Tax Computation For Sole Proprietor In Malaysia

Thereby no separate tax return file is needed.

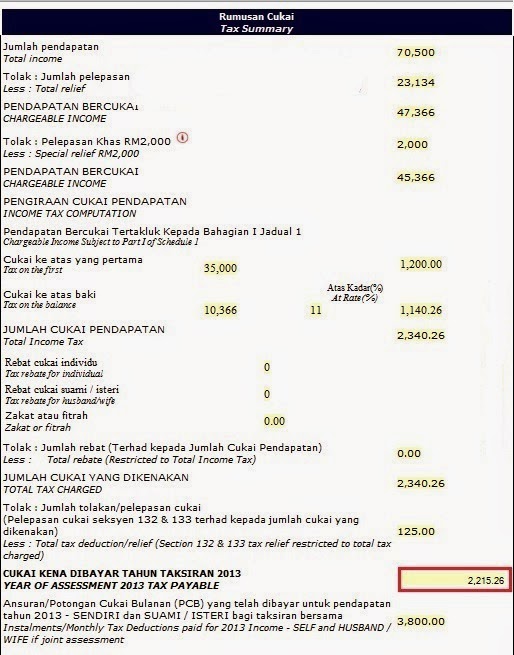

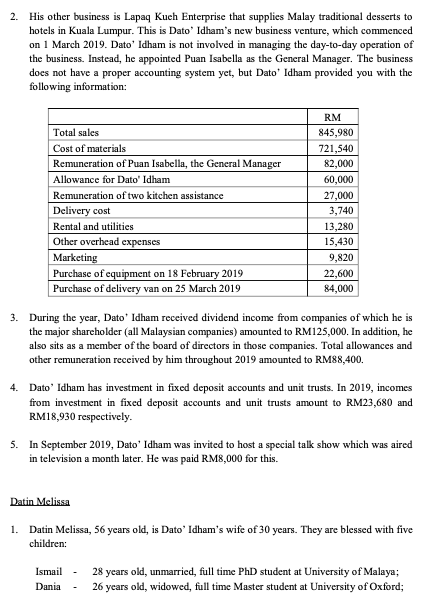

Tax computation for sole proprietor in malaysia. Malaysia personal income tax rates 2013. Other income is taxed at a rate of 30. Lembaga hasil dalam negeri lhdn inland revenue board irb who you pay your taxes to and where you register for tax filing. Nonresidents are subject to withholding taxes on certain types of income.

The system is thus based on the taxpayer s ability to pay. Husband and wife have to fill separate income tax return forms. Key points of malaysia s income tax for individuals include. Special personal tax relief rm2 000.

