Tax Evasion In Malaysia

What is tax evasion.

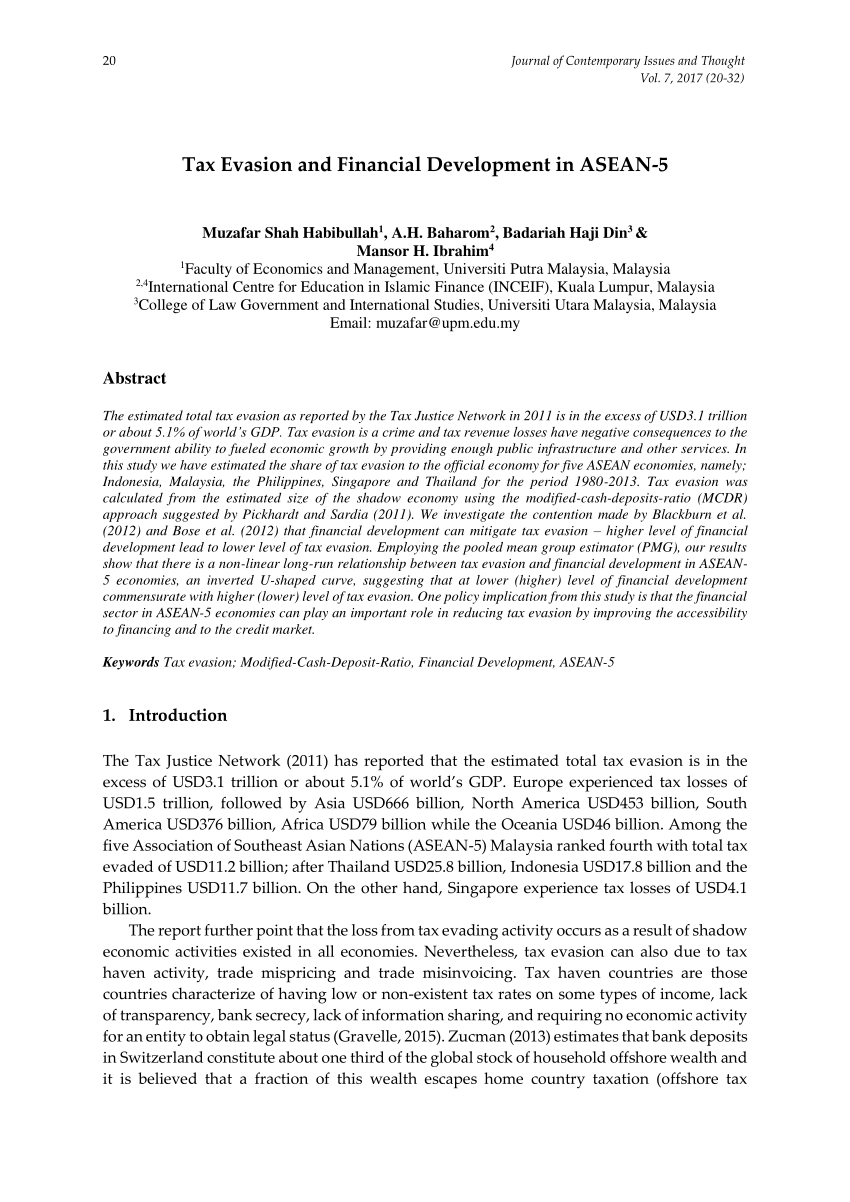

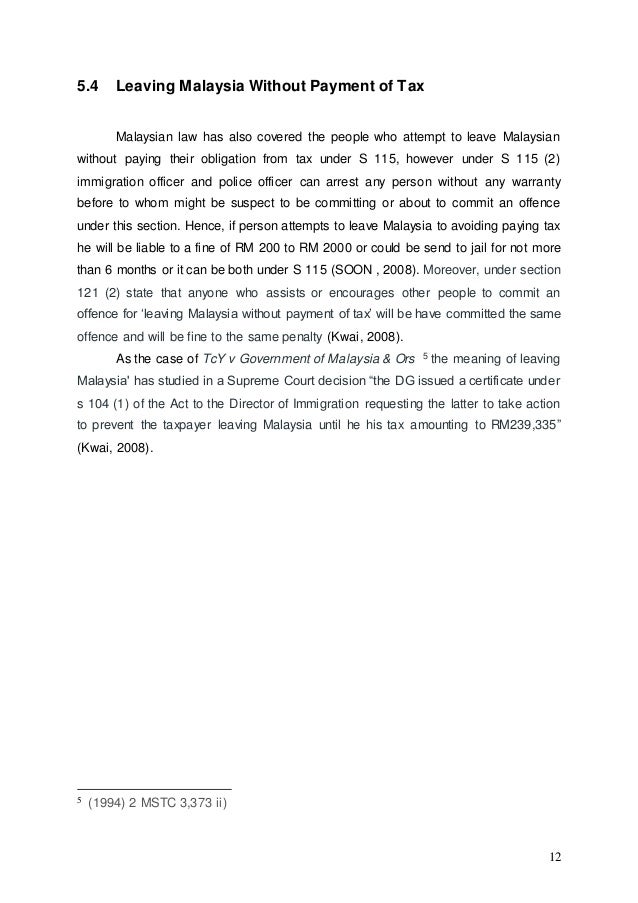

Tax evasion in malaysia. If convicted tax evasion can result in fines of up to 250 000 for individuals 500 000 for corporations or imprisonment of up to five years or both plus court the cost of prosecution. This paper attempts to reveal the determinants of tax evasion from the institutional. If this certificate has been issued it s a crime to try and leave malaysia without paying your taxes off under section 115 which carries a punishment of rm200 to rm20 000 in fines and or up to 6 months in jail. The majority of individuals and companies own overseas bank accounts because of property purchases and investments.

We are committed to targeting tax evasion and you can help us to make sure everyone pays their fair share of tax. Evasion is a disease and needs to be minimized so that the black economy or hidden economy can be mitigated. 113 1 b 1 000 to 10 000 and 200 of tax undercharged. If you have information about fraudulent or possible criminal activity please contact us and lodge the report regarding tax evasion.

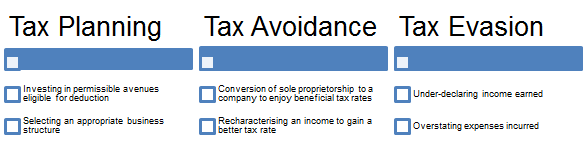

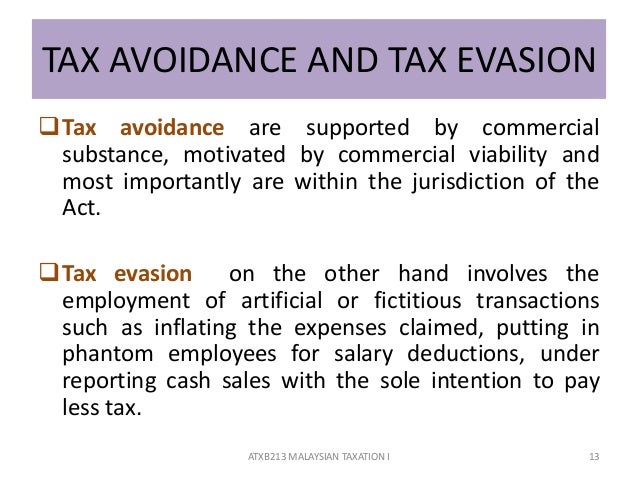

Wilfully and with intent to evade or assist any other person to evade tax. 114 1 1 000 to 20 000 or imprisonment or both and 300 of tax undercharged. Tax evasion is the use of illegal means to avoid paying your taxes. Tax evasion is part of an overall definition of tax fraud which is illegal intentional non payment of taxes.

You cannot run if you have been under declaring or evading taxes. Lembaga hasil dalam negeri. For example if someone transfers assets to prevent the irs from determining their actual tax liability there is an attempted to evade assessment. According to yong it is impossible for tax evasion as malaysia is a participant of several international tax agreements to identify errant individuals and firms.

In malaysia just as in any other country to which tax revenue contributes much economic benefit tax evasion harms the government s efforts to allocate revenue for programs and also impairs its ability to provide desirable social services. Thus tax evasion hinders economic development. Give any incorrect information in matters affecting the tax liability of a taxpayer or any other person. The aim of tax investigations is to investigate taxpayers who are suspected to be involved in fraud wilful defraud or negligence in reporting their income.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)