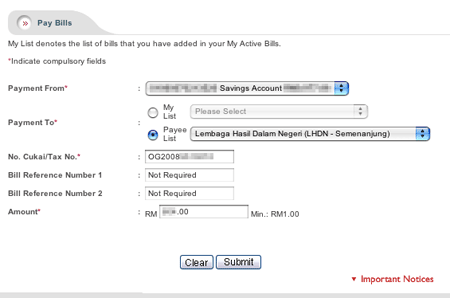

Cp500 payment for march 2020 and may 2020 tax installments can be deferred starting from april 2020 to june 2020. Estimate of tax payable in malaysia form cp204 with effect from y a 2008 where a sme first commences operations in a year of assessment the sme is not required to furnish an estimate of tax payable or make instalment payments for a period of two years beginning from the year of assessment in which the sme commences operations. By far online payment is the easiest and most efficient way to pay income tax in malaysia. If a company fails to pay the monthly instalment on the tax estimate by the stipulated date a late payment penalty of 10 will be imposed on the balance of tax instalment not paid for the month.

And revision of income tax estimation in the month of the 3 rd instalment payment for all companies if the 3 rd month of the instalment payment falls in 2020. And there is no requirement to pay the deferred tax installment payments and tax penalties will not be imposed. Taxpayers who qualify for the deferment are still entitled for the revision of tax estimate in the third month of instalment. Who is eligible for deferment of cp204 payment for 3 months beginning april 2020 until.

The best would be via the irb s own online platform byrhasil. Penalty under instalment scheme. The balance of tax if any has to be settled upon the submission of the income tax return.