Tax Computation Format Malaysia

Assessment of real property gain tax.

Tax computation format malaysia. To compute their tax payable. 2018 2019 malaysian tax booklet 7 scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. Corporate income tax in malaysia is applicable to both resident and non resident companies. All supporting documents like business records cp30 and receipts need not be submitted with form p.

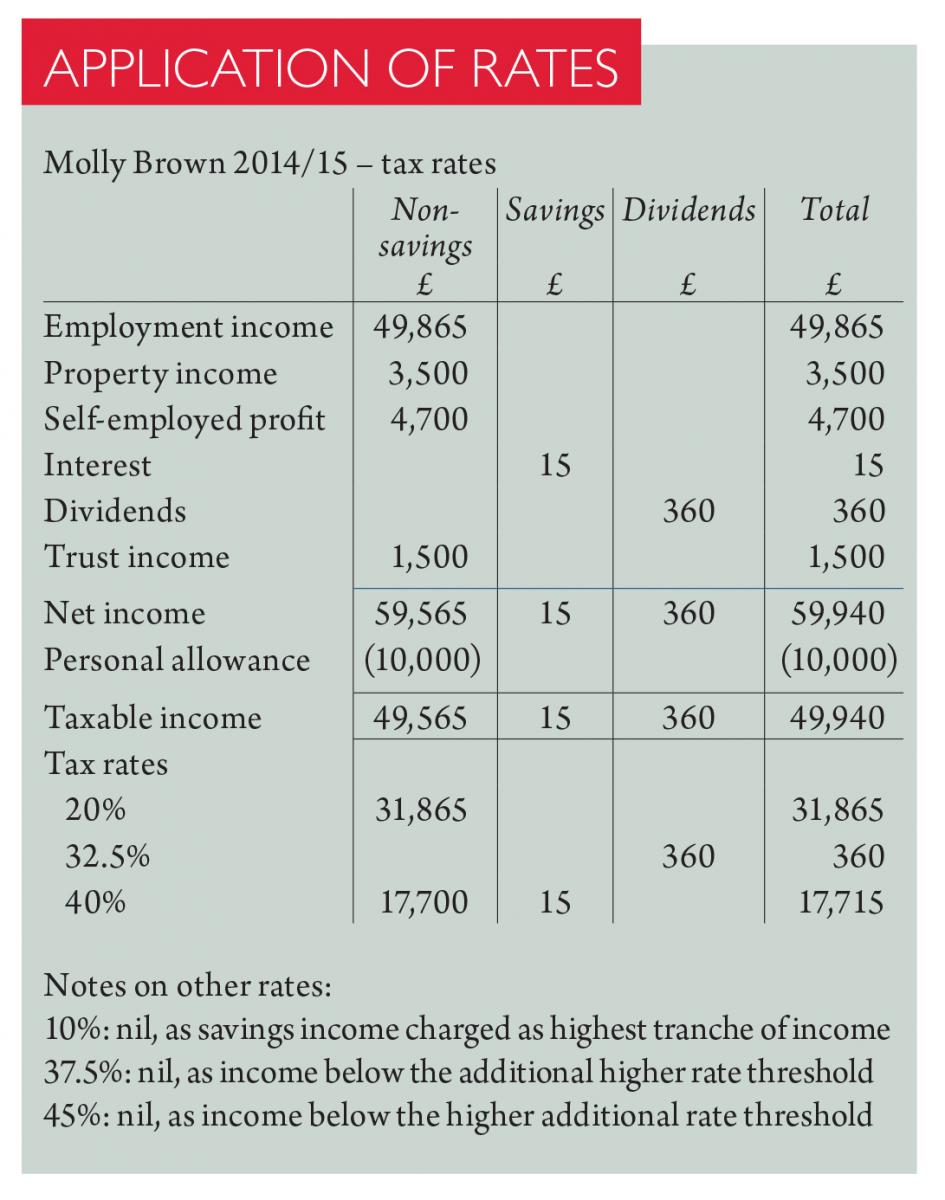

Tax rates and allowances the following tax rates allowances and values are to be used in answering the questions. Income attributable to a labuan business. To check and sign duly completed income tax return form. Income tax rates resident individuals chargeable income rate cumulative tax rm rm rm first 5 000 0 5 000 00 next 15 000 5 001 20 000 2 300 next 15 000 20 001 35 000 6 1 200 next 15 000 35 001 50 000 11 2 850.

