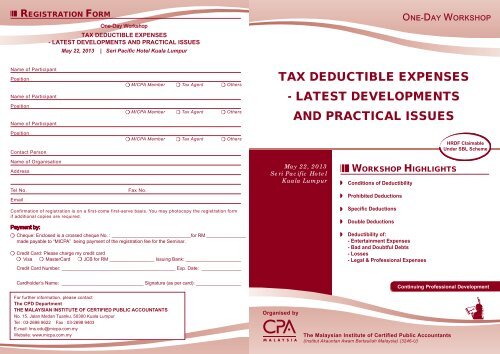

Tax Deductible Expenses Malaysia

Donations to approved institutions or organisations are deductible subject to limits.

Tax deductible expenses malaysia. Lifestyle purchases for self spouse or child. Conditions for claiming capital allowance are. Subscriptions to associations related to the individual s profession are deductible. Is given as deduction from business income in place of depreciation expenses incurred in purchase of business assets.

Operating a business purchase of business assets. Examples of assets used in a business are motor vehicles machines office equipment furniture and computers. Some of the major tax incentives available in malaysia are the pioneer status ps investment tax allowance ita and reinvestment allowance ra. 1 a medical policy must satisfy the following criteria a the expenses should be related to the medical treatment resulting from a disease or an accident or a disability.

To qualify for the this income tax relief the malaysian insurance policy must be in your name policy owner as the claimant.