Statutory Income From Employment

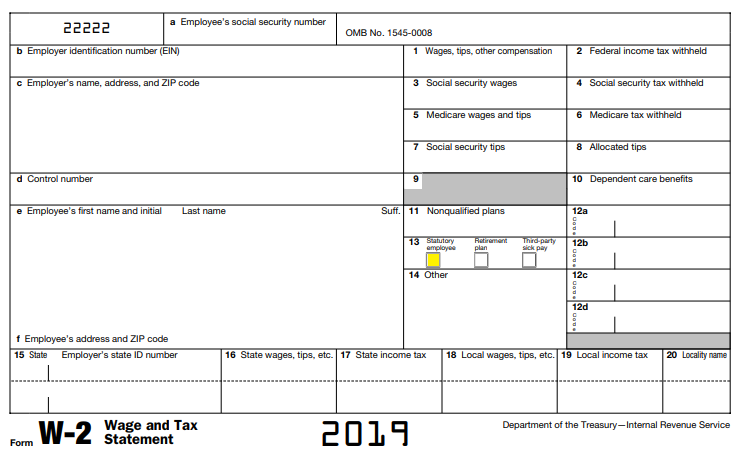

Withhold social security and medicare taxes from the wages of statutory employees if all three of the following conditions apply.

Statutory income from employment. Enter your w 2 information in the wages and salaries section of the program. Check the box for statutory employee under box 13 to automatically transfer your wages to schedule c. Refer to the salesperson section located in publication 15 a employer s supplemental tax guide for additional information. Earnings as a statutory employee are reported as income on line 1 of schedule c rather than form 1040 line 1 wages salaries tips etc.

Statutory employees are also permitted to deduct work related expenses on irs schedule c instead of schedule a in the united states tax system. If you received a form w 2 and the statutory employee box in box 13 of that form was checked report your income and expenses related to that income on schedule c or c ez. This typically means they will receive a w 2 but are. A statutory employee is an independent contractor who is considered an employee for tax withholding purposes if they meet certain conditions.

Social security and medicare taxes. An employee who is allowed to deduct expenses on schedule c business income or loss is a statutory employee although he or she still receives a w 2 from an employer. A statutory employee s business expenses are not subject to the reduction of 2 of their adjusted gross income. Do not combine statutory employee income with self employment income.

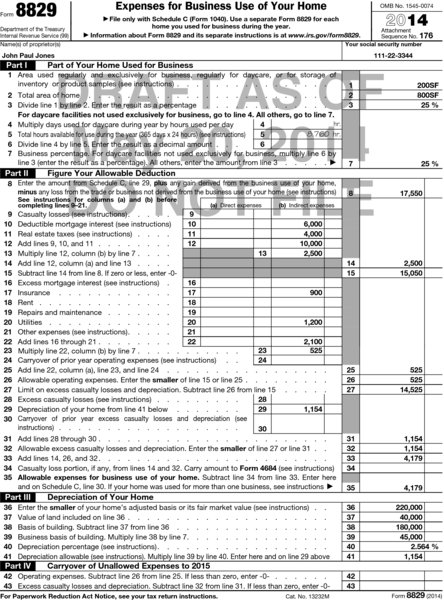

The statutory employee enters the payments from form w 2 on their income tax return on schedule c and they can deduct business expenses from these payments. If the person had other self employment income they must file two schedule c forms one as a statutory employee and the other for other self employment income. On schedule c line 26 the employer declares all employee wages salaries and other compensation. For a standard independent contractor an employer cannot withhold taxes.

Enter your statutory employee income from box 1 of form w 2 on line 1 of schedule c or c ez and check the box on that line.

.png)