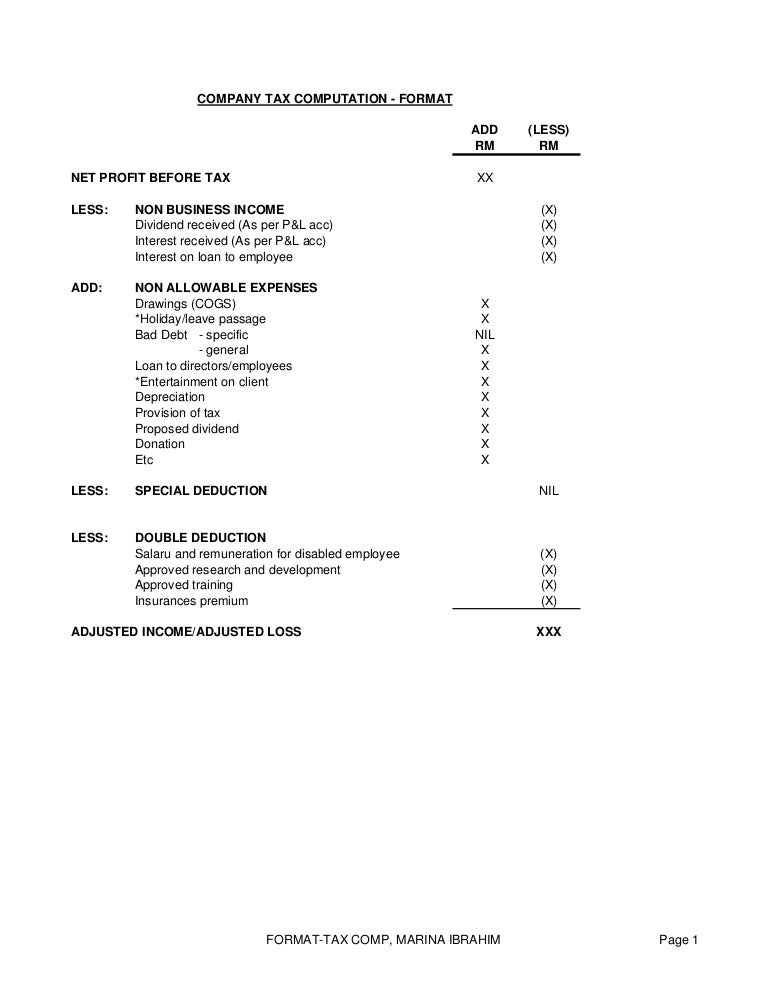

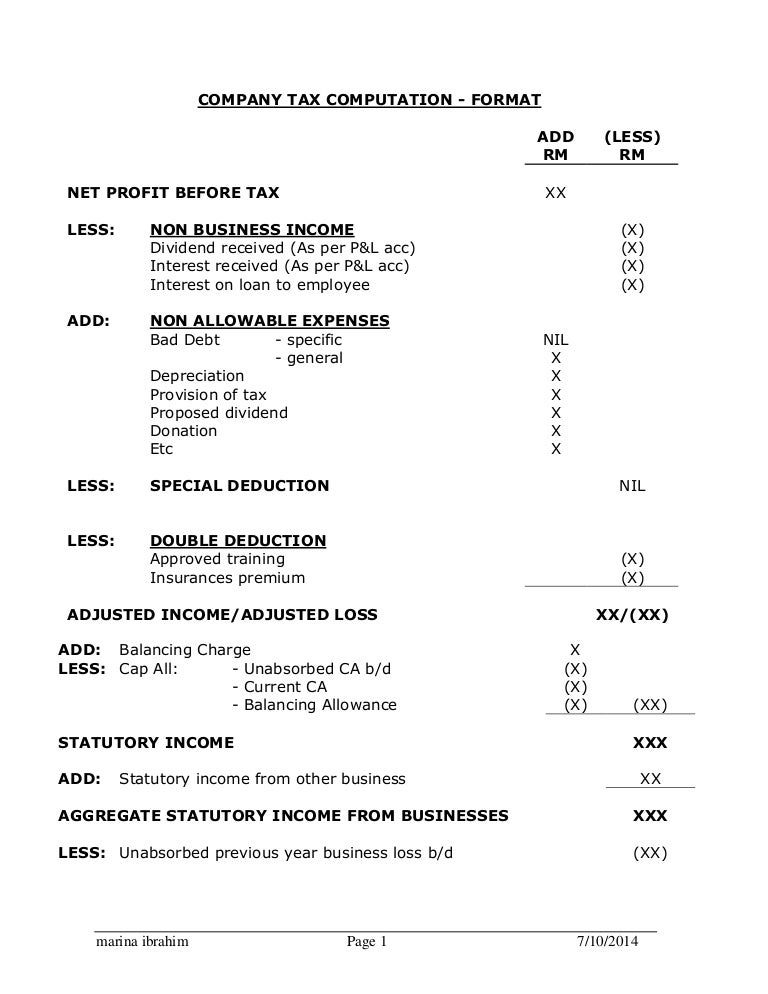

Cancellation of disposal sales transaction. Pegangan dan remitan wang oleh pemeroleh available in malay language only shares in real property company rpc procedures for submission of real porperty gains tax form. Company tax computation format add less rm rm net profit before tax xx less. Tax deducted at source from dividend 25 x 6 000 1 500 00 tax payable 955 00 wife 25 200 dividend gross 3 000 total income 28 200 less.