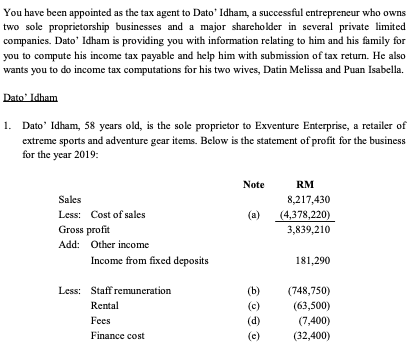

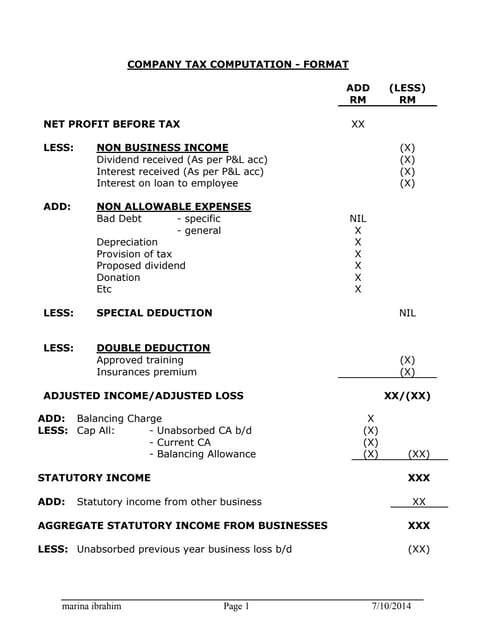

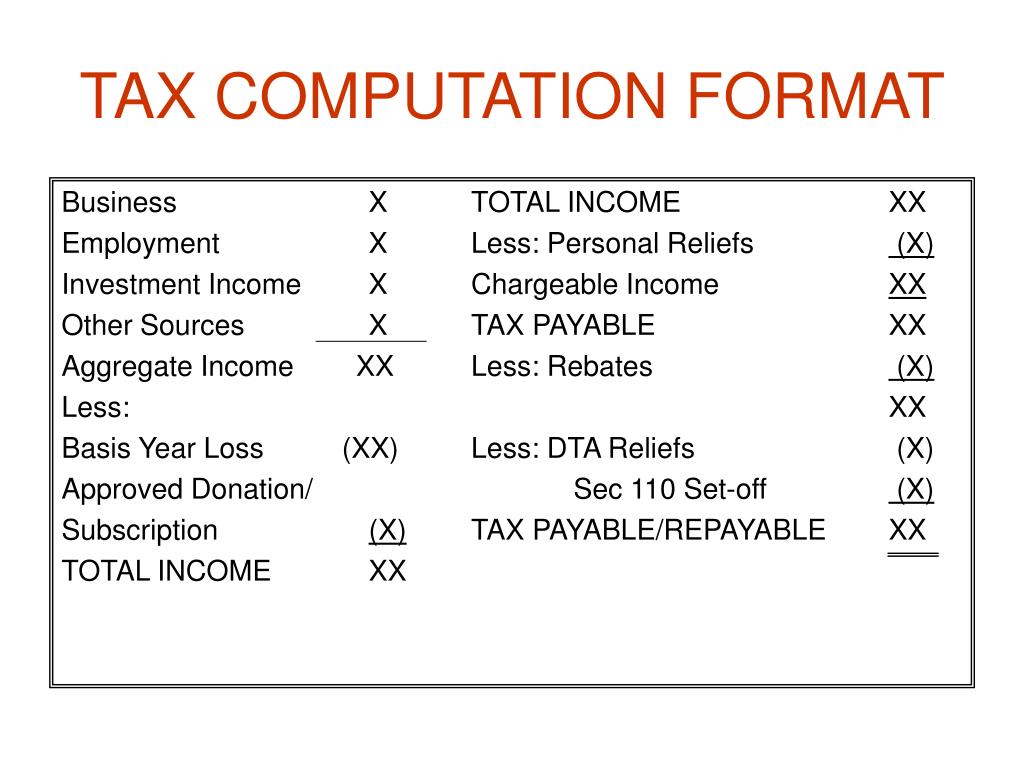

Tax computation tax computation starts from your business income statement that has been prepared in accordance with malaysia accounting standard. To submit the income tax return form by the due date. To check and sign duly completed income tax return form. Sole proprietorships are pass through entities.

For a company an audited report must be available before the computation of tax. Imoney has a useful guide about taxes made up of 11 short chapters. Residents and non. Malaysia personal income tax calculator for ya 2020 malaysia adopts a progressive income tax rate system.

This means that low income earners are imposed with a lower tax rate compared to those with a higher income. To compute their tax payable. All profits and losses go directly to the business owner. All supporting documents like business records cp30 and receipts need not be submitted with form p.

Pay your tax now or you will be barred from travelling oversea. Personal income tax is payable on the taxable income of residents at the progressive rates from 0 to 30 with effective year of assessment 2020. Tax submitted in 2017 is for 2016 income. Malaysia www hasil gov my lembaga hasil dai am ne geri malaysia lhdnm r03 16.

30 june every year refer to account s statement supporting documents other income statement and receipts fill in the correct business code when filling the. You make payment on income generated the previous year i e. Sole proprietor complete and submit form e b via e filing business partner. An employer is a partner sole proprietor or a person responsible for the payments of employees salaries and operating in malaysia.

There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make sure you.

%202.png)