Subsection 44 6

3 2 services or benefits provided by an institution or organisation under subsection 44 6 of the ita 1967.

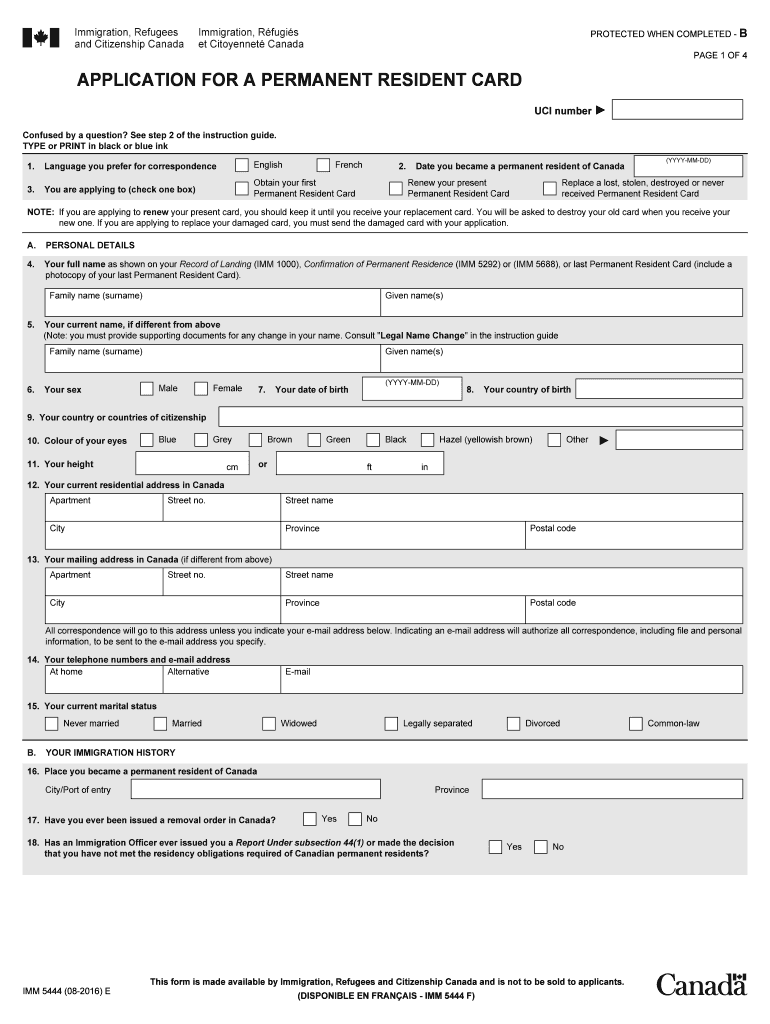

Subsection 44 6. Members of the board of governors of the school their families and school staff should not enjoy the benefits from the fund. These guidelines serve to explain the types of institutions organisations or funds which may be considered for approval under subsection 44 6 of the income tax act 1967 and the various steps procedures involved in the submission of applications for approval and the other related matters. This would occur where the property has been stolen destroyed or expropriated. Notarial officer means a notary public or other individual authorized to perform a notarial act.