Special deduction nil less. Non allowable expenses drawings cogs x holiday leave passage x bad debt specific nil general x loan to directors employees x entertainment on client x depreciation x provision of tax x proposed dividend x donation x etc x less. Husband and wife have to fill separate income tax return forms. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing.

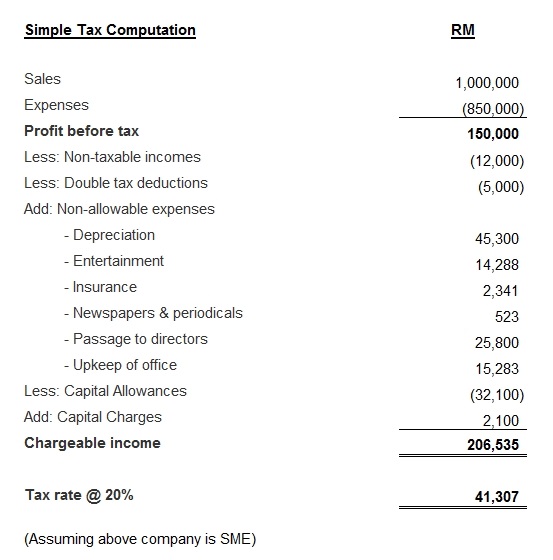

Companies are taxed at the 24 with effect from year of assessment 2016 while small scale companies with paid up capital not exceeding rm2 5 million are taxed as follows. Imposition of penalties and increases of tax. To submit the income tax return form by the due date. Tax on first 35 000 1 525 00 tax on next 7 750 12 930 00 income tax charge 2 455 00 less.

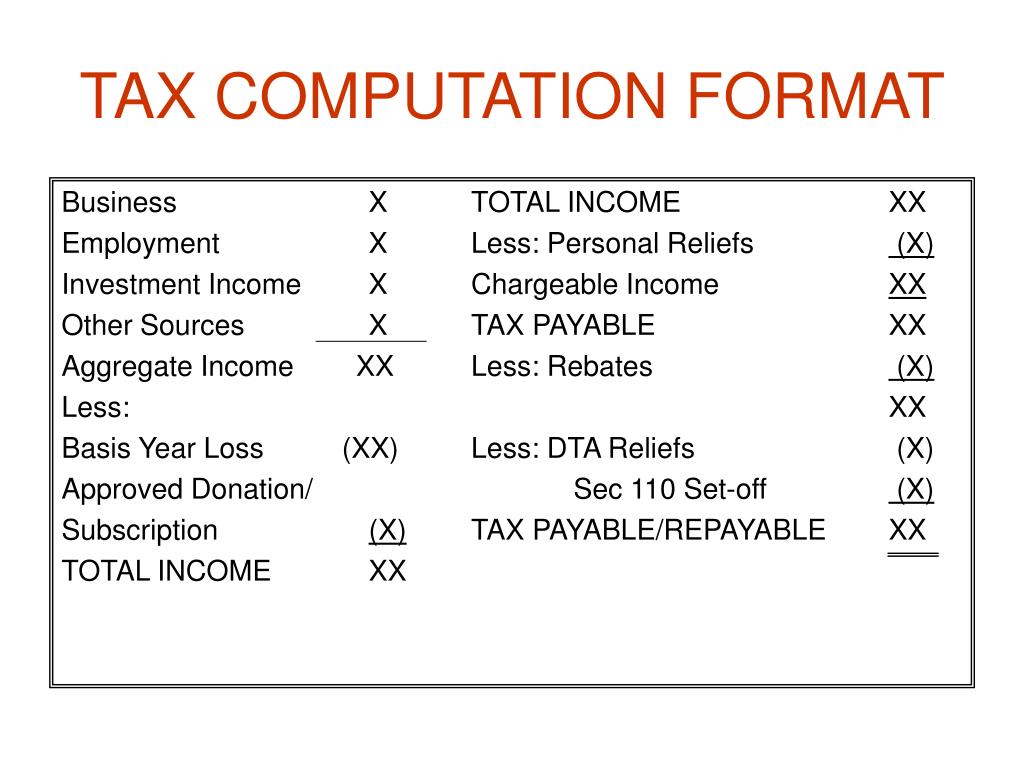

For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 7 2 as only 30 of its profits are subject to tax. Example of tax computation format would be. Tax rate of company.

%202.png)