Tax Bracket Malaysia 2018

What is tax rebate.

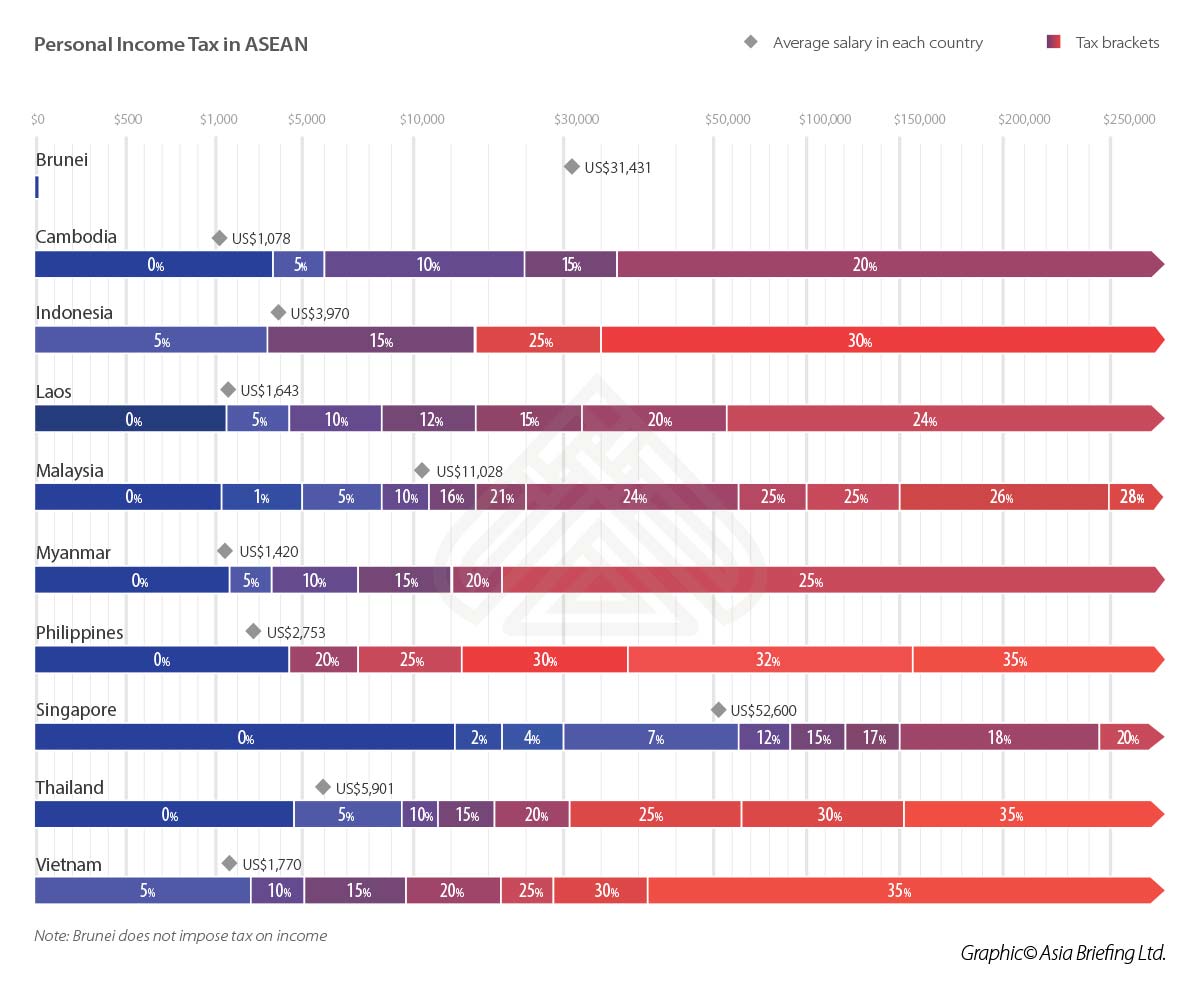

Tax bracket malaysia 2018. Malaysians are categorised into three different income groups. Non resident individuals pay tax at a flat rate of 30 with effect from ya 2020. Malaysia personal income tax rate. Deloitte tax hand information and insights from deloitte s tax specialists globally.

Top 20 t20 middle 40 m40 and bottom 40 b40. To increase the disposable income of middle income taxpayers and address the rising cost of living the 2018 budget would reduce individual income tax rates for resident individuals by 2 for three of the chargeable income bands ranging from myr 20 001 to myr 70 000 as follows. How does monthly tax deduction mtd pcb work in malaysia. Malaysia income tax e filing guide.

Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g.

Green technology educational services. Cukai rm 0 5 000. Other rates are applicable to special classes of income eg interest or royalties. Stay up to date with the latest tax news rates and commentary anytime anywhere.

Pengiraan rm kadar. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. Calculations rm rate tax rm 0 5 000. Who needs to pay income tax.

If you re still in the dark here s our complete guide to filing your income taxes in malaysia 2019 for the year of assessment 2018. His ba is conducted twice every five years and dosm is currently conducting the 2019 survey nationwide. How to pay income. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6.

For year of assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018. What is income tax return. These new rates will apply for those who have accumulated their income from january 2018 to december 2018 and are filing their taxes from march april 2019. This is based on the department of statistics dosm household income and basic amenities his ba survey of 2016.