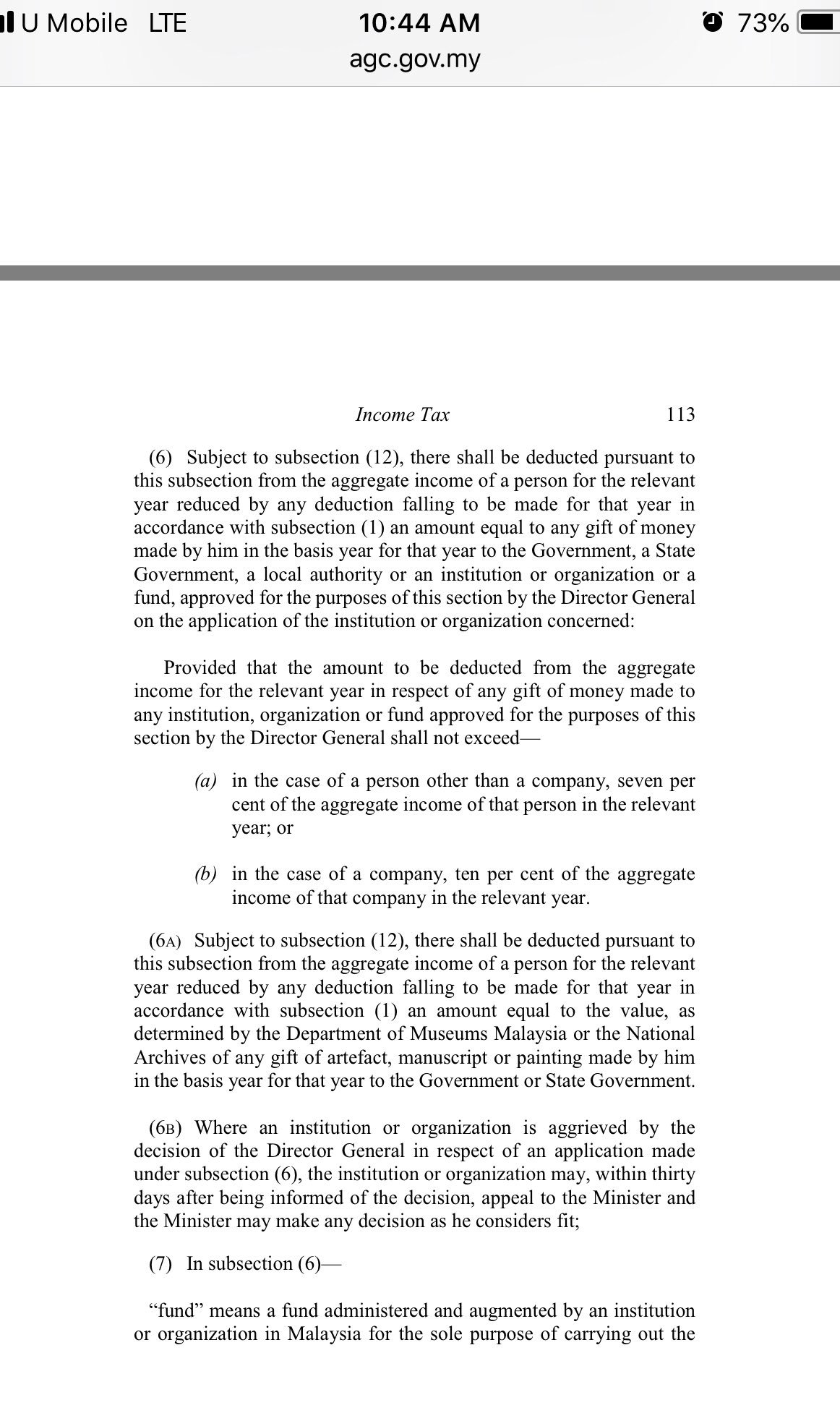

Section 44 this section allows for the deferral of a capital gain where there was an involuntary disposition. Attesting a copy except as provided in subsection 7 of section 44 06 1 23 and noting a protest of a negotiable instrument. It also allows for the deferral if the capital gain was from the sale of real estate used by a taxpayer to earn business income. There is no special form for making an application for approval under subsection 44 6 of the ita.

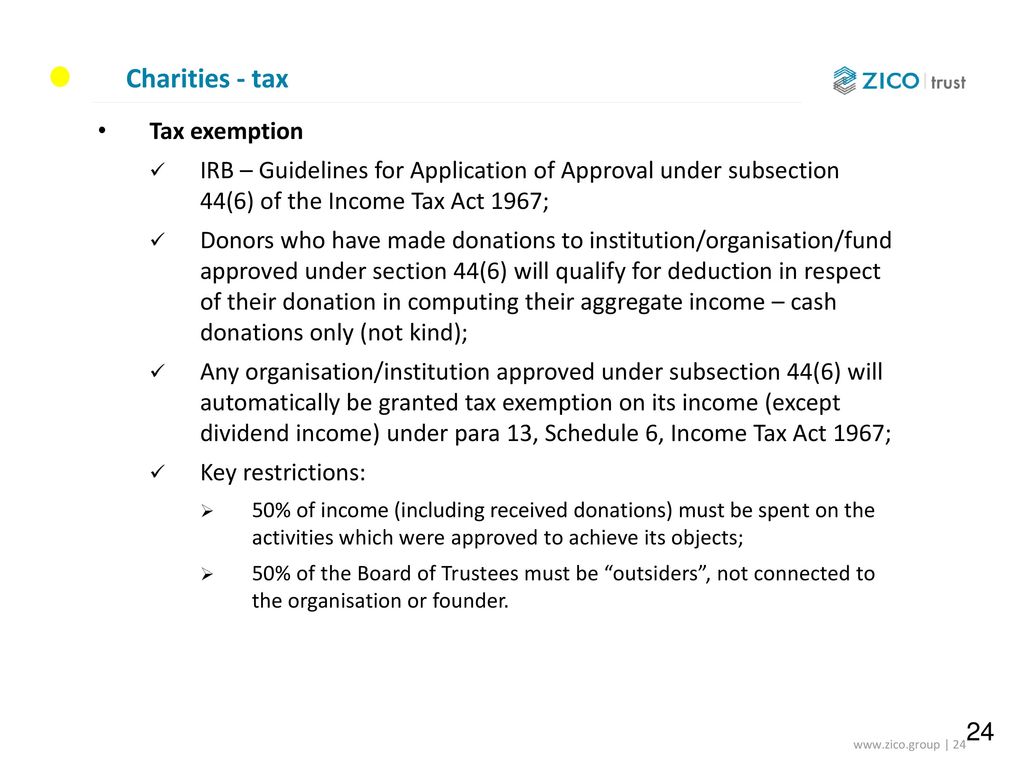

To apply for approval under subsection 44 6 of the ita 1967 3 1 objective of the establishment of the institution or organisation the institution or organisation must be established in malaysia and is not established primarily for profit. Subsection 44 6a 6 gift of money for provision of library facilities or to libraries. One of the criteria to qualify for approval under subsection 44 6 of the income tax act 1967 ita is that more than 50 of the members of the bot bod cm must consist of outsiders who are not related to the institution organization and founder. Section 44 6 of income tax act 1967 subsection 6 amended by act 608 of 2000 s8 a i by substituting for the full stop at the end of the subsection a colon with effect from year of assessment 2001.

At least 50 percent of the committee members of the fund must be made up of parents of students. These guidelines serve to explain the types of institutions organisations or funds which may be considered for approval under subsection 44 6 of the income tax 1967 and the various steps procedures involved in the submission of application for approval and the other related matters.

-page-001.jpg)